|

市場調查報告書

商品編碼

1693372

日本黏合劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Japan Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

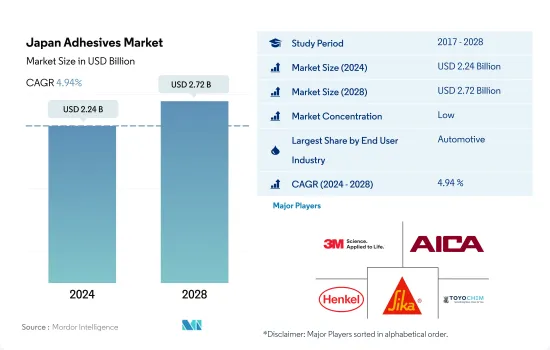

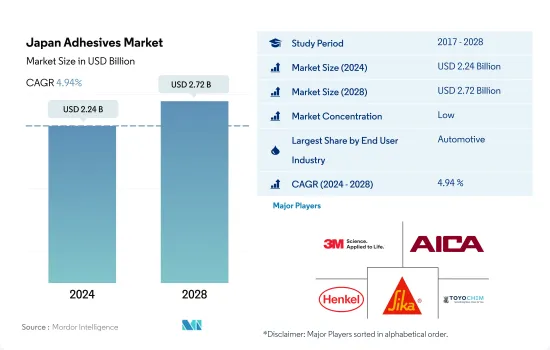

日本黏合劑市場規模預計在 2024 年將達到 22.4 億美元,預計到 2028 年將達到 27.2 億美元,預測期內(2024-2028 年)的複合年成長率為 4.94%。

新興汽車市場和建築業預計將推動日本的黏合劑消費。

- 在日本,黏合劑主要用於包裝、汽車、建築和醫療行業。受新冠疫情影響,2020年日本膠合劑消費量下降。 2020年的需求量與2019年相比下降了11%。持續約六個月的全國封鎖導致生產設施關閉和原料短缺,是日本黏合劑產量和消費量下降的主要原因。

- 日本的汽車產業是世界第三大產業,擁有遍佈22個縣的78家汽車製造商,僱用員工超過550萬人。它是日本經濟的重要支柱。汽車製造業佔日本最大工業部門(運輸機械)的89%,汽車零件製造業已成為日本經濟的重要組成部分,並擴展到化學、橡膠等其他產業。這是一家高度創新和技術驅動的企業,國內和全球市場上的電動和混合動力汽車產量不斷增加,全球範圍內的供需不斷增加。

- 對日本建築業的預測是多年來最好的。日本政府承諾透過多項公共工程項目來促進國內經濟發展。這項承諾是為了籌備 2020 年奧運會和 2025 年大阪世博會等重大活動而做出的。預計預測期內日本各地重點產業的成長將增加對黏合劑的需求。

日本黏合劑市場趨勢

先進的包裝以及食品飲料行業對塑膠可回收性的需求將使塑膠包裝在包裝行業中佔據主導地位

- 近年來,受保護和提高產品安全性和壽命的趨勢日益增強的推動,日本包裝行業經歷了顯著成長,為該國內生產總值) 貢獻了 1.13%。食品和飲料行業因其複雜且不斷發展的特性而佔據日本包裝行業的很大佔有率。日本政府已設定目標,到2025年實現45%的食品自給率,這可能會在未來幾年使包裝業受益。此外,老齡化社會預計將推動包裝需求,因為老年消費者更喜歡容易獲得的包裝和已調理食品。

- 由於新冠疫情,全國範圍內的封鎖和製造工廠的暫時關閉造成了一些問題,包括供應鏈和進出口中斷。因此,2020年全國包裝產量較去年與前一年同期比較6%,對市場造成較大衝擊。該國的包裝生產主要由塑膠包裝驅動,約佔 2021 年包裝產量的 86%。由於各種應用對軟包裝和硬包裝的需求不斷成長以及塑膠回收再利用的進步,塑膠生產領域可能會出現最快的成長,預測期內的複合年成長率為 3.94%。

