|

市場調查報告書

商品編碼

1721631

工業電動車市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Industrial Electric Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

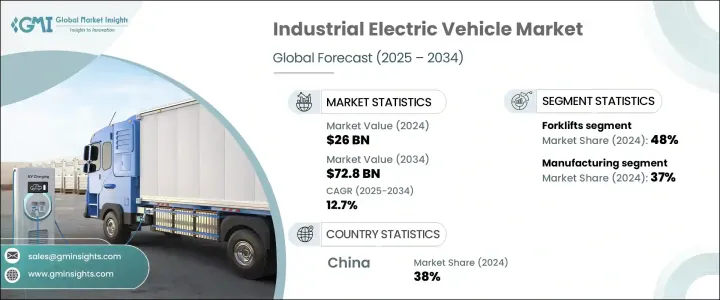

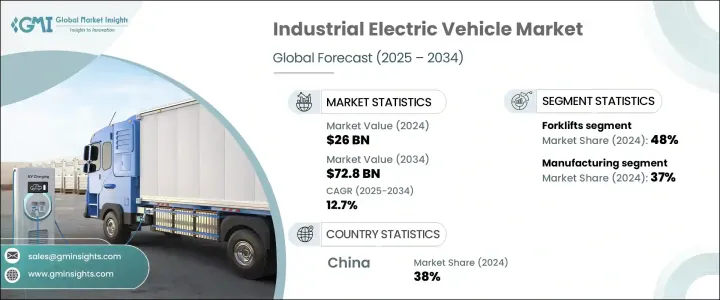

2024 年全球工業電動車市場價值為 260 億美元,預計到 2034 年將以 12.7% 的複合年成長率成長,達到 728 億美元。這一勢頭源於不斷增強的環保意識、監管要求以及電動汽車友善工業服務中心等支持基礎設施的發展。減少碳排放和營運成本的緊迫性日益增強,使得電動車成為傳統內燃機的可行替代品。企業現在優先考慮物流和倉庫營運的電氣化,不僅是為了符合生態目標,也是為了實現長期成本效益。隨著工業流程經歷數位轉型,全球市場對安靜、零排放和自動化相容車輛的需求正在加速成長。電池技術的進步和成本的下降進一步增強了電動車的應用,使企業更容易轉型,而不會影響性能或可擴展性。

在各種車輛類型中,堆高機佔據了最大的市場佔有率,2024 年為 48%,預計到 2034 年將以超過 13% 的複合年成長率成長。由於對符合現代倉儲和製造標準的智慧、低排放物料搬運解決方案的需求,堆高機在各行業的應用正在迅速成長。在應用方面,製造業在 2024 年佔據 37% 的市場佔有率,佔據主導地位,預計在預測期內複合年成長率將超過 13%。這種成長受到更清潔的生產要求、更嚴格的排放法規以及對能夠與智慧工廠生態系統無縫整合的節能車隊日益成長的需求的影響。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 260億美元 |

| 預測值 | 728億美元 |

| 複合年成長率 | 12.7% |

從動力方面來看,電池電動車(BEV)繼續佔據市場主導地位,這得益於其高能源效率、較低的總擁有成本以及對化石燃料的零依賴。這些車輛運作安靜、維護成本低,是室內和封閉工業環境的理想選擇。它們也更容易自動化,使其越來越適合工業 4.0 支援的操作。政府的激勵措施和與排放相關的法規也使 BEV 成為各個工業領域的首選。

從區域來看,中國在 2024 年引領亞太工業電動車市場,佔約 38% 的佔有率,創造近 45 億美元的收入。該國強大的工業基礎、政府對清潔能源轉型的積極支持以及先進的電動車製造能力使其成為重要的市場參與者。倉儲的快速自動化和積極的電氣化目標繼續推動區域需求,而促進智慧工廠基礎設施建設的舉措則進一步加強了這一需求。

全球市場的主要參與者包括杭叉堆高機、現代建築設備、海斯特-耶魯物料搬運、永恆力股份公司、凱傲集團、曼尼通、小松、三菱LOGISNEXT、三一電機和豐田。這些公司正在大力投資模組化電動車設計,擴大電池效率研發,並整合物聯網和遠端資訊處理進行即時診斷。他們的策略性努力還包括擴大本地生產和售後服務中心,以增強已開發經濟體和新興經濟體的市場覆蓋率和客戶支援。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 組件提供者

- 製造商

- 經銷商

- 最終用途

- 川普政府關稅

- 供給側影響(原料)

- 主要材料價格波動

- 生產成本影響

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 政府大力推動電動車發展

- 電動堆高機需求不斷成長

- 電氣技術的技術進步

- 製造業對工業車輛的需求不斷增加

- 產業陷阱與挑戰

- 工業電動車初始成本高

- 電池限制和停機時間

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 牽引車

- 堆高機

- 貨櫃搬運工

- 過道卡車

- 其他

第6章:市場估計與預測:以推進方式,2021 - 2034 年

- 主要趨勢

- 純電動車(BEV)

- 插電式混合動力電動車(PHEV)

- 混合動力電動車(HEV)

