|

市場調查報告書

商品編碼

1693539

非洲特種肥料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Africa Specialty Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

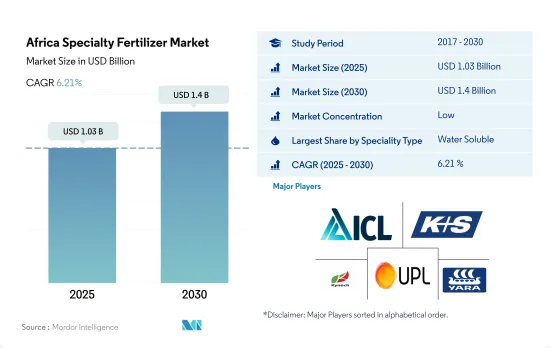

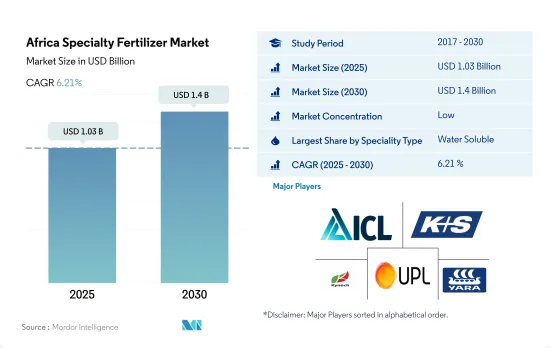

預計 2025 年非洲特種肥料市場規模為 10.3 億美元,到 2030 年將達到 14 億美元,預測期內(2025-2030 年)的複合年成長率為 6.21%。

與傳統肥料相比,特種肥料的各種優勢預計將推動市場成長。

- 2022年,控制釋放肥料(CRF)佔特種肥料市場的7.4%。控釋肥的穩定成長歸因於其相對於傳統肥料的獨特優勢以及人們對高效耕作方法的認知不斷提高。 CRF 在很長一段時間內逐漸釋放養分,確保為植物穩定供應養分。這不僅減少了營養物質的浪費,而且還最大限度地降低了傳統肥料中常見的浸出和蒸發風險。

- 水溶性肥料的市場佔有率為 47.8%,在 2022 年特種肥料市場中排名第二。使用水溶性肥料顯示出減少種植健康植物所需的水和肥料的潛力。

- 受灌溉系統進步和水耕、魚菜共生等先進栽培技術的日益普及的推動,液體肥料市場有望實現成長。預計 2023 年至 2030 年間液體肥料市場價值的複合年成長率為 5.8%。

- 採用緩效肥料不僅為農民帶來經濟效益,還有節省用水、防止氮揮發和淋溶、減少處理肥料所需勞動力等環境效益。由於這些因素,緩釋肥料的市場價值預計在 2023 年至 2023 年間將成長 5.4%。

- 鑑於特種肥料的益處,例如精確釋放養分、減少施肥量以及為農民帶來經濟效益,特種肥料市場在未來幾年有望實現成長。

政府措施和農民對提高生產力的關注預計將推動市場成長

- 2022 年,奈及利亞在非洲特種肥料市場佔有 27.0% 的主導佔有率。該國的農業部門面臨著複雜的土地所有權問題、灌溉基礎設施不足、氣候變遷的不利影響以及逐步採用尖端農業技術等挑戰,但政府的舉措使市場得以成長。這些政策包括農業促進政策(APP)、奈及利亞-非洲貿易和投資促進計劃、國家農業技術和創新計劃(NATIP)和錨定借款人計劃(ABP),所有這些政策都有助於提高農業生產力。

- 南非是非洲大陸最先進、最豐饒、最多樣化的農業地區。 2022 年,強勁的農業部門佔據了非洲特種肥料市場總量的 37.0% 的佔有率。預計預測期內市場複合年成長率將達到 6.7%。這一預期成長主要是由於人們越來越需要透過採用更有效率的肥料解決方案來減輕長期乾旱和極端高溫等氣候相關風險的影響。

