|

市場調查報告書

商品編碼

1693423

歐洲丙烯酸黏合劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Europe Acrylic Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

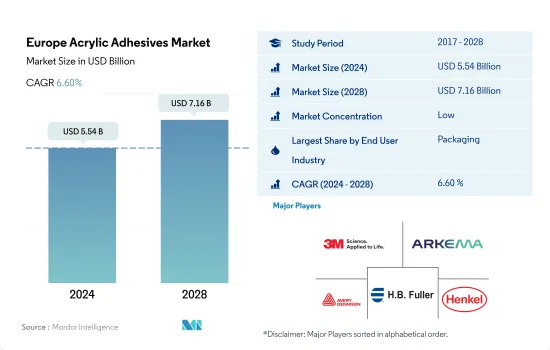

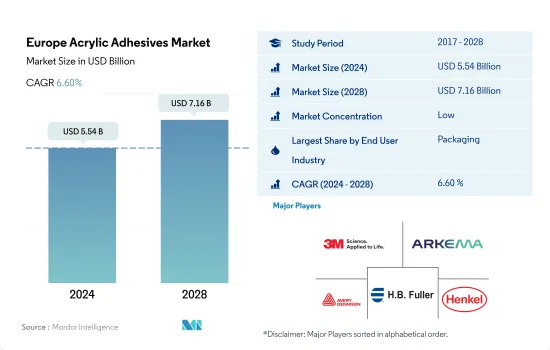

預計 2024 年歐洲丙烯酸黏合劑市場規模為 55.4 億美元,到 2028 年將達到 71.6 億美元,預測期內(2024-2028 年)的複合年成長率為 6.60%。

材料技術的進步推動丙烯酸黏合劑的成長

- 丙烯酸黏合劑因其防水、防風雨、裂縫密封和黏合等用途而被廣泛應用於建設產業。歐洲建築業的銷售額經歷了巨大的成長,2021與前一年同期比較率與 2020 年相比最高。這得歸功於歐盟委員會的舉措和措施,例如根據其名為「下一代歐盟」的新冠疫情復甦計畫向所有產業注資 7,500 億歐元。建築業在該計劃中獲得的投資最多,因為歐洲對建築的綠色化和數位化目標導致現有建築和結構的年度維修增加。 2021 年,歐洲建築膠合劑市場約佔全球市場的 26%。

- 丙烯酸黏合劑也廣泛應用於整個汽車行業,因為它們易於在玻璃、金屬、塑膠和塗漆表面等表面上使用,並且具有極強的耐候性、耐用性和長壽命,這些特性在汽車行業都很有用。這些用於引擎和汽車墊圈。最近提案的法規(Fit for 55)設定了目標,到 2030 年將汽車的二氧化碳排放減少 55% ,將貨車的二氧化碳排放量減少 50%(歐盟,2021 年)。 (歐盟,2021 年)。它還提案在 2035 年徹底消除汽車和貨車的排放。預計這些因素將在預測期內增加對汽車黏合劑的需求。

- 丙烯酸黏合劑用於醫療保健產業,例如組裝醫療設備零件等應用。預計 2022 年至 2028 年預測期內,歐洲各地醫療保健投資的增加將推動需求。

歐洲主要國家工業成長支撐丙烯酸膠黏劑需求

- 2017年至2021年,歐洲的需求量位居全球第二。由於汽車、航太、建築和其他終端用戶行業的高製造能力,該地區對丙烯酸黏合劑的需求佔有率一直佔全球需求的30-31%。反應性、水基性和溶劑型丙烯酸黏合劑佔據了該地區的大部分需求。

- 2017年至2019年期間,該地區對黏合劑的需求複合年成長率為2.14%。丙烯酸黏合劑需求放緩是由於該地區汽車產量下降,尤其是柴油車產量下降。在此期間,這些終端用戶產業的需求量以 0.08% 的複合年成長率下降。

- 2020年,營運、勞動力、原料、供應鏈和其他領域的限制導致全部區域所有終端用戶產業的需求減少。在該地區所有國家的所有行業中,德國和法國的汽車產業受到的打擊最為嚴重,與前一年同期比較較去年同期分別下降22.96%和35.60%。

- 預計該地區所有國家對丙烯酸黏合劑的需求將於 2021 年開始復甦,並在 2022 年超過疫情前的需求水準。義大利的銷量增幅最高,與前一年同期比較去年同期成長 8.85%。預計這一成長趨勢將持續到 2022 年至 2028 年。預計在 2022-2028 年預測期內,歐洲對丙烯酸黏合劑的需求將達到 3.80% 的複合年成長率。

歐洲丙烯酸黏合劑市場趨勢

歐洲食品飲料產業蓬勃發展,帶動包裝產業擴張

- 包裝是歐洲地區的關鍵產業之一。該地區是繼亞太地區之後全球第二大包裝產品生產地區,約佔全球包裝產量的24%。德國、俄羅斯、西班牙和英國是歐洲主要的包裝產品生產國。受新冠疫情影響,預計2020年包裝產量較2019年下降7.14%。今年,多個國家實施了全國封鎖,導致該地區的生產設施關閉了三到四個月。

- 俄羅斯是包裝產品主要生產國,2021年產量為2.138億噸,位居歐洲第一。近年來,俄羅斯包裝產業的發展很大程度上受到食品和飲料產業快速成長的推動。俄羅斯是全球主要食品出口國,進一步影響包裝銷售,以滿足一系列終端產業對複雜包裝的需求。

- 德國是歐洲領先的塑膠包裝生產國。 2021年塑膠包裝將佔包裝產量的約79%。塑膠包裝行業主要受到國內食品和飲料行業快速成長的推動。由於生活方式更加忙碌、消費能力增強及相關因素,該地區對快速和便攜包裝產品的需求正在增加。未來幾年,這一趨勢在歐洲包裝產品中將會成長。

新建築的激增和不斷成長的重建需求正在推動該行業的發展

- 受新冠疫情影響,2020年建設業整體收益大幅下降。

- 歐洲建築業的銷售額呈現驚人的成長勢頭,2021與前一年同期比較率與 2020 年相比最高。這得歸功於歐盟委員會的舉措和措施的成功,例如在名為「下一代歐盟」的新冠疫情復甦計劃下向所有行業注資 7500 億歐元。根據歐盟下一代計劃,建築業獲得了最大的投資,因為歐洲對建築的綠色化和數位化目標導致現有建築和結構的年度維修增加。

- 根據 EUROCONSTRUCT 報告,在基於歐盟政治區域的細分市場中,中歐和東歐預計將以 6.4% 的複合年成長率成長,其次是西歐,複合年成長率為 6.1%。

- 歐盟和國家層面的政策制定者正在透過各種政策(包括《建築能源性能指令》)優先考慮新建築和現有建築的能源效率。預計這些政策將在預測期內提高整體建築收益。

歐洲丙烯酸黏合劑產業概況

歐洲丙烯酸黏合劑市場分散,前五大公司佔17.87%的市場。市場的主要企業有:3M、阿科瑪集團、艾利丹尼森公司、HB Fuller 公司和漢高股份公司(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 鞋類和皮革

- 包裝

- 法律規範

- EU

- 俄羅斯

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 鞋類和皮革

- 衛生保健

- 包裝

- 其他最終用戶產業

- 科技

- 反應性

- 溶劑型

- 紫外線固化膠合劑

- 水性

- 國家

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 英國

- 其他歐洲國家

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- Arkema Group

- AVERY DENNISON CORPORATION

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- MAPEI SpA

- Sika AG

- Soudal Holding NV

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、限制因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 92482

The Europe Acrylic Adhesives Market size is estimated at 5.54 billion USD in 2024, and is expected to reach 7.16 billion USD by 2028, growing at a CAGR of 6.60% during the forecast period (2024-2028).

Advancement in material technology to augment the growth of acrylic adhesives

- Acrylic adhesives are widely used in the construction industry because of their applications, such as waterproofing, weather-sealing, cracks sealing, and bonding. The overall revenue of the construction sector in Europe grew tremendously, registering the highest Y-o-Y growth in 2021 compared to 2020 because of the initiatives and measures taken by the EU Commission, such as the infusion of EUR 750 billion for all sectors under the COVID-19 pandemic recovery plan, named Next Generation EU. Under this plan, the construction sector received the highest investment because of the European objective of green and digital transition in buildings, which led to growth in the annual renovation rate of existing buildings and structures. The European construction adhesives segment accounted for about 26% of the global market in 2021.

- Acrylic adhesives are also widely used across the automotive industry because of their applicability to surfaces such as glass, metal, plastic, and painted surfaces, and their features are helpful in the automotive industry, such as extreme weather resistance, durability, and long-lasting. These are used in engines and car gaskets. The recently proposed regulation (Fit for 55) sets objectives of a 55% reduction in CO2 emissions from vehicles and a 50% reduction in CO2 emissions from vans by 2030. (EU, 2021). It also suggests that by 2035, all emissions from vehicles and vans be eliminated. These factors are expected to increase demand for automotive adhesives in the forecast period.

- Acrylic adhesives are used in the healthcare industry for applications such as assembling medical device parts. The increase in healthcare investments across Europe is expected to lead to a rise in their demand in the forecast period 2022-2028.

