|

市場調查報告書

商品編碼

1693656

電動車:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Electric Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

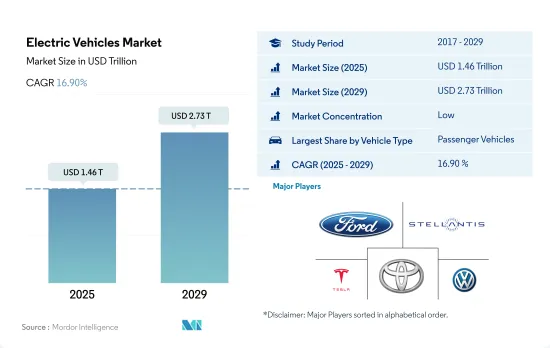

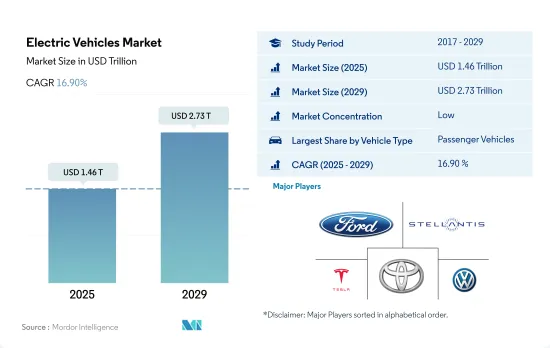

2025 年電動車市場規模估計為 1.46 兆美元,預計到 2029 年將達到 2.73 兆美元,預測期內(2025-2029 年)的複合年成長率為 16.90%。

由於日益成長的環境問題、政府舉措、人們對電動車優勢的認知不斷提高以及政府補貼,電動車市場正在成長。

- 近年來,受日益成長的環境問題、政府舉措、人們對電動車優勢的認知不斷提高以及政府補貼的推動,全球電動車市場經歷了顯著成長。其中,乘用車佔據電動車市場的主導地位,佔總銷售量的67%。這是因為其型號範圍廣泛、利用率高且價格具有競爭力。受此影響,全球對電動車的需求在這段歷史時期顯著成長了 758.44%。

- 世界各國政府都在積極推動電動車的發展。 2022 年,法國政府擴大了電動車激勵措施,為購買價格低於 45,000 歐元的電動車的私人車主提供最高 6,000 歐元的激勵措施,為購買價格低於 45,000 歐元的電動車的企業客戶提供最高 4,000 歐元的激勵措施。許多國家都採取了此類舉措,預計 2022 年全球電動車需求與前一年同期比較成長 55.07%。

- 全球各國政府正不斷審查補貼制度,以促進電動車和永續交通的發展。例如,法國於2023年5月推出了更新的補貼要求,為購買價格低於47,000歐元的純電動車提供5,000歐元的獎勵。預計世界各國政府的持續努力將在 2024 年至 2030 年期間推動全球電動車市場的發展。

汽車產業對清潔能源的需求不斷成長是電動車市場成長的主要動力

- 世界各國政府都在積極實施鼓勵使用電動車(EV)的政策。特別是中國、印度、法國和英國已設定目標,到2040年徹底淘汰汽油和柴油汽車。

- 汽車產業對清潔能源的需求不斷成長是電動車市場成長的主要動力。目標商標產品製造商(OEM)正在重新評估其電動車策略。例如,起亞汽車於 2022 年 3 月宣布計劃進軍電動皮卡車領域,並計劃在 2027 年推出兩款車型。其中一款車型將與特斯拉的 Cybertruck、福特的 F-150 Lightning、Rivian 的 R1T 和 GMC 的悍馬 EV 等現有車型直接競爭。同月,福特宣布將在 2024 年之前推出四款電動商用車新系列。該系列將包括 2023 年推出的新型一噸貨車 Transit 自訂和多用途車 Tourneo 自訂,以及 2024 年推出的下一代 Transit Courier 貨車和多用途車 Tourneo Courier。

- 北美網路和智慧型手機普及率高,為電商企業進入零售電商市場提供了巨大的機會。這種數位化環境不僅有助於擴大業務,而且在全球電動車市場的成長中發揮著至關重要的作用。需求激增促使汽車製造商加大對電動卡車領域的研發投入,進一步支持電動車市場的擴張。

全球電動車市場趨勢

全球需求成長和政府支持將推動電動車市場成長

- 電動車(EV)已成為汽車產業的重要組成部分,因為它具有提高能源效率、減少溫室氣體和污染排放的潛力。這種快速成長背後的主要因素是日益成長的環境問題和政府的支持。其中,電動車全球銷售呈現強勁成長勢頭,2022年較2021年成長10.82%。據預測,2025年底,電動乘用車年銷量將超過500萬輛,約佔汽車總銷量的15%。