- 由於人口快速成長、可耕地面積減少、迫切需要提高現有農地的產量以及努力提高全部區域的農業生產率,非洲特種肥料市場預計將擴大。預計 2023 年至 2030 年的複合年成長率將達到 6.0%。

非洲特種肥料市場趨勢

由於國內需求不斷成長,預計不久的將來農業產量將翻倍。

- 非洲的農業生態區從每年降雨兩次的茂密熱帶雨林到降雨稀少的乾旱沙漠。該地區的主要田間作物包括玉米、高粱、小麥和水稻。到2022年,這些作物的種植面積將達到2.248億公頃,佔該地區農業用地的95%以上。由於玉米庫存過剩抑制了價格,南非玉米種植者在2018-19年度將玉米種植面積減少了10%,至210萬公頃。結果,該國玉米產量下降了11%,從1300萬噸下降到1200萬噸,而出口量從250萬噸下降到100萬噸。這種轉變促使農民將更多土地分配給作物,尤其是大豆,導致2018-2019年非洲各地玉米種植面積下降。

- 奈及利亞是非洲最大的高粱生產國,緊隨其後的是衣索比亞。高粱佔奈及利亞穀物總產量的50%,約佔奈及利亞穀物種植面積的45%。高粱以其耐旱、耐澇而聞名,能夠在各種土壤條件下生長。這些特性使高粱成為非洲乾旱地區的主要作物,確保了糧食安全和收入安全。

- 肯亞、索馬利亞和衣索比亞大部分地區正面臨嚴重的糧食安全危機。過去十年,非洲的農業和可耕地面積不斷擴大,但其糧食進口支出卻增加了近兩倍。

油菜是氮消費量最高的作物

- 油菜籽鉀、磷施用量最高,分別為162.4公斤/公頃、281.7公斤/公頃。同時,非洲田間作物平均施氮量為364.9公斤/公頃。 2022年,非洲田間作物佔一次養分總消費量的87.1%,達55.61萬噸。這項優勢得益於用於田間作物的土地面積廣闊。其中,氮、磷、鉀養分平均施用量分別為每作物223.2公斤、125.3公斤、155.3公斤。

- 奈及利亞的幾內亞大草原為玉米生產提供了適當的環境條件。然而,儘管有這樣的潛力,該地區的農民仍然在為低產量而苦苦掙扎。主要原因是由於土地集約利用導致土壤劣化和養分耗盡(主要是氮)。田間作物優先施用氮肥,因為氮肥具有多種益處,包括犁地、增加葉面積、形成籽粒、灌漿和促進蛋白質合成。氮在提高作物產量和品質方面也發揮著重要作用。

- 主要營養成分對於作物生長至關重要,由於對土壤枯竭和氮氣淋失的擔憂,預計未來幾年主要營養成分的施用率將大幅增加。

非洲特種肥料產業概況

非洲特種肥料市場較分散,前五大企業佔29.76%。市場的主要企業有:ICL Group Ltd、K+S Aktiengesellschaft、Kynoch Fertilizer、UPL Limited 和 Yara International ASA(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 主要作物種植面積

- 田間作物

- 園藝作物

- 平均養分施用量

- 微量營養素

- 田間作物

- 園藝作物

- 主要營養素

- 田間作物

- 園藝作物

- 次要宏量營養素

- 田間作物

- 園藝作物

- 微量營養素

- 灌溉農田

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 專業類型

- CRF

- 聚合物塗層

- 聚合硫塗層

- 其他

- 液體肥料

- SRF

- 水溶性

- CRF

- 施肥方式

- 受精

- 葉面噴布

- 土壤

- 作物類型

- 田間作物

- 園藝作物

- 草坪和觀賞植物

- 原產地

- 奈及利亞

- 南非

- 其他非洲國家

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Gavilon South Africa(MacroSource, LLC)

- Haifa Group

- ICL Group Ltd

- K+S Aktiengesellschaft

- Kynoch Fertilizer

- UPL Limited

- Yara International ASA

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 92604

The Africa Specialty Fertilizer Market size is estimated at 1.03 billion USD in 2025, and is expected to reach 1.4 billion USD by 2030, growing at a CAGR of 6.21% during the forecast period (2025-2030).

