|

市場調查報告書

商品編碼

1693685

半導體鍵合設備:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Semiconductor Bonding Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

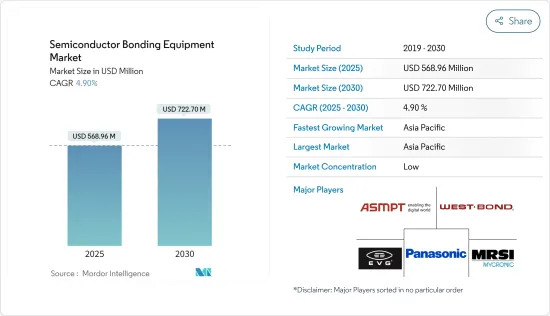

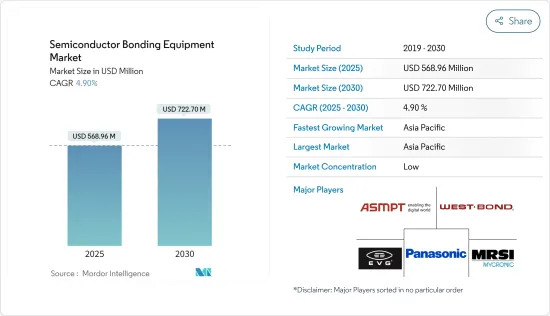

預計 2025 年半導體鍵合設備市場規模為 5.6896 億美元,到 2030 年將達到 7.227 億美元,預測期內(2025-2030 年)的複合年成長率為 4.9%。

由於對具有更高效率、處理能力和更小占地面積的半導體晶片的需求不斷增加,半導體鍵合設備正在尋找應用,從而推動預測期內的市場需求。

關鍵亮點

- 隨著數位化影響力的不斷擴大,半導體市場正在蓬勃發展。值得注意的是,這促使政府推出進一步計畫來支持 5G 的推出。例如,歐盟委員會很早就認知到5G網路的重要性,並建立了官民合作關係關係,共同開發和研究5G技術。

- 隨著未來十年晶片需求的飆升,預計到 2030 年全球半導體產業將成為一個價值 1 兆美元的產業。推動這一成長的是企業和國家向半導體製造、材料和研究投入大量資金,確保晶片和技術的穩定供應,從而支撐日益以數據為中心的各行各業的成長。

- 生產關鍵技術部件的半導體行業由於需求激增而成為頭條新聞。根據《華爾街日誌》近日報道,半導體是全球第四大交易商品(進出口總合),僅次於原油、精製油和汽車。這是因為半導體對於各種行業的高運算應用至關重要,包括電子、製造、農業、醫療保健、基礎設施、娛樂、交通、通訊、軍事系統、能源管理和太空。

- 當產品需要連接兩個晶粒或晶圓時,會使用幾種方法。除了選擇鍵合方法本身的類型之外,您還必須決定鍵合的是晶圓還是晶粒。所選的接合製程是黏合擁有成本的主要因素。對於一個製程來說最重要的三個因素是鍵結所需的上游製程的成本、接合製程的週期時間和接合製程的產量比率。

- 全球疫情的爆發和為遏制COVID-19蔓延而採取的限制措施嚴重擾亂了半導體鍵合設備產業的全球供應鏈,影響了生產能力。儘管 COVID-19 感染人數已大幅下降,但仍需解決這些零件的材料供需方面的重大問題,這仍然是市場成長面臨的挑戰。

半導體鍵合設備市場趨勢

電源IC和功率分離式元件元件應用領域佔據較大的市場佔有率

- 功率半導體裝置有助於在各種應用中實現高效的電源管理、轉換和控制。人們對節能和電力消耗的興趣日益濃厚,功率半導體裝置的重要性也日益凸顯。該市場的驅動力在於減少損失、提高可控性、增強耐用性以及在正常和故障條件下的可靠性能。隨著功率半導體需求的不斷增加,功率IC和鍵結技術的市場也預計將擴大。

- 行業的快速數位化和互聯設備的興起正在推動這一領域的成長。這些設備需要高效的電源管理和高效能的功率半導體裝置。利用這些設備可以實現最佳功率轉換,減少能量損失,並提高電子系統的整體能源效率。

