|

市場調查報告書

商品編碼

1693692

電動汽車電池冷卻液:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Electric Vehicle Battery Coolant - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

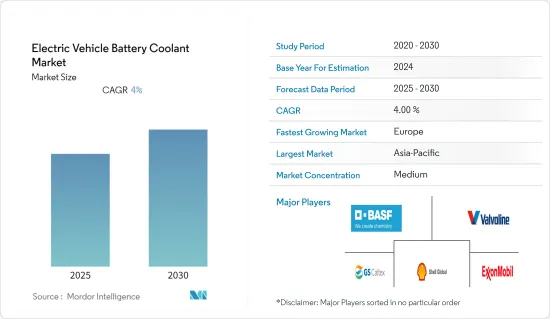

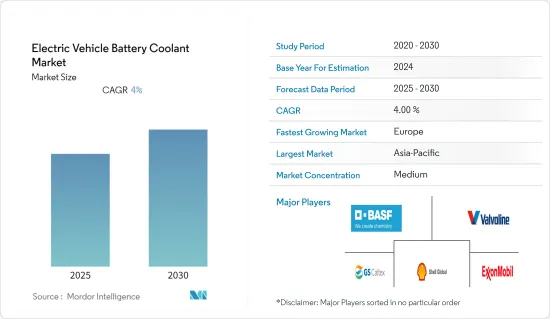

預計預測期內電動車電池冷卻液市場複合年成長率將達到 4%。

汽車用品和供應鏈市場受到COVID-19的嚴重影響。此外,旅行限制和封鎖減緩了電動車的銷售,直接影響了汽車零件的需求。然而,封鎖結束後,電動車電池的需求大幅增加。然而,汽車產業目前正在從虧損中恢復,為推出優質產品以滿足全部區域消費者日益成長的需求鋪平了道路。汽車產業很可能在 2021 年看到電動車產量大幅增加,這可能會在預測期內增加對電動車電池冷卻液的需求。

從中期來看,預計可再生能源領域對能源儲存解決方案的認知不斷提高將在預測期內推動市場發展。由於政府越來越重視在全部區域推廣電動車的使用,預計市場將大幅成長。

在汽車產業,為了提高乘坐品質和車內舒適度,對隔熱材料的需求不斷增加,這大大增加了對電池冷卻劑的需求。此外,汽車內部電氣和電子元件數量的不斷增加也推動了對更好的散熱冷卻系統的需求,這可能會在預測期內推動市場大幅成長。

電動車電池冷卻液的市場趨勢

電動車需求不斷成長

由於各種原因,電動車正在引起多個國家的興趣。交通擁擠和污染已成為代名詞,促使世界各大城市實施綠色永續政策,包括使用電動車。此外,政府補貼和逐步取消積體電路汽車是中期需求預測中的關鍵成長動力。

碳排放增加和氣候變遷給印度多個邦帶來了挑戰。運輸業是溫室效應的主要貢獻者,約佔二氧化碳排放總量的7%。要最大限度地減少交通運輸部門的碳排放,需要大規模部署低碳或零碳排放技術。

由於知名汽車製造商越來越關注電動車,加上政府政策支援和電動車電池技術的改進,導致需求不斷增加,這些都是推動該市場發展的關鍵因素。

鋰離子電池是電動車使用的二次電池,其能量密度比鎳鎘二次電池和鉛酸電池更高。鋰離子電池的這些特性使得製造商可以縮小電池組的整體尺寸,從而節省空間。鋰離子電池是現有最輕的金屬之一。鋰離子電池不含鋰金屬,但含有離子。

一些電池製造商正在主要國家擴大其生產設施,預測期內市場可能會顯著成長。例如

- 2022 年 10 月:中國電池製造商國軒高科投資 23.6 億美元在密西根州建造電池組件工廠。

多家電動車製造商正在主要國家推出新車型,這可能會在預測期內推動市場大幅成長。例如,2022年8月,印度最大的汽車製造商瑪魯蒂鈴木透露,將在2025年底推出首款電動車。

由於上述發展,市場預計在預測期內將顯著成長。

亞太地區佔市場主導地位

由於印度、中國和日本等主要國家生產的電動車數量眾多,導致製造業和勞動力成本低,亞太地區在全球電動車電池冷卻液市場中佔有主要佔有率。

對省油、高性能和低排放氣體汽車的需求不斷增加、汽車排放氣體法律法規越來越嚴格、電池成本不斷下降以及燃料成本不斷上升,都促進了電動乘用車市場需求的成長。

印度政府已宣布計劃加強該國的充電基礎設施,作為其電氣化使命的一部分。電力部已授權能源效率局(BEE)作為在全國範圍內實施電動車公共充電基礎設施的中央聯絡機構(CNA)。參與實施公用事業收費的另一個重要組織是重工業部。重工業部負責監督FAME-II 計劃,該計劃為電動車公共充電基礎設施提供資金。

政府設立的先進化學電池和電池儲存生產連結獎勵計畫(PLI-ACC)也旨在改善印度的電池基礎設施。根據美國預算,該計劃的總成本為24.5億美元,將在製造廠建立後的五年內分配給受益者。

增加國內冷卻劑產量將大大有助於冷卻劑製造商滿足全部區域對電動車電池冷卻劑日益成長的需求。預計這將在未來幾年刺激該地區的電動車電池冷卻液市場。

電動汽車電池冷卻液產業概況

電動車電池冷卻液市場由BASFSE、Valvoline Inc.、埃克森美孚、殼牌集團和 GS Caltex 等主要企業主導。主要企業正在擴大其全球影響力,以加強其製造設施和產品系列,這很可能在預測期內帶來市場顯著成長。例如

- 2022 年 10 月:BASF歐洲公司在中國湛江新一體化基地啟用一座年產能 8 萬噸的新乙二醇工廠。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 車型

- 純電動車

- 油電混合車

- 插電式混合動力汽車

- 電池類型

- 鉛酸電池

- 鋰離子電池

- 其他

- 冷卻水類型

- 乙二醇基

- 水性

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 巴西

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Valvoline Inc.

- BASF SE

- Exxon Mobil Corporation

- Shell group

- GS Caltex

- BP PLC(Castrol Limited)

- TotalEnergies

- Voltronic GmbH

第7章 市場機會與未來趨勢

The Electric Vehicle Battery Coolant Market is expected to register a CAGR of 4% during the forecast period.

The automotive goods and supply chain market were drastically impacted by COVID-19. Also, travel restrictions and lockdowns resulted in a slowdown of electric vehicle sales, directly affecting vehicle parts demand. However, post-lockdown, the demand for electric vehicle batteries increased significantly. However, the automotive industry is now recovering from the losses and paving the way to introduce quality products to cater to the rising demand from consumers across the region. The automotive industry witnessed significant growth in terms of the production of electric vehicles in 2021, which is likely to increase the demand for electric vehicle battery coolant during the forecast period.

Over the medium term, the rising awareness about energy storage solutions in the renewable-based power sector is expected to drive the market during the forecast period. The government's growing focus on promoting the use of electric vehicles across the region is likely to witness significant growth in the market.

The automotive industry greatly emphasizes the increasing need for better ride quality and heat insulation for cabin comfort, leading to a much higher demand for battery coolant. Further, the ever-increasing number of electrical and electronic components inside vehicles also drives the need for better coolant systems due to heat dissipation, which in turn is likely to witness major growth for the market during the forecast period.

Electric Vehicle Battery Coolant Market Trends

Rise in demand for Electric Vehicles

E-mobility has sparked interest among several countries for a variety of reasons. Traffic congestion and pollution have become synonymous, which has prompted large cities in the countries to implement green and sustainable policies, including the usage of electric vehicles. Moreover, government subsidies and phasing out of IC vehicles have been the key growth propeller during the medium-term demand forecast.

Increasing carbon emissions and climate change have posed challenges for several states in India. The transportation sector contributes significantly to greenhouse effects, accounting for around 7% of total Co2 emissions. To minimize the carbon emission from the transportation sector, technologies of low or zero-carbon emission are required to deploy at a vast scale.

