|

市場調查報告書

商品編碼

1693510

印度特種肥料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)India Specialty Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

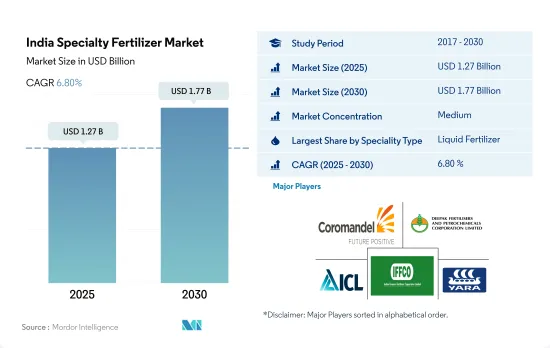

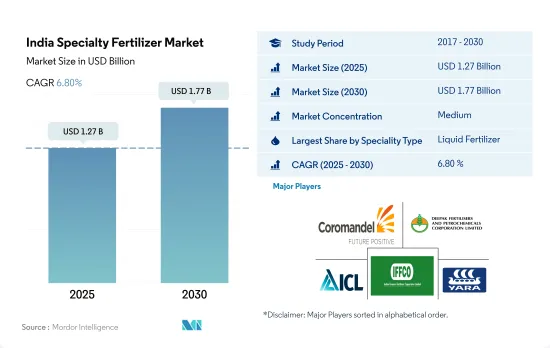

印度特種肥料市場規模預計在 2025 年將達到 12.7 億美元,預計到 2030 年將達到 17.7 億美元,預測期內(2025-2030 年)的複合年成長率為 6.80%。

永續的農業實踐和改善的環境安全推動了特殊肥料的使用

- 2017-2021年期間,該國控制釋放肥市場價值成長了106.1%,而消費量增加了24.2%。主要原因是印度政府要求所有國內尿素生產商必須生產 100% 印楝尿素,並以補貼價格分發給農民。

- 2022年,液體肥料佔印度特種肥料市場的49.7%。在液體肥料市場中,複合肥料佔比最大,為75.7%。 2017 年該產業的價值為 2.061 億美元,預計到 2030 年將達到 21.2 億美元。同樣,到 2022 年,單質肥料將佔液體肥料市場的 24.3%。

- 緩效肥料佔2022年專用肥料市場的1.0%。田間作物和園藝作物是緩釋肥的主要消費者,到2022年,它們將分別佔市場佔有率的89.6%和10.2%。由於田間作物和作物作物在該國廣泛種植,預計該國將推動緩釋肥市場的發展。

- 在專用肥料市場中,水溶性肥料將在2022年佔據46.2%的市場。預計水溶性肥料市場將在2017年至2021年期間穩定成長,到2022年將達到14.6億美元。田間作物佔比最大,為88.8%,其次是園藝作物。

- 對高效肥料的需求不斷成長、施用的便利性、永續農業實踐的採用以及更高的環境安全性是推動印度特種肥料市場發展的一些因素。

印度特種肥料市場趨勢

錳缺乏症是歐洲國家常見的問題,在沙質土壤和pH值高於6的有機土壤中最為常見。

- 2017年至2022年間,該國田間作物種植面積增加了3.5%。由於國內外消費需求不斷成長,該國穀物、豆類和油籽種植面積增加是種植面積增加的主要驅動力。

- 依作物類型分類,水稻、小麥和大豆的種植面積最大,到2022年分別為4,700萬公頃、3,110萬公頃和1,230萬公頃。水稻是印度最重要的作物,約佔印度種植總面積的四分之一,養活了全國約一半的人口。它主要生長在西孟加拉邦、北方邦、安得拉邦、旁遮普邦和泰米爾納德邦。

- 因此,預計該國的米消費量將從 2016 年的 9,580 萬噸增加到 2022 年的 1.07 億噸,顯示該國對作物的需求不斷成長。預計這一趨勢將在 2023 年至 2030 年期間進一步推高化肥需求。同樣,國內小麥種植量從 2017 年的 9,850 萬噸增加到 2020 年的 1.076 億噸。小麥主要種植在旁遮普邦、西孟加拉邦、哈里亞納邦和拉賈斯坦邦。小麥是印度第二大穀物作物,在該國的糧食和營養安全中發揮著至關重要的作用。因此,該國的穀物種植業蓬勃發展,再加上國內外需求的不斷成長,預計將在 2023 年至 2030 年期間推動印度肥料市場的發展。