- 由於對節能和省電設備的需求不斷增加,這一領域正在成長。無線和可攜式電子產品的廣泛應用、汽車行業向電氣化的轉變以及這些設備的使用日益增多進一步推動了這一需求。

- 各行各業越來越傾向於電源模組和整合解決方案。功率半導體製造商正在開發緊湊、高度整合的模組,整合開關、二極體和驅動器等各種功率元件,以簡化系統設計、減少元件數量並提高整體系統效率。為了保持競爭力,功率半導體公司可以從在產品設計過程的早期了解障礙和市場趨勢中受益。預計供應商增加投資以提高功率半導體產量將影響市場擴張。

- 電源 IC 和分立元件的重大發展使得電源管理更有效率。系統結構的最新進展減少了 AC-DC 電源供應器的尺寸和組件數量,從而提高了其效率。新的乙太網路供電 (PoE) 標準的推出實現了更高的電力傳輸能力,刺激了連網照明等創新設備類別的誕生。電子設備製造商越來越注重降低電力消耗,家用電子電器的需求不斷成長,這是推動電源 IC 需求的主要因素。這些因素可能會刺激對黏合設備的需求。

- 智慧型手機的傳輸速度大幅提升,要求電池模組也能滿足處理要求。電源轉接器現在配備了離散半導體,由於電池供電設備的銷售量增加,預計需求將激增。物聯網應用的成長預計將進一步推動對離散半導體的需求。

- 例如,根據愛立信預測,全球蜂巢式物聯網連線數將在 2022 年達到 19 億,到 2027 年將達到 55 億。由於 5G 的發展,智慧型手機的日益普及預計將推動市場成長。

- 同樣,旨在為全球消費者提供技術增強和互聯設備的物聯網應用的重大技術進步也有望對市場成長產生積極影響。物聯網應用的擴展正在推動智慧型設備和小型半導體的普及,從而導致對先進半導體鍵合設備的需求增加。

- 愛立信表示,2022 年至 2028 年間,全球連網裝置的數量將約加倍,這主要得益於短距離物聯網設備的興起。預計到2028年此類設備將達到約287.2億台。隨著物聯網連接設備需求的擴大,預計電源IC的需求也將增加,從而推動鍵合設備市場的成長。

亞太地區可望成為成長最快的市場

- 半導體產業已成為亞洲經濟成長的主要驅動力。它的快速擴張和技術進步使其成為全球供應鏈的重要組成部分。

- 亞太地區佔據全球半導體代工廠的大部分佔有率,是三星電子、台積電等知名公司的所在地。韓國、台灣、日本和中國在該地區佔有很大的佔有率。台灣擁有全球最大的晶圓代工市場佔有率之一,是半導體價值鏈中的重要地區。預計增加對該地區半導體製造能力的投資將極大促進市場成長。

- 2023年9月,中國推出一項400億美元的基金,以促進其半導體產業的發展。中國正計劃設立一個國家支持的投資基金,以幫助縮小與全球競爭對手(特別是美國)的差距。該基金可望發展成為中國積體電路產業投資基金(俗稱大基金)管理的三支基金中最重要的一支。中國國家主席習近平強調實現半導體自給自足的重要性,這主要是為了回應美國的出口管制措施。該基金已獲得中國相關部門核准,財政部將出資 600 億元人民幣(83 億美元)。

- 基於國內晶片需求的成長,中國預計將超越美國成為全球最大的半導體產業強國。根據半導體產業協會預測,到2030年,半導體市場規模預計將擴大一倍,超過1兆美元,其中中國將佔成長的60%以上。預計這種快速成長將增加對半導體鍵合設備的需求。

- 新的半導體晶圓廠將生產顯示器驅動器、電源管理IC、微控制器和高效能運算邏輯等應用的晶片,以滿足運算、資料儲存、汽車、無線通訊和人工智慧等市場日益成長的需求。該晶圓廠的月產能為 50,000 片晶圓,預計將於 2026 年底出貨首批晶片。