- 日本包裝產業的成長主要得益於人均收入的提高、供應鏈的改善以及電子商務活動的增加。疫情過後,全國對食品安全和品質的關注度不斷提高,這可能會推動未來幾年食品加工產業和燃料包裝需求的成長。

除了是豐田、本田和日產等知名汽車製造商的所在地之外,對電動車的需求也推動了汽車產業的發展。

- 日本是豐田、本田、日產等世界最大汽車製造商的所在地,其中豐田是全球市值第二大公司。豐田截至2022年3月的會計年度銷量較上年同期成長15%,顯示日本汽車市場呈現成長趨勢。預計到2027年日本乘用車銷量將達到3,951,710輛。

- 受新冠疫情影響,全國的封鎖、整體經濟放緩、出口下降以及供應鏈中斷,導致汽車銷售大幅下降。受這些因素影響,乘用車銷量從2019年的399.7萬輛下降至2020年的384.1萬輛,導致2020年汽車銷量下滑。

- 在日本,由於人們環保意識的增強以及日本都市區公共運輸使用量的增加,2021 年汽車市場銷售量與 2020 年相比有所下降。政府也透過提高公共運輸的效率來支持這項事業。鐵路佔日本公共運輸的近72%。

- 2017年,受吸引消費者的新型插電式混合動力汽車的推出推動,日本的電動車銷售量達到頂峰。預計 2022 年至 2027 年期間汽車產業的電動車領域的複合年成長率將達到 24.39%。預計到2027年,日本的電動車銷量將達到165,500輛。這將為整個日本汽車產業帶來收益的成長。

日本黏合劑產業概況

日本膠合劑市場細分化,前五大企業佔25.89%的市場。該市場的主要企業包括 3M、Aica Kogyo、Henkel AG & Co. KGaA、Sika AG、TOYOCHEM 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 鞋類皮革

- 包裝

- 木製品和配件

- 法律規範

- 日本

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 鞋類和皮革

- 醫療保健

- 包裝

- 木製品和配件

- 其他

- 科技

- 熱熔膠

- 反應性

- 溶劑型

- 紫外線固化膠合劑

- 水性

- 樹脂

- 丙烯酸纖維

- 氰基丙烯酸酯

- 環氧樹脂

- 聚氨酯

- 矽膠

- VAE,EVA

- 其他

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- Aica Kogyo Co..Ltd.

- Arkema Group

- CEMEDINE Co.,Ltd.

- HB Fuller Company

- Henkel AG & Co. KGaA

- Oshika

- Sika AG

- THE YOKOHAMA RUBBER CO., LTD.

- TOYOCHEM CO., LTD.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、限制因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 92427

The Japan Adhesives Market size is estimated at 2.24 billion USD in 2024, and is expected to reach 2.72 billion USD by 2028, growing at a CAGR of 4.94% during the forecast period (2024-2028).

Emerging automotive market and building & construction industry expected to boost the consumption of adhesives in Japan

- In Japan, adhesives are largely used across the packaging, automotive, building and construction, and healthcare industries. The consumption of adhesives in Japan declined in 2020 due to the impact of the COVID-19 pandemic. Demand fell by 11% in terms of volume in 2020 compared to 2019. The lockdown in the country for nearly six months, which resulted in the shutdown of production facilities and raw material shortage, is the major reason behind the decline in adhesives production and consumption in Japan.

- The Japanese automobile industry is the third-largest globally, with 78 manufacturers in 22 prefectures employing over 5.5 million people. It is a vital pillar of the country's economy. Automotive manufacturing accounts for 89% of Japan's largest industrial sector (the transportation machinery industry), and car components suppliers have become a significant part of the Japanese economy, expanding into other industries such as chemicals and rubber. It is a highly innovative and technologically oriented business, with rising production of electric and hybrid vehicles in local and worldwide markets, as well as a growth in supply and demand on a global scale.

- The prognosis for Japan's construction industries is better than it has been in years. The Japanese government has promised to boost the domestic economy with many public works projects. This commitment was prompted by its preparations for major events such as the 2020 Olympics and the 2025 World Expo in Osaka. The growing core industries across Japan are expected to increase the demand for adhesives over the forecast period.

