|

市場調查報告書

商品編碼

1692585

中東和非洲汽車黏合劑和密封劑市場佔有率分析、行業趨勢、統計數據和預測(2025-2030 年)Middle East & Africa Automotive Adhesives & Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

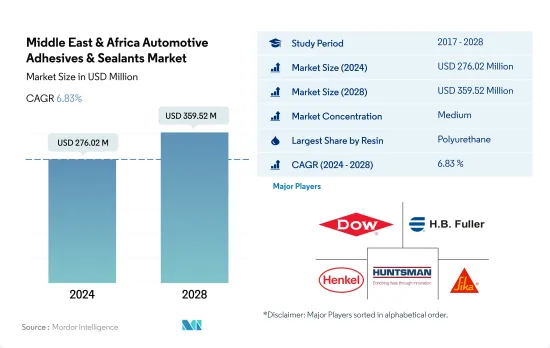

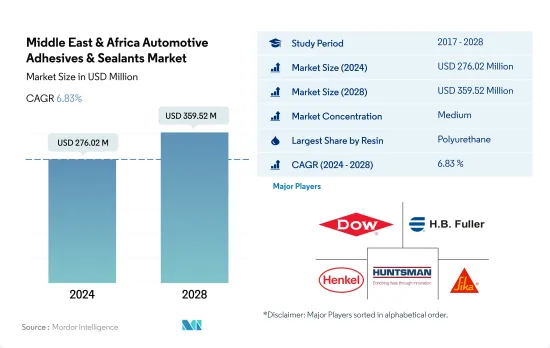

預計 2024 年中東和非洲汽車黏合劑和密封劑市場規模將達到 2.7602 億美元,預計到 2028 年將達到 3.5952 億美元,預測期內(2024-2028 年)的複合年成長率為 6.83%。

該地區對電動車的採用和需求將推動市場成長

- 中東和非洲汽車工業的成長導致對汽車黏合劑和密封劑的需求增加。南非等非洲主要國家的汽車產量正在上升,佔2020年全球汽車產量的0.58%,並且由於電動車的採用和需求,預計在2022-2028年的預測期內將大幅成長。預計這一趨勢將在 2022-2028 年預測期內推動汽車製造所需的黏合劑和密封劑的需求。

- 2020 年新冠疫情導致經濟放緩和價值鏈中斷,嚴重影響了中東和北非地區的汽車產業。不過,沙烏地阿拉伯降低15%的進口關稅、中東國家降低燃油價格等政府支持措施,帶動汽車需求快速復甦,提振了2021年汽車膠合劑和密封劑的需求。

- 汽車工業主要使用的樹脂是環氧樹脂、聚氨酯和丙烯酸基樹脂,因為它們與構成汽車整個結構的各種基材(如陶瓷、塑膠、玻璃、金屬和複合材料)具有廣泛的兼容性。聚氨酯樹脂在汽車製造中用作聚氨酯反應性(PUR)黏合劑。

- VAE/EVA黏合劑是中東和非洲汽車產業發展最快的技術。由於熱熔膠的市場需求逐漸超過溶劑型膠合劑,預計預測期內(2022-2028 年)這些膠合劑的複合年成長率將達到 8.24%。

汽車產業取代笨重金屬框架的技術發展正在推動市場成長

- 現代和中東和非洲的其他主要汽車製造商正在努力減輕汽車重量,以提高燃油效率並降低成本。為了實現這一目標,汽車黏合劑和密封劑被用來代替笨重的金屬框架和連接部件,如焊接接頭、螺絲和螺栓。預計這些技術發展將在 2022 年至 2028 年期間推動對汽車黏合劑和密封劑的需求。

- 2020年汽車黏合劑和密封劑收益和需求的急劇下降是由於COVID-19疫情的影響,導致整體經濟放緩和價值鏈中斷。 2020年,非洲乘用車銷量從2019年的85萬輛下降至65萬輛。 2021年的復甦得益於政府推出的支持汽車產業的措施,因為汽車產業佔非洲GDP的很大一部分。

- 市場規模由該地區的人均收入和人口決定。因此,從人口結構來看,全球超過75%的人口居住在撒哈拉以南非洲、北非和其他中東國家,而且該地區的汽車數量高於其他任何地區。汽車的數量與製造汽車所需的汽車黏合劑和密封劑成正比。

- 南非是該地區最大的汽車製造國,佔全球汽車產量的0.58%,佔有近五分之一的市場佔有率。

中東和非洲汽車膠合劑和密封劑市場趨勢

較低的利率和燃料成本將促進行業成長

- 乘用車在一個地區汽車市場的佔有率是衡量該地區人均收入的一個指標。由於該地區的經濟衰退,2017 年至 2019 年期間汽車產業收益下降。然而,2021年疫情過後,市場迎來了巨大的成長潛力。在中東和非洲,日本汽車製造商豐田是乘用車的最大暢銷品牌,市場佔有率為 10.2%。預計中東和非洲的汽車產業在 2022-2028 年預測期內將實現成長,但速度將適中。

- 阿拉伯聯合大公國、伊朗、沙烏地阿拉伯、科威特、卡達和巴林等中東石油資源豐富的國家有望成為豪華汽車的生產中心。沙烏地阿拉伯是中東地區汽車銷量最高的國家,2019年銷量為7,257.2萬輛。 2018年汽車進口量較2017年下降18.4%。

- 新冠疫情主要影響了非洲地區的汽車產業。作為該地區最大的市場擁有者,豐田的乘用車銷量從 2019 年的 90 萬輛下降到 2020 年的 62 萬輛。這導致該地區整體汽車市場的收益下降。然而,中東地區政府採取的降低汽車利率和燃油價格等措施預計將在 2022-2028 年預測期內推動汽車產業的成長。

中東和非洲汽車膠合劑和密封劑產業概況

中東和非洲汽車黏合劑和密封劑市場適度整合,前五大公司佔據47.51%的市場佔有率。市場的主要企業有:陶氏化學、富勒公司、漢高股份公司、亨斯邁國際有限責任公司和西卡股份公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 車

- 法律規範

- 沙烏地阿拉伯

- 南非

- 價值鍊和通路分析

第5章市場區隔

- 樹脂

- 丙烯酸纖維

- 氰基丙烯酸酯

- 環氧樹脂

- 聚氨酯

- 矽膠

- VAE,EVA

- 其他

- 科技

- 熱熔膠

- 反應性

- 密封劑

- 溶劑型

- 紫外線固化膠合劑

- 水性

- 國家

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- Arkema Group

- AVERY DENNISON CORPORATION

- DELO Industrie Klebstoffe GmbH & Co. KGaA

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- PPG Industries, Inc.

- Sika AG

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、限制因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 92422

The Middle East & Africa Automotive Adhesives & Sealants Market size is estimated at 276.02 million USD in 2024, and is expected to reach 359.52 million USD by 2028, growing at a CAGR of 6.83% during the forecast period (2024-2028).

Introduction and demand for electric vehicles in the region to create upswings for market growth

- The growth in the Middle East & African automotive industry has led to the growth of demand for automotive adhesives and sealants. There was an increase in automobile production in major countries of Africa, such as South Africa, which accounted for 0.58% of global vehicle production in 2020 and is expected to grow significantly because of the introduction and demand for electric vehicles in the forecast period 2022-2028. This trend is expected to boost the demand for adhesives and sealants required for automobile manufacture over the forecast period 2022-2028.

- The COVID-19 pandemic in 2020 severely affected the automotive industry in the Middle East and Africa because of economic slowdowns and value chain disruptions. However, government support in the form of policies such as a 15% reduction in import duties in Saudi Arabia and lower fuel prices in Middle East countries led to a rapid recovery in demand for automobiles, which increased the demand for automotive adhesives and sealants in 2021.

- The majorly used resins in the automotive industry are epoxy-based, polyurethane-based, and acrylic-based because of their wide compatibility with different substrates such as ceramics, plastics, glass, metals, and composites, which comprise the overall structure of an automobile. Polyurethane resin is used as polyurethane reactive (PUR) adhesives in manufacturing automobiles.

