|

市場調查報告書

商品編碼

1766304

電動貨運自行車市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electric Cargo Bikes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

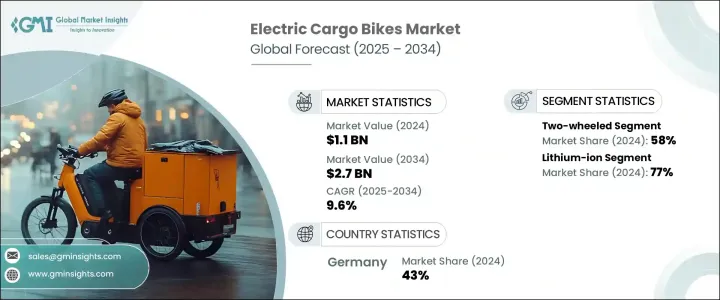

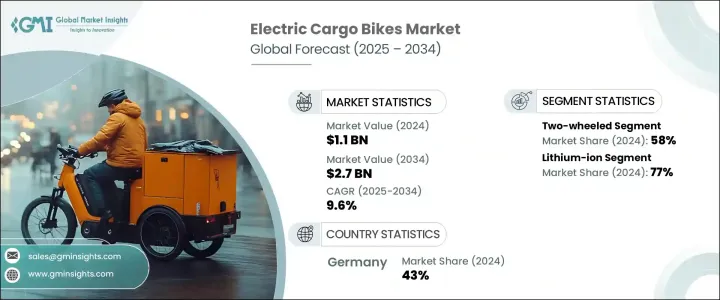

2024年,全球電動貨運自行車市場規模達11億美元,預計2034年將以9.6%的複合年成長率成長,達到27億美元。這一成長動力源於城市物流需求的不斷成長、環保交通法規的支持性訂定、電子商務行業的蓬勃發展,以及全球人口稠密、排放得到嚴格控制的城市對經濟實惠的最後一英里配送解決方案的需求。電動貨運自行車為笨重車輛提供了一種靈活、節省空間的替代方案,有助於緩解擁擠城市中心的交通堵塞。透過取代大型交通工具,這些自行車有助於提升交通順暢度,使其成為解決城市出行挑戰的關鍵力量。

對永續性和環保意識的關注是推動電動貨運自行車市場發展的重要因素。隨著企業和消費者尋求降低碳足跡,這些零排放自行車提供了一種環保的貨運方式,避免了傳統車輛造成的污染。線上購物的快速成長顯著增加了對高效「最後一哩路」配送解決方案的需求,尤其是在交通堵塞和停車位有限的擁擠城市地區。電動貨運自行車提供了完美的解決方案,它緊湊、靈活、環保,能夠輕鬆穿越狹窄的街道,比大型送貨車輛更快到達目的地。電動貨運自行車能夠縮短配送時間並降低營運成本,因此對致力於提高客戶滿意度的物流公司和零售商極具吸引力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 11億美元 |

| 預測值 | 27億美元 |

| 複合年成長率 | 9.6% |

2024年,兩輪電動貨運自行車市場佔據主導地位,佔約58%的市場佔有率,預計在2025-2034年期間將維持9.1%的複合年成長率。兩輪自行車憑藉其高機動性和高速度佔據主導地位,使駕駛者能夠輕鬆穿越擁擠的城市街道。其緊湊的設計使其能夠在狹小空間內停車,並在交通堵塞時平穩行駛,因此尤其受到快遞公司、外賣配送商和注重環保的消費者的青睞。此外,與三輪和四輪自行車相比,兩輪自行車往往更具成本效益,也更易於維護。

2024年,鋰離子電池市場佔77%的市場佔有率,預計2025年至2034年期間的複合年成長率將達到10%。與鉛酸電池或鎳氫電池等相比,鋰離子電池因其卓越的能量密度、輕量化結構和更長的使用壽命而成為電動貨運自行車的首選。其高能量重量比使其單次充電即可行駛更長時間,且性能絲毫不受影響。這些電池還支援快速充電,並在頻繁使用的情況下表現出色,這對於從事日常配送的物流營運商至關重要。