- 領先的製造商和組織(例如倫敦警察廳和消防隊)正在積極推行電動車策略。例如,該公司設定了在 2025 年實現零排放汽車、在 2030 年實現 40% 貨車電氣化、到 2040 年實現全電動化的目標。預計全球也將出現類似的趨勢,電動車的需求和銷售量將在 2024 年至 2030 年期間大幅成長。

- 在電池技術和汽車電氣化進步的推動下,亞太地區和歐洲有望主導電動車生產。 2020年5月,起亞汽車歐洲公司公佈“S計劃”,宣布轉向電動化策略。這項決定是在起亞電動車在歐洲創下銷售紀錄之際做出的。起亞雄心勃勃地計劃在 2025 年之前在全球推出 11 款電動車,涵蓋轎車、SUV 和 MPV 等各個領域。該公司的目標是到 2026 年實現全球電動車年銷量達到 50 萬輛。

電動汽車產業概況

電動車市場較為分散,前五大公司佔了27.50%的市場。市場的主要企業是:福特汽車公司、Stellantis NV、特斯拉公司、豐田汽車公司和大眾汽車公司(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 人均GDP

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 消費者汽車購買支出(cvp)

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 通貨膨脹率

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 汽車貸款利率

- 共乘

- 電氣化的影響

- 電動車充電站

- 電池組價格

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 新款 Xev 車型發布

- 二手車銷售

- 燃油價格

- OEM生產統計

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 車輛類型

- 商用車

- 大型商用卡車

- 中型商用卡車

- 搭乘用車

- 多用途車輛

- 摩托車

- 商用車

- 燃料類別

- BEV

- FCEV

- HEV

- PHEV

- 地區

- 非洲

- 亞太地區

- 歐洲

- 奧地利

- 比利時

- 捷克共和國

- 丹麥

- 愛沙尼亞

- 法國

- 德國

- 愛爾蘭

- 義大利

- 拉脫維亞

- 立陶宛

- 挪威

- 波蘭

- 俄羅斯

- 西班牙

- 瑞典

- 英國

- 其他歐洲國家

- 中東

- 北美洲

- 南美洲

- 巴西

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- BYD Auto Co. Ltd.

- Daimler AG(Mercedes-Benz AG)

- Ford Motor Company

- Gac Aion New Energy Automobile Co.Ltd

- General Motors Company

- Groupe Renault

- Nissan Motor Co. Ltd.

- Stellantis NV

- Tesla Inc.

- Toyota Motor Corporation

- Volkswagen AG

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 93049

The Electric Vehicles Market size is estimated at 1.46 trillion USD in 2025, and is expected to reach 2.73 trillion USD by 2029, growing at a CAGR of 16.90% during the forecast period (2025-2029).

EV market is witnessing growth driven by rising environmental concerns, government initiatives, increased awareness of EV benefits, and government subsidies

- The global market for electric vehicles (EVs) has experienced substantial growth in recent years, driven by rising environmental concerns, government initiatives, increased awareness of EV benefits, and government subsidies. Notably, passenger cars dominate the EV market, accounting for 67% of total sales. This is attributed to a wider range of models, higher usage rates, and competitive pricing. Thus, the global demand for EVs increased by a remarkable 758.44% during the historic period.

- Various governments worldwide are actively promoting electric mobility. In 2022, the French government expanded its EV incentives, offering private owners up to EUR 6000 and business customers up to EUR 4000 on purchases of electric vehicles priced at EUR 45,000 or below. Such initiatives, seen in multiple countries, contributed to a 55.07% global increase in EV demand in 2022 compared to the previous year.

- Globally, governments are continually revising their subsidy programs to bolster electric and sustainable transportation. For instance, in May 2023, France introduced updated subsidy requirements, providing a EUR 5000 incentive for purchasing a fully electric car priced at EUR 47,000 or less. These ongoing efforts by governments worldwide are expected to propel the global electric vehicle market during 2024-2030.

The rising demand for clean energy in the automotive industry is a key driver of the EV market's growth

- Several governments worldwide have proactively implemented policies to incentivize the adoption of electric vehicles (EVs). Notably, China, India, France, and the United Kingdom set targets to phase out the petrol and diesel vehicle sector entirely by 2040.

- The rising demand for clean energy in the automotive industry is a key driver of the EV market's growth. Original equipment manufacturers (OEMs) are reshaping their strategies for EVs. For instance, in March 2022, Kia Motors unveiled plans to enter the electric pickup truck segment, with two models slated for release by 2027. One of these models will directly compete with established players like Tesla's Cybertruck, Ford's F-150 Lightning, Rivian's R1T, and GMC's Hummer EV. In the same month, Ford announced its commitment to launch a new lineup of four electric commercial vehicles by 2024. This lineup includes the all-new Transit Custom one-ton van and Tourneo Custom multi-purpose vehicle in 2023, followed by the next-generation Transit Courier van and Tourneo Courier multi-purpose vehicle in 2024.

- North America, with its high internet and smartphone penetration, presents significant opportunities for e-commerce companies to tap into the retail e-commerce market. This digital landscape not only aids in expanding their business but also plays a pivotal role in the global EV market's growth. This surge in demand has prompted automakers to ramp up their R&D investments in the electric truck segment, further bolstering the EV market's expansion.

Global Electric Vehicles Market Trends

The rising global demand and government support propel electric vehicle market growth

- Electric vehicles (EVs) have become indispensable in the automotive industry, driven by their potential to enhance energy efficiency and reduce greenhouse gas and pollution emissions. This surge is primarily attributed to growing environmental concerns and supportive government initiatives. Notably, global EV sales witnessed a robust 10.82% growth in 2022 compared to 2021. Projections indicate that annual sales of electric passenger cars will surpass 5 million by the end of 2025, accounting for approximately 15% of total vehicle sales.

- Leading manufacturers and organizations, like the London Metropolitan Police & Fire Service, have been actively pursuing their electric mobility strategies. For instance, they have set a target of a zero-emission fleet by 2025, with a goal of electrifying 40% of their vans by 2030 and achieving full electrification by 2040. Similar trends are expected globally, with the period from 2024 to 2030 witnessing a surge in demand and sales of electric vehicles.

- Asia-Pacific and Europe are poised to dominate electric vehicle production, driven by their advancements in battery technology and vehicle electrification. In May 2020, Kia Motors Europe unveiled its "Plan S," signaling a strategic shift toward electrification. This decision came on the heels of record-breaking sales of Kia's EVs in Europe. Kia has ambitious plans to introduce 11 EV models globally by 2025, spanning various segments like passenger vehicles, SUVs, and MPVs. The company aims to achieve annual global EV sales of 500,000 by 2026.

Electric Vehicles Industry Overview

The Electric Vehicles Market is fragmented, with the top five companies occupying 27.50%. The major players in this market are Ford Motor Company, Stellantis N.V., Tesla Inc., Toyota Motor Corporation and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.1.1 Africa

- 4.1.2 Asia-Pacific

- 4.1.3 Europe

- 4.1.4 Middle East

- 4.1.5 North America

- 4.1.6 South America

- 4.2 GDP Per Capita

- 4.2.1 Africa

- 4.2.2 Asia-Pacific

- 4.2.3 Europe

- 4.2.4 Middle East

- 4.2.5 North America

- 4.2.6 South America

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.3.1 Africa

- 4.3.2 Asia-Pacific

- 4.3.3 Europe

- 4.3.4 Middle East

- 4.3.5 North America

- 4.3.6 South America

- 4.4 Inflation

- 4.4.1 Africa

- 4.4.2 Asia-Pacific

- 4.4.3 Europe

- 4.4.4 Middle East

- 4.4.5 North America

- 4.4.6 South America

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.9.1 Africa

- 4.9.2 Asia-Pacific

- 4.9.3 Europe

- 4.9.4 Middle East

- 4.9.5 North America

- 4.9.6 South America

- 4.10 New Xev Models Announced

- 4.11 Used Car Sales

- 4.12 Fuel Price

- 4.13 Oem-wise Production Statistics

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Heavy-duty Commercial Trucks

- 5.1.1.2 Medium-duty Commercial Trucks

- 5.1.2 Passenger Vehicles

- 5.1.2.1 Multi-purpose Vehicle

- 5.1.3 Two-Wheelers

- 5.1.1 Commercial Vehicles

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

- 5.3 Region

- 5.3.1 Africa

- 5.3.2 Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 Austria

- 5.3.3.2 Belgium

- 5.3.3.3 Czech Republic

- 5.3.3.4 Denmark

- 5.3.3.5 Estonia

- 5.3.3.6 France

- 5.3.3.7 Germany

- 5.3.3.8 Ireland

- 5.3.3.9 Italy

- 5.3.3.10 Latvia

- 5.3.3.11 Lithuania

- 5.3.3.12 Norway

- 5.3.3.13 Poland

- 5.3.3.14 Russia

- 5.3.3.15 Spain

- 5.3.3.16 Sweden

- 5.3.3.17 UK

- 5.3.3.18 Rest-of-Europe

- 5.3.4 Middle East

- 5.3.5 North America

- 5.3.6 South America

- 5.3.6.1 Brazil

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Auto Co. Ltd.

- 6.4.2 Daimler AG (Mercedes-Benz AG)

- 6.4.3 Ford Motor Company

- 6.4.4 Gac Aion New Energy Automobile Co.Ltd

- 6.4.5 General Motors Company

- 6.4.6 Groupe Renault

- 6.4.7 Nissan Motor Co. Ltd.

- 6.4.8 Stellantis N.V.

- 6.4.9 Tesla Inc.

- 6.4.10 Toyota Motor Corporation

- 6.4.11 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219