The various advantages of using specialty fertilizers over conventional fertilizers is expected to bolster the growth of the market

- In 2022, controlled-release fertilizers (CRFs) held a 7.4% share of the specialty fertilizer market. The steady growth of CRFs can be attributed to their distinct advantages over traditional fertilizers and the increasing awareness of efficient agricultural practices. CRFs gradually release nutrients over an extended period, ensuring a consistent nutrient supply to plants. This not only reduces nutrient wastage but also minimizes the risk of leaching or evaporation, which is common with conventional fertilizers.

- Water-soluble fertilizers, with a 47.8% market share, ranked second in the specialty fertilizer market in 2022. The use of water-soluble fertilizers has shown potential in reducing both water and fertilizer requirements for cultivating healthy plants.

- The liquid fertilizer market is poised for growth, propelled by advancements in irrigation systems and the rising adoption of advanced cultivation techniques such as hydroponics and aquaponics. The market value of liquid fertilizers is projected to witness a CAGR of 5.8% during 2023-2030.

- The adoption of slow-release fertilizers offers farmers not only economic benefits but also environmental advantages, such as water conservation, prevention of nitrogen volatilization and leaching, and reduced labor in fertilizer handling. These factors are expected to drive a 5.4% growth in the market value of slow-release fertilizers during 2023-20230.

- Given the benefits of specialty fertilizers, including precise nutrient release, reduced application rates, and economic advantages for farmers, the specialty fertilizer market is poised for growth in the coming years.

Government initiatives and farmers' focus on increasing productivity are expected to bolster the growth of the market

- In 2022, Nigeria held a commanding 27.0% value share in the African specialty fertilizer market. The country's agricultural sector, while facing challenges such as complex land tenure issues, inadequate irrigation infrastructure, the adverse effects of climate change, and the gradual adoption of cutting-edge agricultural technologies, has seen growth in the market supported by government initiatives. These include the Agriculture Promotion Policy (APP), the Nigeria-Africa Trade and Investment Promotion Programme, the National Agricultural Technology and Innovation Plan (NATIP), and the Anchor Borrowers Program (ABP), all of which have been instrumental in enhancing agricultural productivity.

- South Africa distinguishes itself as the continent's most advanced, productive, and diverse agricultural region. In 2022, its robust agricultural sector held a substantial 37.0% share of the total African specialty fertilizer market. The market is expected to record a CAGR of 6.7% during forecast period. This anticipated growth is largely due to the increasing need to mitigate the effects of climate-related risks, such as prolonged droughts and intense heat waves, by adopting more efficient fertilizer solutions.

- The African specialty fertilizer market is set to expand, driven by a rapidly growing population, the diminishing availability of arable land, the urgent necessity to improve yields on existing farmland, and concerted efforts to enhance agricultural productivity across the region. Thus, the market is forecasted to witness a CAGR of 6.0% from 2023 to 2030.

Africa Specialty Fertilizer Market Trends

The rising domestic demand will lead to double the agricultural production in the near future

- The agro-ecological zones in Africa span from dense rainforests with bi-annual rainfall to arid deserts with minimal precipitation. Key field crops in the region include corn, sorghum, wheat, and rice. In 2022, the cultivation area for these crops reached 224.8 million hectares, accounting for over 95% of the region's agricultural land. In response to a surplus of corn stocks leading to price suppression, South African corn farmers scaled back their planting by 10% to 2.1 million hectares in the 2018-19 season. Consequently, corn production in the country dipped by 11% from 13 million to 12 million tonnes, and exports fell from 2.5 million to 1 million tonnes. This shift prompted producers to allocate more of their fields to oilseed crops, particularly soybeans, resulting in an overall decline in corn cultivation across Africa in 2018-2019.

