|

市場調查報告書

商品編碼

1693642

亞太地區電動商用車市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia Pacific Electric Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

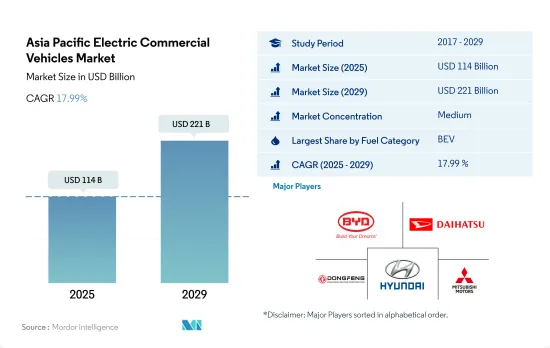

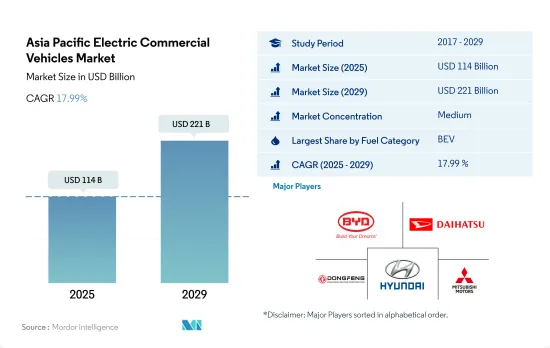

亞太地區電動商用車市場規模預計在 2025 年為 1,140 億美元,預計到 2029 年將達到 2,210 億美元,預測期內(2025-2029 年)的複合年成長率為 17.99%。

預計到 2030 年,亞太地區混合動力和電動商用車的普及率將增加兩倍以上

- 2022-2023 年,亞太地區將轉向更環保的交通解決方案,這在混合動力和電動商用車 (CV) 領域尤其明顯。混合動力汽車和電動車的註冊量將大幅成長,從 2021 年的 264,007 輛增加到 2022 年的 490,958 輛。這個數字不僅代表著從先前的疲軟中復甦,也證實了在環保意識不斷增強和政府政策不斷演變的背景下,人們對這些清潔技術的強烈偏好。

- 歷史數據提供了一些有趣的背景。 2017年至2019年期間,註冊的混合動力汽車和電動車數量逐漸下降,從260,519輛下降到188,118輛。下降可能歸因於基礎設施準備、車輛價格分佈和最初的猶豫等因素。然而,在隨後的幾年裡,尤其是 2022 年,這一數字大幅反彈,凸顯了該地區透過更清潔的 CV 解決方案快速適應對抗排放氣體的能力。

- 展望未來,亞太地區的混合動力汽車和電動車正呈現令人驚訝的樂觀上升軌跡。到 2025 年,這一數字預計將超過 926,761 台。到 2030 年,汽車總註冊量預計將達到 1,677,598 輛。這項預測是由技術突破、成熟的充電基礎設施、降低的總體擁有成本以及對電動商用車在實現永續性目標方面發揮的重要作用的認可所推動的。

在嚴格的排放法規和對更環保的公共和物流運輸解決方案的大力推動下,亞太地區電動商用車市場預計將快速擴張。

- 亞太地區是電動商用車最具活力的市場之一,經濟多元化,都市化迅速,並且越來越重視減少碳排放。各國的市場條件有很大差異,反映了經濟發展、政府政策、基礎設施發展和產業採用率的差異。中國是電動車技術的全球領導者,憑藉積極的政府舉措、對充電基礎設施的大量投資以及眾多國內製造商,在亞太電動汽車市場佔據主導地位。

- 該地區的其他國家,如日本和韓國,也在電動商用車市場取得了長足的進步。日本擁有成熟的汽車工業,目前專注於氫燃料電池汽車,這是其與純電動車共同推進的電動車 (ECV) 更廣泛策略的一部分。日本致力於實現“氫能社會”,這與其在商用車電氣化方面的努力相輔相成。同時,韓國正快速推進電池技術和基礎建設。

- 相較之下,該地區的新興國家,如印度、印尼和泰國,正處於採用 ECV 的早期階段,面臨基礎設施有限和前期成本高等挑戰。然而,由於都市化加快、人們對環境問題的認知不斷提高以及政府致力於推廣電動車使用的舉措,這些國家的電動車市場具有巨大的成長潛力。例如,印度已推出多項舉措來推動電動車的普及,重點是基礎建設和購車補貼。

