|

市場調查報告書

商品編碼

1693602

馬來西亞精煉石油產品-市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Malaysia Refined Petroleum Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

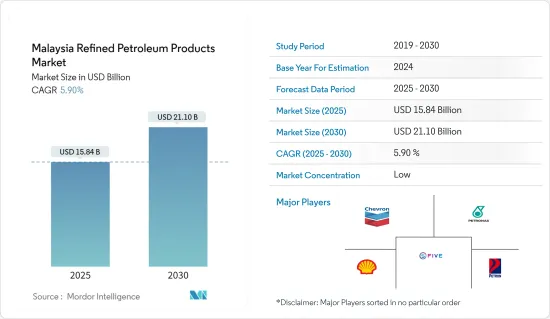

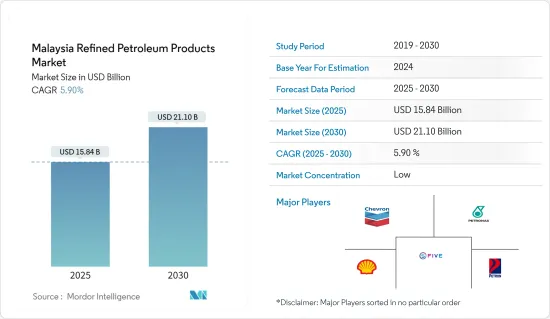

馬來西亞精煉石油產品市場規模預計在 2025 年為 158.4 億美元,預計到 2030 年將達到 211 億美元,預測期內(2025-2030 年)的複合年成長率為 5.9%。

從長遠來看,國內成品油需求的快速成長預計將成為推動市場發展的關鍵因素。

然而,由於替代燃料汽車(AFV)的普及,預計預測期內市場成長將會放緩。

石化產業對液化石油氣的高需求預計將為馬來西亞的精煉石油產品創造巨大的機會。

馬來西亞精煉石油產品市場趨勢

汽油預計將主導市場

- 汽油是一種石油衍生的易燃液體,用於大多數火花點火內燃機,包括乘用車、摩托車和商用車。汽油是透過分餾原油生產的,並添加了各種添加劑以賦予其某些特性。

- 將四乙基鉛等化合物和其他化學物質的混合物添加到汽油中,以提高化學穩定性和性能特徵、控制腐蝕性並清洗燃料系統。此外,還可以在汽油中添加乙醇、甲基叔丁基醚、乙基叔丁基醚等化學物質,以改善汽車的燃燒。

- 馬來西亞常用的汽油是RON95和RON97。截至 2024 年 4 月,RON95 的價格約為每公升 0.43 美元,而 RON97 的價格為每公升 0.73 美元。由於政府補貼,RON95 比 RON97 便宜。然而,2023 年 11 月,政府強調計劃在 2024 年下半年限制對 RON-95 等級燃料的補貼。此舉旨在填補可能影響 RON-95 消費的預算缺口。

- 隨著馬來西亞工業化和都市化進程的快速推進,乘用車和二輪車的需求不斷增加,汽油需求在不久的將來可能會擴大。

- 例如,根據馬來西亞汽車協會的數據,2023 年汽車銷量約為 799,731 輛,而 2022 年為 721,177 輛。預計乘用車銷量將在馬來西亞實現最高成長。歐佩克年度統計快報顯示,馬來西亞煉油能力與前一年同期比較成長26%,達到每日56.9萬桶。精製能力的提高意味著馬來西亞對精製汽油的需求增加。

- 因此,由於上述因素,預計汽油產品類型將在預測期內主導馬來西亞精煉石油產品市場。

預計精製石油產品需求激增將推動市場

- 過去幾年,馬來西亞精煉石油產品的銷售量穩定成長。精煉石油產品的成長主要是由於液化石油氣作為家庭烹飪燃料,特別是作為運輸燃料的需求不斷成長。

- 過去二十年來,馬來西亞對精製活動進行了巨額投資,以滿足國內對精煉石油產品的需求。國際公司正大力投資馬來西亞的煉油市場。例如,2023年4月,中國榮盛石化透露將投資高達167.4億美元在馬來西亞柔佛州邊佳蘭建立一座精製。

- 近年來,馬來西亞的生質燃料使用量也有所增加,生物燃料與暖氣油、汽油和柴油等精煉石油產品混合。 2024 年 4 月,生質燃料精製Ecoceres 宣布將在 2025 年底前運作一座年精製能力為 35 萬噸的煉油廠。這很可能在不久的將來帶動永續精煉石油產品市場的成長。

- 然而,隨著對精煉石油產品的需求不斷成長,以及馬來西亞注重自給自足以滿足這一需求,預計未來幾年該地區的下游基礎設施將大幅增加。該國正在製定擴建現有煉油廠或建造新煉油廠的計畫。

- 此外,馬來西亞計劃擴大其下游業務,以生產更多增值精煉石油產品,並成為石油和天然氣儲存和交易中心。根據世界能源統計,2022年馬來西亞的石油消費量將為每天89.4萬桶,與前一年同期比較增加15%。

- 因此,由於上述因素,預計預測期內對精煉石油產品的需求不斷成長將推動馬來西亞精煉石油產品市場的發展。

馬來西亞精煉石油工業概況

馬來西亞的精煉石油產品市場較為分散。市場主要企業(排名不分先後)包括雪佛龍公司、國家石油公司、殼牌公司、馬來西亞五石油有限公司和馬來西亞石油煉油與行銷有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 2029年成品油消費量預測(百萬噸油當量)

- 2029 年市場規模與需求預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 市場促進因素

- 精製石油產品需求激增

- 需要永續精製產品

- 市場限制

- 替代燃料汽車的普及率不斷提高

- 市場促進因素

- 供應鏈分析

- PESTLE分析

5. 按產品類型細分市場

- 汽油

- 柴油引擎

- LPG

- 其他產品類型(包括煤油、航空燃料)

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Chevron Corporation

- Petroliam Nasional Berhad

- Shell PLC

- FIVE Petroleum Malaysia Sdn Bhd

- Petron Malaysia Refining & Marketing Bhd

- Petroleum Sarawak Berhad

- Gas Malaysia Berhad

- EcoCeres

- PETMAL Oil Holdings Sdn Bhd

- Rongsheng Petrochemical Co. Ltd

- 市場排名分析

第7章 市場機會與未來趨勢

The Malaysia Refined Petroleum Products Market size is estimated at USD 15.84 billion in 2025, and is expected to reach USD 21.10 billion by 2030, at a CAGR of 5.9% during the forecast period (2025-2030).

Over the long term, the major driving factor of the market is expected to be the surging demand for refined petroleum products in the country.

However, the increasing adoption of alternative fuel vehicles (AFVs) is expected to slow down the growth of the market during the forecast period.

High demand for LPG from the petrochemical sector is expected to create immense opportunities for Malaysia's refined petroleum products.

Malaysia Refined Petroleum Products Market Trends

Petrol is Expected to Dominate the Market

- Petrol, also known as gasoline, is a petroleum-derived flammable liquid used in most spark-ignited internal combustion engines, such as passenger cars, motorcycles, and commercial vehicles. Petrol is produced by the fractional distillation of crude oil, enhanced with various additives to induce particular properties.

- Blends of compounds such as tetraethyl lead and other chemicals are added to petrol to improve its chemical stability and performance characteristics, control corrosiveness, and provide fuel system cleaning. Furthermore, petrol sometimes also contains chemicals such as ethanol, methyl tertiary-butyl ether, or ethyl tertiary-butyl ether, which improves the overall combustion of vehicles.

- Popular petrol variants consumed in Malaysia are RON95 and RON97. As of April 2024, the price of RON95 hovered around USD 0.43 per liter, while RON97 stood at USD 0.73 per liter. RON95 is cheaper than RON97 petrol due to the imposition of government subsidies. However, in November 2023, the government highlighted its plans to limit the subsidy on RON-95 grade fuel in the second half of 2024. The move is intended to fill the budget gap that might impact RON-95 consumption.

- Nevertheless, the demand for petrol in Malaysia is likely to grow in the near future due to the country's rapid industrialization and urbanization, which has resulted in higher demand for passenger vehicles and two-wheelers.

- For instance, as per Malaysia Automotive Association, in 2023, about 799,731 automobiles were sold compared to 721,177 units in 2022. Passenger car sales are attributed to lead the highest growth in Malaysia. As per OPEC's Annual Statistical Bulletin, the refinery throughput in Malaysia has increased to 569 thousand barrels per day, an increase of 26% from the previous year. The increase in refinery capacity signifies a growing demand for refined petrol in Malaysia.

- Therefore, based on the factors mentioned above, petrol product type is expected to dominate the Malaysian refined petroleum products market during the forecast period.

Surging Demand for Refined Petroleum Products is Expected to Propel the Market

- Malaysia has witnessed a steady growth in sales of manufactured refined petroleum products for the past several years. The increase in refined petroleum products can be mainly attributed to the growing demand for LPG as cooking fuel in homes and particularly as a transport fuel.

- Malaysia has invested heavily in refining activities during the past two decades to meet its demand for petroleum products with domestic supplies. International companies have noted significant investments in Malaysia's refinery market. For instance, in April 2023, China's Rongsheng Petrochemical Co. Ltd highlighted its investment of up to USD 16.74 billion to set up a refining facility in Pengerang, Johor, Malaysia.

- The utilization of biofuels blended with refined petroleum products, such as heating oil, gasoline, and diesel fuel, has also been on the rise in Malaysia in recent years. In April 2024, Ecoceres, a biofuel refiner, declared that it would commence its refinery by the second half of 2025, with an estimated capacity of 350,000 metric tons annually. This is likely to lead to growth in sustainable refined petroleum products markets in the near future.

- However, with the growing demand for petroleum products and Malaysia's focus on self-reliance to meet the demand, the downstream infrastructure in the region is expected to increase significantly in the coming years. The country has formulated plans to either expand the current refineries or construct new ones.

- Furthermore, Malaysia is planning to increase downstream activities by creating higher-value-added petroleum products and becoming the oil and gas storage and trading hub. According to the Statistical Review of World Energy, oil consumption in Malaysia in 2022 stood at 894 thousand barrels per day, an increase of 15% from the previous year.

- Therefore, owing to the factors mentioned above, the growing demand for petroleum products is expected to drive the Malaysian refined petroleum products market during the forecast period.

Malaysia Refined Petroleum Products Industry Overview

The Malaysian refined petroleum products market is fragmented. Some of the major players in the market (in no particular order) include Chevron Corporation, Petroliam Nasional Berhad, Shell PLC, FIVE Petroleum Malaysia Sdn Bhd, and Petron Malaysia Refining & Marketing Bhd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Refined Petroleum Products Consumption Forecast in million tons of Oil Equivalent, till 2029

- 4.3 Market Size and Demand Forecast, in USD billion, till 2029

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Market Drivers

- 4.6.1.1 Surge in Demand of Refined Petroleum Products

- 4.6.1.2 Need for Sustainable Refined Petroleum Products

- 4.6.2 Market Restraints

- 4.6.2.1 Increase in Adoption of Alternative Fuel Vehicles

- 4.6.1 Market Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION - By Product Type

- 5.1 Petrol

- 5.2 Diesel

- 5.3 LPG

- 5.4 Other Product Types (Including Kerosene and Aviation Fuel)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Chevron Corporation

- 6.3.2 Petroliam Nasional Berhad

- 6.3.3 Shell PLC

- 6.3.4 FIVE Petroleum Malaysia Sdn Bhd

- 6.3.5 Petron Malaysia Refining & Marketing Bhd

- 6.3.6 Petroleum Sarawak Berhad

- 6.3.7 Gas Malaysia Berhad

- 6.3.8 EcoCeres

- 6.3.9 PETMAL Oil Holdings Sdn Bhd

- 6.3.10 Rongsheng Petrochemical Co. Ltd

- 6.4 Market Ranking Analysis