|

市場調查報告書

商品編碼

1773353

混凝土攪拌站市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Concrete Batch Plants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

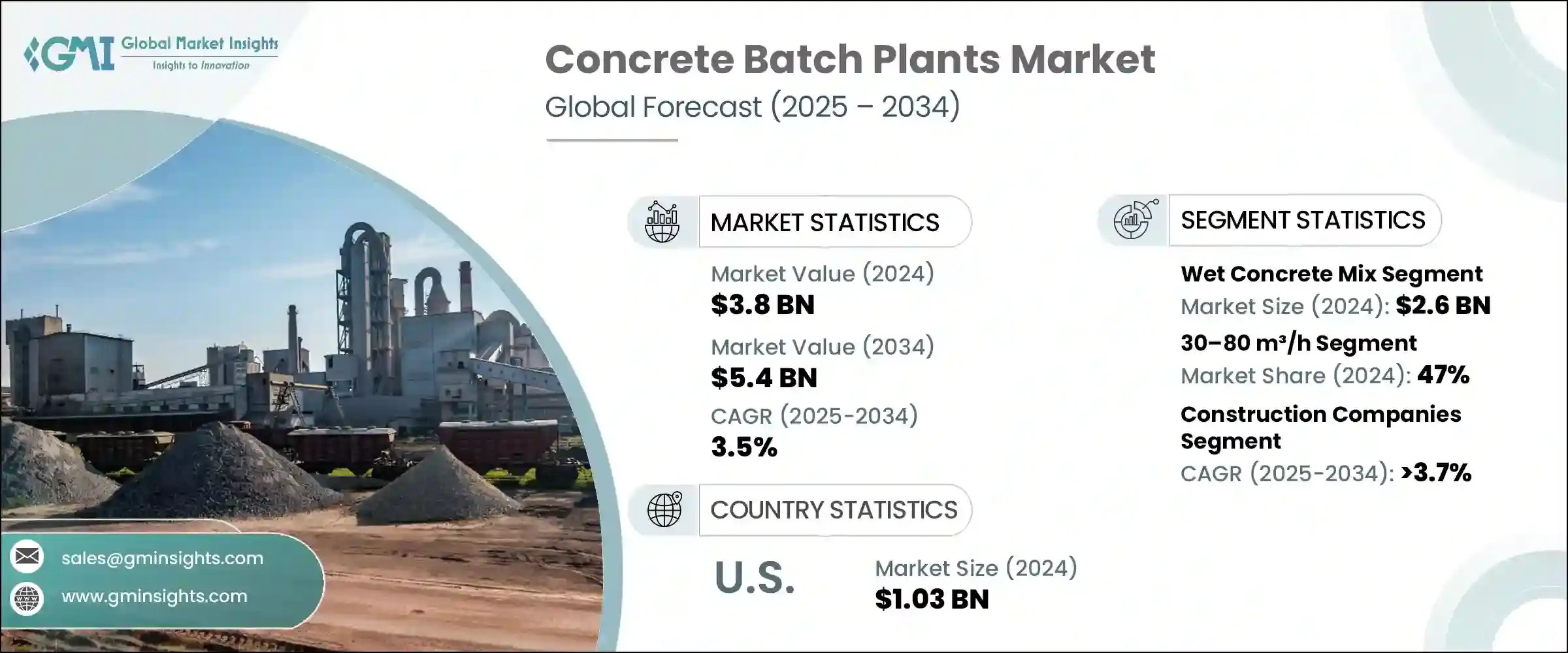

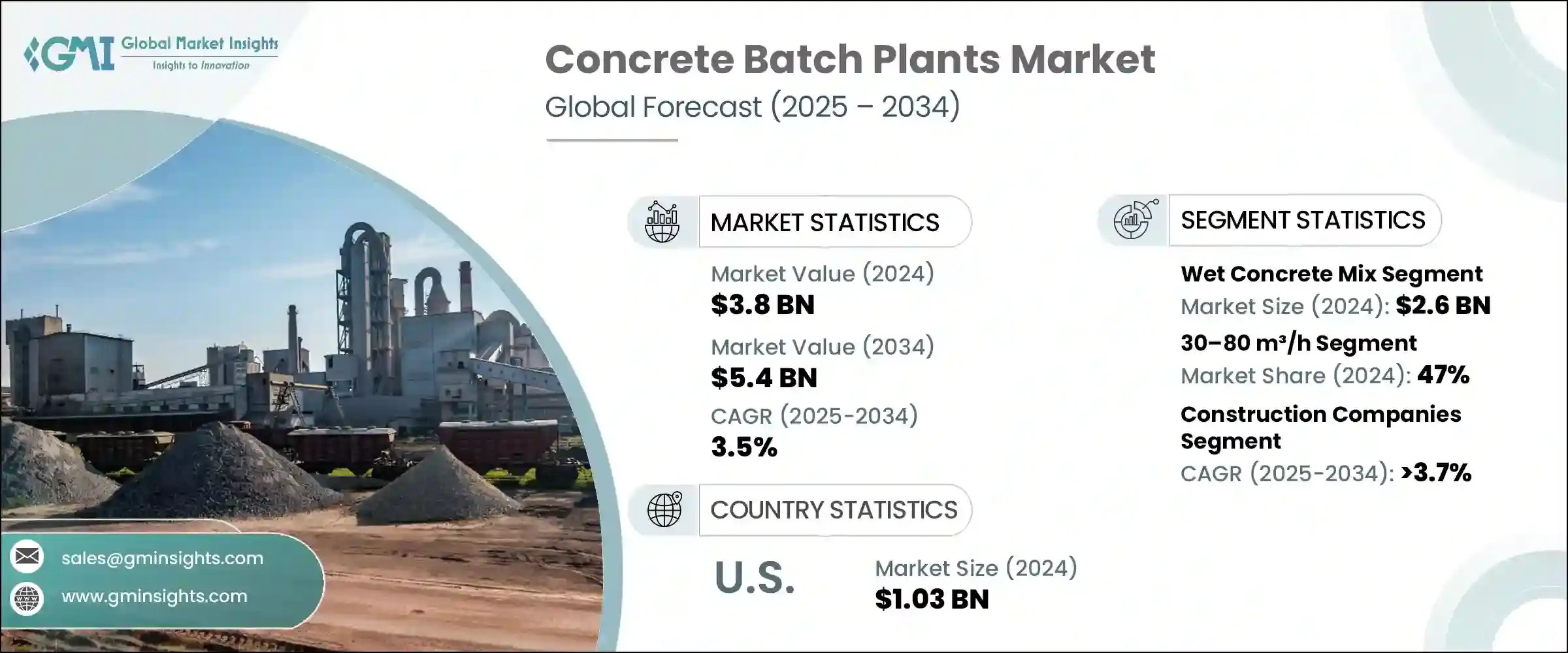

2024年,全球混凝土攪拌站市場規模達38億美元,預計2034年將以3.5%的複合年成長率成長,達到54億美元。這一成長趨勢得益於基礎設施建設的蓬勃發展、城市化進程的加速以及對高效能、高品質混凝土生產方法日益成長的需求。已開發經濟體和發展中經濟體的政府和私人實體都在持續投資建設完善的交通系統、商業樞紐、住宅開發項目以及能源相關基礎設施。這些項目都高度依賴穩定、高性能的混凝土,這推動了對先進攪拌站的需求。

移動式混凝土攪拌站因其現場攪拌能力而備受青睞,這減少了對運輸的依賴,並加快了專案進度。這種需求涵蓋了公用事業、工業發展和道路建設等各個領域。不斷變化的環境政策和對永續建築的日益重視,促使承包商考慮採用電動移動式攪拌站而非柴油動力,尤其是在人口稠密的城市地區。緊湊型模組化攪拌站具有便攜性,且易於遷移和靈活設置,因此越來越受到人們的青睞。此外,物聯網整合、自動化和智慧控制面板等創新技術正在改變工廠營運,使即時監控和最大程度減少人工輸入成為可能。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 38億美元 |

| 預測值 | 54億美元 |

| 複合年成長率 | 3.5% |

2024年,濕混凝土混合料市場規模達26億美元,預計2025年至2034年的複合年成長率將達到3.7%。濕拌混凝土攪拌站正日益受到青睞,因為它們能夠在混凝土裝車運輸前,將所有必需材料(包括水)在現場徹底攪拌。這使得混凝土混合更加均勻,品質更卓越,對追求一致性和可靠性的建築專業人士極具吸引力。與需要預先稱重材料並在運輸途中攪拌的乾拌混凝土攪拌站相比,濕拌系統具有更強的控制力和均勻性,尤其是在對強度規格要求更高的大型項目中。雖然乾拌混凝土解決方案適用於快速移動的遠端施工任務,但濕拌混凝土以其更佳的攪拌效果和生產精度,仍佔據主導地位。

2024年,生產能力在30至80立方米/小時範圍內的攪拌站佔據了47%的市場佔有率,預計2025-2034年期間的複合年成長率將達到3.9%。這些攪拌站非常適合中型基礎設施開發和城市項目,兼顧了產能和靈活性。其適中的吞吐量使承包商能夠將其部署到各種應用中,例如商業開發、市政專案和道路鋪設作業。它們在產出效率和移動性之間取得了良好的平衡,使用戶能夠快速適應不同的專案需求。

2024年,歐洲混凝土攪拌站市場規模達8億美元,預計2025年至2034年期間的複合年成長率為3.1%。該地區的成長主要受到監管壓力的影響,要求減少建築排放,以及對永續建築實踐日益成長的需求。歐洲各地的承包商正在採用移動式混凝土攪拌站,以減少混凝土運輸對環境的影響,並更好地融入以生態為重點的基礎設施建設計畫。西歐市場需求穩定,主要得益於翻新和維護活動;而東歐市場則因公共和私人對基礎設施建設的投資成長以及新興的建築需求而迅速擴張。該地區各國正將永續性作為發展策略的核心,大力推廣新一代混凝土攪拌系統。

引領市場的主要製造商包括三一、Elkon、Vince Hagan、普茨邁斯特、徐工、Cemco、Meka、JEL Concrete Plants、SCHWING Stetter、Semix、Stephens Mfg、Ammann、AIMIX Group、利勃海爾和 Astec。混凝土攪拌站市場的頂尖企業正在部署多項重點策略,以增強競爭優勢並提高市場佔有率。各公司優先考慮產品創新,高度重視自動化和數位整合,以提供具有即時控制功能的智慧配料解決方案。他們正在引入節能模型,以順應永續發展趨勢並滿足排放標準。透過合作夥伴關係和本地化製造進行的區域擴張正在幫助企業提高市場響應能力並降低物流成本。模組化和攜帶式工廠設計正在受到重視,以服務偏遠項目和快節奏的施工現場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計(HS 編碼 - 84743110)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 固定式配料廠

- 移動式配料廠

第6章:市場估計與預測:依產能,2021 - 2034 年

- 主要趨勢

- 低於30立方米/小時

- 30-80 立方米/小時

- 高於80立方米/小時

第7章:市場估計與預測:依混合類型,2021 - 2034

- 主要趨勢

- 濕混凝土混合物

- 乾混凝土混合物

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 住宅建築

- 商業建築

- 辦公大樓

- 零售空間

- 飯店和度假村

- 衛生保健

- 教育機構

- 其他

- 基礎設施項目

- 道路和高速公路

- 橋樑和隧道

- 機場和海港

- 鐵路和地鐵

- 水壩和水庫

- 風力發電場和太陽能發電場

- 倉庫

- 其他

- 市政和智慧城市項目

- 工業建築

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 建築公司

- 政府機構

- 其他

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- AIMIX Group

- Ammann

- Astec

- Cemco

- Elkon

- JEL Concrete Plants

- Liebherr

- Meka

- Putzmeister

- Sany

- SCHWING Stetter

- Semix

- Stephens Mfg

- Vince Hagan

- XCMG

The Global Concrete Batch Plants Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 3.5% to reach USD 5.4 billion by 2034. This upward trend is supported by growing infrastructure development, rapid urban expansion, and the rising demand for efficient, high-quality concrete production methods. Governments and private entities across both developed and developing economies are continuing to invest in robust transportation systems, commercial hubs, housing developments, and energy-related infrastructure. These projects all rely heavily on consistent and high-performance concrete, which is fueling the need for advanced batch plants.