亞太地區電動商用車市場趨勢

受政府措施和商用車電氣化推動,亞太地區電動車需求和銷售快速成長

- 近年來,亞太地區電動車(EV)的需求和銷售量激增。主要市場中國2022年電動車銷量較2021年成長2.90%,日本同期電動車銷量成長11.11%。推動這一趨勢的因素包括日益成長的環境問題、嚴格的法規以及電動車的優勢,例如燃油效率、降低維護成本和零碳排放。政府補貼進一步推動了亞洲國家對電動車的採用。

- 使用傳統燃料的商用車輛,尤其是卡車和公共汽車,正在導致亞太國家污染水平上升。為此,該地區許多國家正在大力投資,將內燃機 (ICE) 汽車轉型為電動車,以減少二氧化碳排放。例如,2020 年 12 月,印尼市政公車業者 Transjakarta 宣布了雄心勃勃的計劃,到 2030 年將其電動公車車隊擴大到 10,000 輛。類似這樣的全部區域努力正在推動商用車的電氣化。

- 亞太地區各國政府機構正積極提案逐步淘汰石化燃料汽車的措施,此舉可望提振電動商用車市場。值得注意的進展是,2022 年 5 月,塔塔汽車贏得了一份政府契約,根據 FAME 2 計劃,向印度供應 5,450 輛電動公車,價值 500 億印度盧比。該公司還宣布計劃向六家大型電子商務公司交付20,000 輛小型電動卡車。預計電動車領域的這些進步將在 2024 年至 2030 年間進一步推動亞太地區對電動商用車的需求。

亞太地區電動商用車產業概覽

亞太地區電動商用車市場適度整合,前五大公司佔48.55%。該市場的主要企業有比亞迪汽車、大發汽車、東風汽車公司、現代汽車公司、三菱汽車公司等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均GDP

- 消費者汽車支出(cvp)

- 通貨膨脹率

- 汽車貸款利率

- 電氣化的影響

- 電動車充電站

- 電池組價格

- 新款 Xev 車型發布

- 物流績效指數

- 燃油價格

- OEM生產統計

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 體型

- 公車

- 大型商用卡車

- 輕型商用皮卡車

- 輕型商用廂型車

- 中型商用卡車

- 燃料類別

- BEV

- FCEV

- HEV

- PHEV

- 國家

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 韓國

- 泰國

- 其他亞太地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- BYD Auto Co. Ltd.

- Daihatsu Motor Co. Ltd.

- Dongfeng Motor Corporation

- Higer Bus Company Ltd.

- Hino Motors Ltd.

- Hyundai Motor Company

- Mahindra & Mahindra Limited

- Mitsubishi Motors Corporation

- Tata Motors Limited

- Zhengzhou Yutong Bus Co. Ltd.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 93030

The Asia Pacific Electric Commercial Vehicles Market size is estimated at 114 billion USD in 2025, and is expected to reach 221 billion USD by 2029, growing at a CAGR of 17.99% during the forecast period (2025-2029).

The adoption of hybrid and electric commercial vehicles in Asia-Pacific is expected to be more than triple by 2030

- Asia-Pacific's transition toward greener transportation solutions has been pronouncedly evident in the hybrid and electric commercial vehicle (CV) sector between 2022 and 2023. The collective figures for hybrid and electric CV registrations rose significantly, reaching 490,958 units in 2022 from the previous 264,007 units in 2021. These numbers signify not only a rebound from the prior slump but also underline a strong preference for these cleaner technologies amid escalating environmental concerns and progressive governmental policies.

- Historical data provides an intriguing context. From 2017 to 2019, the combined registrations for hybrid and electric CVs experienced a gentle downward trend, from 260,519 units to 188,118 units. This dip might be attributed to factors like infrastructure readiness, vehicle price points, and initial hesitations. However, the next few years, especially 2022, saw a dramatic resurrection in the numbers, emphasizing the region's fast-adapting stance to combat emissions through cleaner CV solutions.

- Projecting into the future, the upward trajectory for hybrid and electric CVs in Asia-Pacific is remarkably optimistic. By 2025, it is estimated the numbers will cross the 926,761 units mark. By 2030, the total registrations are anticipated to reach an impressive 1,677,598 units. This forecasted upswing can be attributed to technological breakthroughs, a matured charging infrastructure, reduced total cost of ownership, and the realization of the critical role these vehicles play in achieving sustainability goals.

The Asia-Pacific electric commercial vehicles market is poised for rapid expansion, fueled by stringent emission regulations and a robust push for greener public and logistic transport solutions

- Asia-Pacific represents one of the most dynamic markets for electric commercial vehicles due to its diverse economies, rapidly growing urbanization, and increasing focus on reducing carbon emissions. The market landscape varies significantly by country, reflecting differences in economic development, government policies, infrastructure readiness, and industry adoption rates. China, as a global leader in electric vehicle technology, dominates the ECV market in Asia Pacific, benefiting from aggressive government policies, substantial investments in charging infrastructure, and a wide range of domestic manufacturers.

- Other countries in the region, such as Japan and South Korea, are also making significant strides in the electric commercial vehicle market. Japan, with its well-established automotive industry, is focusing on hydrogen fuel cell vehicles as part of its broader strategy for ECVs alongside BEVs. The country's commitment to creating a 'hydrogen society' complements its efforts in electrifying its commercial vehicle segment. South Korea, on the other hand, is rapidly advancing in battery technology and infrastructure development.

- In contrast, emerging economies in the region, such as India, Indonesia, and Thailand, are in the earlier stages of ECV adoption, facing challenges such as limited infrastructure and higher upfront costs. However, these countries hold significant potential for growth in the ECV market due to increasing urbanization, rising awareness of environmental issues, and government initiatives aimed at encouraging the use of electric vehicles. India, for example, has launched multiple initiatives to boost EV adoption, focusing on both improving infrastructure and offering subsidies to buyers.

Asia Pacific Electric Commercial Vehicles Market Trends

APAC's rapid electric vehicle demand and sales growth are driven by government initiatives and commercial vehicle electrification

- Electric vehicle (EV) demand and sales have surged in the APAC region in recent years. China, the dominant market, saw a 2.90% rise in electric car sales in 2022 compared to 2021, while Japan experienced an 11.11% increase during the same period. Factors driving this trend include mounting environmental concerns, stringent regulations, and the advantages of EVs, such as fuel efficiency, lower maintenance costs, and zero carbon emissions. Government subsidies further bolster the adoption of EVs in Asian nations.

- Conventional fuel-powered commercial vehicles, notably trucks and buses, are contributing to the escalating pollution levels in several Asia-Pacific countries. In response, many nations in the region are making substantial investments to transition their internal combustion engine (ICE) vehicles to electric ones, aiming to curb carbon emissions. For instance, in December 2020, TransJakarta, a city-owned bus operator in Indonesia, unveiled an ambitious plan to expand its electric bus (e-bus) fleet to 10,000 units by 2030. Such initiatives across the region are propelling the electrification of commercial vehicles.

- Government bodies in various APAC countries are actively proposing measures to phase out fossil fuel vehicles, a move that is poised to bolster the market for electric commercial vehicles. In a notable development, in May 2022, Tata Motors secured a government contract in India to supply 5,450 electric buses worth INR 5,000 crore under the FAME 2 scheme. Additionally, the company announced plans to deliver 20,000 light electric trucks to six major e-commerce players. These advancements in the EV space are anticipated to further fuel the demand for electric commercial vehicles in the APAC region from 2024 to 2030.

Asia Pacific Electric Commercial Vehicles Industry Overview

The Asia Pacific Electric Commercial Vehicles Market is moderately consolidated, with the top five companies occupying 48.55%. The major players in this market are BYD Auto Co. Ltd., Daihatsu Motor Co. Ltd., Dongfeng Motor Corporation, Hyundai Motor Company and Mitsubishi Motors Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Body Type

- 5.1.1 Buses

- 5.1.2 Heavy-duty Commercial Trucks

- 5.1.3 Light Commercial Pick-up Trucks

- 5.1.4 Light Commercial Vans

- 5.1.5 Medium-duty Commercial Trucks

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Malaysia

- 5.3.7 South Korea

- 5.3.8 Thailand

- 5.3.9 Rest-of-APAC

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Auto Co. Ltd.

- 6.4.2 Daihatsu Motor Co. Ltd.

- 6.4.3 Dongfeng Motor Corporation

- 6.4.4 Higer Bus Company Ltd.

- 6.4.5 Hino Motors Ltd.

- 6.4.6 Hyundai Motor Company

- 6.4.7 Mahindra & Mahindra Limited

- 6.4.8 Mitsubishi Motors Corporation

- 6.4.9 Tata Motors Limited

- 6.4.10 Zhengzhou Yutong Bus Co. Ltd.

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219