The growing emphasis of prominent automobile manufacturers and rising demand for electric vehicles in the wake of supporting government policies and improved electric vehicle battery technology are several significant factors responsible for driving this market.

A lithium-ion battery is a type of rechargeable battery installed in electric vehicles and has a higher energy density when compared to nickel-cadmium and lead-acid rechargeable batteries. These features of lithium-ion batteries will enable the manufacturers to save space by reducing the overall battery pack size. It is one of the lightest metals. Although lithium-ion batteries do not contain any lithium metal, they contain ions.

Several battery manufacturers are expanding their manufacturing facilities across the major countries, which is likely to witness major growth for the market during the forecast period. For instance,

- October 2022: Gotion, a Chinese battery manufacturer, invested USD 2.36 billion to build a battery component facility in Michigan.

Several electric vehicle manufacturers are launching new vehicle models across the major countries, which in turn is likely to witness major growth for the market during the forecast period. For instance, In August 2022, India's largest automaker Maruti Suzuki confirmed that it shall soon introduce the first electric vehicle latest by 2025 end.

With the above-mentioned developments, the market is witnessing major growth for the market during the forecast period.

Asia-Pacific is dominating the market

Asia-Pacific held a leading share of the global electric vehicle battery coolant market due to the higher volume of electric vehicles produced in major countries, including India, China, and Japan, and lower manufacturing and labor costs across the region.

Increased demand for fuel-efficient, high-performance, and low-emission vehicles, as well as increasingly strict laws and regulations on vehicle emissions, as well as lowering battery costs, and rising fuel costs, all contribute to the increased demand for the electric passenger vehicle market's growth.

The government of India has announced its plans to robust the charging infrastructure in the country amid the electrification missions of the government. The Ministry of Power has recognized the Bureau of Energy Efficiency (BEE) as the Central Nodal Agency (CNA) for implementing EV public charging infrastructure across the nation. The other important organization concerned with implementing public charges is the Department of Heavy Industry. This is responsible for overseeing the FAME-II program, which provides financial aid for public EV charging infrastructure.

The Production Linked Incentive for Advanced Chemistry Cell Battery Storage (PLI-ACC) program established by the government has also aimed to improve India's battery infrastructure. According to the Union Budget, the overall cost of the program, which is US$ 2.45 billion, will be distributed to beneficiaries over five years following the establishment of the manufacturing plant, which in turn is likely to witness major growth for the electric vehicle battery coolant market during the forecast period.

The increasing domestic production of coolants may significantly help coolant manufacturers cater to the rising demand for electric vehicle battery coolants across the region. This is projected to fuel the electric vehicle battery coolant market in the region over the next few years.

Electric Vehicle Battery Coolant Industry Overview

Electric Vehicle Battery Coolant Market is dominated by several key players such as BASF SE, Valvoline Inc., Exxon Mobil Corporation, Shell Group, GS Caltex, and others. Major key players are expanding their presence across the globe to enhance the manufacturing facilities and their product portfolio, which in turn is likely to witness significant growth for the market during the forecast period. For instance,

- October 2022: BASF SE opened a new Glycol plant with an annual production capacity of 80,000 metric tons at its new Zhanjiang Verbund site in China.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porters 5 Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD billion)

- 5.1 Vehicle Type

- 5.1.1 Battery Electric Vehicles

- 5.1.2 Hybrid Electric Vehicles

- 5.1.3 Plug-in Hybrid Electric Vehicles

- 5.2 Battery Type

- 5.2.1 Lead Acid Battery

- 5.2.2 Lithium-Ion Battery

- 5.2.3 Others

- 5.3 Coolant Type

- 5.3.1 Glycol Based

- 5.3.2 Water Based

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States Of America

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 Saudi Arabia

- 5.4.4.3 United Arab Emirates

- 5.4.4.4 South Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Valvoline Inc.

- 6.2.2 BASF SE

- 6.2.3 Exxon Mobil Corporation

- 6.2.4 Shell group

- 6.2.5 GS Caltex

- 6.2.6 BP PLC (Castrol Limited)

- 6.2.7 TotalEnergies

- 6.2.8 Voltronic GmbH