|

市場調查報告書

商品編碼

1740891

電動汽車電池組市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測EV Battery Pack Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球電動車電池組市場規模達1,244億美元,預計到2034年將以12.8%的複合年成長率成長,達到4,253億美元。這得歸功於電動車出行模式的加速發展、環境法規的不斷完善以及強力的政策支持。隨著各國加強排放標準並推動永續交通的發展,對高性能電動車的需求正在飆升。政府推出的補貼、稅收抵免以及針對製造商和終端用戶的激勵措施等舉措,正在進一步推動電動車在全球的普及。汽車製造商正在迅速擴展其電動車產品組合,以滿足日益成長的消費者期望,進一步提升了對高效可靠電池系統的需求。

鋰離子、鎳鈷鋁 (NCA) 和固態技術等電池化學技術的進步正在提高能量密度、縮短充電時間並延長電池的整體使用壽命。隨著儲能技術的不斷發展,消費者和汽車製造商都對大規模電動車整合表現出更大的信心,從而創造了一個充滿活力且競爭激烈的市場格局。電池研發投資的增加、區域超級工廠的建立以及整個供應鏈的戰略合作夥伴關係,正在為未來十年的產業持續成長奠定基礎。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1244億美元 |

| 預測值 | 4253億美元 |

| 複合年成長率 | 12.8% |

隨著電動車的普及,汽車製造商正在擴大產能並重新設計車輛架構,以整合更緊湊、更有效率的電池組。電動車製造的激增加劇了對先進電池技術的需求,這些技術需要在更小、更輕的體積內平衡功率、壽命和能量密度。汽車製造商正在與電池生產商建立策略聯盟,以確保穩定的供應,並利用化學和設計方面的創新。製造商還優先考慮輕量化材料和模組化電池系統,以在不影響安全性的情況下提升整體性能並最大限度地延長續航里程。

鎳鈷鋁 (NCA) 電池化學技術持續獲得強勁發展,預計到 2034 年,電動車備用電池市場規模將達到 880 億美元。 NCA 電池以其高能量密度、輕量化和長循環壽命而聞名,正在幫助汽車製造商在保持高效運行的同時提升電動車性能。其快速充電能力和卓越的熱穩定性使其成為支持日益壯大的快速充電站網路的理想選擇,最終緩解消費者的續航里程焦慮,並提高電動車的整體普及率。

2024年,方形電池佔據了48.4%的市場佔有率,為汽車製造商提供了設計靈活性,使其能夠打造更時尚、更安全的電池組,同時最大限度地提高儲存容量。方形電池的堅固外殼能夠增強對物理損壞和膨脹的保護,從而延長電池壽命。隨著汽車設計向安全性和續航里程優先發展,領先的電動車製造商正在與方形電池生產商簽訂長期供應協議,並組成合資企業,以滿足不斷成長的需求。

到2024年,美國電動車電池組市場規模將達到154億美元,佔13.1%的市場。 2022年《通膨削減法案》等聯邦立法,以及人們對清潔能源解決方案日益成長的認知,持續推動美國國內製造業和投資的發展。老牌汽車製造商不斷擴展其電動車產品組合,進一步刺激了該地區對先進高效電池系統的需求。

全球電動車電池組市場企業採取的關鍵策略包括區域擴張、長期供應鏈合作以及對下一代電池技術的大力投資。優先進行研發以提高能量密度和安全性,與汽車製造商和原料供應商建立合作關係,以及確保關鍵礦產資源的安全,這些舉措正在幫助各大品牌打造富有韌性的生態系統,以滿足全球電動車市場日益成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:以電池形式,2021 - 2034

- 主要趨勢

- 圓柱形

- 小袋

- 棱柱形

第6章:市場規模及預測:依電池化學,2021 - 2034 年

- 主要趨勢

- 磷酸鋰

- 鎳鈷鋁

- 鎳錳鈷

- 鋰錳氧化物

- 其他

第7章:市場規模及預測:依推進類型,2021 - 2034

- 主要趨勢

- 純電動車

- 插電式混合動力

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 西班牙

- 英國

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- FRIWO

- LG Energy Solution

- Octillion Power Systems

- Panasonic

- PMBL Limited

- Rivian

- Rapport

- Samsung

- TOSHIBA

- VARTA

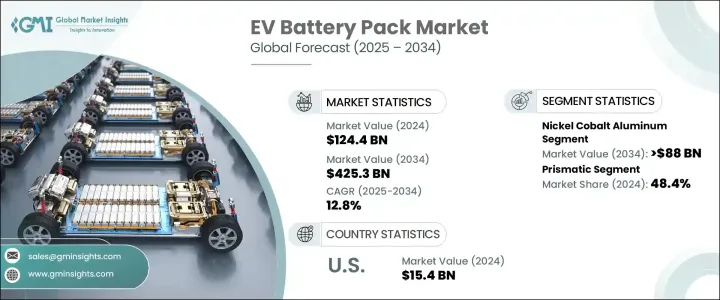

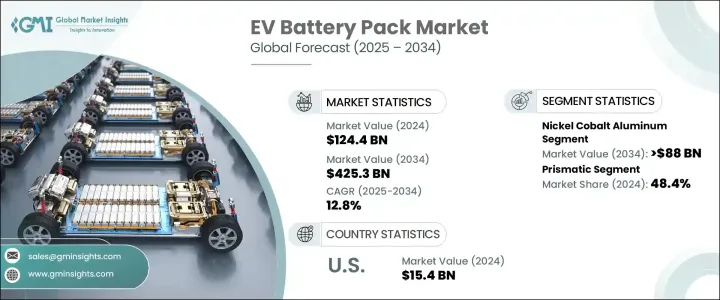

The Global EV Battery Pack Market was valued at USD 124.4 billion in 2024 and is estimated to grow at a CAGR of 12.8% to reach USD 425.3 billion by 2034, fueled by the accelerating shift toward electric mobility, rising environmental regulations, and robust policy support. As countries tighten emission norms and push for sustainable transportation, the demand for high-performance electric vehicles is skyrocketing. Government initiatives such as subsidies, tax credits, and incentives for manufacturers and end-users are further propelling EV adoption worldwide. Automakers are rapidly expanding their EV portfolios to meet growing consumer expectations, increasing the need for efficient and reliable battery systems.

Advances in battery chemistries like lithium-ion, nickel cobalt aluminum (NCA), and solid-state technologies are improving energy density, reducing charging times, and extending the overall lifespan of batteries. As energy storage technology evolves, both consumers and automakers are showing greater confidence in mass EV integration, creating a dynamic and competitive market landscape. Increasing investments in battery R&D, establishment of regional gigafactories, and strategic partnerships across the supply chain are laying the foundation for sustained industry growth over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $124.4 Billion |

| Forecast Value | $425.3 Billion |

| CAGR | 12.8% |

As the shift toward electric mobility gains momentum, automakers are scaling up production capabilities and redesigning vehicle architectures to integrate more compact, high-efficiency battery packs. This surge in EV manufacturing is intensifying demand for advanced battery technologies that balance power, longevity, and energy density within a smaller, lighter footprint. Automakers are forming strategic alliances with battery producers to ensure consistent supply and leverage innovations in chemistry and design. Manufacturers are also prioritizing lightweight materials and modular battery systems to enhance overall performance and maximize driving range without compromising safety.

Nickel cobalt aluminum (NCA) battery chemistry continues to gain strong traction, with the EV Backup Market expected to reach USD 88 billion by 2034. Known for high energy density, lightweight properties, and long cycle life, NCA batteries are helping automakers enhance EV performance while maintaining efficiency. Their fast-charging capability and superior thermal stability make them ideal for supporting the growing network of rapid charging stations, ultimately easing range anxiety for consumers and strengthening overall EV adoption rates.

Prismatic battery cells held a commanding 48.4% share in 2024, offering automakers design flexibility to create sleeker, safer battery packs while maximizing storage capacity. The rigid casing of prismatic cells provides enhanced protection against physical damage and swelling, contributing to extended battery life. Leading EV manufacturers are securing long-term supply agreements and forming joint ventures with prismatic cell producers to meet surging demand as vehicle designs evolve to prioritize safety and range.

The U.S. EV Battery Pack Market generated USD 15.4 billion by 2024, claiming a 13.1% share. Federal legislation like the Inflation Reduction Act of 2022, along with growing awareness of clean energy solutions, continues to boost domestic manufacturing and investment. Established automakers expanding their EV portfolios are further fueling the need for advanced, high-efficiency battery systems across the region.

Key strategies adopted by companies in the Global EV Battery Pack Market include regional expansion, long-term supply chain partnerships, and significant investment in next-generation battery technologies. Prioritizing R&D to enhance energy density and safety, building collaborations with automakers and raw material suppliers, and securing critical minerals are helping brands create resilient ecosystems that meet the surging global demand for electric vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Battery Form, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Cylindrical

- 5.3 Pouch

- 5.4 Prismatic

Chapter 6 Market Size and Forecast, By Battery Chemistry, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Lithium iron phosphate

- 6.3 Nickel cobalt aluminum

- 6.4 Nickel manganese cobalt

- 6.5 Lithium manganese oxide

- 6.6 Others

Chapter 7 Market Size and Forecast, By Propulsion Type, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 BEV

- 7.3 PHEV

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 Spain

- 8.3.4 UK

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 FRIWO

- 9.2 LG Energy Solution

- 9.3 Octillion Power Systems

- 9.4 Panasonic

- 9.5 PMBL Limited

- 9.6 Rivian

- 9.7 Rapport

- 9.8 Samsung

- 9.9 TOSHIBA

- 9.10 VARTA