在主要養分中,氮是大田作物最常使用的養分,平均施用量為每公頃 223.5 公斤。

- 2022年所有主要養分的平均施用率為125.1公斤/公頃,其中氮和其他養分的平均施用率最高,為223.5公斤/公頃。因此,氮是該國集約化種植的水稻等作物的主要營養來源,而土壤養分缺乏正在限制全國的水稻產量。

- 印度的生物肥料和有機肥料的現狀顯示土壤健康狀況不佳,化學肥料的消耗量不斷增加。結果表明,受試土壤中氮、磷、鉀缺量的比例分別為97.0%、83.0%和71.0%。

- 以作物,2022年平均施肥量最高的作物是小麥、水稻和玉米,估計分別為231公斤/公頃、156公斤/公頃和149公斤/公頃。小麥和米是我國乃至全球重要的主糧。多種營養缺乏是降低產量和利潤的重要因素。小麥和水稻作物需要氮、磷、鉀和硫、硼、鐵和鋅等微量營養素才能正常生長。適當的營養管理對於作物的成功生產是必要的,這推動了市場的成長。

- 田間作物消耗大量的主要營養物質,例如氮肥。該國對穀類的密集種植正在耗盡土壤的養分,需要更多的肥料來補充。

印度特種肥料產業概況

印度特種肥料市場適度整合,前五大公司佔48.56%的市佔率。該市場的主要企業有:Coromandel International Ltd.、Deepak Fertiliser & Petrochemicals Corporation Ltd、ICL Group Ltd、Indian Farmers Fertiliser Cooperative Limited 和 Yara International ASA(按字母排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 主要作物種植面積

- 田間作物

- 園藝作物

- 平均養分施用量

- 微量營養素

- 田間作物

- 園藝作物

- 主要營養素

- 田間作物

- 園藝作物

- 次要宏量營養素

- 田間作物

- 園藝作物

- 微量營養素

- 灌溉農田

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 專業類型

- CRF

- 聚合物塗層

- 聚合硫塗層

- 其他

- 液體肥料

- SRF

- 水溶性

- CRF

- 施肥方式

- 受精

- 葉面噴布

- 土壤

- 作物類型

- 田間作物

- 園藝作物

- 草坪和觀賞植物

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Chambal Fertilizers & Chemicals Ltd

- Coromandel International Ltd.

- Deepak fertilizers & Petrochemicals Corporation Ltd

- Grupa Azoty SA(Compo Expert)

- Haifa Group

- ICL Group Ltd

- Indian Farmers Fertiliser Cooperative Limited

- Mangalore Chemicals & Fertilizers Ltd.

- Sociedad Quimica y Minera de Chile SA

- Yara International ASA

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The India Specialty Fertilizer Market size is estimated at 1.27 billion USD in 2025, and is expected to reach 1.77 billion USD by 2030, growing at a CAGR of 6.80% during the forecast period (2025-2030).

Sustainable farming practices and higher environmental safety are being adopted, driving the usage of specialty fertilizers

- The controlled-release fertilizer market in the country witnessed an increase in market value by 106.1%, whereas the consumption volume increased by 24.2% during 2017-2021. The main reason for this was the Government of India making it mandatory for all domestic producers of urea to produce 100% neem-coated urea and distribute it at a subsidized price to the farmers.

- Liquid fertilizers accounted for 49.7% of India's specialty fertilizer market in 2022. Complex fertilizers accounted for the maximum share in the liquid fertilizer market, i.e., 75.7%. This segment was valued at USD 206.1 million in 2017, which is anticipated to reach USD 2.12 billion by 2030. Similarly, straight fertilizers accounted for 24.3% of the liquid fertilizers market in 2022.

- Slow-release fertilizers accounted for 1.0% of the specialty fertilizer market value in 2022. Field crops and horticultural crops are the major consumers of slow-release fertilizers, accounting for 89.6% and 10.2% of the market volume in 2022. The intensive field crop and horticultural crop cultivation in the country are anticipated to drive the market for slow-release fertilizers.

- In the specialty fertilizer market, water-soluble fertilizers accounted for 46.2% of the value share in 2022. The water-soluble fertilizer market witnessed stable growth during 2017-2021, valued at USD 1.46 billion in 2022. Field crops occupied the largest share of 88.8%, followed by horticultural crops.

- The rise in demand for high-efficiency fertilizers, ease of application, adoption of sustainable farming practices, and higher environmental safety are some of the factors driving the specialty fertilizer market in India.

India Specialty Fertilizer Market Trends

manganese deficiency is a common problem in European countries, which most frequently affects sandy soils, organic soils with a pH above 6

- The area under field crop cultivation in the country increased by 3.5% during 2017-2022. The increased cultivation of cereals, pulses, and oilseeds in the country due to the rising consumer demand domestically and internationally is the major driving factor for the rising acreage.