半導體鍵結設備市場概況

半導體鍵合設備市場高度分散,主要參與者包括 EV Group、ASMPT Semiconductor Solutions、MRSI Systems(Myronic AB)、WestBond Inc. 和松下控股公司。市場參與企業正在參與聯盟和收購以獲得永續的競爭優勢並加強其產品組合。

- 2023 年 11 月 - EV 集團 (EVG) 宣布 EVG 總部擴建下一階段工程完工。 「製造 V」工廠將作為 EVG 的設備零件製造部門,並將顯著擴大其生產車間和倉庫空間。 Manufacturing V 工廠的開幕標誌著 EVG 最新的擴張舉措和投資。 EVG 繼續受益於對其混合鍵合解決方案和其他製程解決方案及製程開發服務的持續高需求,以支援快速成長的先進封裝和 3D/異質整合市場。

- 2023 年 9 月 - MRSI Systems(Mycronic AB)宣布推出成熟的 MRSI-7001 平台的新版本:MRSI 7001HF。 7001HF 具有加熱鍵合頭,鍵合時能夠施加高達 500N 的力。此加熱鍵合頭也可從頂部加熱,溫度最高可達 400°C。這使得 7001HF 成為 IC 封裝功率半導體燒結和 IC 封裝熱壓鍵合機等應用的高負載晶片鍵合機的完美工具。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 市場吸引力—波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈/供應鏈分析

- COVID-19 市場影響

第5章市場動態

- 市場促進因素

- 半導體製造商正在加大投資以擴大其製造能力

- 各種應用對半導體晶片的需求不斷增加

- 市場限制

- 擁有成本高

- 電路小型化帶來的複雜性

第6章市場區隔

- 按類型

- 永久黏合設備

- 臨時黏合設備

- 混合鍵合設備

- 按應用

- 先進封裝

- 電源IC和功率分離式元件

- 光子裝置

- MEMS感測器和致動器

- 工程師基板

- 射頻設備

- CMOS影像感測器(CIS)

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- EV Group

- ASMPT Semiconductor Solutions

- MRSI Systems.(Myronic AB)

- WestBond Inc.

- Panasonic Holding Corporation

- Palomar Technologies

- Dr. Tresky AG

- BE Semiconductor Industries NV

- Fasford Technology Co.Ltd(Fuji Group)

- Kulicke and Soffa Industries Inc.

- DIAS Automation(HK)Ltd

- Shibaura Mechatronics Corporation

- SUSS MicroTec SE

- Tokyo Electron Limited

第8章投資分析

第9章:市場的未來

The Semiconductor Bonding Equipment Market size is estimated at USD 568.96 million in 2025, and is expected to reach USD 722.70 million by 2030, at a CAGR of 4.9% during the forecast period (2025-2030).

Semiconductor bonding equipment finds application owing to the rising demand for semiconductor chips with higher efficiency, processing power, and smaller footprint, thereby driving the demand for the market during the forecast period.

Key Highlights

- As the impact of digitalization has increased, semiconductor markets have boomed. Notably, this has further resulted in government programs to support the 5G deployment. For instance, the European Commission recognized the importance of the 5G network early and established a public-private partnership to develop and research 5G technology.

- With chip demand set to surge over the coming decade, the global semiconductor industry is expected to become a trillion-dollar industry by 2030. This growth is favored by companies and countries funneling vast sums of money into semiconductor manufacturing, materials, and research to guarantee a constant supply of chips and know-how to support growth across a broad swath of increasingly data-centric industries.

- The semiconductor industry, which makes crucial technological components, has been hitting the headlines due to a rampant demand increase. A recent Wall Street Journal report shows that semiconductors rank as the world's fourth-largest traded product (imports and exports, counted), after crude oil, refined oil, and cars. This is because semiconductors are critical for high-computing applications in various industries, including electronics and manufacturing industries, agriculture, healthcare, infrastructure, entertainment, transportation, telecommunications, military systems, energy management, and space, to name just a few.

- Several methods might be used when a product needs the bonding of two dies or wafers. Not only does the type of bonding method itself have to be selected, but it must also be decided whether the items being bonded will be in wafer or die form. The selected bonding process is the primary driver for the cost of ownership of bonding. For a given process, the three most important factors are the cost of the upstream process needed for bonding, the cycle time of the bonding process, and the yield of the bonding process.

- With the global outbreak of the pandemic and restrictive measures taken to control the spread of COVID-19, the global supply chain of the semiconductor bonding equipment industry was significantly disrupted, impacting the production capabilities of various companies. Although the number of COVID-19-infected patients decreased considerably, salient issues with materials supply and demand for these components still need to be addressed, challenging the market's growth.

Semiconductor Bonding Equipment Market Trends

Power IC and Power Discrete Application Segment Holds Significant Market Share

- Power semiconductor devices facilitate efficient power management, conversion, and control across various applications. The increasing focus on energy conservation and power consumption is increasing the significance of power semiconductor devices. The market is supported by reduced losses, enhanced controllability, greater durability, and reliable performance in standard and fault conditions. As the demand for power semiconductors continues to rise, there is also an expected increase in the market for power ICs and bonding technology.

- The segment's growth is driven by the rapid digitization of industries and the increasing number of connected devices. These devices necessitate efficient power management and high-performance power semiconductor devices. By utilizing these devices, optimal power conversion is achieved, energy losses are reduced, and the overall energy efficiency of electronic systems is enhanced.

- The segment is experiencing growth due to the rising demand for high-energy and power-efficient devices. This demand is further fueled by the prevalence of wireless and portable electronic products, the automotive industry's shift toward electrification, and the increased use of these devices.

- The industry has a rising inclination toward power modules and integrated solutions. Manufacturers of power semiconductors are creating compact, highly integrated modules that merge various power components like switches, diodes, and drivers to streamline system design, lower component quantity, and improve overall system efficiency. Power semiconductor firms stand to gain by understanding the obstacles and market trends early in the product design process to remain competitive. The increasing investments by vendors to boost power semiconductor production are anticipated to affect the market's expansion.

- A significant development in power IC and discrete components enhances power management efficiency. Recent advancements in system architectures have led to more efficient AC-DC power adapters with reduced size and component numbers. Introducing new Power-over-Ethernet (PoE) standards has enabled higher power transfer capabilities, facilitating the creation of innovative device categories like connected lighting. The growing emphasis on minimizing electricity consumption by electronics manufacturers and the increasing demand from consumer electronics are the primary drivers behind the necessity for Power ICs. These factors could potentially boost the demand for bonding equipment.

- There is a significant rise in smartphone transmission speeds, necessitating battery modules to accommodate the processing requirements. Power adapters are now incorporating discrete semiconductors, leading to an anticipated surge in demand driven by the increasing sales of battery-powered devices. The growth of IoT applications is projected to propel the demand for discrete semiconductors further.

- For example, according to Ericsson, global cellular IoT connections reached 1.9 billion in 2022 and are estimated to reach 5.5 billion by 2027. The increasing penetration of smartphones with the evolution of 5G is expected to drive the market's growth.

- Similarly, the market's growth is expected to be positively influenced by the significant technological advancements in IoT applications, which aim to provide technologically enhanced linked devices to consumers worldwide. The expansion of IoT applications has increased the prevalence of smart devices and small semiconductors, consequently driving the demand for advanced semiconductor bonding equipment.

- Ericsson stated that the number of connected devices globally will nearly double from 2022 to 2028, primarily due to the rise in short-range IoT devices. It is expected that there will be approximately 28.72 billion such devices by 2028. With the growing demand for these IoT-connected devices, the demand for power ICs is expected to rise, thereby enhancing the growth of the bonding equipment market.

Asia-Pacific is Expected to be the Fastest Growing Market

- The semiconductor industry has emerged as a critical driver of economic growth in Asia. Its rapid expansion and technological advancements have become an important component of the global supply chain.

- Asia-Pacific holds a major share of semiconductor foundries globally, with the region having the presence of prominent companies like Samsung Electronics, TSMC, etc. South Korea, Taiwan, Japan, and China have significant market shares in the region. Taiwan holds a prominent share of the foundries in the world and is a vital region in the semiconductor value chain. The increasing investments in the expansion of semiconductor manufacturing capacities in the region are expected to aid the market's growth significantly.