Japan Adhesives Market Trends

With the advancement in plastic recyclability and demand from food and beverage industry, plastic packaging to lead the packaging industry

- The Japanese packaging industry registered significant growth in recent times and contributed 1.13% to the nation's GDP owing to the growing trend for protecting and enhancing products' safety and longevity. The food & beverages sector contributes a major share to the Japanese packaging industry due to its complex and evolving nature. The Japanese government has set a target of achieving 45% sufficiency of food products by 2025, likely contributing to the packaging industry over the coming years. Moreover, the aging population is expected to propel packaging demand as elderly consumers prefer packaged and prepared food for easy access.

- In line with the COVID-19 pandemic, the country-wide lockdowns and temporary shutdown of manufacturing facilities caused several issues, including disruptions to the supply chain and imports & exports. As a result, the country's packaging production declined by 6% in 2020 compared to the previous year, significantly affecting the market. Packaging production is majorly driven by plastic packaging in the country, which accounts for around 86% of the packaging produced in 2021. With the growing demand for flexible and rigid packaging for various applications and plastic recycling advancements, the plastic production segment is likely to register the fastest growth, with a 3.94% CAGR during the forecast period.

- The growth of the Japanese packaging industry is mainly attributed to the rising per capita income, improvement of the supply chain, and increasing e-commerce activities over the years. The growing attention to food safety and quality in post-pandemic times across the nation is likely to drive the food processing industry, which will further propel the packaging demand over the coming years.

In addition to being home to renowned automotive manufacturers including Toyota, Honda, and Nissan, the demand for EVs is rising the automotive industry

- Japan is home to the world's largest automotive companies, such as Toyota, Honda, and Nissan, of which Toyota is the world's second-largest company in terms of market capitalization. Toyota's sales revenue showed a 15% Y-o-Y growth in the fiscal year ending March 2022, suggesting an increasing trend of automotive market growth in Japan. Passenger vehicle sales in Japan are expected to reach 3951.71 thousand units by 2027.

- Due to the impact of the COVID-19 pandemic, the sales of automobiles reduced drastically because of nationwide lockdowns, overall economic slowdown, decreased exports, supply chain disruptions, etc. These factors led to a decrease in the sales volume of automobiles in 2020 as passenger car sales fell from 3997 thousand in 2019 to 3841 thousand in 2020.

- Japan witnessed a decrease in automotive market revenue in 2021 compared to 2020 because of the increasing awareness of environmental concerns and increased use of public transport in the cities of Japan. The government is also supporting the cause by making public transport more efficient than before. The railways cover nearly 72% of the public transportation system in Japan.

- Japan witnessed peak sales of electric vehicles in 2017 because of the launch of new plug-in hybrid vehicles, which appealed to consumers. The electric vehicles segment of the automotive industry is expected to record a CAGR of 24.39% in 2022-2027. The number of electric vehicles sold in Japan is expected to be 165.5 thousand by 2027. This will lead to an increase in the overall revenue of the automotive industry in Japan.

Japan Adhesives Industry Overview

The Japan Adhesives Market is fragmented, with the top five companies occupying 25.89%. The major players in this market are 3M, Aica Kogyo Co..Ltd., Henkel AG & Co. KGaA, Sika AG and TOYOCHEM CO., LTD. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.1.6 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 Japan

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Woodworking and Joinery

- 5.1.8 Other End-user Industries

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured Adhesives

- 5.2.5 Water-borne

- 5.3 Resin

- 5.3.1 Acrylic

- 5.3.2 Cyanoacrylate

- 5.3.3 Epoxy

- 5.3.4 Polyurethane

- 5.3.5 Silicone

- 5.3.6 VAE/EVA

- 5.3.7 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Aica Kogyo Co..Ltd.

- 6.4.3 Arkema Group

- 6.4.4 CEMEDINE Co.,Ltd.

- 6.4.5 H.B. Fuller Company

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 Oshika

- 6.4.8 Sika AG

- 6.4.9 THE YOKOHAMA RUBBER CO., LTD.

- 6.4.10 TOYOCHEM CO., LTD.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219