- By crop type, rice, wheat, and soybean occupied the largest area under cultivation in the country, accounting for 47 million ha, 31.1 million ha, and 12.3 million ha in the year 2022. Rice is the most important food crop of India, covering about one-fourth of the total cropped area and providing food to about half of the Indian population. It is cultivated in almost all the states of the country, mainly in West Bengal, Uttar Pradesh, Andhra Pradesh, Punjab, and Tamil Nadu.

- Accordingly, rice consumption in the country increased from 95.8 million tons in 2016 to 107 million tons in 2022, which shows the rising demand for the crop in the country. This trend is further anticipated to drive the demand for fertilizers during 2023-2030. Similarly, wheat cultivation in the country increased from 98.5 million tons in 2017 to 107.6 million tons in the year 2020. It is cultivated majorly in Punjab, West Bengal, Haryana, and Rajasthan. Wheat is the second most important cereal crop in India and plays a vital role in the food and nutritional security of the country. Therefore, the intense cereal cultivation in the country, coupled with rising domestic and international demand, is anticipated to drive the Indian fertilizer market during 2023-2030.

Among the primary nutrients, nitrogen is the most-applied nutrient in field crops, with an average application rate of 223.5 kg per hectare

- The overall primary nutrient average application rate in 2022 was 125.1 kg/ha, with nutrients such as nitrogen with the highest average application rate of 223.5 kg/ha. Accordingly, nitrogen is the major source of nutrients for crops such as rice, which is intensively cultivated in the country, and such nutrient deficiency in soil is limiting rice productivity across the nation.

- The State of Biofertilizers and Organic Fertilizers in India marked poor status of soil health and increasing consumption of chemical fertilizers in India. Accordingly, 97.0%, 83.0%, and 71.0% of the soil tested were found to be deficient in nitrogen, phosphorous, and potassium.

- By crop, wheat, rice, and corn/maize were estimated to be the crop types with the highest average nutrient application rate of 231, 156, and 149 kg/ha in 2022. Wheat and rice are important staple food domestically and globally. Multiple nutrient deficiencies are the key factors that reduce yield and profit. Wheat and rice crops require nitrogen, phosphorous, and potassium, along with other micronutrients such as sulfur, boron, iron, and zinc, for their proper growth and development. The proper management of nutrients is necessary for successful crop production, which in turn is driving market growth.

- Field crops consume the maximum amount of primary nutrients, such as nitrogen fertilizer. As grains and cereals are intensively grown in the country, the soil is depleted of its nutrition, and hence they require more amount of fertilizers to supplement them, which in turn is anticipated to drive the market during 2023-2030.

India Specialty Fertilizer Industry Overview

The India Specialty Fertilizer Market is moderately consolidated, with the top five companies occupying 48.56%. The major players in this market are Coromandel International Ltd., Deepak fertilizers & Petrochemicals Corporation Ltd, ICL Group Ltd, Indian Farmers Fertiliser Cooperative Limited and Yara International ASA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Micronutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.2 Primary Nutrients

- 4.2.2.1 Field Crops

- 4.2.2.2 Horticultural Crops

- 4.2.3 Secondary Macronutrients

- 4.2.3.1 Field Crops

- 4.2.3.2 Horticultural Crops

- 4.2.1 Micronutrients

- 4.3 Agricultural Land Equipped For Irrigation

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Speciality Type

- 5.1.1 CRF

- 5.1.1.1 Polymer Coated

- 5.1.1.2 Polymer-Sulfur Coated

- 5.1.1.3 Others

- 5.1.2 Liquid Fertilizer

- 5.1.3 SRF

- 5.1.4 Water Soluble

- 5.1.1 CRF

- 5.2 Application Mode

- 5.2.1 Fertigation

- 5.2.2 Foliar

- 5.2.3 Soil

- 5.3 Crop Type

- 5.3.1 Field Crops

- 5.3.2 Horticultural Crops

- 5.3.3 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Chambal Fertilizers & Chemicals Ltd

- 6.4.2 Coromandel International Ltd.

- 6.4.3 Deepak fertilizers & Petrochemicals Corporation Ltd

- 6.4.4 Grupa Azoty S.A. (Compo Expert)

- 6.4.5 Haifa Group

- 6.4.6 ICL Group Ltd

- 6.4.7 Indian Farmers Fertiliser Cooperative Limited

- 6.4.8 Mangalore Chemicals & Fertilizers Ltd.

- 6.4.9 Sociedad Quimica y Minera de Chile SA

- 6.4.10 Yara International ASA

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms