|

市場調查報告書

商品編碼

1693629

印度乘用車:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)India Passenger Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

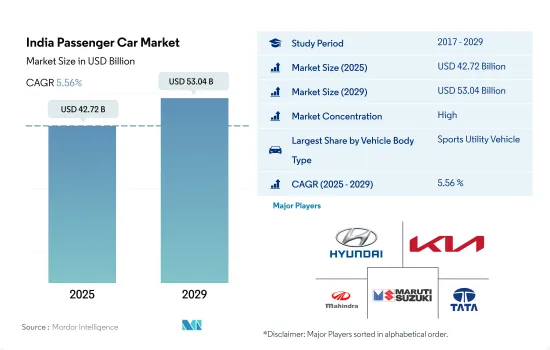

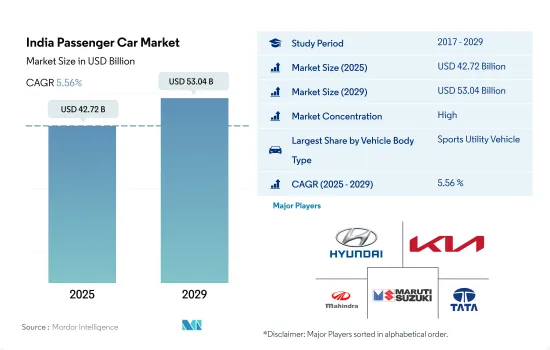

印度乘用車市場規模預計在 2025 年達到 427.2 億美元,預計到 2029 年將達到 530.4 億美元,預測期內(2025-2029 年)的複合年成長率為 5.56%。

它展示了適應印度不斷變化的客戶需求和城市景觀的乘用車日益成長的客製化和創新。

- 印度乘用車市場分為掀背車、轎車、SUV(運動型多用途車)和 MPV(多用途車),這可以深入了解印度消費者的多樣化偏好和需求,反映更廣泛的社會經濟趨勢和生活方式願望。這種細分凸顯了市場的複雜性以及推動每個車輛類別成長的因素。掀背車歷來在印度乘用車市場佔據重要地位,受到首次購車者、中產階級家庭和尋求實用、經濟、高效的出行解決方案的城市居民的青睞。

- 掀背車在印度的受歡迎程度得益於其緊湊的尺寸,即使在擁擠的城市街道上也能靈活行駛。由於有如此多的製造商提供掀背車,消費者在價格、功能和性能方面享有廣泛的選擇。

- 儘管競爭日益激烈,掀背車仍佔據了相當大的市場佔有率。儘管來自其他領域的競爭日益激烈,但掀背車憑藉其多功能性和經濟性仍保持了較大的市場佔有率。 SUV 近來人氣飆升,成為印度乘用車市場成長最快的細分市場。向 SUV 轉變的促進因素有很多,包括更高的座位位置、更寬敞的內部空間和更高的安全性。此外,還有各種各樣的 SUV 可供選擇,從緊湊型和超小型車型到中型和全尺寸車型,幾乎可以滿足每種預算和生活方式的要求。

印度乘用車市場趨勢

政府措施和嚴格監管推動印度電動車市場快速成長

- 印度的電動車 (EV) 市場正處於成長階段,政府正在積極制定應對污染的策略。 2015年啟動的Fame India計畫在推動汽車電氣化方面發揮了關鍵作用。基於其成功經驗,Fame 第二階段計劃將持續到 2022 年 4 月,預計將進一步推動電動車的銷量,尤其是在 2021 年,政府將為電池容量高達 15kWh 的電動車提供 10,000 印度盧比(約 1,000 萬美元)的補貼。

- 印度各邦政府正大力引進電動公車,以擺脫內燃機(ICE)公車的束縛。此舉不僅可以降低營運成本,還可以抑制碳排放並改善空氣品質。引人注目的是,德里政府已於 2021 年 3 月批准採購 300 輛新型低地板電動(AC)公車,其中 100 輛將於 2022 年 1 月上路。這些舉措導致印度對電動商用車的需求大幅成長,2022 年與 2021 年相比成長了 62.58%。

- 受政府嚴格標準的推動,近年來電動車的需求激增。 2021年8月,印度政府宣布了一項車輛報廢政策,旨在逐步淘汰污染嚴重且不合規的車輛,無論其使用年限為何。該政策將於 2024 年實施,旨在推動消費者購買電動車。此外,政府還設定了一個雄心勃勃的目標,即到 2030 年使印度 30% 的汽車實現電動化。這些努力預計將在 2024 年至 2030 年期間促進印度的電動車銷售。

印度乘用車產業概況

印度乘用車市場相當集中,前五名廠商佔91.48%的市佔率。市場的主要企業是:現代汽車印度有限公司、起亞汽車公司、馬恆達有限公司、瑪魯蒂鈴木印度有限公司和塔塔汽車有限公司(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均GDP

- 消費者汽車支出(cvp)

- 通貨膨脹率

- 汽車貸款利率

- 共乘

- 電氣化的影響

- 電動車充電站

- 電池組價格

- 新款 Xev 車型發布

- 二手車銷售

- 燃油價格

- OEM生產統計

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 車輛配置

- 搭乘用車

- 掀背車

- 多用途車輛

- 轎車

- SUV

- 搭乘用車

- 推進類型

- 混合動力汽車和電動車

- 按燃料類別

- BEV

- FCEV

- HEV

- PHEV

- ICE

- 按燃料類別

- 天然氣

- 柴油引擎

- 汽油

- LPG

- 混合動力汽車和電動車

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Honda Cars India Limited

- Hyundai Motor India Limited

- Kia Corporation

- Mahindra & Mahindra Limited

- Maruti Suzuki India Limited

- MG Motor India Private Limited

- Nissan Motor India Pvt. Ltd.

