|

市場調查報告書

商品編碼

1693676

北美預拌混凝土:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)North America Ready-Mix Concrete - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

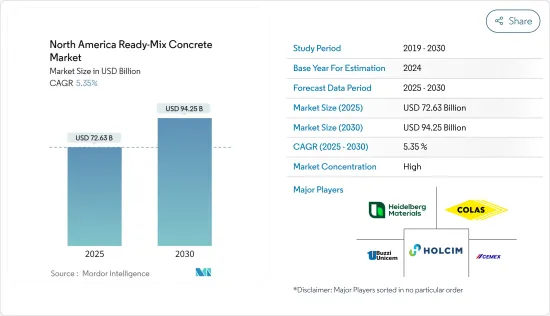

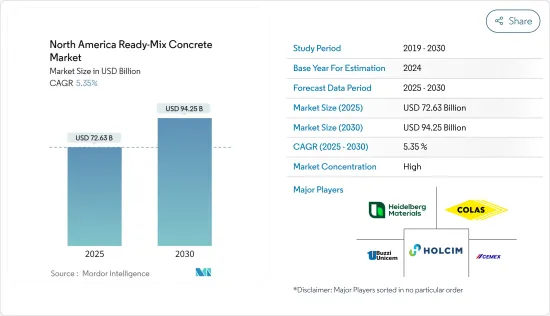

北美預拌混凝土市場規模預計在 2025 年為 726.3 億美元,預計到 2030 年將達到 942.5 億美元,預測期內(2025-2030 年)的複合年成長率為 5.35%。

新冠疫情為建築業等密集型產業帶來了沉重打擊。然而,隨著所有有關社交距離規範和隔離的限制被取消,該地區現在正走上復甦之路。

關鍵亮點

- 預計全部區域建築需求的不斷成長,以及人們對 RMC 的潛在優勢及其優於普通混凝土的性能的認知不斷提高,將推動該地區市場的成長。

- 另一方面,RMC 運輸相關的挑戰以及潛在替代品的易得性可能會阻礙市場成長。

- 然而,基礎設施建設投資的增加導致全部區域的建設活動增加,為未來的預拌混凝土市場提供了潛在的機會。

- 在預測期內,美國預計將引領北美預拌混凝土市場。

北美預拌混凝土市場趨勢

住宅領域展現出巨大的成長潛力

- 北美被視為住宅開發的有前景的地區,美國和加拿大等主要經濟體已經宣布並正在進行各種計劃。

- 住宅建築中預拌混凝土的應用包括路緣石鋪設和襯砌、鋼筋和非鋼筋地基、單層和雙層擴建、鋼筋和非鋼筋住宅地板、筏板、車庫、化糞池鋪設、溝槽填充、花園棚屋和牆壁、排水工程、外部花園區、重型貨車 (HGV) 停車場、車道、小路填充、樓梯、外部表面、排水工程、外部花園區、重型貨車 (HGV) 停車場、小徑、小路、樓梯、外部表面、溫室、地板、建築和停車場。

- 政府在房地產市場住宅方面的支出增加,以及對豪華住宅的需求不斷成長,可能會有利於所研究市場的成長。公共和私營部門對經濟適用住宅的日益關注推動了該地區住宅建築業的成長。

- 在美國和加拿大的部分地區,儘管中產階級住宅停滯不前(經濟適用住宅持續減少),但低房屋抵押貸款利率仍在推動住宅建設增加。

- 在加拿大,經濟適用房舉措(AHI)、新建築加拿大計劃(NBCP)和加拿大製造等各種政府計劃極大地推動了住宅領域的擴張,並促進了建築塗料在住宅領域的使用。

- 此外,根據哈佛大學住宅研究聯合中心的數據,美國每年估計在住宅重建和維修上花費超過 4,000 億美元,其中可能包括建築塗料和塗層,這將對需求產生積極影響。

- 根據美國人口普查局的數據,預計2022年美國私部門新建住宅數量將達到約9,000億美元,連續第三年強勁成長。這一趨勢也反映在建築許可上,德克薩斯州的達拉斯-沃斯堡-阿靈頓大都會區是全國住宅建築率最高的地區之一。

- 此外,2023年3月,以季節性已調整的的以年度為基礎,共獲得141.3萬套自住住宅的建築許可。這比2023年2月修正後的155萬套低8.8%,比2022年3月的187.9萬套低24.8%。 3月獨棟住宅許可證數量為81.8萬套,比2月修正後的78.6萬套增加4.1%。 2023 年 3 月,五套或五套以上單元建築的核准數量為 543,000 套。

- 因此,由於上述因素,住宅產業對預拌混凝土的需求可能會在預測期內影響市場成長。

美國主導市場

- 美國建築業前景廣闊,住宅和基礎設施建設吸引了大量關注和投資。

- 美國擁有龐大的建築業,僱用了超過 760 萬人。該國的建築業在商業、工業、機構、住宅、基礎設施、能源和公共工程建設中發揮關鍵作用,是該國經濟的主要貢獻者。根據經濟分析局的數據,建築業占美國GDP 的佔有率將從前一年的 4.1% 放緩至 2022 年的 4%。

- 根據美國人口普查局的數據,2023 年 2 月美國建築支出經季節性已調整的後年化率估計為 1.8,441 兆美元,比 2023 年 1 月修訂後的 1.8451 兆美元低 0.1%。

- 此外,根據美國人口普查局的數據,2022 年美國私人建築支出的成長率幾乎是公共建築支出的四倍。縱觀美國所有 50 個州的建築支出,德克薩斯州和加利福尼亞州處於領先地位。預測顯示,美國新建築的價值將持續上漲。

- 同樣,2023年2月美國私人建築業經季節性調整後的年率估計為1.45兆美元,而住宅建築業經季節性調整後的年率估計為8521億美元,比1月份修訂後的估計值8570億美元低0.6%。 2023 年 2 月住宅建築經季節性調整後的年率為 6,010 億美元,比 1 月修訂後的 5,967 億美元高出 0.7%。

- 美國除了新建住宅外,還正在進行大規模的重建。該國不斷成長的移民人口帶來了越來越大的翻修需求。人們對永續性和高效建築的認知不斷提高,也推動了修復趨勢。多種政府貸款也為該國的住宅裝修提供支援。

- 根據美國保險建築業共識預測小組的數據,2022 年住宅建築支出將增加 5.4%。此外,美國新的私人住宅建築支出將在 2022 年達到峰值,略高於 5,390 億美元。到 2023 年,預計所有主要商業、工業和機構類別都將實現至少相當健康的成長。

- 2022 年 5 月,Holcim 美國收購了大巴吞魯日地區著名的預拌混凝土 。此次收購使 Holcim 獲得了 51 輛攪拌機攪拌車和 8 家國家認證的配料廠,為巴吞魯日及周邊城市提供服務。

- 此外,2022 年 5 月,Martin Marietta Materials Inc. 簽署最終協議,以 2.5 億美元現金將其西海岸水泥預拌混凝土業務的一部分出售給 CalPortland Corp.。交易完成後,CalPortland 將獲得加州雷丁水泥廠、相關水泥配送終端和 14 家預拌混凝土廠的使用權。

- 這些因素表明,未來幾年住宅和基礎設施發展可能會出現強勁成長,從而加強該地區的預拌混凝土市場。

北美預拌混凝土產業概況

北美預拌混凝土市場本質上是整合的。市場的主要企業包括 CEMEX SAB de CV、HOLCIM、Buzzi Unicem SpA、HeidelbergCement AG 和 Colas。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 整個全部區域建築需求不斷成長

- 比普通混凝土具有更優異的性能和優勢

- 限制因素

- 潛在替代方案的可用性

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按最終用戶部門

- 住宅

- 商業的

- 工業/設施

- 基礎設施

- 按地區

- 美國

- 加拿大

- 墨西哥

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- BuzziUnicem SpA

- CEMEX SAB de CV

- Colas Group

- CRH

- 海灣合作理事會國家

- HeidelbergCement

- HOLCIM

- RW Sidley, Inc.

- Sika AG

- Thomas Concrete Group

- Titan Cement

- Vicat SA

- Vulcan Materials

第7章 市場機會與未來趨勢

- 增加對該地區商業基礎建設的投資

The North America Ready-Mix Concrete Market size is estimated at USD 72.63 billion in 2025, and is expected to reach USD 94.25 billion by 2030, at a CAGR of 5.35% during the forecast period (2025-2030).

The COVID-19 pandemic wreaked havoc on labor-intensive industries like the building and construction industry. However, with all restrictions on social distancing norms and lockdowns lifted, the region is now progressing on the path to recovery.

Key Highlights

- The growing demand for building construction across the region, along with the rising awareness about the potential advantages and superior properties of RMC over normal concrete, is expected to drive regional market growth.

- On the flip side, the easy availability of potential substitutes, along with the challenges associated with the transportation of RMC, may hamper the market growth.

- However, the rising investments in infrastructure development are resulting in increasing construction activities across the region, thereby providing potential opportunities to the ready-mix concrete market in the future.

- The United States is expected to the leader in the North American ready-mix concrete market during the forecast period.

North America Ready-Mix Concrete Market Trends

Residential Segment Showing Great Potential for Growth

- In the North American region, residential development looks promising, with various projects already announced and initiated across major economies like the United States and Canada.

- The applications of ready-mix concrete found in residential construction are curb bedding and backing, reinforced and unreinforced foundations, single and double-story extensions, reinforced and unreinforced house floors, raft, garage, and septic tank bedding, trench fill, garden shed and wall, drainage works, external yard areas, heavy goods vehicle (HGV) parking and driveways, paths, steps, and external paving, and hard standings and bases for greenhouses, patios, and conservatories.

- The increased government spending in the real estate market for residential construction, along with the growing demand for high-class residential homes, are likely to benefit the growth of the market studied. The increased focus on affordable housing by both the public and private sectors is driving the residential construction sector's growth in the region.

- Though the middle-class housing segment is suffering a slump in a few regions of the United States and Canada (as they keep losing ground on affordability), low interest rates for home mortgages have increased residential construction.

- In Canada, various government projects, including the Affordable Housing Initiative (AHI), the New Building Canada Plan (NBCP), and Made in Canada, are set to support the expansion of the sector hugely, thereby driving the use of architectural paints and coatings in the residential sector.

- Furthermore, as per the Harvard Joint Center for Housing Studies, it is estimated that Americans spend more than USD 400 billion a year on residential renovations and repairs, which might as well involve the use of architectural paints and coatings, which positively affects their demand.

- According to the US Census Bureau, the private sector's production of new house building in the United States reached approximately USD 900 billion in 2022, marking the third year of robust growth in a row. This trend is mirrored in the number of dwelling units authorized by building permits, with the Dallas-Fort Worth-Arlington metropolitan area in Texas having some of the largest residential construction production in the country.

- Additionally, in March 2023, 1,413,000 privately owned homes had building permits authorized on a seasonally adjusted annual basis. It was 8.8% lower than the revised February 2023 rate of 1,550,000 and 24.8% lower than the March 2022 rate of 1,879,000. Single-family authorizations were 818,000 in March, up by 4.1% from the revised February figure of 786,000. In March 2023, there were 543,000 authorizations for units in buildings with five or more units.

- Therefore, owing to the aforementioned factors, the demand for ready-mix concrete for the residential industry is likely to impact market growth during the forecast period.

United States to Dominate the Market

- The United States construction sector shows great promise, with residential and infrastructure construction drawing substantial attention and investment.

- The United States boasts a colossal construction sector that employs over 7.6 million people. It plays a prominent role in commercial, industrial, institutional, residential, infrastructure, energy, and utility construction; the construction sector in the country exhibits a significant contribution to the country's economy. As per the Bureau of Economic Analysis, in 2022, the share of the US construction sector in the country's GDP slumped to 4% from 4.1% in the past year.

- According to the US Census Bureau, during February 2023, construction spending in the country was estimated at a seasonally adjusted annual rate of USD 1,844.1 billion, 0.1% lower than the revised January 2023 estimate of USD 1,845.1 billion.

- Moreover, according to the US Census Bureau, in 2022, private construction spending in the United States grew at a rate roughly four times that of public construction spending. When looking at building spending throughout the 50 states, Texas and California came out on top. According to projections, the value of new buildings in the United States will continue to rise in the coming years.

- Similarly, in February 2023, private construction in the country was estimated at a seasonally adjusted annual rate of USD 1.45 trillion, with residential construction assessed at a seasonally adjusted annual rate of USD 852.1 billion, 0.6% lower than the revised January estimate of USD 857.0 billion. Nonresidential construction remained at a seasonally adjusted annual rate of USD 601.0 billion in February 2023, 0.7% higher than the revised January 2023 estimate of USD 596.7 billion.

- In addition to new home construction, the United States is doing massive home renovations. With the growing population of migrants in the country, the need for renovation has become increasingly important. Also, the growing awareness toward sustainability and high-efficiency structures has created a spur in the restoration trend. The availability of several loans by the government also supports home remodeling in the country.

- According to the AIA (American Institute of Architects) Construction Consensus Forecast Panel, non-residential building construction spending expanded to 5.4% in 2022. Further, US expenditure on new private non-residential buildings peaked at over USD 539 billion in 2022. By 2023, all the major commercial, industrial, and institutional categories are projected to witness at least reasonably healthy gains.

- In May 2022, Holcim US acquired a prominent ready-mix concrete company in the Greater Baton Rouge Area, Cajun Ready-Mix Concrete, to further expand its reach in Louisiana through enhanced capacity to serve its customers. The acquisition allowed Holcim to have access to 51 mixer trucks and eight state-certified batch plants that serve Baton Rouge and surrounding cities.

- Further, in May 2022, Martin Marietta Materials Inc. entered into a definitive agreement to divest certain West Coast cement and ready-mixed concrete operations and sell them to CalPortland Company for a transaction of USD 250 million in cash. On completion of the transaction, CalPortland Company will have access to the Redding cement plant, related cement distribution terminals, and 14 ready-mixed concrete plants located in California.

- These factors indicate that residential and infrastructure development may potentially gain strong traction in the coming years, thereby strengthening the market for ready-mix concrete in the region.

North America Ready-Mix Concrete Industry Overview

The North American ready-mix concrete market is consolidated in nature. Some of the key players in the market include CEMEX SAB de CV, HOLCIM, Buzzi Unicem SpA, HeidelbergCementAG, Colas, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Building Construction across The Region

- 4.1.2 Superior Properties and Advantages Over Normal Concrete

- 4.2 Restraints

- 4.2.1 Easy Availability of Potential Subsitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By End-user Sector

- 5.1.1 Residential

- 5.1.2 Commercial

- 5.1.3 Industrial/Institutional

- 5.1.4 Infrastructure

- 5.2 By Geography

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BuzziUnicem SpA

- 6.4.2 CEMEX SAB de CV

- 6.4.3 Colas Group

- 6.4.4 CRH

- 6.4.5 GCC

- 6.4.6 HeidelbergCement

- 6.4.7 HOLCIM

- 6.4.8 R.W. Sidley, Inc.

- 6.4.9 Sika AG

- 6.4.10 Thomas Concrete Group

- 6.4.11 Titan Cement

- 6.4.12 Vicat SA

- 6.4.13 Vulcan Materials

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Investment in Commercial and Infrastructure Development in the Region