|

市場調查報告書

商品編碼

1693634

印度混合動力汽車市場:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)India Hybrid Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

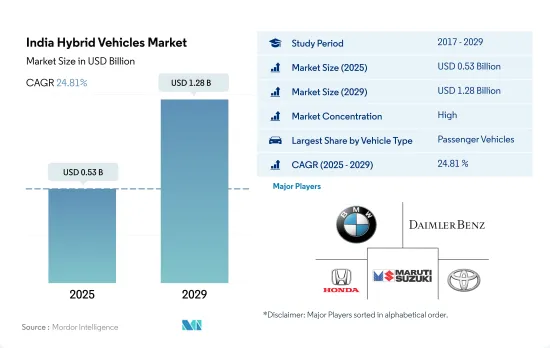

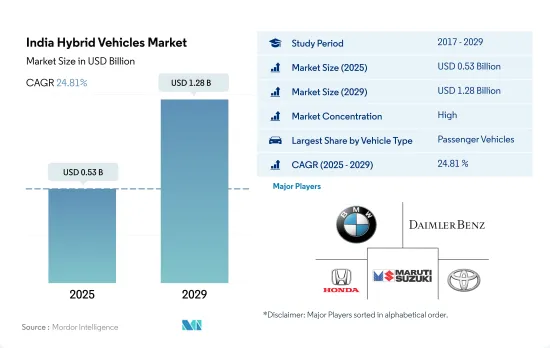

印度混合動力汽車市場規模預計在 2025 年為 5.3 億美元,預計到 2029 年將達到 12.8 億美元,預測期內(2025-2029 年)的複合年成長率為 24.81%。

混合動力汽車是向全電動汽車過渡的橋樑,標誌著印度向電氣化邁出了堅實的一步。

- 印度混合動力汽車市場雖然不如純電動車市場規模大,但卻是實現提高燃油效率、減少汽車、商用車和二輪車等多種車型排放這一更廣泛目標的重要基石。全混合動力汽車無需插電即可使用內燃機和馬達,在傳統汽車和全電動汽車之間提供了一種可行的折衷方案,與傳統汽車相比,它具有更高的燃油經濟性和更低的排放氣體。

- 在乘用車領域,全混合動力汽車逐漸受到印度消費者的歡迎,主要在中高階市場。混合動力汽車在印度的吸引力在於,它能夠顯著提高燃油效率、降低營運成本,而且不存在純電動車的續航里程焦慮和基礎設施需求。然而,由於初始購買價格高和車型選擇有限,混合動力車在乘用車領域的成長受到了一定程度的限制。然而,隨著越來越多的製造商進入市場以及技術成本的下降,這種情況開始改變。

- 印度商用車領域對混合動力技術的興趣雖然有限但日益成長,尤其是在環境問題和燃油效率日益重要的領域。混合動力公車就是一個顯著的例子,一些城市已經開始試行或小規模部署混合動力技術,以減少公共交通的排放氣體和燃料消耗。

印度混合動力汽車市場趨勢

受印度儲備銀行措施和貸款實務變化的推動,印度的汽車利率一直呈下降趨勢。

- 印度近期汽車利率約 8.567%,低於 2021 年的 8.698%。這一約 1.5% 的小幅下降延續了前幾年的趨勢,當時利率從 2019 年的 9.15% 降至 2021 年的 8.698%。支持這項措施的因素可能包括印度儲備銀行 (RBI) 的貨幣政策決定、國內信貸需求和更廣泛的宏觀經濟經濟狀況。

- 2017年至2023年,印度汽車利率為9.508%。在接下來的幾年裡,利率經歷了小幅波動,2018 年小幅下降至 9.454%,2019 年小幅上升至 9.466%。然而,自 2019 年以來出現了更顯著的下降,2022 年達到 8.567%。根據印度儲備銀行的報告,這些變化可以歸因於寬鬆的貨幣政策、不斷變化的貸款實踐以及在全球疫情等挑戰面前刺激經濟成長的努力。

- 對印度汽車利率近期趨勢的分析表明,預計未來幾年相對較低的利率趨勢仍將持續下去。當前利率將在 2022 年降至 8.567%,這一降幅高於 2019 年的 9.15%,反映了印度儲備銀行 (RBI) 為刺激經濟成長而做出的刻意努力。隨著印度儲備銀行繼續採取寬鬆的貨幣政策,並不斷改進貸款實踐以支持信貸需求,這種利率下行壓力可能會持續存在。

