|

市場調查報告書

商品編碼

1693722

歐洲生物炭:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Biochar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

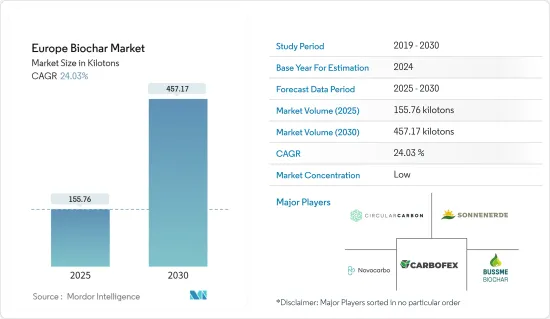

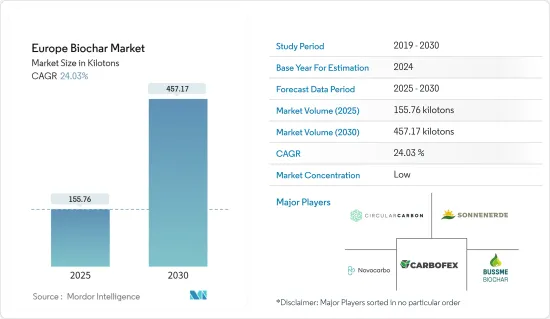

預計 2025 年歐洲生物炭市場規模為 155.76 千噸,2030 年將達到 457.17 千噸,預測期間(2025-2030 年)的複合年成長率為 24.03%。

在新冠疫情期間,門鎖等限制措施擾亂了零售的業務,許多市場因擔心病毒傳播而關閉。然而,隨著農業部門逐漸從疫情後復甦,預計未來幾年歐洲生物炭市場將實現強勁成長率。

關鍵亮點

- 從長遠來看,農業領域對有機農業的需求不斷成長以及對廢棄物管理行業的日益關注預計將成為市場的成長引擎。

- 另一方面,未經 EBC 認證的生物炭生產可能會阻礙市場成長。

- 另一方面,用於污水處理和建築材料的生物炭的研究和開發可能會在預測期內為市場成長提供機會。

- 預計在預測期內,德國將主導歐洲生物炭市場,這得益於全國範圍內多個正在進行的生物炭計劃。

歐洲生物炭市場趨勢

農業領域需求增加

- 生物炭是一種類似木炭的物質,透過受控的熱解過程,燃燒廢棄物的有機物(稱為生質能)製成。使用生物炭作為土壤肥料可以改善土壤質量,提高其運輸和循環養分的能力,從而實現長期的碳封存。

- 生物炭還可以修復受污染的土壤,同時帶來環境效益。生物炭由於其多孔結構,堆積密度較低,比表面積較高(50-900 m2 g-1),保水能力強。

- 歐洲擁有龐大且不斷發展的有機產業和成熟且競爭激烈的農業投入市場。有機食品消費量的增加為有機農業提供了潛在的成長機會。因此,許多符合自願性歐洲生物炭認證(EBC)標準的新生產商正在進入市場。

- 強勁的市場成長令人鼓舞,但如果歐盟委員會 (2020) 要實現「從農場到餐桌」戰略目標,即到 2030 年有機土地面積佔比達到 25%,那麼有機土地面積的擴張必須繼續加速。歐洲消費者購買有機食品的常見原因包括支持當地企業、健康原因以及避免使用殺蟲劑和其他噴霧劑。

- 有機農業在整個歐洲正在穩步成長。例如,作為農業重組的一部分,德國計劃在2030年將三分之一的農場有機化。但隨著通貨膨脹的上升,農民呼籲政府提供更多支持。

- 同樣,歐盟委員會發布的一份報告稱,法國政府計劃將在2023年至2027年期間將向有機農業轉型的支持增加36%,平均每年達到3.4億歐元(3.76億美元)。目標是到2027年將有機農業的涵蓋範圍積增加一倍,並實現聯合農業用地(UAA)中18%的土地被有機農業覆蓋的目標。

- 此外,根據義大利國家有機農業資訊系統(SINAB)的數據,到2022年,義大利將有約432,000公頃土地用於種植有機飼料,約428,000公頃土地將用於有機牧場和牧場。