德國電動貨運自行車市場佔43%的市場佔有率,2024年市場規模達2.546億美元。該國的領先地位源於其不斷完善的環境法規、政府激勵措施以及對永續城市交通日益成長的熱情。積極採取減排措施的城市已見證了電動貨運自行車在商業和個人用途上的廣泛應用。專用自行車道和低排放區等基礎設施的改善加速了這一趨勢。此外,高達25%的電動貨運自行車購買折扣補貼計畫也顯著促進了市場成長。

電動貨運自行車產業的主要參與者包括 Riese & Muller、Accell Group、Blix Bikes、Urban Arrow、Mahindra & Mahindra、Tern Bicycles、Giant Bicycles、Butchers & Bicycles、Rad Power Bikes 和 Yuba Bicycles。為了鞏固市場地位,各公司正專注於產品創新,提升電池性能、增加載重能力並提升自行車的彈性。與物流公司和電商公司的策略合作和夥伴關係也很常見,這擴大了市場覆蓋範圍和應用領域。許多製造商強調永續性,透過採購環保材料和減少製造足跡來滿足消費者日益成長的綠色交通需求。此外,擴展售後服務並開發模組化設計以簡化維護,有助於公司提高客戶滿意度和保留率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 零件供應商

- OEM(原始設備製造商)

- 裝配和整合公司

- 車隊和物流合作夥伴

- 電池製造商

- 利潤率分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 其他國家的報復措施

- 對產業的影響

- 主要材料價格波動

- 供應鏈重組

- 提供成本影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和供應策略

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 價格趨勢

- 成本細分分析

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 電動貨運自行車需求增加,以緩解交通堵塞

- 永續性和環保意識的增強,以減少碳排放

- 電子商務和最後一哩配送的興起

- 在商業和市政營運中的應用日益增多

- 低營運和維護成本

- 產業陷阱與挑戰

- 缺乏基礎設施和充電相關挑戰

- 初始成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 兩輪

- 三輪

- 四輪

第6章:市場估計與預測:按電池,2021 - 2034 年

- 主要趨勢

- 鋰離子

- 鉛基

- 鎳基

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 快遞和包裹服務

- 服務交付

- 個人使用

- 大型零售供應商

- 廢棄物和市政服務

- 其他

第8章:市場估計與預測:依範圍,2021 - 2034 年

- 主要趨勢

- 少於50公里

- 超過50公里

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Accell Group

- Amsterdam Bicycle Company

- Askoll EVA

- Aventon Bikes

- Blix Bikes

- Bullitt Bikes

- Butchers & Bicycles

- CERO

- DOUZE Factory SAS

- Giant Bicycles

- Mahindra & Mahindra

- Moustache Bikes

- Pedego Electric Bikes

- Rad Power Bikes

- Riese & Muller

- Tern Bicycles

- Urban Arrow (Pon Holdings BV)

- Worksman Cycles

- Xtracycle Cargo Bikes

- Yuba Bicycles

The Global Electric Cargo Bikes Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 9.6% to reach USD 2.7 billion by 2034. This growth is fueled by increasing demand for urban logistics, supportive eco-friendly transportation regulations, the booming e-commerce sector, and the need for affordable last-mile delivery solutions in densely populated, emission-controlled cities worldwide. Electric cargo bikes offer a nimble, space-saving alternative to bulky vehicles, helping to reduce traffic congestion in crowded urban centers. By replacing larger transport modes, these bikes contribute to smoother traffic flow, making them a key player in solving urban mobility challenges.

The focus on sustainability and environmental consciousness is a significant factor driving the electric cargo bikes market. As businesses and consumers seek to lower their carbon footprints, these zero-emission bikes provide an eco-friendly way to transport goods without the pollution caused by traditional vehicles. The rapid growth of online shopping has significantly increased the demand for efficient last-mile delivery solutions, especially in crowded urban areas where traffic congestion and limited parking space pose major challenges. Electric cargo bikes offer a perfect answer by providing a compact, agile, and eco-friendly transportation option that can easily navigate narrow streets and reach destinations faster than larger delivery vehicles. Their ability to reduce delivery times while lowering operational costs makes them highly attractive to logistics companies and retailers aiming to improve customer satisfaction.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $2.7 Billion |

| CAGR | 9.6% |

In 2024, the two-wheeled electric cargo bike segment led the market, capturing about 58% of the share, and is expected to maintain a CAGR of 9.1% during 2025-2034. Two-wheeled bikes dominate due to their high maneuverability and speed, enabling operators to navigate congested city streets easily. Their compact design allows parking in tight spaces and smooth movement through heavy traffic, making them especially popular among courier companies, food delivery providers, and environmentally conscious consumers. Additionally, two-wheeled models tend to be more cost-effective and easier to maintain compared to three- and four-wheeled alternatives.

The lithium-ion battery segment held a 77% share in 2024 and is projected to grow at a CAGR of 10% between 2025 and 2034. Lithium-ion batteries are preferred for electric cargo bikes because of their exceptional energy density, lightweight structure, and long lifespan compared to options like lead-acid or nickel-metal hydride batteries. Their high energy-to-weight ratio enables longer rides on a single charge without sacrificing performance. These batteries also support rapid charging and demonstrate durability under frequent use, which is crucial for logistics operators engaged in daily deliveries.

Germany Electric Cargo Bikes Market held a 43% share, generating USD 254.6 million in 2024. The country's leadership stems from progressive environmental regulations, government incentives, and growing enthusiasm for sustainable urban transportation. Cities with proactive emission reduction initiatives have witnessed widespread adoption of electric cargo bikes for both commercial and personal purposes. Infrastructure enhancements such as dedicated bike lanes and low-emission zones have accelerated this trend. Moreover, subsidy programs offering up to 25% off the purchase price of electric cargo bikes have significantly boosted market growth.

Key players in the Electric Cargo Bikes Industry include Riese & Muller, Accell Group, Blix Bikes, Urban Arrow, Mahindra & Mahindra, Tern Bicycles, Giant Bicycles, Butchers & Bicycles, Rad Power Bikes, and Yuba Bicycles. To strengthen their market positions, companies are focusing on product innovation by enhancing battery performance, increasing load capacity, and improving bike agility. Strategic collaborations and partnerships with logistics firms and e-commerce companies are also common, expanding market reach and application fields. Many manufacturers emphasize sustainability by sourcing eco-friendly materials and reducing manufacturing footprints, aligning with growing consumer demand for green transport. Additionally, expanding after-sales services and developing modular designs for easier maintenance help companies boost customer satisfaction and retention.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 OEMs (Original Equipment Manufacturers)

- 3.2.3 Assembly & integration firms

- 3.2.4 Fleet & logistics partners

- 3.2.5 Battery manufacturers

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Offering cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and Offering strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Increase in demand for electric cargo bikes to reduce traffic congestion

- 3.11.1.2 Surge in sustainability and environmental awareness to reduce carbon emission

- 3.11.1.3 Rise of e-commerce and last mile delivery

- 3.11.1.4 Increasing use in commercial and municipal operations

- 3.11.1.5 Low operating and maintenance costs

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Lack of infrastructure and challenges related to charging

- 3.11.2.2 High initial cost

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Two-wheeled

- 5.3 Three-wheeled

- 5.4 Four-wheeled

Chapter 6 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Lithium-ion

- 6.3 Lead-based

- 6.4 Nickel-based

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Courier and parcel services

- 7.3 Service delivery

- 7.4 Personal use

- 7.5 Large retail suppliers

- 7.6 Waste & municipal services

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Range, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Less than 50 km

- 8.3 More than 50 km

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Accell Group

- 10.2 Amsterdam Bicycle Company

- 10.3 Askoll EVA

- 10.4 Aventon Bikes

- 10.5 Blix Bikes

- 10.6 Bullitt Bikes

- 10.7 Butchers & Bicycles

- 10.8 CERO

- 10.9 DOUZE Factory SAS

- 10.10 Giant Bicycles

- 10.11 Mahindra & Mahindra

- 10.12 Moustache Bikes

- 10.13 Pedego Electric Bikes

- 10.14 Rad Power Bikes

- 10.15 Riese & Muller

- 10.16 Tern Bicycles

- 10.17 Urban Arrow (Pon Holdings BV)

- 10.18 Worksman Cycles

- 10.19 Xtracycle Cargo Bikes

- 10.20 Yuba Bicycles