|

市場調查報告書

商品編碼

1693426

矽膠密封膠:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Silicone Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

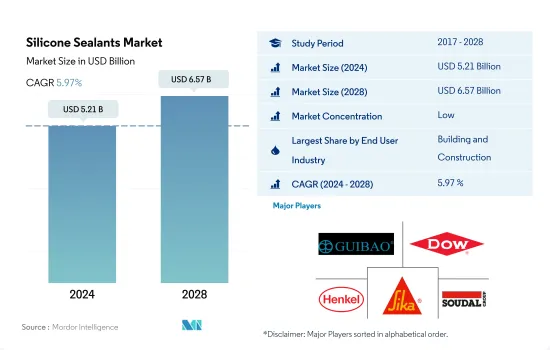

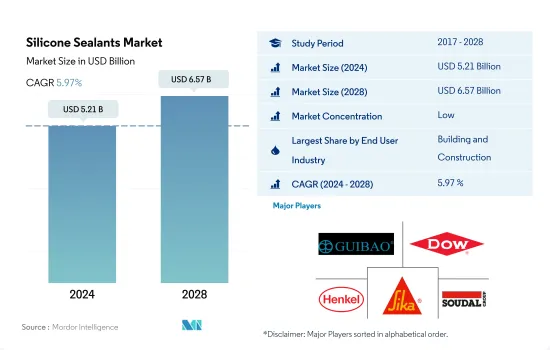

預計 2024 年矽膠密封膠市場規模為 52.1 億美元,到 2028 年將達到 65.7 億美元,預測期內(2024-2028 年)的複合年成長率為 5.97%。

建築和汽車終端使用行業的成長預計將推動全球矽膠密封膠的消費

- 矽膠密封膠在 40 華氏度至 140 華氏度之間的溫度下固化,僅乾燥,並且由於其獨特的性能(例如對多孔表面的良好粘附性)而成為最常用的類型。

- 矽膠密封膠因其防水、防風雨和裂縫密封等用途而被廣泛應用於建築業。預計到 2030 年,全球建築業將以每年 3.5% 的速度成長。中國、印度、美國和印尼預計將佔全球建築業的 58% 左右。

- 矽膠密封膠廣泛應用於汽車產業,因為它們可以應用於玻璃、金屬、塑膠和油漆表面。其特性包括極強的耐候性、耐用性和長壽命,這些特性在汽車行業中都很有用。它也用於引擎和汽車墊圈。由於發展中國家的需求不斷成長,預計預測期內汽車產業的電動車領域將以 17.75% 的複合年成長率成長。預計這將在預測期內推動汽車矽膠密封膠的需求。

- 矽膠密封膠廣泛應用於電子、電氣設備的製造。用於密封感測器和電纜。預計全球電子和家用電子電器產業的複合年成長率分別為 2.51% 和 5.77%,這可能會在預測期內推動對矽膠密封膠的需求。

- 矽膠樹脂基密封劑用於醫療行業組裝和密封醫療設備組件。預計全球醫療保健投資的增加將導致預測期內需求增加。

中國建築業和歐洲汽車業不斷成長的需求可能會推動全球矽膠密封膠的銷售。

- 矽膠密封膠因其強大的密封性能而受到世界各地消費者的歡迎。這些密封劑用於建築、汽車和電子等 10 多個行業。矽膠密封膠主要用於建築業。預計2022年新建築占地面積(包括住宅和非住宅)將達到417億平方公尺,較2021年增加6.15%。因此,2022年矽膠密封膠的消費量與2021年相比成長了8.33%。

- 由於新冠疫情對美國、德國、中國、沙烏地阿拉伯等全球多個國家的影響,2020年矽膠密封膠的需求較2019年下降了9.09%。在此期間,許多國家的生產設施因封鎖而關閉,導致生產原料供應不正常。

- 受建築和汽車產業需求成長的推動,亞太地區的矽膠密封膠消費量最高。到2022年,預計全球建築投資總額的45%左右將來自該地區。中國擁有世界上最大的建築業,預計 2022 年至 2030 年的複合年成長率為 8.6%。在日本,2021 年住宅總數為 856,480 套,比 2020 年增加 4.8%。預計亞太地區建築業的這種成長將在預測期內推動對矽膠密封膠的需求。