- In September 2023, China launched a USD 40 billion fund to boost the semiconductor industry. China plans to establish a state-backed investment fund to narrow the gap with global rivals, especially the United States. This initiative is poised to evolve as the most significant of the trio of funds managed by the China Integrated Circuit Industry Investment Fund, generally known as the Big Fund. President Xi Jinping of China stressed the critical importance of achieving semiconductor self-sufficiency, primarily in response to export control measures imposed by the United States. The latest fund obtained approval from Chinese authorities, with the finance ministry committing CNY 60 billion (USD 8.30 billion).

- Based on its expanding domestic chip demand, China is estimated to overtake the United States as the world's top powerhouse in the semiconductor industry. By 2030, the semiconductor market is expected to double in size to reach more than USD 1 trillion, with China contributing over 60% of that increase, according to the Semiconductor Industry Association. Such exponential growth is anticipated to increase demand for semiconductor bonding equipment.

- The new semiconductor fab would fabricate chips for applications like display drivers, power management IC, microcontrollers, and high-performance computing logic, addressing the growing demand in markets like computing and data storage, automotive, wireless communication, and artificial intelligence. This fab claims to have a manufacturing capacity of up to 50,000 wafers per month, and the first chip will come out of the facility before the end of 2026.

Semiconductor Bonding Equipment Market Overview

The semiconductor bonding equipment market is highly fragmented, with major players like EV Group, ASMPT Semiconductor Solutions, MRSI Systems (Myronic AB), WestBond Inc., and Panasonic Holding Corporation. Market players participate in partnerships and acquisitions to gain sustainable competitive advantage and enhance their product offerings.

- November 2023 - The EV Group (EVG) announced the completion of construction works for the next phase of the expansion of EVG corporate headquarters. The "Manufacturing V" facility serves as EVG's manufacturing department for equipment components and offers a significant expansion of production floor and warehouse space. The opening of the Manufacturing V facility marks the latest expansion phase and investment of EVG, which continues to benefit from the continuing high demand for EVG's hybrid bonding solutions and other process solutions, as well as process development services, to support the fast-growing advanced packaging market and 3D / heterogeneous integration market.

- September 2023 - MRSI Systems (Mycronic AB) announced the launch of the new variant of the well-established MRSI-7001 platform, the MRSI 7001HF. The 7001HF features a heated bond head capable of applying up to 500N forces during bonding. The heated bond head also provides heating from the top at a temperature of 400°C. This makes the 7001HF the perfect tool for high-force die bonders for applications such as power semiconductor sintering for IC packaging or thermocompression bonders for IC packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 Market Dynamics

- 5.1 Market Driver

- 5.1.1 Increasing Investment by Semiconductor Manufacturers to Expand their Manufacturing Capacity

- 5.1.2 Rising Demand for Semiconductor Chips across Various Application

- 5.2 Market Restraints

- 5.2.1 High Cost of Ownership

- 5.2.2 Increased Complexity Owing to Miniaturization of Circuits

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Permanent Bonding Equipment

- 6.1.2 Temporary Bonding Equipment

- 6.1.3 Hybrid Bonding Equipment

- 6.2 By Application

- 6.2.1 Advanced Packaging

- 6.2.2 Power IC and Power Discrete

- 6.2.3 Photonic Devices

- 6.2.4 MEMS Sensors and Actuators

- 6.2.5 Engineered Substrates

- 6.2.6 RF Devices

- 6.2.7 CMOS Image Sensors (CIS)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 EV Group

- 7.1.2 ASMPT Semiconductor Solutions

- 7.1.3 MRSI Systems. (Myronic AB)

- 7.1.4 WestBond Inc.

- 7.1.5 Panasonic Holding Corporation

- 7.1.6 Palomar Technologies

- 7.1.7 Dr. Tresky AG

- 7.1.8 BE Semiconductor Industries NV

- 7.1.9 Fasford Technology Co.Ltd (Fuji Group)

- 7.1.10 Kulicke and Soffa Industries Inc.

- 7.1.11 DIAS Automation (HK) Ltd

- 7.1.12 Shibaura Mechatronics Corporation

- 7.1.13 SUSS MicroTec SE

- 7.1.14 Tokyo Electron Limited