- Renault India Pvt. Ltd.

- Tata Motors Limited

- Toyota Kirloskar Motor Pvt. Ltd.

- Volkswagen AG

- Skoda Auto Volkswagen India Pvt. Ltd.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 93017

The India Passenger Car Market size is estimated at 42.72 billion USD in 2025, and is expected to reach 53.04 billion USD by 2029, growing at a CAGR of 5.56% during the forecast period (2025-2029).

Indicates the growing customization and innovation in passenger cars, adapting to India's dynamic consumer demands and urban landscape

- The Indian passenger car market, categorized into hatchbacks, sedans, SUVs (sport utility vehicles), and MPVs (multi-purpose vehicles), offers insights into the diverse preferences and needs of Indian consumers, reflecting broader socio-economic trends and lifestyle aspirations. This segmentation underscores the market's intricacy and the drivers fueling growth in each vehicle category. Hatchbacks, historically pivotal in the Indian passenger car market, resonate with first-time buyers, middle-class families, and urban dwellers seeking practical, affordable, and efficient mobility solutions.

- Hatchbacks' popularity in India stems from their compact size, making them agile on congested city streets, as well as their relatively lower ownership and maintenance costs. With a plethora of manufacturers offering hatchbacks, consumers enjoy a wide array of choices in terms of pricing, features, and performance.

- Despite the intensifying competition, hatchbacks retain a substantial share of the market. Despite the growing competition from other segments, hatchbacks hold a significant market share due to their versatility and economic viability. SUVs have recently witnessed a meteoric rise in popularity, becoming the fastest-growing segment in the Indian passenger car market. The shift toward SUVs is driven by a combination of factors, including a growing preference for higher seating positions, more spacious interiors, and perceived safety advantages. Moreover, the broad spectrum of SUVs available, from compact and subcompact models to mid-size and full-size options, ensures an SUV to suit almost every budget and lifestyle requirement.

India Passenger Car Market Trends

Government initiatives and stringent norms drive rapid growth in the electric vehicle market in India

- India's electric vehicle (EV) market is in a growth phase, with the government actively formulating strategies to combat pollution. The Fame India scheme, launched in 2015, has played a pivotal role in driving vehicle electrification. Building on its success, Fame Phase 2, active till April 2022, further bolstered EV sales, especially in 2021, with the government offering subsidies like INR 10,000 grants for electric cars with battery capacities up to 15 kWh.

- State governments across India are increasingly incorporating electric buses into their fleets, aiming to transition from internal combustion engine (ICE) buses. This move not only cuts operational costs but also curbs carbon emissions and improves air quality. In a notable move, the Delhi government greenlit the procurement of 300 new low-floor electric (AC) buses in March 2021, with 100 of them hitting the roads in January 2022. These initiatives contributed to a significant 62.58% surge in demand for electric commercial vehicles in India in 2022 over 2021.

- The demand for electric cars has surged in recent times, driven by the government's introduction of stringent norms. In August 2021, the Indian government unveiled the Vehicle Scrappage Policy, targeting the phasing out of polluting and unfit vehicles, irrespective of their age. This policy, set to be implemented by 2024, is steering consumers toward electric cars. Additionally, the government has set an ambitious target of having 30% of all cars in India electrified by 2030. These initiatives are poised to propel electric car sales during the 2024-2030 period in India.

India Passenger Car Industry Overview

The India Passenger Car Market is fairly consolidated, with the top five companies occupying 91.48%. The major players in this market are Hyundai Motor India Limited, Kia Corporation, Mahindra & Mahindra Limited, Maruti Suzuki India Limited and Tata Motors Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Used Car Sales

- 4.12 Fuel Price

- 4.13 Oem-wise Production Statistics

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Passenger Cars

- 5.1.1.1 Hatchback

- 5.1.1.2 Multi-purpose Vehicle

- 5.1.1.3 Sedan

- 5.1.1.4 Sports Utility Vehicle

- 5.1.1 Passenger Cars

- 5.2 Propulsion Type

- 5.2.1 Hybrid and Electric Vehicles

- 5.2.1.1 By Fuel Category

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Category

- 5.2.2.1.1 CNG

- 5.2.2.1.2 Diesel

- 5.2.2.1.3 Gasoline

- 5.2.2.1.4 LPG

- 5.2.1 Hybrid and Electric Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Honda Cars India Limited

- 6.4.2 Hyundai Motor India Limited

- 6.4.3 Kia Corporation

- 6.4.4 Mahindra & Mahindra Limited

- 6.4.5 Maruti Suzuki India Limited

- 6.4.6 MG Motor India Private Limited

- 6.4.7 Nissan Motor India Pvt. Ltd.

- 6.4.8 Renault India Pvt. Ltd.

- 6.4.9 Tata Motors Limited

- 6.4.10 Toyota Kirloskar Motor Pvt. Ltd.

- 6.4.11 Volkswagen AG

- 6.4.12 Skoda Auto Volkswagen India Pvt. Ltd.

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219