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 製造業

- 倉儲

- 貨運與物流

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第9章:公司簡介

- Aisle Master

- Alke

- Anhui Heli

- Aprolis

- CLARK

- Crown Equipment

- Doosan Industrial Vehicle

- EP Equipment

- Hangcha Forklift

- Hyster-Yale Materials Handling

- Hyundai Construction Equipment

- Jungheinrich AG

- Kalmar Global

- KION Group

- Komatsu

- Manitou

- Mitsubishi Logisnext

- Motrec International

- Sany Electric

- Toyota Material Handling

The Global Industrial Electric Vehicle Market was valued at USD 26 billion in 2024 and is estimated to grow at a CAGR of 12.7% to reach USD 72.8 billion by 2034. This momentum stems from rising environmental awareness, regulatory mandates, and the evolution of support infrastructure such as EV-friendly industrial service centers. The growing urgency to reduce carbon emissions and operating costs has positioned electric vehicles as a viable alternative to traditional internal combustion engines. Businesses are now prioritizing electrification in logistics and warehouse operations not only to align with eco-goals but also to leverage long-term cost efficiencies. As industrial processes undergo digital transformation, the demand for quiet, emission-free, and automation-compatible vehicles is accelerating across global markets. Advancements in battery technologies and falling costs have further strengthened the case for electric adoption, making it easier for businesses to transition without compromising performance or scalability.

Among vehicle types, forklifts held the largest market share at 48% in 2024 and are expected to expand at a CAGR of over 13% through 2034. Their application across industries is growing rapidly, driven by the need for smart, low-emission material handling solutions that align with modern warehousing and manufacturing standards. On the application front, the manufacturing segment led the market with a 37% share in 2024 and is projected to grow at over 13% CAGR through the forecast period. This growth is being shaped by cleaner production mandates, tighter emissions regulations, and the growing demand for energy-efficient vehicle fleets that can seamlessly integrate with smart factory ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26 Billion |

| Forecast Value | $72.8 Billion |

| CAGR | 12.7% |

By propulsion, Battery Electric Vehicles (BEVs) continue to dominate the market, supported by their high energy efficiency, lower total cost of ownership, and zero dependence on fossil fuels. These vehicles offer quiet operation and minimal maintenance and are ideal for indoor and enclosed industrial environments. They are also easier to automate, making them increasingly suitable for Industry 4.0-enabled operations. Government incentives and emission-related regulations are also making BEVs the preferred option across various industrial domains.

Regionally, China led the Asia Pacific industrial electric vehicle market in 2024, capturing around 38% share and generating nearly USD 4.5 billion in revenue. The country's strong industrial base, proactive government support for clean energy transitions, and advanced EV manufacturing capabilities have positioned it as a key market player. Rapid automation in warehousing and aggressive electrification goals continue to drive regional demand, further strengthened by initiatives that promote smart factory infrastructure.

Key players in the global market include Hangcha Forklift, Hyundai Construction Equipment, Hyster-Yale Materials Handling, Jungheinrich AG, KION Group, Manitou, Komatsu, MITSUBISHI LOGISNEXT, Sany Electric, and Toyota. These companies are heavily investing in modular electric vehicle designs, expanding R&D in battery efficiency, and integrating IoT and telematics for real-time diagnostics. Their strategic efforts also involve expanding local production and aftersales service hubs to enhance market reach and customer support across both developed and emerging economies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material providers

- 3.2.2 Component providers

- 3.2.3 Manufacturers

- 3.2.4 Distributors

- 3.2.5 End use

- 3.3 Trump administration tariffs

- 3.3.1 Supply-side impact (Raw Materials)

- 3.3.2 Price volatility in key materials

- 3.3.3 Production cost implications

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rise in government initiatives for electric vehicles

- 3.9.1.2 Increasing demand for battery-operated forklift

- 3.9.1.3 Technology advancement in electric technology

- 3.9.1.4 Increasing demand for industrial vehicle form manufacturing industry

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial costs of industrial electric vehicles

- 3.9.2.2 Battery limitations and downtime

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Tow tractors

- 5.3 Forklifts

- 5.4 Container handlers

- 5.5 Aisle trucks

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Battery Electric Vehicles (BEV)

- 6.3 Plug-in Hybrid Electric Vehicles (PHEV)

- 6.4 Hybrid Electric Vehicles (HEV)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Manufacturing

- 7.3 Warehousing

- 7.4 Freight & logistics

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 Saudi Arabia

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Aisle Master

- 9.2 Alke

- 9.3 Anhui Heli

- 9.4 Aprolis

- 9.5 CLARK

- 9.6 Crown Equipment

- 9.7 Doosan Industrial Vehicle

- 9.8 EP Equipment

- 9.9 Hangcha Forklift

- 9.10 Hyster-Yale Materials Handling

- 9.11 Hyundai Construction Equipment

- 9.12 Jungheinrich AG

- 9.13 Kalmar Global

- 9.14 KION Group

- 9.15 Komatsu

- 9.16 Manitou

- 9.17 Mitsubishi Logisnext

- 9.18 Motrec International

- 9.19 Sany Electric

- 9.20 Toyota Material Handling