政府措施和嚴格規範推動印度電動車市場快速成長

- 印度的電動車 (EV) 市場正處於成長階段,政府正在積極制定應對污染的策略。 2015年啟動的Fame India計畫在推動汽車電氣化方面發揮了關鍵作用。基於其成功經驗,Fame 第二階段計劃將持續到 2022 年 4 月,預計將進一步推動電動車的銷量,尤其是在 2021 年,政府將為電池容量高達 15kWh 的電動車提供 10,000 印度盧比(約 1,000 萬美元)的補貼。

- 印度各邦政府正大力引進電動公車,以擺脫內燃機(ICE)公車的束縛。此舉不僅可以降低營運成本,還可以抑制碳排放並改善空氣品質。引人注目的是,德里政府已於 2021 年 3 月批准採購 300 輛新型低地板電動(AC)公車,其中 100 輛將於 2022 年 1 月上路。這些舉措導致印度對電動商用車的需求大幅成長,2022 年與 2021 年相比成長了 62.58%。

- 受政府嚴格標準的推動,近年來電動車的需求激增。 2021年8月,印度政府宣布了汽車報廢政策,旨在逐步淘汰污染嚴重且不合規的汽車,無論其使用年限為何。該政策將於 2024 年實施,旨在推動消費者購買電動車。此外,政府還設定了一個雄心勃勃的目標,即到 2030 年使印度 30% 的汽車實現電動化。這些努力預計將在 2024 年至 2030 年期間促進印度的電動車銷售。

印度混合動力汽車產業概況

印度混合動力汽車市場相當鞏固,前五名廠商佔據 100% 的市場。市場的主要企業有:寶馬印度私人有限公司、戴姆勒股份公司(梅賽德斯-奔馳股份公司)、本田汽車印度有限公司、瑪魯蒂鈴木印度有限公司和豐田 Kirloskar Motor Pvt。有限公司(按字母順序)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均GDP

- 消費者汽車支出(cvp)

- 通貨膨脹率

- 汽車貸款利率

- 共乘

- 電氣化的影響

- 電動車充電站

- 電池組價格

- 新款 Xev 車型發布

- 物流績效指數

- 二手車銷售

- 燃油價格

- OEM生產統計

- 法規結構

- 價值鍊和通路分析

第5章市場區隔

- 車輛類型

- 商用車

- 公車

- 大型商用卡車

- 輕型商用皮卡車

- 輕型商用廂型車

- 中型商用卡車

- 商用車

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Audi Auto India Pvt. Ltd.

- BMW India Private Limited

- Daimler AG(Mercedes-Benz AG)

- Honda Cars India Limited

- Hyundai Motor India Limited

- Maruti Suzuki India Limited

- Toyota Kirloskar Motor Pvt. Ltd.

- Volvo Auto India Private Limited

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

The India Hybrid Vehicles Market size is estimated at 0.53 billion USD in 2025, and is expected to reach 1.28 billion USD by 2029, growing at a CAGR of 24.81% during the forecast period (2025-2029).

Hybrid vehicles serve as a bridge in the country's shift to full electric mobility, marking India's incremental steps toward electrification

- The Indian hybrid vehicles market, though not as vast as that for purely electric vehicles, presents a critical stepping stone toward achieving broader goals of fuel efficiency and reduced emissions across different vehicle types, such as passenger cars, commercial vehicles, and two-wheelers. Full hybrids, which can operate on both an internal combustion engine and an electric motor without the need to be plugged in, offer a practical compromise between traditional and fully electric vehicles, providing enhanced fuel efficiency and lower emissions compared to conventional vehicles.

- In the passenger car segment, full hybrid vehicles are gradually gaining traction among Indian consumers, primarily in the mid to high-end market segments. The appeal of hybrid cars in India lies in their ability to offer significant improvements in fuel efficiency and reduced operational costs without the range anxiety or infrastructure demands associated with pure electric vehicles. However, the growth of HEVs in the passenger car segment has been somewhat constrained by higher initial purchase prices and a limited selection of models, although this is beginning to change as more manufacturers enter the market and technology costs decrease.

- The commercial vehicle segment in India has seen limited but growing interest in hybrid technology, particularly in sectors where environmental concerns and fuel efficiency are becoming increasingly important. Hybrid buses are a notable example, with several cities initiating trials or small-scale deployments of hybrid technology to reduce emissions and fuel consumption in public transportation.

India Hybrid Vehicles Market Trends

India's auto interest rates have shown a consistent downward trend, driven by RBI's measures and evolving lending practices

- In recent times, India's auto interest rate stood at approximately 8.567%, marking a decline from the 8.698% observed in 2021. This slight decrement of about 1.5% continues the trend from the prior year, wherein rates reduced from 9.15% in 2019 to 8.698% in 2021. Factors underpinning these dynamics may encompass monetary policy decisions by the Reserve Bank of India (RBI), domestic credit demand, and broader macroeconomic conditions.

- During 2017-2023, India's auto interest rate was observed at 9.508%. Over the subsequent years, the rate experienced minor fluctuations, descending slightly to 9.454% in 2018 and then marginally ascending to 9.466% in 2019. However, a more significant decline was observed from 2019 onwards, culminating at 8.567% in 2022. Reports from the RBI suggest that these shifts could be attributed to a combination of monetary easing measures, evolving lending practices, and attempts to bolster economic growth in the face of challenges such as the global pandemic.

- The recent trend analysis of India's auto interest rates anticipates a continued trend of relatively lower interest rates in the coming years. The current decrease to 8.567% in 2022, building on the decline from 9.15% in 2019, reflects a deliberate effort by the Reserve Bank of India (RBI) to stimulate economic growth. This downward pressure on rates is likely to persist as the RBI continues to employ monetary easing measures and lending practices evolve to support credit demand.

Government initiatives and stringent norms drive rapid growth in the electric vehicle market in India

- India's electric vehicle (EV) market is in a growth phase, with the government actively formulating strategies to combat pollution. The Fame India scheme, launched in 2015, has played a pivotal role in driving vehicle electrification. Building on its success, Fame Phase 2, active till April 2022, further bolstered EV sales, especially in 2021, with the government offering subsidies like INR 10,000 grants for electric cars with battery capacities up to 15 kWh.

- State governments across India are increasingly incorporating electric buses into their fleets, aiming to transition from internal combustion engine (ICE) buses. This move not only cuts operational costs but also curbs carbon emissions and improves air quality. In a notable move, the Delhi government greenlit the procurement of 300 new low-floor electric (AC) buses in March 2021, with 100 of them hitting the roads in January 2022. These initiatives contributed to a significant 62.58% surge in demand for electric commercial vehicles in India in 2022 over 2021.

- The demand for electric cars has surged in recent times, driven by the government's introduction of stringent norms. In August 2021, the Indian government unveiled the Vehicle Scrappage Policy, targeting the phasing out of polluting and unfit vehicles, irrespective of their age. This policy, set to be implemented by 2024, is steering consumers toward electric cars. Additionally, the government has set an ambitious target of having 30% of all cars in India electrified by 2030. These initiatives are poised to propel electric car sales during the 2024-2030 period in India.

India Hybrid Vehicles Industry Overview

The India Hybrid Vehicles Market is fairly consolidated, with the top five companies occupying 100%. The major players in this market are BMW India Private Limited, Daimler AG (Mercedes-Benz AG), Honda Cars India Limited, Maruti Suzuki India Limited and Toyota Kirloskar Motor Pvt. Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Logistics Performance Index

- 4.12 Used Car Sales

- 4.13 Fuel Price

- 4.14 Oem-wise Production Statistics

- 4.15 Regulatory Framework

- 4.16 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Buses

- 5.1.1.2 Heavy-duty Commercial Trucks

- 5.1.1.3 Light Commercial Pick-up Trucks

- 5.1.1.4 Light Commercial Vans

- 5.1.1.5 Medium-duty Commercial Trucks

- 5.1.1 Commercial Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Audi Auto India Pvt. Ltd.

- 6.4.2 BMW India Private Limited

- 6.4.3 Daimler AG (Mercedes-Benz AG)

- 6.4.4 Honda Cars India Limited

- 6.4.5 Hyundai Motor India Limited

- 6.4.6 Maruti Suzuki India Limited

- 6.4.7 Toyota Kirloskar Motor Pvt. Ltd.

- 6.4.8 Volvo Auto India Private Limited

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms