|

市場調查報告書

商品編碼

1635511

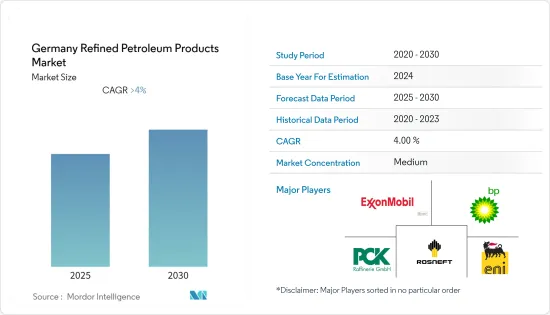

德國精製石油產品 -市場佔有率分析、產業趨勢、成長預測(2025-2030)Germany Refined Petroleum Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

德國精煉石油產品市場預計在預測期內複合年成長率將超過 4%。

從中期來看,精煉石油產品消費量的增加、出口的增加以及對精煉石油產品的需求預計將推動研究市場的成長。同時,替代燃料的日益採用預計將在預測期內抑制德國精煉石油產品市場。

石化產業不斷成長的液化石油氣需求預計將在預測期內為德國精製石油產品市場創造有利的成長機會。

德國精煉石油產品市場趨勢

精製油消費快速成長

2021 年,柴油和馬達汽油在德國燃料消費量的總合佔有率約為 93%。燃料消耗的激增預計將推動德國對精製石油產品的需求。根據英國石油公司《2022 年世界能源統計回顧》的數據,2021 年,德國每天消耗約 205 萬桶石油。總體而言,該國的石油消費量在所考慮的大部分時期都在下降。德國是石油和天然氣消費大國。預計在預測期內,精煉石油產品的需求將大幅成長。

根據聯邦網路局統計,德國私人家庭和小型工業消耗了40%的消費量,而大型製造業則需要全國60%的天然氣。德國2021年天然氣使用量為1000億立方公尺。 2022 年 9 月,TotalEnergies SE 將為 Bilfinger SE 提供長期綜合維護服務,重點是確保該公司位於德國中部日產量 227,000 桶的 Leuna 煉油廠的效率和永續性。

此外,2022年9月,德國政府宣布將暫時接管俄羅斯能源巨頭俄羅斯石油公司的兩家子公司:Rosneft Deutschland GmbH和RN Refining & Marketing GmbH。政府此舉將使俄羅斯石油公司控制其在該國持有的三座煉油廠。其中包括該國東北部的關鍵設施,這些設施供應柏林約 90% 的燃料,大部分股權歸俄羅斯石油公司所有。預計這將在預測期內推動德國精製石油產品的使用。

因此,精煉石油產品消費的增加以及政府增加其在能源結構中的佔有率的努力預計將在未來幾年推動德國精煉石油市場的發展。

液化石油氣(LPG)實現顯著成長

液化石油氣(LPG)產品用作車輛燃料(汽車燃氣)以及農業和工業應用中的加熱。丁烷和丙烷也經常用作汽車、耐用消費品和包裝行業各種生產目的的原料。德國俄羅斯石油公司 (Rosneft Deutschland) 是德國最大的 LPG(液化石油氣)生產商之一。該公司在俄羅斯石油公司擁有的三個煉油廠生產高品質的丙烷、丁烷和液化石油氣混合物,並將其供應給德國和鄰國的客戶。

根據能源資訊署統計,德國平均液化石油氣消費量在2002年達到83,450桶/日的低點,在2017年達到126,450桶/日的高峰。從 2021 年起,該價值為 117,380 桶/天。

根據聯邦獨立加油站協會統計,為滿足日益成長的液化石油氣需求,德國將把液化石油氣(汽車燃氣)加氣站數量從2014年的6,852個增加到2021年的6,971個。汽車燃氣需求的增加導致汽車燃氣加氣站在全國擴建。

此外,2022年8月,贏創工業股份公司宣布計畫使其德國製造地實現能源來源多元化,以減少對天然氣的依賴。最重要的措施將在贏創位於馬爾的德國最大工廠實施。新的燃氣發電廠使用液化石油氣(LPG)取代天然氣來能源產出。因此,液化石油氣(LPG)需求的增加預計將導致預測期內德國精煉石油產品市場的顯著成長。

德國精製石油產品產業概況

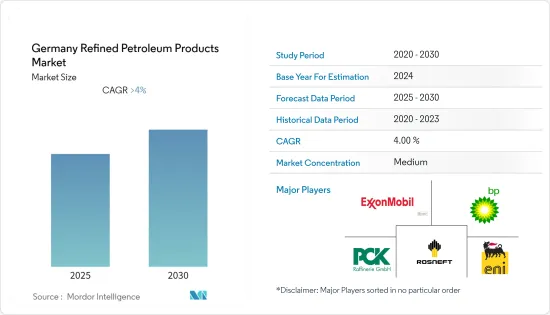

德國精煉石油產品市場因其性質而適度分割。市場上的主要企業包括(排名不分先後)Rosneft Deutschland GmbH、Eni SpA、PCK Raffinerie GmbH、BP PLC 和埃克森美孚公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2027年成品油消費量預測(百萬噸油噹量)

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔:依產品

- 汽車燃料

- 船用燃料

- 航空燃料

- 液化石油氣(LPG)

- 其他

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Rosneft Deutschland GmbH

- Eni SpA

- PCK Raffinerie GmbH

- BP PLC

- Exxon Mobil Corporation

- Chevron Corporation

- Shell PLC

- TotalEnergies SE

- HOLBORN Europa Raffinerie GmbH

- BAYERNOIL Raffineriegesellschaft mbH

第7章 市場機會及未來趨勢

The Germany Refined Petroleum Products Market is expected to register a CAGR of greater than 4% during the forecast period.

Over the medium term, the increasing consumption of refined petroleum products, increasing exports, and demand for refined petroleum products are factors expected to drive the growth of the market studied. On the other hand, the increasing adoption of alternative fuels is expected to restrain the German refined petroleum products market during the forecast period.

Nevertheless, the increasing demand for LPG from the petrochemical sector is expected to create lucrative growth opportunities for the German refined petroleum products market during the forecast period.

Germany Refined Petroleum Products Market Trends

Surging Consumption of Refined Petroleum Products

Diesel fuel and motor gasoline had a combined share of approximately 93% of German fuel consumption in 2021. The surging fuel consumption is expected to drive the demand for refined petroleum products in Germany. As per BP's Statistical Review of World Energy 2022, in 2021, Germany consumed about 2.05 million barrels of oil per day. Overall, oil consumption in the country has been mostly decreasing during the period in consideration. Germany is a heavy consumer of oil and natural gas. The demand for refined petroleum products is expected to witness significant growth during the forecast period.

As per the Federal Network Agency, German households and small industries account for 40% of consumption, while big manufacturing industries require 60% of the country's gas. Germany used 100 billion cubic meters of gas in 2021. In September 2022, TotalEnergies SE awarded a contract with Bilfinger SE to deliver long-term integrated maintenance services focused on ensuring efficiency and sustainability at the operator's 227,000-b/d Leuna refinery in central Germany.

Furthermore, in September 2022, the German government announced that it is temporarily controlling two subsidiaries of the Russian energy giant Rosneft, including Rosneft Deutschland GmbH and RN Refining & Marketing GmbH. The move by the government puts it in charge of Rosneft's stakes in three refineries in the country. This includes a critical facility in the northeast of the country, which supplies around 90% of Berlin's fuel and in which Rosneft has a majority stake. This is expected to drive the use of German refined petroleum products during the forecast period.

Therefore, the growing consumption of refined petroleum products and the government's efforts to increase the refined petroleum products in the energy mix is expected to drive the German refined petroleum products market in the coming years.

Liquefied Petroleum Gas (LPG) to Witness Significant Growth

Liquid petroleum gas (LPG) products are used as motor fuel (autogas) and for heating in agriculture and industrial applications. Butane and propane are also often used as raw materials for various production purposes in the automotive, durable goods, and packaging industries. Rosneft Deutschland is one of Germany's largest producers of LPG (Liquefied petroleum gas). The company produces high-quality propane, butane, and LPG mix in the three refineries with Rosneft shareholding and supplies its customers in Germany and neighboring countries.

As per the Energy Information Administration statistics, the average LPG consumption in Germany recorded a minimum of 83.45 thousand barrels per day in 2002 and a maximum of 126.45 thousand barrels per day in 2017. The value from 2021 is 117.38 thousand barrels per day.

To meet the increasing LPG demand, as per the Federal Association of Independent Gas Stations statistics, Germany increased the number of LPG (autogas) filling stations from 6,852 in 2014 to 6,971 in 2021. The increase in the demand for autogas has led to growth in the expansion of autogas filling stations across the country.

Furthermore, in August 2022, Evonik Industries AG announced plans to diversify its energy sources at its manufacturing sites in Germany to make it less dependent on natural gas. The most significant measure is being implemented at Evonik's largest German site in Marl. In the new gas-fired power plant, liquefied petroleum gas (LPG) will be used instead of natural gas to generate energy. Therefore, the increasing demand for liquefied petroleum gas (LPG) is expected to lead to significant growth in the German refined petroleum products market during the forecast period.

Germany Refined Petroleum Products Industry Overview

The German refined petroleum products market is moderately fragmented in nature. Some of the major players in the market (in no particular order) are Rosneft Deutschland GmbH, Eni SpA, PCK Raffinerie GmbH, BP PLC, and Exxon Mobil Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Refined Petroleum Products Consumption Forecast in million tons of oil equivalent, till 2027

- 4.3 Market Size and Demand Forecast in USD billion, till 2027

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION - BY PRODUCT

- 5.1 Automotive Fuels

- 5.2 Marine Fuels

- 5.3 Aviation Fuels

- 5.4 Liquefied Petroleum Gas (LPG)

- 5.5 Other Products

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Rosneft Deutschland GmbH

- 6.3.2 Eni SpA

- 6.3.3 PCK Raffinerie GmbH

- 6.3.4 BP PLC

- 6.3.5 Exxon Mobil Corporation

- 6.3.6 Chevron Corporation

- 6.3.7 Shell PLC

- 6.3.8 TotalEnergies SE

- 6.3.9 HOLBORN Europa Raffinerie GmbH

- 6.3.10 BAYERNOIL Raffineriegesellschaft mbH