- Nigeria takes the lead as the largest sorghum producer in Africa, closely followed by Ethiopia. Sorghum, accounting for 50% of the total cereal output, dominates about 45% of Nigeria's cereal crop land. Known for its drought and waterlogging tolerance, sorghum thrives in diverse soil conditions. These attributes position sorghum as the go-to staple crop in Africa's drier regions, ensuring both food and income security.

- Kenya, Somalia, and significant parts of Ethiopia are grappling with the looming specter of severe food shortages. Over the past decade, Africa's spending on food imports has nearly tripled, even as its agricultural industry and cultivated land have continued to expand.

Rapeseed is the highest nitrogen consuming crop

- Rapeseed crops have the highest potassium and phosphorous application rates, accounting for 162.4 kg/hectare and 281.7 kg/hectare, respectively. Meanwhile, the average nitrogen application rate for field crops in Africa stands at 364.9 kg/hectare. In 2022, field crops in Africa accounted for 87.1% of the total primary nutrient consumption, which amounted to 556.1 thousand metric tons. This dominance can be attributed to the extensive land area dedicated to field crops. Specifically, the average nutrient application rates for nitrogen, phosphorous, and potassium in these crops were 223.2 kg/ha, 125.3 kg/ha, and 155.3 kg/ha, respectively.

- The Guinea savannas in Nigeria offer favorable environmental conditions for maize production. However, despite this potential, farmers in the region struggle with low yields. The primary culprits are soil degradation and nutrient depletion, primarily nitrogen, resulting from intensified land use. Field crops prioritize nitrogen application due to its multiple benefits, including promoting tillering, leaf area development, grain formation, filling, and protein synthesis. Nitrogen also plays a crucial role in enhancing both grain yield and quality.

- Given that primary nutrients are vital for crop growth and with concerns over soil depletion and nitrogen leaching, the application rates for primary nutrients are expected to witness significant growth in the coming years.

Africa Specialty Fertilizer Industry Overview

The Africa Specialty Fertilizer Market is fragmented, with the top five companies occupying 29.76%. The major players in this market are ICL Group Ltd, K+S Aktiengesellschaft, Kynoch Fertilizer, UPL Limited and Yara International ASA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Micronutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.2 Primary Nutrients

- 4.2.2.1 Field Crops

- 4.2.2.2 Horticultural Crops

- 4.2.3 Secondary Macronutrients

- 4.2.3.1 Field Crops

- 4.2.3.2 Horticultural Crops

- 4.2.1 Micronutrients

- 4.3 Agricultural Land Equipped For Irrigation

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Speciality Type

- 5.1.1 CRF

- 5.1.1.1 Polymer Coated

- 5.1.1.2 Polymer-Sulfur Coated

- 5.1.1.3 Others

- 5.1.2 Liquid Fertilizer

- 5.1.3 SRF

- 5.1.4 Water Soluble

- 5.1.1 CRF

- 5.2 Application Mode

- 5.2.1 Fertigation

- 5.2.2 Foliar

- 5.2.3 Soil

- 5.3 Crop Type

- 5.3.1 Field Crops

- 5.3.2 Horticultural Crops

- 5.3.3 Turf & Ornamental

- 5.4 Country

- 5.4.1 Nigeria

- 5.4.2 South Africa

- 5.4.3 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Gavilon South Africa (MacroSource, LLC)

- 6.4.2 Haifa Group

- 6.4.3 ICL Group Ltd

- 6.4.4 K+S Aktiengesellschaft

- 6.4.5 Kynoch Fertilizer

- 6.4.6 UPL Limited

- 6.4.7 Yara International ASA

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219