- 矽膠密封膠在歐洲也廣泛使用。預計汽車產量將從 2021 年的 1,630 萬輛增至 2027 年的 1,920 萬輛。這些發展預計將在預測期內推動對矽膠密封膠的需求。

全球矽膠密封膠市場趨勢

住宅基礎建設推動建築業發展

- 建築業呈現穩定成長,2017 年至 2019 年的複合年成長率為 2.6%。這一成長受到全球經濟活動好轉和獨棟住宅需求成長的推動。 2020年,新冠疫情對全球建築業產生了重大影響。勞動力供應限制、建築融資和供應鏈中斷以及經濟不確定性對全球 AEC 產業產生了負面影響。

- 雖然2021年呈現正成長,但疫情對供應鏈的衝擊導致原物料價格上漲,仍在困擾產業。不過,由於建築業對一個國家的經濟影響重大,北美和亞太國家都透過提供支持計畫來重新啟動經濟週期。支持計劃包括澳大利亞的HomeBuilder計劃和歐盟國家的經濟復甦計劃。

- 亞太地區的建設活動,預計到 2028 年仍將是最大的建築市場,這得益於其龐大的人口、不斷加快的都市化以及中國、印度、日本、印尼和韓國等國家對基礎設施建設的投資不斷增加。

- 預計在預測期內,對綠色建築的日益重視和減少全球建設活動排放的努力將帶來更永續的營運程序。例如,法國已累計75億歐元用於建築業轉型為低碳能源經濟的。

政府推行的電動車優惠政策將推動汽車產業

- 自2021年起,全球汽車產業預計將穩定成長,但成長速度將有所放緩。預計預測期內全球汽車產業將以每年 2% 的速度成長,總收益增加價值將達到 1.5 兆美元。

- 2020年,受新冠疫情影響,汽車銷量下滑,但2021年卻迅速回升。汽車市場通常對GDP貢獻巨大,因此世界各國政府紛紛推出措施支持經濟。汽車銷量從2019年的9000萬輛下降到2020年的7800萬輛。

- 由於電動車能源成本低廉、環保且移動性能高效,其在全球範圍內的普及對全球汽車市場的總收益做出了重大貢獻。各種政府政策和標準也在推動電動車產量的成長。例如,歐盟二氧化碳排放標準在2021年增加了對電動車的需求。根據國際能源總署的永續發展情景,到2030年將需要2.3億輛電動車取代燃油汽車。 2021年,最大的電動車製造商特斯拉的電動車產量增加了157%。預計在預測期(2022-2028 年),消費者對電動車的偏好將進一步成長。

矽膠密封膠產業概況

矽膠密封膠市場分散,前五大公司佔29.40%的市佔率。該市場的主要企業包括成都矽寶科技、陶氏化學、漢高股份公司、西卡股份公司、Soudal Holding NV 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 法律規範

- 阿根廷

- 澳洲

- 巴西

- 加拿大

- 中國

- EU

- 印度

- 印尼

- 日本

- 馬來西亞

- 墨西哥

- 俄羅斯

- 沙烏地阿拉伯

- 新加坡

- 南非

- 韓國

- 泰國

- 美國

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 醫療保健

- 其他

- 地區

- 亞太地區

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 新加坡

- 韓國

- 泰國

- 其他亞太地區

- 歐洲

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 英國

- 其他歐洲國家

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地區

- 亞太地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- Arkema Group

- Chengdu Guibao Science and Technology Co., Ltd.

- Dow

- Guangzhou Jointas Chemical Co.,Ltd.

- HB Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- MAPEI SpA

- Momentive

- RPM International Inc.

- Shin-Etsu Chemical Co., Ltd.

- Sika AG

- Soudal Holding NV

- Wacker Chemie AG

第7章 CEO 的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、限制因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 92485

The Silicone Sealants Market size is estimated at 5.21 billion USD in 2024, and is expected to reach 6.57 billion USD by 2028, growing at a CAGR of 5.97% during the forecast period (2024-2028).

Emerging construction and automotive end-use sector expected to boost the consumption of silicone sealants, globally

- Silicone sealants are the most used type because of their unique properties, such as curing between temperatures of 40 degrees F to 140 degrees F, with drying only, good adhesion to porous surfaces, etc.

- Silicone sealants are widely used in the construction industry because of their applications, such as waterproofing, weather sealing, and crack sealing. The global construction industry is expected to grow at 3.5% per annum up to 2030. China, India, the United States, and Indonesia are expected to account for about 58% of global construction.

- Silicone sealants are widely used in the automotive industry because they apply to glass, metal, plastic, and painted surfaces. Their features are helpful in the automotive industry, such as extreme weather resistance, durability, and long-lasting. They are used in engines and car gaskets. The electric vehicles segment of the automotive industry is expected to record a 17.75% CAGR during the forecast period because of the increase in demand for the same in growing economies. This is expected to boost demand for automotive silicone sealants in the forecast period.

- Silicone sealants are widely used in electronics and electrical equipment manufacturing. They are used for sealing sensors and cables. The electronics and household appliances industries are expected to grow at a CAGR of 2.51% and 5.77%, respectively, globally, which may drive the demand for silicone sealants during the forecast period.

- Silicone resin-based sealants are used in the healthcare industry for assembling and sealing medical device parts. The increase in healthcare investments worldwide is expected to lead to a rise in demand during the forecast period.

Inflating demand from China's construction sector and Europe's automotive industry likely to drive the global sales of silicone sealants

- Silicone sealants are consumed across the globe due to their strong sealing properties. These sealants are used in more than ten industries, including building and construction, automotive, and electronics. Silicone sealants are consumed mainly in the building and construction industry. The new floor area, including residential and non-residential buildings, was expected to reach 41.7 billion square footage in 2022, 6.15% more than in 2021. As a result, the consumption of silicone sealants witnessed a growth of 8.33% in 2022 compared to 2021.

- The demand for silicone sealants fell by 9.09% in 2020 compared to 2019 due to the COVID-19 pandemic's impact on many countries worldwide, including the United States, Germany, China, and Saudi Arabia. Production facilities were shut down during the period owing to lockdowns in many countries, which resulted in an irregular supply of raw materials for production.

- Asia-Pacific accounts for the highest silicone sealants consumption due to the rising building and construction and automotive industries. About 45% of the total construction investment in the world was set to come from this region in 2022. China is the world's largest construction industry, and it is expected to record a CAGR of 8.6% during the period 2022-2030. In Japan, the number of housing construction starts in 2021 were 856.48 thousand units, 4.8% more than in 2020. Such growth in the Asia-Pacific construction industry is expected to drive demand for silicone sealants over the forecast period.

- Silicone sealants are also widely consumed in Europe. Automotive production is expected to reach 19.2 million units by 2027 from 16.3 million units in 2021. These developments are expected to boost the demand for silicone sealants over the forecast period.

Global Silicone Sealants Market Trends

Growing residential and infrastructural development to thrive the construction sector

- The building and construction industry witnessed steady growth, with a CAGR of 2.6% from 2017 to 2019. This growth was driven by the upswing in global economic activity and increasing demand for single-family homes. In 2020, the COVID-19 pandemic had a major impact on the global building and construction industry. Constraints in labor supply, disruptions in construction finances and the supply chain, and economic uncertainty negatively impacted the global building and construction industry.

- Though the industry showed positive growth in 2021, the pandemic's effect on supply chains, which resulted in a hike in raw material prices, is still plaguing the industry. However, as the construction industry heavily influences a nation's economy, countries in Europe, North America, and Asia-Pacific have used the construction industry to restart their economic cycles by offering support schemes. Some support schemes include the Homebuilder Programme in Australia and the economic recovery plan of EU countries.

- The Asia-Pacific region experiences the highest volume of construction activities, and it is expected to remain the largest construction market till 2028 due to its huge population, increasing urbanization, and increasing investments in infrastructural development in countries like China, India, Japan, Indonesia, and South Korea.

- Increasing emphasis on green buildings and efforts to reduce emissions from global construction activities are expected to result in more sustainable operational procedures during the forecast period. For example, France has sanctioned EUR 7.5 billion for the construction industry to transform itself into a low-carbon energy economy.

Favorable government policies to promote electric vehicles will propel automotive industry

- Since 2021, the global automotive industry has been expected to grow steadily but at a slower pace because of the decline in consumers' preferences for individual ownership of passenger vehicles and their increased preference for shared mobility in transportation. The global automotive industry is expected to experience a growth rate of 2% annually, with an expected value addition of USD 1.5 trillion in total revenue during the forecast period.

- In 2020, due to the impact of the COVID-19 pandemic, vehicle sales declined but recovered rapidly in 2021 because the governments of various countries took measures to support their economies, as automotive markets usually contribute majorly to their GDP. Vehicle sales declined from 90 million units of passenger vehicles in 2019 to 78 million units in 2020.

- The introduction of electric vehicles worldwide has contributed significantly to the overall revenue of the global automotive market because of their cheaper energy costs, environmentally benign nature, and efficient mobility features. Various government policies and standards also work as driving factors to increase EV production. For instance, the EU standards for CO2 emissions increased the demand for electric vehicles in 2021. As per the IEA's Sustainable Scenario, 230 million electric vehicles are required to replace combustion fuel-based vehicles by 2030. In 2021, Tesla, the largest EV manufacturer, recorded a rise of 157% in the number of electric vehicles manufactured. This growing trend of consumers preferring electric vehicles is expected to rise further during the forecast period (2022-2028).

Silicone Sealants Industry Overview

The Silicone Sealants Market is fragmented, with the top five companies occupying 29.40%. The major players in this market are Chengdu Guibao Science and Technology Co., Ltd., Dow, Henkel AG & Co. KGaA, Sika AG and Soudal Holding N.V. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 Argentina

- 4.2.2 Australia

- 4.2.3 Brazil

- 4.2.4 Canada

- 4.2.5 China

- 4.2.6 EU

- 4.2.7 India

- 4.2.8 Indonesia

- 4.2.9 Japan

- 4.2.10 Malaysia

- 4.2.11 Mexico

- 4.2.12 Russia

- 4.2.13 Saudi Arabia

- 4.2.14 Singapore

- 4.2.15 South Africa

- 4.2.16 South Korea

- 4.2.17 Thailand

- 4.2.18 United States

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Healthcare

- 5.1.5 Other End-user Industries

- 5.2 Region

- 5.2.1 Asia-Pacific

- 5.2.1.1 Australia

- 5.2.1.2 China

- 5.2.1.3 India

- 5.2.1.4 Indonesia

- 5.2.1.5 Japan

- 5.2.1.6 Malaysia

- 5.2.1.7 Singapore

- 5.2.1.8 South Korea

- 5.2.1.9 Thailand

- 5.2.1.10 Rest of Asia-Pacific

- 5.2.2 Europe

- 5.2.2.1 France

- 5.2.2.2 Germany

- 5.2.2.3 Italy

- 5.2.2.4 Russia

- 5.2.2.5 Spain

- 5.2.2.6 United Kingdom

- 5.2.2.7 Rest of Europe

- 5.2.3 Middle East & Africa

- 5.2.3.1 Saudi Arabia

- 5.2.3.2 South Africa

- 5.2.3.3 Rest of Middle East & Africa

- 5.2.4 North America

- 5.2.4.1 Canada

- 5.2.4.2 Mexico

- 5.2.4.3 United States

- 5.2.4.4 Rest of North America

- 5.2.5 South America

- 5.2.5.1 Argentina

- 5.2.5.2 Brazil

- 5.2.5.3 Rest of South America

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Chengdu Guibao Science and Technology Co., Ltd.

- 6.4.4 Dow

- 6.4.5 Guangzhou Jointas Chemical Co.,Ltd.

- 6.4.6 H.B. Fuller Company

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 Illinois Tool Works Inc.

- 6.4.9 MAPEI S.p.A.

- 6.4.10 Momentive

- 6.4.11 RPM International Inc.

- 6.4.12 Shin-Etsu Chemical Co., Ltd.

- 6.4.13 Sika AG

- 6.4.14 Soudal Holding N.V.

- 6.4.15 Wacker Chemie AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219