Europe's Acrylic adhesive demand aided by the growth of industries in major economies

- From 2017 to 2021, the demand generated from Europe ranked second globally. The share of the demand for acrylic adhesives from this region has consistently accounted for 30-31% of the global demand because of the high manufacturing capacity of the automotive, aerospace, building and construction, and other end-user industries in the region. Acrylic adhesives with reactive, water-borne, and solvent-borne technologies generate most of the demand in the region.

- From 2017 to 2019, the demand for adhesives from this region recorded a CAGR of 2.14%. The slow growth in the demand for acrylic adhesives was due to a decline in automotive production, especially the diesel vehicles segment in the region. The demand from these end-user industries declined with a CAGR of 0.08% in volume terms during this period.

- In 2020, the demand from all end-user industries across the region declined due to constraints in operations, labor, raw material, supply chain, and other areas. Among all industries from all the countries in the region, the automotive industry in Germany and France took the worst hit, declining by 22.96% and 35.60%, respectively, in y-o-y volume terms.

- In 2021, the demand for acrylic adhesives started to recover from all countries in the region and was expected to outgrow pre-pandemic demand volume by 2022. The demand from Italy witnessed the highest y-o-y growth of 8.85% in volume terms. This growth trend is expected to continue from 2022 to 2028. The demand for acrylic adhesives from Europe is expected to record a CAGR of 3.80% during the forecast period 2022-2028.

Europe Acrylic Adhesives Market Trends

Significant growth of food & beverage industry in Europe to escalate packaging industry

- Packaging is one of the major sectors of Europe region. The region is the second-largest producer of packaging products in the world, which holds about 24% of global packaging production after the Asia-Pacific region. Germany, Russia, Spain, and the United Kingdom are major producers of packaging products in Europe. It is seen that packaging production reduced by 7.14% in 2020 compared to 2019 due to the impact of the COVID-19 pandemic. During the year, a nationwide lockdown imposed by several countries halted the production facilities for three to four months in the region.

- Russia is a leading producer of packaging products producing 213.8 million tons in 2021, which is the highest in Europe. The Russian packaging industry has majorly been driven by the rapid growth of the food and beverages industry in recent years. Russia is a major exporter of food products worldwide, which further influences packaging sales to meet the need for sophisticated packaging across various-end use industries.

- Germany is the major producer of plastic packaging in Europe. Plastic packaging which nearly accounts for around 79% of the packaging produced in 2021. The plastic packaging industry is majorly driven by the rapid growth of the food and beverages industry in the country. With the rise in busier lifestyles, greater spending power, and related factors in the region, the demand for quick and on-the-go packaged products is increasing. This trend will rise in packaging products in the coming years in Europe.

Rapid growth of new construction along with rising need for renovation activities will drive the industry

- The overall revenue of construction showed a steep decrement in 2020 because of the impact of the pandemic situation due to COVID-19, which led to an overall recovery slowdown and social distancing measures on work sites.

- The overall revenue of the construction sector in Europe grew tremendously, with the highest year-on-year growth in 2021 compared to that of 2020 because of the initiatives and measures taken by the EU Commission, such as the infusion of EUR 750 billion for all sectors under the COVID recovery plan named Next Generation EU. Under the Next Generation EU plan, the construction sector received the maximum investment because of the European objective of green and digital transition in buildings which led to growth in the annual renovation rate of existing buildings and structures.

- As per the EUROCONSTRUCT report, among the segments of the European Union based on political geography, Central and Eastern Europe are expected to register a CAGR of 6.4%, followed by Western Europe at a CAGR of 6.1% in 2022-2024.

- The policymakers at European Union and national level are prioritizing the construction of new buildings and conversion of existing buildings to be energy efficient through various policies including Energy Performance of Buildings Directive and others. These policies will lead to an increase in overall revenue for construction in the forecast period.

Europe Acrylic Adhesives Industry Overview

The Europe Acrylic Adhesives Market is fragmented, with the top five companies occupying 17.87%. The major players in this market are 3M, Arkema Group, AVERY DENNISON CORPORATION, H.B. Fuller Company and Henkel AG & Co. KGaA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.2 Regulatory Framework

- 4.2.1 EU

- 4.2.2 Russia

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Technology

- 5.2.1 Reactive

- 5.2.2 Solvent-borne

- 5.2.3 UV Cured Adhesives

- 5.2.4 Water-borne

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Russia

- 5.3.5 Spain

- 5.3.6 United Kingdom

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 AVERY DENNISON CORPORATION

- 6.4.4 Dow

- 6.4.5 H.B. Fuller Company

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 Huntsman International LLC

- 6.4.8 MAPEI S.p.A.

- 6.4.9 Sika AG

- 6.4.10 Soudal Holding N.V.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219