|

市場調查報告書

商品編碼

1693666

中國電動自行車市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)China E-bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

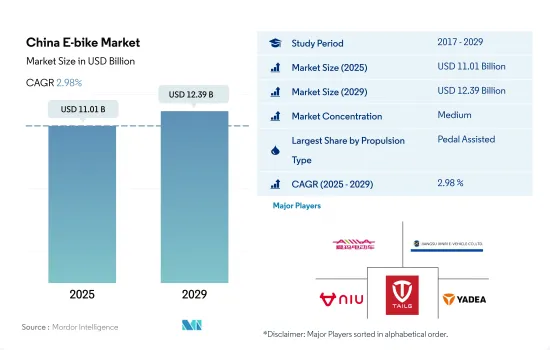

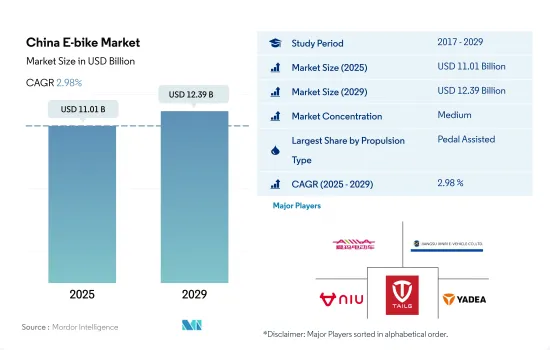

預計 2025 年中國電動自行車市場規模為 110.1 億美元,到 2029 年將達到 123.9 億美元,預測期內(2025-2029 年)的複合年成長率為 2.98%。

推進系統細分市場概覽

- 電動自行車的功能越來越強大,有些型號的性能更像Scooter或摩托車,而不是自行車。政府支持使用電動自行車等綠色技術的政策和法律是中國電動自行車市場的重要驅動力。這些努力促進了利用巨量資料的應用平台和配備智慧電池的電動自行車的發展。截至 2007 年,電動自行車為中華人民共和國 (PRC) 約 4,000 萬至 5,000 萬人提供了一種廉價、便捷且相對節能的交通方式。 2015 年,中國共售出約 1,435 萬輛電動自行車。該國是世界上最重要的電動自行車市場。

- 2019年,雅迪作為中國電動自行車領導品牌,銷量約610萬輛,較2016年成長近一倍。同時,尚拉和小牛電動在2016年至2019年期間的銷量也呈現成長態勢,2019年分別售出170萬輛和40萬輛。

- 交通基礎設施建設和交通量增加的後果包括污染和溫室氣體排放。 2020年,交通運輸業佔直接二氧化碳排放的9%。中國政府正全力推動交通運輸系統朝向智慧化、綠色化方向轉變。考慮到這些因素,中國政府可能會鼓勵使用踏板輔助、速度踏板和油門控制的電動自行車,以幫助緩解中國的交通堵塞、污染和燃料價格。

中國電動自行車市場趨勢

中國的電動自行車普及率很高且呈上升趨勢,凸顯了其龐大的市場和強大的消費者接受度。

- 由於中國電動自行車銷量龐大,佔亞太地區電動自行車市場消費量的 90% 以上,有助於解決日益嚴重的交通堵塞和車輛污染問題。近年來,我國電動自行車進出口量較大。中國目前是世界上最大的電動自行車出口國。

- 中國電動二輪車產業受到政府支持使用綠色技術的多項舉措和法律的大力推動,推動了對配備智慧電池和應用平台的電動二輪車的需求。中國製造商生產的電動二輪車因其高品質和技術進步在歐洲越來越受歡迎。此外,為了防止交通堵塞和事故,該國對電動摩托車的需求正在增加。由於人們越來越關注共用微行動服務,租賃服務的出現也使該行業受益。推動電動自行車普及的其他因素包括高度都市化、停車位不足以及燃油汽車運輸成本上升。

- 電動二輪車的價格在 1,500 至 3,000 元人民幣(約 180-360 美元)之間,僅為汽車價格的一小部分,因此對於許多中國消費者來說,電動二輪車是可以負擔的選擇。在預測期內,隨著電動自行車成本的下降,預計中國市場的電動自行車消費量將持續擴大。國內汽油價格上漲和農村地區電費下降使得電動自行車在經濟上與汽油Scooter等替代品具有競爭力。

