|

市場調查報告書

商品編碼

1693660

電動輕型商用車:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Electric Light Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

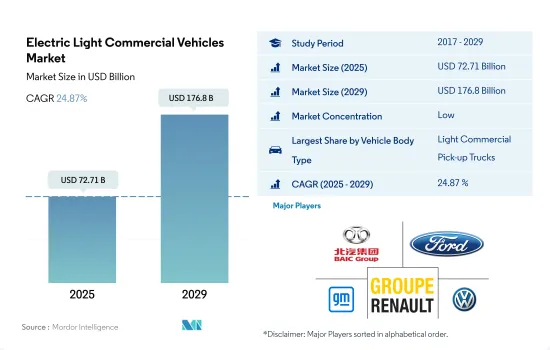

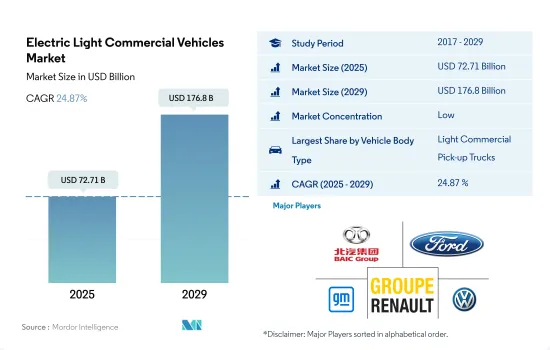

預計 2025 年電動輕型商用車市場規模將達到 727.1 億美元,到 2029 年預計將達到 1,768 億美元,預測期內(2025-2029 年)的複合年成長率為 24.87%。

隨著網路和智慧型手機的普及,全球線上零售和電子商務蓬勃發展,帶動全球輕型商用車購買量增加。

- 電子商務和物流行業是全球電動輕型商用車市場的主要驅動力。隨著網路和智慧型手機的普及,網路零售和電子商務蓬勃發展,導致全球輕型商用車的購買量增加。 2021年全球輕型商用車產量達18,593,850輛,高於去年的17,217,990輛。

- 新冠疫情推動了網路銷售的成長,導致全球電子商務市場的收益和用戶數量都大幅增加。隨著網上購物越來越受歡迎,預計這一趨勢將會持續下去。 2020 年全球電子商務市場呈現快速擴張態勢,預計未來一年仍將持續成長,2021 年收益將達到 26.7 兆美元。全球網路購物購物者的數量和比例一直在穩步成長,其中 2020 年出現了最大成長,這得益於疫情引發的向網路購物的轉變。

- 歐洲、美國和中國等主要經濟體的電子商務和物流產業正在強勁成長,推動對現代化物流網路的需求。戴姆勒、日產、福特、雷諾等知名輕型商用車製造商的電子商務銷售額正在大幅成長,並正在加強其物流產業。傳統上,皮卡車和貨車一直是電子商務物流和消費者配送的首選車輛,進一步加強了全球輕型商用車市場。

汽車產業對清潔能源的需求不斷成長以及鼓勵採用電動車的政策是全球電動商用車發展的主要驅動力。

- 近年來,世界各國政府都在積極推行鼓勵電動車發展的政策。特別是中國、印度、法國和英國已設定目標,2040年逐步淘汰汽油和柴油汽車。

- 汽車產業對清潔能源的需求不斷成長是市場成長的主要動力。主要OEM正在重新調整其針對電動車的策略。例如,起亞汽車於2022年3月宣布進軍電動皮卡領域,並計畫在2027年推出兩款車型。其中一款車型將直接與特斯拉Cybertruck、福特F-150 Lightning、Rivian R1T和GMC Hummer EV等現有競爭對手競爭。同樣,福特在2022年3月宣布,計畫在2024年推出四款商用電動車的新陣容。陣容包括將於2023年上市的新型1噸廂型車“Transit 自訂”和多功能車“Tourneo 自訂”,以及將於2024年上市的下一代“Transit Courier Van”和多功能車“Tourneo Courier”。

- 北美網路和智慧型手機普及率高,為電子商務公司進入零售電子商務市場提供了豐厚的機會。這種數位化環境不僅有利於電子商務公司的業務擴展,而且在推動全球電動輕型商用車市場和卡車領域發展方面發揮關鍵作用。因此,汽車製造商正在加大對卡車領域的研發投入,進一步推動電動卡車的發展。

全球電動輕型商用車市場趨勢

全球需求成長和政府支持將推動電動車市場成長

- 電動車(EV)已成為汽車產業的重要組成部分,因為它具有提高能源效率、減少溫室氣體和污染排放的潛力。這種快速成長背後的主要因素是日益成長的環境問題和政府的支持。其中,電動車全球銷售呈現強勁成長勢頭,2022年較2021年成長10.82%。據預測,2025年底,電動乘用車年銷量將超過500萬輛,約佔汽車總銷量的15%。

- 領先的製造商和組織(例如倫敦警察廳和消防隊)正在積極推行電動車策略。例如,該公司設定了在 2025 年實現零排放汽車、在 2030 年實現 40% 貨車電氣化、到 2040 年實現全電動化的目標。預計全球也將出現類似的趨勢,2024 年至 2030 年間電動車的需求和銷售量將急劇成長。

- 在電池技術和汽車電氣化進步的推動下,亞太地區和歐洲有望主導電動車生產。 2020年5月,起亞汽車歐洲公司公佈“S計劃”,宣布轉向電動化策略。這項決定是在起亞電動車在歐洲創下銷售紀錄之際做出的。起亞雄心勃勃地計劃在 2025 年之前在全球推出 11 款電動車,涵蓋轎車、SUV 和 MPV 等各個領域。該公司的目標是到 2026 年實現全球電動車年銷量達到 50 萬輛。

電動輕型商用車產業概況

電動輕型商用車市場較為分散,前五大企業佔22.60%的市場。市場的主要企業是:北京汽車股份有限公司、福特汽車公司、通用汽車公司、雷諾集團和大眾汽車集團(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 人均GDP

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 消費者汽車購買支出(cvp)

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 通貨膨脹率

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 汽車貸款利率

- 電氣化的影響

- 電動車充電站

- 電池組價格

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 新款 Xev 車型發布

- 物流績效指數

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 燃油價格

- 製造商生產統計

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 車輛配置

- 輕型商用車

- 燃料類別

- BEV

- FCEV

- HEV

- PHEV

- 地區

- 非洲

- 南非

- 非洲

- 亞太地區

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 韓國

- 泰國

- 亞太地區其他國家

- 歐洲

- 奧地利

- 比利時

- 捷克共和國

- 丹麥

- 愛沙尼亞

- 法國

- 德國

- 愛爾蘭

- 義大利

- 拉脫維亞

- 立陶宛

- 挪威

- 波蘭

- 俄羅斯

- 西班牙

- 瑞典

- 英國

- 其他歐洲國家

- 中東

- 沙烏地阿拉伯

- 其他中東地區

- 北美洲

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地區

- 非洲

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- BAIC Motor Corporation Ltd.

- BYD Auto Co. Ltd.

- Daimler AG(Mercedes-Benz AG)

- Dongfeng Motor Corporation

- Ford Motor Company

- General Motors Company

- Groupe Renault

- Nissan Motor Co. Ltd.

- Rivian Automotive Inc.

- Volkswagen AG

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 93053

The Electric Light Commercial Vehicles Market size is estimated at 72.71 billion USD in 2025, and is expected to reach 176.8 billion USD by 2029, growing at a CAGR of 24.87% during the forecast period (2025-2029).

The surge in online retail and e-commerce worldwide, fueled by increased internet and smartphone access, is leading to a rise in light commercial vehicle purchases globally

- The e-commerce and logistics industries are the primary drivers of the global electric light commercial vehicles market. The surge in online retail and e-commerce worldwide, fueled by increased internet and smartphone access, is leading to a rise in light commercial vehicle purchases globally. In 2021, global light commercial vehicle production reached 18,593.85 thousand units, up from 17,217.99 thousand units in the previous year.

- The COVID-19 pandemic propelled online sales, resulting in a significant boost in both revenue and user base for the global e-commerce market. This trend is expected to continue as internet shopping gains further traction. The global e-commerce market witnessed a rapid expansion in 2020, which continued over the next year, generating USD 26.7 trillion in revenue in 2021. The number and proportion of online shoppers have been steadily rising worldwide, with the largest surge seen in 2020, driven by the pandemic-induced shift to online shopping.

- The e-commerce and logistics industries are experiencing robust growth in major economies, including Europe, the United States, and China, driving the need for modernized distribution networks. Prominent light commercial vehicle manufacturers, such as Daimler, Nissan, Ford, and Renault, have witnessed a significant uptick in e-commerce sales, bolstering the logistics industry. Traditionally, pickup trucks and vans have been the go-to vehicles for e-commerce logistics and consumer deliveries, further bolstering the global light commercial vehicle market.

The rising demand for clean energy in the automotive industry and policies to promote the adoption of EVs are the key drivers for electric commercial vehicles globally

- Several governments worldwide have proactively implemented policies to promote the adoption of electric vehicles in recent years. Notably, China, India, France, and the United Kingdom have set targets to phase out the petrol and diesel vehicle industries by 2040.

- The rising demand for clean energy in the automotive industry is a key driver for the market's growth. Major OEMs are reshaping their strategies for electric vehicles. For example, in March 2022, Kia Motors unveiled plans to enter the electric pickup truck segment, with two models slated for release by 2027. One of these models will directly compete with established rivals like the Tesla Cybertruck, Ford F-150 Lightning, Rivian R1T, and GMC Hummer EV. Similarly, in March 2022, Ford announced its intention to introduce a new lineup of four commercial electric vehicles by 2024. This lineup included the all-new Transit Custom one-tonne van and Tourneo Custom multi-purpose vehicle launched in 2023, followed by the next-generation Transit Courier van and Tourneo Courier multi-purpose vehicle in 2024.