- 因此,由於上述因素,預計預測期內有機農業對生物炭的需求將呈指數級成長。

預計德國將主導歐洲市場

- 德國是歐洲積極實施生物炭計劃的國家之一。例如,在德國下奧德河谷國家公園的一個示範點,低營養濕地草透過熱解和熱液碳化(HTC)轉化為生物炭。

- 生物炭對農業有顯著的好處,因為它可以提高土壤肥力,促進碳固定,利用有機廢棄物,提高微生物活性,並可能減少溫室氣體排放。

- 根據聯邦農業資訊中心(BZL)的初步計算,2023年德國農作物產值將達到373億歐元(405億美元),年平均成長1.4%。

- 生物炭在德國畜牧業中也被廣泛用作飼料。

- 根據德國飼料協會(DVT)預測,2023年德國飼料產量將達1,610萬噸。根據德國聯邦統計局(Statistisches Bundesamt)預測,2022年德國食品和飼料進口額將成長至646.4億歐元(701.8億美元),而2021年為627.9億歐元(681.7億美元)。

- 生物炭具有吸附污染物和改善水質的能力,與水淨化有關。當添加到水處理系統中時,生物炭充當過濾介質,有效捕獲重金屬、有機污染物和營養物質等雜質。其多孔結構提供了較大的吸附表面積,使其成為一種有效且永續的水淨化方法。此應用對於解決水污染問題、改善水資源整體品質具有重要意義。

- 生物炭在水處理產業也有廣泛的應用。德國的水處理業是歐洲最大的,並且持續大幅成長。該國擁有歐洲最大的工業污水處理(WTP)廠市場。

- 該地區約有3000家處理廠和12,000家排放企業。每年有超過9.2億立方公尺的工業污水需要經過處理才能安全排放到環境中。

- 根據德國聯邦統計局(Statistisches Bundesamt)的數據,2023年德國水收集、處理和供應產業收益價值114.1億美元,預計2025年將達到117.3億美元。

- 因此,上述因素顯示歐洲生物炭的終端用戶應用將成長,從而加強預測期內對生物炭的需求。

歐洲生物炭產業概況

歐洲生物炭市場較為分散,主要企業的市場佔有率。市場的主要企業包括(不分先後順序)Carbofex Ltd、Circular Carbon GmbH、Sonnenerde GmbH、Novocarbo GmbH 和 BussmeEnergy AB。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 農業領域對有機農業的需求不斷增加

- 更關注廢棄物管理領域

- 其他

- 限制因素

- 非EBC認證的生物炭生產

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 技術部門

- 熱解

- 氣化系統

- 其他

- 應用領域

- 農業

- 畜牧業

- 工業的

- 其他

- 地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Bussme Energy AB

- Circular Carbon Gmbh

- Carbofex Ltd

- Carbon Centric

- Carbon Finland Oy

- Carbon Gold Ltd

- Carbuna

- Charline Gmbh

- Egos Gmbh

- Eoc Energy Ocean

- Lucrat Gmbh

- Nettenergy BV

- Novocarbo Gmbh

- Sonnenerde Gmbh

- Verora AG

第7章 市場機會與未來趨勢

- 污水處理和建築材料的潛在用途

The Europe Biochar Market size is estimated at 155.76 kilotons in 2025, and is expected to reach 457.17 kilotons by 2030, at a CAGR of 24.03% during the forecast period (2025-2030).

During the COVID-19 pandemic, the operations of retail sellers were disrupted due to the imposition of lockdowns and other restrictions, while many marketplaces were shut down due to fears of spreading the virus. However, the agricultural sector slowly recovered from the aftermath of the pandemic, with the European biochar market anticipated to register strong growth figures in the next several years.

Key Highlights

- In the long term, the increasing demand for organic farming in the agricultural industry and the rising focus on the waste management industry are expected to serve as the growth engines for the market studied.

- On the flip side, the market growth could be hindered by the production of non-EBC-certified biochar.

- Meanwhile, the potential research and development of biochar in wastewater treatment and as a construction material could present future opportunities for market growth during the forecast period.

- Germany is anticipated to dominate the European biochar market during the forecast period, supported by several ongoing biochar projects spread across the country.

Europe Biochar Market Trends

Increasing Demand from the Agricultural Industry

- Biochar is a charcoal-like substance created by burning organic material from agricultural and forest wastes (also known as biomass) in a controlled process known as pyrolysis. Using biochar as a fertilizer for the soil improves the soil's quality and nutrient-carrying and cycling ability, leading to long-term carbon sequestration.

- Biochar can also remediate contaminated soil while providing environmental benefits. Due to its porous structure, biochar includes a low bulk density that helps to achieve a high specific surface area ranging between 50 and 900 m2 g-1 and a high water-holding capacity.

- Europe includes a sophisticated and highly competitive agro-input market with a large and growing organic industry. The rising consumption of organic food presents potential growth opportunities for the organic farming industry. Therefore, many new producers are now entering the market, meeting the voluntary European Biochar Certificate (EBC) standard.

- While strong market growth is encouraging, organic farmland area must continue to expand faster to meet the European Commission's (2020) Farm to Fork strategy goal of 25% organic area share by 2030. Among European consumers, common reasons for buying organic food include supporting local businesses, health reasons, and not using pesticides or other sprays.

- The organic farming industry is witnessing steady growth across Europe. For instance, Germany is aiming to have a third of all farms organic by 2030 as part of an effort to restructure its agriculture. However, with rising inflation, farmers are asking for more government support.

- Similarly, according to a report published by the European Commission, in France, under the government program, 2023-2027 will see a 36% increase in support for conversion to organic farming, reaching an average of EUR 340 million (USD 376 million) per year. The objective is to double the area covered by organic farming and reach the 18% target of the union agricultural area (UAA) covered by organic farming by 2027.

- Furthermore, as per the SINAB (National Information System on Organic Agriculture), in 2022, approximately 432,000 hectares of Italian land were dedicated to the cultivation of organic forage, while roughly 428,000 hectares were allocated for organic meadows and pastures.

- Thus, owing to the factors above, the demand for biochar in organic farming is anticipated to rise exponentially during the forecast period.

Germany is Anticipated to Dominate the European Market

- Germany is among the top countries actively executing several biochar projects in Europe. For instance, in the German demo site at the Unteres Odertal National Park, low-nutritional grass from the wetlands is converted into biochar through pyrolysis or hydrothermal carbonization (HTC).

- Biochar significantly benefits the agriculture industry by enhancing soil fertility, promoting carbon sequestration, utilizing organic waste, improving microbial activity, and potentially reducing greenhouse gas emissions.

- According to preliminary calculations by the Federal Agricultural Information Center (BZL), German crop production was valued at EUR 37.3 billion (USD 40.5 billion) in 2023, up by 1.4% annually.

- Biochar is also widely used as animal feed in livestock farming in Germany.

- As per the German Feed Association (DVT), animal feed production in Germany reached 16.1 million tons in 2023. According to Statistisches Bundesamt (a federal authority of Germany), the Import value of food and animal feed to Germany was EUR 64.64 billion (USD 70.18 billion) in 2022 and registered growth when compared to EUR 62.79 billion (USD 68.17 billion) in 2021.

- Biochar is linked to water purification through its ability to adsorb contaminants and improve water quality. When added to water treatment systems, biochar acts as a filtration medium, effectively capturing impurities such as heavy metals, organic pollutants, and nutrients. Its porous structure provides a large surface area for adsorption, making it an effective and sustainable method for water purification. This application is valuable in addressing water pollution issues and enhancing the overall quality of water resources.

- Biochar is also being used more extensively in the water treatment industry. The German water treatment industry is the largest in Europe and continues to grow considerably. The country includes the largest market for industrial wastewater treatment (WTP) plants across Europe.

- There are around 3,000 treatment plants spread across the region, with around 12,000 discharging companies. Every year, more than 920 million cubic meters of industrial wastewater is treated before being safely discharged into the environment.

- According to the Statistisches Bundesamt, the industry revenue of water collection, treatment, and supply in Germany was valued at USD 11.41 billion in 2023 and is projected to reach USD 11.73 billion by 2025.

- Thus, the abovementioned factors indicate the growth of end-user applications of biochar in Europe, thereby strengthening demand for biochar during the forecast period.

Europe Biochar Industry Overview

The European biochar market is fragmented, with the top players accounting for a marginal market share. Some of the key companies in the market include (not in any particular order) Carbofex Ltd, Circular Carbon GmbH, Sonnenerde GmbH, Novocarbo GmbH, and BussmeEnergy AB.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Organic Farming in the Agricultural Industry

- 4.1.2 Increasing Focus on the Waste Management Sector

- 4.1.3 Others

- 4.2 Restraints

- 4.2.1 Non-EBC Certified Biochar Production

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Technology

- 5.1.1 Pyrolysis

- 5.1.2 Gasification Systems

- 5.1.3 Other Technologies

- 5.2 Application

- 5.2.1 Agriculture

- 5.2.2 Animal Farming

- 5.2.3 Industrial Uses

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Nordic

- 5.3.7 Turkey

- 5.3.8 Russia

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Bussme Energy AB

- 6.4.2 Circular Carbon Gmbh

- 6.4.3 Carbofex Ltd

- 6.4.4 Carbon Centric

- 6.4.5 Carbon Finland Oy

- 6.4.6 Carbon Gold Ltd

- 6.4.7 Carbuna

- 6.4.8 Charline Gmbh

- 6.4.9 Egos Gmbh

- 6.4.10 Eoc Energy Ocean

- 6.4.11 Lucrat Gmbh

- 6.4.12 Nettenergy BV

- 6.4.13 Novocarbo Gmbh

- 6.4.14 Sonnenerde Gmbh

- 6.4.15 Verora AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Potential Use in Wastewater Treatment and Construction Material