Mobile batching plants are gaining notable traction due to their on-site mixing capability, which reduces the reliance on transportation and speeds up project timelines. This demand spans across various sectors, including utilities, industrial development, and road construction. Evolving environmental policies and growing emphasis on sustainable construction are prompting contractors to consider electric-powered mobile plants over diesel-based alternatives, particularly in dense urban areas. Compact modular plants with portable features are increasingly being adopted for their ease of relocation and set-up flexibility. Furthermore, innovations like IoT integration, automation, and smart control panels are transforming plant operations, making real-time monitoring and minimal manual input possible.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 3.5% |

The wet concrete mix segment generated USD 2.6 billion in 2024 and is expected to grow at a CAGR of 3.7% from 2025 to 2034. Wet mix plants are gaining more preference as they allow all essential materials-including water-to be thoroughly mixed at the site before the concrete is loaded for delivery. This results in a more even mix and superior concrete quality, which appeals to construction professionals seeking consistency and reliability. Compared to dry batch plants that deliver pre-weighed materials for mixing in transit, wet mix systems offer greater control and uniformity, especially in larger projects requiring higher strength specifications. While dry mix solutions are useful for fast-moving, remote construction tasks, wet batching remains dominant for its better results and production precision.

Plants with a production capacity ranging from 30 to 80 m3/h segment accounted for 47% share in 2024 and are projected to register a CAGR of 3.9% during 2025-2034. These batch plants are ideally suited for medium-scale infrastructure developments and urban projects, balancing capacity with flexibility. Their moderate throughput enables contractors to deploy them for a wide range of applications such as commercial developments, municipal projects, and road paving operations. They strike a good balance between output efficiency and mobility, allowing users to adapt quickly to different project requirements.

Europe Concrete Batch Plants Market was valued at USD 800 million in 2024 and is anticipated to grow at a CAGR of 3.1% from 2025 to 2034. This regional growth is being shaped by regulatory pressure to cut construction emissions and the rising demand for sustainable building practices. Contractors throughout Europe are adopting mobile batch plants to reduce the environmental footprint of transporting concrete and to better align with eco-focused infrastructure initiatives. Western Europe sees steady demand supported by refurbishment and maintenance activities, while in Eastern Europe, the market is expanding rapidly due to public and private investment in infrastructure growth and emerging construction demands. Countries across the region are making sustainability central to development strategies, pushing the adoption of newer-generation concrete batching systems.

Key manufacturers leading the market include Sany, Elkon, Vince Hagan, Putzmeister, XCMG, Cemco, Meka, JEL Concrete Plants, SCHWING Stetter, Semix, Stephens Mfg, Ammann, AIMIX Group, Liebherr, and Astec. Top players in the concrete batch plants market are deploying several focused strategies to strengthen their competitive edge and enhance market share. Companies prioritize product innovation with a strong emphasis on automation and digital integration to deliver smart batching solutions with real-time control features. They are introducing energy-efficient models to align with sustainability trends and meet emission norms. Regional expansion through partnerships and localized manufacturing is helping firms improve market responsiveness and reduce logistics costs. Modular and portable plant designs are being emphasized to serve remote projects and fast-paced construction sites.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 By type

- 2.2.3 By capacity

- 2.2.4 By mix type

- 2.2.5 By application

- 2.2.6 By end use

- 2.2.7 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code - 84743110)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Stationary batch plant

- 5.3 Mobile batch plant

Chapter 6 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Below 30 m³/h

- 6.3 30-80 m³/h

- 6.4 Above 80 m³/h

Chapter 7 Market Estimates & Forecast, By Mix Type, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Wet concrete mix

- 7.3 Dry concrete mix

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Residential construction

- 8.3 Commercial construction

- 8.3.1 Office buildings

- 8.3.2 Retail spaces

- 8.3.3 Hotels and resorts

- 8.3.4 Healthcare

- 8.3.5 Educational institutions

- 8.3.6 Others

- 8.4 Infrastructure projects

- 8.4.1 Roads and highways

- 8.4.2 Bridges and tunnels

- 8.4.3 Airports and seaports

- 8.4.4 Railways and Metros

- 8.4.5 Dam & reservoirs

- 8.4.6 Wind farms and solar farms

- 8.4.7 Warehouses

- 8.4.8 Others

- 8.5 Municipality & smart city projects

- 8.6 Industrial construction

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Construction companies

- 9.3 Government agencies

- 9.4 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AIMIX Group

- 12.2 Ammann

- 12.3 Astec

- 12.4 Cemco

- 12.5 Elkon

- 12.6 JEL Concrete Plants

- 12.7 Liebherr

- 12.8 Meka

- 12.9 Putzmeister

- 12.10 Sany

- 12.11 SCHWING Stetter

- 12.12 Semix

- 12.13 Stephens Mfg

- 12.14 Vince Hagan

- 12.15 XCMG