|

市場調查報告書

商品編碼

1693612

美國電動公車:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)United States Electric Bus - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

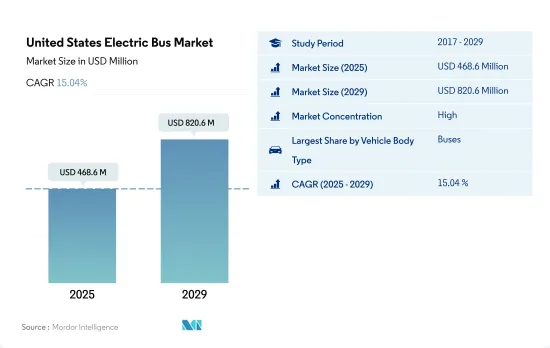

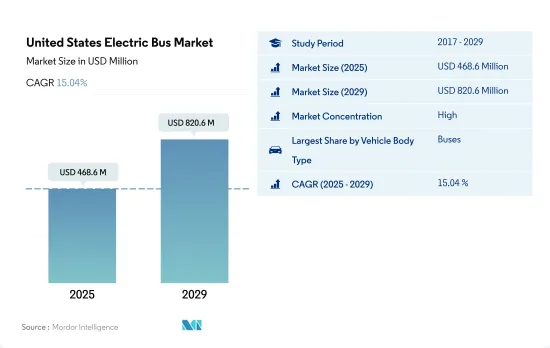

美國電動公車市場規模預計在 2025 年達到 4.686 億美元,預計到 2029 年將達到 8.206 億美元,預測期內(2025-2029 年)的複合年成長率為 15.04%。

美國電動公車市場趨勢

受政府措施和美國不斷成長的需求推動,電動車銷量激增。

- 近年來,美國電動車(EV)的普及率一直呈現蓬勃發展之勢。這種成長是由人們對電動車的認知不斷提高、對環境問題的日益關注以及政府法規的實施所推動的。特別是2016年,加州推出了零排放汽車(ZEV)計劃,旨在減少二氧化碳排放,改善空氣品質。這項措施不僅推動了加州電動車的普及,也影響了其他州採取類似的零排放汽車法規。因此,2017 年至 2022 年間,電池式電動車(BEV) 的需求激增 634%。

- 美國對電動商用車的需求也在上升。電子商務行業的蓬勃發展、物流活動的增加以及政府對清潔交通的舉措等因素正在推動這一成長。紐約州州長於2021年9月簽署了一項重要措施—先進清潔卡車(ACT)法規。該法規設定的目標是到2035年使所有新型輕型汽車實現零排放,到2045年使中型和大型汽車實現零排放。受此影響,2022年美國電動商用車需求與前一年同期比較激增21%。

- 政府的回扣、補貼和戰略規劃等措施正在進一步支持全國範圍內的汽車電氣化。 2022年5月,拜登總統宣布了一項30億美元的計劃,旨在促進國內電池製造業的發展,以實現從燃氣驅動汽車向電動車的過渡。預計這項措施將顯著推動該國的電動車發展,尤其是在 2024 年至 2030 年期間,從而增加對電池組的需求。

美國電動公車產業概況

美國電動公車市場格局較為集中,前五大公司佔了81.60%的市場。該市場的主要企業有:比亞迪汽車、GreenPower Motor Company Inc.、Lion Electric Company、NFI Group Inc. 和 Proterra INC.(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均GDP

- 消費者汽車支出(cvp)

- 通貨膨脹率

- 汽車貸款利率

- 共乘

- 電氣化的影響

- 電動車充電站

- 電池組價格

- 新款 Xev 車型發布

- 燃油價格

- OEM生產統計

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 燃料類別

- BEV

- FCEV

- HEV

第6章競爭格局

- 重大策略舉措

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Blue Bird Corporation

- BYD Auto Co. Ltd.

- Daimler Truck Holding AG

- GILLIG LLC

- GreenPower Motor Company Inc.

- Lion Electric Company

- NFI Group Inc.

- Proterra INC.

- REV group Inc.

- Volvo Group

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 92994

The United States Electric Bus Market size is estimated at 468.6 million USD in 2025, and is expected to reach 820.6 million USD by 2029, growing at a CAGR of 15.04% during the forecast period (2025-2029).

United States Electric Bus Market Trends

Rapid growth in electric vehicle sales driven by government initiatives and increasing demand in the US

- The United States has witnessed a significant surge in the adoption of electric vehicles (EVs) in recent years. This uptick can be attributed to a heightened awareness of EVs, growing environmental concerns, and the implementation of government regulations. Notably, in 2016, California introduced the Zero-Emission Vehicle (ZEV) program aimed at curbing carbon emissions and improving air quality. This initiative has not only spurred the growth of electric cars within California but has also influenced other states to adopt similar ZEV regulations. Consequently, the nation saw a remarkable 634% surge in demand for battery electric vehicles (BEVs) from 2017 to 2022.

- The demand for electric commercial vehicles in the United States is also on the rise. Factors such as the booming e-commerce industry, increased logistics activities, and governmental initiatives for cleaner transportation have fueled this growth. In a significant move, the governor of New York signed the Advanced Clean Truck (ACT) Rule in September 2021. This rule sets a target for all new light-duty vehicles to be zero-emission by 2035 and the same for medium- and heavy-duty vehicles by 2045. As a result, the United States witnessed a 21% surge in demand for electric commercial vehicles in 2022 compared to the previous year.

- Governmental efforts, including rebates, subsidies, and strategic plans, are further bolstering the electrification of vehicles nationwide. In May 2022, President Biden unveiled a USD 3 billion plan to expedite domestic battery manufacturing, with the aim of transitioning gas-powered vehicles to electric ones. This push is expected to significantly boost electric mobility in the country, particularly during 2024-2030, thereby amplifying the demand for battery packs.

United States Electric Bus Industry Overview

The United States Electric Bus Market is fairly consolidated, with the top five companies occupying 81.60%. The major players in this market are BYD Auto Co. Ltd., GreenPower Motor Company Inc., Lion Electric Company, NFI Group Inc. and Proterra INC. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Fuel Category

- 5.1.1 BEV

- 5.1.2 FCEV

- 5.1.3 HEV

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Blue Bird Corporation

- 6.4.2 BYD Auto Co. Ltd.

- 6.4.3 Daimler Truck Holding AG

- 6.4.4 GILLIG LLC

- 6.4.5 GreenPower Motor Company Inc.

- 6.4.6 Lion Electric Company

- 6.4.7 NFI Group Inc.

- 6.4.8 Proterra INC.

- 6.4.9 REV group Inc.

- 6.4.10 Volvo Group

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219