中國每天通勤5至15公里的人數持續增加,反映出通勤模式逐漸改變。

- 在中國,自行車作為交通工具的使用量逐年增加,帶動了需求的成長。這種日益成長的需求導致騎自行車上班的人數不斷增加,每天騎行距離為 5 至 15 公里。 2020年,中國近15%的個人以自行車為主要交通工具,每天出遊5-15公里,前往辦公室和學校等各個地方。

- 由於人們鎖門、健身房和瑜珈館關閉,新冠疫情顯著增加了中國2020年和2021年對自行車的需求。在中國的許多城市,人們也避免搭乘公共運輸以保持社交距離,而是選擇騎自行車去職場、去企業和其他附近的地方。 2021 年,騎乘 5 至 15 公里的通勤者數量增加。

- 目前,許多人騎自行車5至15公里去職場、購物中心和附近的市場。 2022年,約有17%的日常通勤者騎自行車。由於自行車基礎設施的改善和政府推出的各種推廣騎自行車的政策,2022 年騎自行車上下班的人數與 2021 年相比有所增加。預計這些因素將增加每天騎自行車出行 5-15 公里的通勤者數量,這可能會在預測期內增加中國對自行車的需求。

中國電動自行車產業概況

中國電動自行車市場格局適度整合,前五大企業市佔率合計為49.61%。該市場的主要企業包括愛瑪科技集團、江蘇新日電動車、小牛電動、深圳台鈴科技集團、雅迪集團控股有限公司等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 自行車銷量

- 人均GDP

- 通貨膨脹率

- 電動自行車普及率

- 每天出遊 5-15 公里的人口/通勤者百分比

- 自行車租賃

- 電動自行車電池價格

- 電池化學價格表

- 超本地化配送

- 自行車道

- 徒步人數

- 電池充電容量

- 交通堵塞指數

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 推進類型

- 踏板輔助

- 高速電動自行車

- 油門輔助

- 應用程式類型

- 貨運/公共產業

- 城市/城區

- 健行

- 電池類型

- 鉛酸電池

- 鋰離子電池

- 其他

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Aima Technology Group Co. Ltd

- Jiangsu Lvneng Electrical Bicycle Technology Co., Ltd.

- Jiangsu Xinri E-Vehicle Co. Ltd

- Luyuan Electric Vehicle Co., Ltd.

- NIU Technologies

- Shanghai Lima Electric Bicycle Co.,Ltd

- Shenzhen TAILG Technology Group Co., LTD.

- Tianjin Baishan Electric bicycle Co., LTD

- Tianjin Fuji-Ta Bicycle Co. Ltd.

- Yadea Group Holdings Ltd.

第7章 CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 93104

The China E-bike Market size is estimated at 11.01 billion USD in 2025, and is expected to reach 12.39 billion USD by 2029, growing at a CAGR of 2.98% during the forecast period (2025-2029).

PROPULSION SEGMENT MARKET OVERVIEW

- E-bikes are becoming more powerful, and some models are more similar to scooters and motorcycles than to bicycles in terms of performance. The government's policies and laws supporting the use of green technologies, like e-bikes, are what essentially fuel the China e-bike market. These initiatives have sparked the development of big data-using application platforms and e-bikes with smart batteries. Electric bikes (e-bikes) provide cheap, convenient, and relatively energy-efficient transportation to an estimated 40 million to 50 million people in the People's Republic of China (PRC) as of 2007. In 2015, some 14.35 million electric bikes were sold to customers in China. The country is the most important market for electric bikes worldwide.

- In 2019, as the leading brand of electric bicycles in China, Yadea sold around 6.1 million units, almost doubling its sales compared to 2016. Meanwhile, Sunra and Niu also experienced sale growth from 2016 to 2019, with respective sales of 1.7 and 0.4 million units in 2019.

- The consequences of developing transportation infrastructure and increasing transportation volume include pollution and greenhouse gas emissions. The transportation industry accounted for 9% of direct CO2 emissions in 2020. The Chinese government is making concerted efforts to change its transportation system into a smart and environmentally friendly one. Given these considerations, the Chinese government will encourage pedal-assisted, speed pedelec, and throttle e-bikes to alleviate China's congestion, pollution, and fuel price difficulties.

China E-bike Market Trends

China demonstrates exceptionally high and increasing E-Bike adoption rates, highlighting a vast market and strong consumer adoption.

- China accounted for more than 90% of consumption in the Asia-Pacific e-bike market during the historical period, owing to the high sales of e-bikes in the country to tackle heavy traffic conditions and growing vehicle pollution. The import and export volumes of e-bikes in China have been large over the past years. Currently, China ranks as the largest exporter of electric bikes worldwide.