- North America, with its high internet and smartphone penetration, presents lucrative opportunities for e-commerce companies to tap into the retail e-commerce market. This digital landscape not only facilitates broader business expansion for e-commerce players but also plays a pivotal role in driving the global electric light commercial vehicles market as well as its truck segment. Consequently, automakers are ramping up their R&D investments in the truck segment, further fueling the growth of electric trucks.

Global Electric Light Commercial Vehicles Market Trends

The rising global demand and government support propel electric vehicle market growth

- Electric vehicles (EVs) have become indispensable in the automotive industry, driven by their potential to enhance energy efficiency and reduce greenhouse gas and pollution emissions. This surge is primarily attributed to growing environmental concerns and supportive government initiatives. Notably, global EV sales witnessed a robust 10.82% growth in 2022 compared to 2021. Projections indicate that annual sales of electric passenger cars will surpass 5 million by the end of 2025, accounting for approximately 15% of total vehicle sales.

- Leading manufacturers and organizations, like the London Metropolitan Police & Fire Service, have been actively pursuing their electric mobility strategies. For instance, they have set a target of a zero-emission fleet by 2025, with a goal of electrifying 40% of their vans by 2030 and achieving full electrification by 2040. Similar trends are expected globally, with the period from 2024 to 2030 witnessing a surge in demand and sales of electric vehicles.

- Asia-Pacific and Europe are poised to dominate electric vehicle production, driven by their advancements in battery technology and vehicle electrification. In May 2020, Kia Motors Europe unveiled its "Plan S," signaling a strategic shift toward electrification. This decision came on the heels of record-breaking sales of Kia's EVs in Europe. Kia has ambitious plans to introduce 11 EV models globally by 2025, spanning various segments like passenger vehicles, SUVs, and MPVs. The company aims to achieve annual global EV sales of 500,000 by 2026.

Electric Light Commercial Vehicles Industry Overview

The Electric Light Commercial Vehicles Market is fragmented, with the top five companies occupying 22.60%. The major players in this market are BAIC Motor Corporation Ltd., Ford Motor Company, General Motors Company, Groupe Renault and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.1.1 Africa

- 4.1.2 Asia-Pacific

- 4.1.3 Europe

- 4.1.4 Middle East

- 4.1.5 North America

- 4.1.6 South America

- 4.2 GDP Per Capita

- 4.2.1 Africa

- 4.2.2 Asia-Pacific

- 4.2.3 Europe

- 4.2.4 Middle East

- 4.2.5 North America

- 4.2.6 South America

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.3.1 Africa

- 4.3.2 Asia-Pacific

- 4.3.3 Europe

- 4.3.4 Middle East

- 4.3.5 North America

- 4.3.6 South America

- 4.4 Inflation

- 4.4.1 Africa

- 4.4.2 Asia-Pacific

- 4.4.3 Europe

- 4.4.4 Middle East

- 4.4.5 North America

- 4.4.6 South America

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.8.1 Africa

- 4.8.2 Asia-Pacific

- 4.8.3 Europe

- 4.8.4 Middle East

- 4.8.5 North America

- 4.8.6 South America

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.10.1 Africa

- 4.10.2 Asia-Pacific

- 4.10.3 Europe

- 4.10.4 Middle East

- 4.10.5 North America

- 4.10.6 South America

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Light Commercial Vehicles

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 South Africa

- 5.3.1.2 Rest-of-Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 Australia

- 5.3.2.2 China

- 5.3.2.3 India

- 5.3.2.4 Indonesia

- 5.3.2.5 Japan

- 5.3.2.6 Malaysia

- 5.3.2.7 South Korea

- 5.3.2.8 Thailand

- 5.3.2.9 Rest-of-APAC

- 5.3.3 Europe

- 5.3.3.1 Austria

- 5.3.3.2 Belgium

- 5.3.3.3 Czech Republic

- 5.3.3.4 Denmark

- 5.3.3.5 Estonia

- 5.3.3.6 France

- 5.3.3.7 Germany

- 5.3.3.8 Ireland

- 5.3.3.9 Italy

- 5.3.3.10 Latvia

- 5.3.3.11 Lithuania

- 5.3.3.12 Norway

- 5.3.3.13 Poland

- 5.3.3.14 Russia

- 5.3.3.15 Spain

- 5.3.3.16 Sweden

- 5.3.3.17 UK

- 5.3.3.18 Rest-of-Europe

- 5.3.4 Middle East

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 Rest-of-Middle East

- 5.3.5 North America

- 5.3.5.1 Canada

- 5.3.5.2 Mexico

- 5.3.5.3 US

- 5.3.5.4 Rest-of-North America

- 5.3.6 South America

- 5.3.6.1 Argentina

- 5.3.6.2 Brazil

- 5.3.6.3 Rest-of-South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BAIC Motor Corporation Ltd.

- 6.4.2 BYD Auto Co. Ltd.

- 6.4.3 Daimler AG (Mercedes-Benz AG)

- 6.4.4 Dongfeng Motor Corporation

- 6.4.5 Ford Motor Company

- 6.4.6 General Motors Company

- 6.4.7 Groupe Renault

- 6.4.8 Nissan Motor Co. Ltd.

- 6.4.9 Rivian Automotive Inc.

- 6.4.10 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219