- VAE/EVA adhesives are the fastest-growing technology in the Middle East & African automotive industry. It is expected that these adhesives will register a CAGR of 8.24% during the forecast period (2022-2028) due to the rising trend of hot-melt adhesives over solvent-borne adhesives.

Technological developments in automotive industry to replace bulky metallic frames to aid market growth

- The major automotive companies in the Middle East & Africa, such as Hyundai, are working on making the vehicles light in weight so as to improve fuel efficiency and as cost-cutting measures. To achieve this, automotive adhesives and sealants are used to replace bulkier metallic frames and joinery components such as welding joints, screws, and bolts. This technology development will lead to an increase in demand for automotive adhesives and sealants in mentioned period of 2022-2028.

- The abrupt reductions in revenue and demand for automotive adhesives and sealants in 2020 are due to the impact of the COVID-19 pandemic, which caused an overall economic slowdown and value chain disruptions. Passenger vehicle sales in Africa decreased from 850,000 vehicular units in 2019 to 650,000 vehicular units in 2020. This growth was recovered in 2021 because of government policies that were meant to support the automotive industry, as it covers the major portion of the GDP of a nation.

- The size of the market is determined by the per capita income and population of the region. So based on demographics, more than 75% is covered by countries in the sub-Sahara region, Northern Africa, and the rest of the Middle East countries, which is a larger number of vehicles in the region than that of the rest. The vehicle's count is directly proportional to the automotive adhesives and sealants required to manufacture the same.

- South Africa contains nearly one-fifth of the market share as it is the largest manufacturer of automobiles in the region, which comprise 0.58% of global automobile production.

Middle East & Africa Automotive Adhesives & Sealants Market Trends

Lower interest rates and fuel rates to aid the industry's growth

- The share of passenger vehicles in a regional automotive market is an indicator of the per capita income in the region. The revenue in the automotive industry declined from 2017 to 2019 owing to a recession in the region. However, post-pandemic, the market recorded tremendous growth potential in 2021. Japanese automobile manufacturer Toyota sold the maximum number of passenger vehicles in the Middle East & Africa, accounting for 10.2% of the market share. The Middle East & African automotive industry is expected to grow in the forecast period 2022-2028 but at a slower pace.

- The crude oil-rich countries in the Middle East, such as UAE, Iran, Saudi Arabia, Kuwait, Qatar, and Bahrain, are trying to become production hubs for luxury cars as currently, they are importing the majority of them from European and Asian automotive manufacturers at significantly higher costs. The sales of automobiles in the Middle East were the highest in Saudi Arabia, amounting to 72,572 thousand units of vehicles in 2019. Car imports dropped by 18.4% in 2018 compared to 2017.

- The COVID-19 pandemic impacted the automotive industry, majorly in the African region. Toyota, the largest market share holder in the region, registered a dip in sales of passenger vehicles from 900 thousand units in 2019 to 620 thousand units in 2020. This led to a decrease in the revenue of the whole automotive market in the region. However, government initiatives such as lower auto interest rates and cheaper fuel rates in the Middle East region are expected to lead to the growth of the automotive sector in the forecast period 2022-2028.

Middle East & Africa Automotive Adhesives & Sealants Industry Overview

The Middle East & Africa Automotive Adhesives & Sealants Market is moderately consolidated, with the top five companies occupying 47.51%. The major players in this market are Dow, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman International LLC and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Automotive

- 4.2 Regulatory Framework

- 4.2.1 Saudi Arabia

- 4.2.2 South Africa

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 Resin

- 5.1.1 Acrylic

- 5.1.2 Cyanoacrylate

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Silicone

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Sealants

- 5.2.4 Solvent-borne

- 5.2.5 UV Cured Adhesives

- 5.2.6 Water-borne

- 5.3 Country

- 5.3.1 Saudi Arabia

- 5.3.2 South Africa

- 5.3.3 Rest of Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 AVERY DENNISON CORPORATION

- 6.4.4 DELO Industrie Klebstoffe GmbH & Co. KGaA

- 6.4.5 Dow

- 6.4.6 H.B. Fuller Company

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 Huntsman International LLC

- 6.4.9 PPG Industries, Inc.

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219