- The Chinese e-bike industry is largely driven by several government efforts and legislation supporting the use of green technology, thus boosting the demand for e-bikes with smart batteries and application platforms. Electric motorcycles made by Chinese manufacturers have gained favor in Europe due to their high quality and technical advancements. There has also been an increase in the demand for e-bikes in the country to prevent traffic congestion and accidents. The advent of rental services due to the rising focus on shared micro-mobility services has also benefited the industry. other factors driving the adoption of e-bikes include hyper-urbanization, a scarcity of parking spaces, and high transport expenses for fuel vehicles

- An electric bike is becoming an affordable option to many Chinese consumers, as it is priced at CNY 1,500-3,000 (about USD 180-360), which is a small fraction of the cost of a car. During the forecast period, the consumption of e-bikes is likely to continue to grow due to the decreasing cost of e-bikes in the Chinese market. Gasoline prices have risen in the country, while electricity prices in rural areas have dropped, making e-bikes more economically competitive to alternatives, like gasoline-powered scooters.

China demonstrates a consistent rise in the population commuting 5-15 km daily, reflecting a gradual change in commuting patterns.

- Every year, the use of bicycles for transportation grows in China, driving their demand. This growing demand is leading to an increase in the number of people who use bicycles to commute 5-15 km per day. Nearly 15% of individuals in China used bicycles as their primary mode of transportation in 2020 to travel between 5 and 15 km daily to various locations, including offices and schools.

- The COVID-19 pandemic significantly boosted China's bicycle demand in 2020 and 2021 due to lockdowns and the closure of gyms and yoga studios. People also avoided public transportation to maintain social distancing and chose bicycles to commute to their workplaces, places of business, and other nearby sites in many Chinese cities. In 2021, there was an increase in the number of commuters traveling 5-15 km on bicycles.

- Currently, many people use bicycles to travel a distance of 5-15 km to their workplaces, places of commerce, and nearby markets. About 17% of daily commuters rode bicycles in 2022. Due to improvements in bicycle infrastructure and a variety of cycling promotion initiatives by the government, the number of people biking to work increased in 2022 compared to 2021. Such factors are anticipated to boost the number of commuters using bicycles to cover a distance of 5-15 km daily, which may also increase the demand for bicycles in China during the forecast period.

China E-bike Industry Overview

The China E-bike Market is moderately consolidated, with the top five companies occupying 49.61%. The major players in this market are Aima Technology Group Co. Ltd, Jiangsu Xinri E-Vehicle Co. Ltd, NIU Technologies, Shenzhen TAILG Technology Group Co., LTD. and Yadea Group Holdings Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Bicycle Sales

- 4.2 GDP Per Capita

- 4.3 Inflation Rate

- 4.4 Adoption Rate Of E-bikes

- 4.5 Percent Population/commuters With 5-15 Km Daily Travel Distance

- 4.6 Bicycle Rental

- 4.7 E-bike Battery Price

- 4.8 Price Chart Of Different Battery Chemistry

- 4.9 Hyper-local Delivery

- 4.10 Dedicated Bicycle Lanes

- 4.11 Number Of Trekkers

- 4.12 Battery Charging Capacity

- 4.13 Traffic Congestion Index

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Pedal Assisted

- 5.1.2 Speed Pedelec

- 5.1.3 Throttle Assisted

- 5.2 Application Type

- 5.2.1 Cargo/Utility

- 5.2.2 City/Urban

- 5.2.3 Trekking

- 5.3 Battery Type

- 5.3.1 Lead Acid Battery

- 5.3.2 Lithium-ion Battery

- 5.3.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Aima Technology Group Co. Ltd

- 6.4.2 Jiangsu Lvneng Electrical Bicycle Technology Co., Ltd.

- 6.4.3 Jiangsu Xinri E-Vehicle Co. Ltd

- 6.4.4 Luyuan Electric Vehicle Co., Ltd.

- 6.4.5 NIU Technologies

- 6.4.6 Shanghai Lima Electric Bicycle Co.,Ltd

- 6.4.7 Shenzhen TAILG Technology Group Co., LTD.

- 6.4.8 Tianjin Baishan Electric bicycle Co., LTD

- 6.4.9 Tianjin Fuji-Ta Bicycle Co. Ltd.

- 6.4.10 Yadea Group Holdings Ltd.

7 KEY STRATEGIC QUESTIONS FOR E BIKES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219