|

市場調查報告書

商品編碼

1692582

亞太地區汽車黏合劑和密封劑:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Asia-Pacific Automotive Adhesives & Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

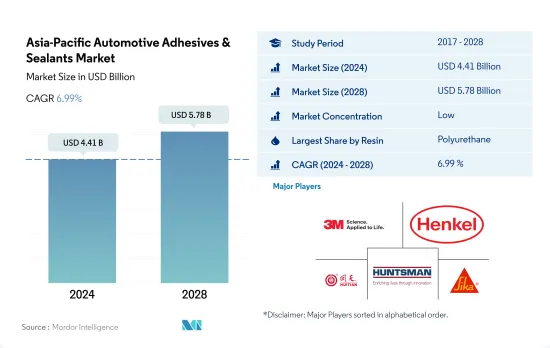

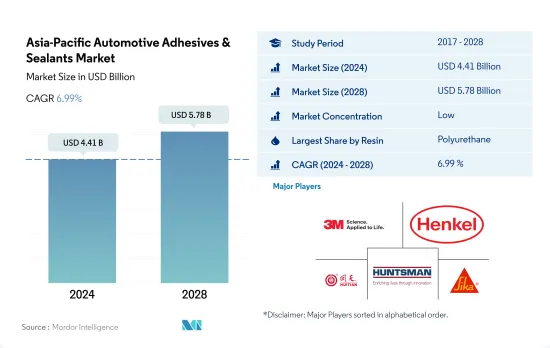

預計 2024 年亞太地區汽車黏合劑和密封劑市場規模將達到 44.1 億美元,預計到 2028 年將達到 57.8 億美元,預測期內(2024-2028 年)的複合年成長率為 6.99%。

汽車產業採用永續性概念和增加電動車產量將推動市場需求

- 聚氨酯樹脂佔據亞太地區汽車黏合劑和密封劑市場的最大佔有率。由於聚氨酯接著劑在北美擁有眾多生產設施,其使用範圍高於其他樹脂。 2017年至2019年,受汽車產量下降影響,消費成長下降約-5%。新冠疫情之後,消費成長率與前一年同期比較%。預計聚氨酯接著劑在 2022-2028 年預測期內的複合年成長率將達到 4.5%。

- 環氧膠黏劑和丙烯酸膠黏劑在亞太汽車膠黏劑市場也佔有重要地位。然而,用於製造環氧膠黏劑的原料本質上是危險的,因此受到 AICS、PICCS、IECSC 和 NZIoC 等地方政府機構的監管。環氧樹脂膠黏劑是第二大消費材料,預計在 2022-2028 年預測期內複合年成長率約為 4.2%。繼環氧膠黏劑領域之後,丙烯酸膠黏劑領域預計在 2022-2028 年預測期內以約 4.5% 的複合年成長率成長。

- 氰基丙烯酸酯和矽膠密封膠等黏合劑正在興起。汽車產業對永續性的採用已顯著增加,電動車的產量也顯著增加。因此,這些黏合劑在汽車電子組件中的使用越來越多,這可能會導致未來幾年需求的增加。就產量而言,預計在 2022-2028 年預測期內,氰基丙烯酸酯黏合劑和矽膠黏合劑的複合年成長率將分別超過 3.41% 和 4.05%。

中國作為領先的汽車製造商,主導市場主導地位

- 亞太地區是全球最大的汽車生產地區,中國、印度、日本等國家均名列全球主要汽車生產國。該地區的汽車產量預計將從 2021 年的 4,790 萬輛成長 2022 年的 5.9%。

- 2020年,中國、印度、馬來西亞、日本、印尼等多個國家都受到了新冠肺炎疫情的影響。由於生產設施關閉、國際邊境關閉以及多個國家原料短缺,汽車黏合劑和密封劑的消費量與 2019 年相比下降了近 13.3%。

- 亞太地區是黏合劑和密封劑生產不斷成長的地區,中國憑藉其高品質的國內生產設施成為最大的汽車黏合劑和密封劑生產國。中國有 100 多家黏合劑和密封劑製造商,其產品銷往世界各地。印度也是汽車生產大國,預計2022年汽車產量將比2021年增加6.5%,達610萬輛。

- 隨著許多國家實施推廣電動車的政策,該地區的電動車產量正在上升。中國和印度是電動車不斷成長的市場。預計這些因素將在預測期內推動汽車黏合劑和密封劑的需求。例如,2021年中國電動車產量將達到111萬輛,較2020年成長1.05%。

亞太汽車膠黏劑和密封劑市場趨勢

電動車的普及正在推動該產業

- 亞太地區汽車產業是市場主導產業之一,汽車銷量大幅成長。在所有國家中,中國是最大的汽車生產國,佔該地區汽車產量的57%左右,其次是日本(17%)、印度(10%)和韓國(8%)。

- 該地區的汽車銷售和產量均大幅下降,影響了黏合劑的使用。 2017- 與前一年同期比較變動為-1.8%,而2018-19年度則進一步下降-6.4%。 2019-20年度,受新冠疫情影響,該地區產量再次受到負面影響,較去年同期與前一年同期比較10.2%。由於製造工廠停工和供應鏈中斷,汽車零件短缺,生產水準受到限制。然而,預計汽車需求將在 2021 年再次增加並持續成長,從而導致預測期內全部區域的黏合劑使用量增加。

- 亞太電動車市場為黏合劑市場帶來了另一個成長機會。電動和混合動力汽車的產量和採用率的不斷提高,推動了汽車電子組裝中黏合劑的使用量。中國是世界上最大的電動車生產國,也是全部區域最大的電動車生產國。 2016年至2021年,商用電動車保有量從562,603輛成長至1,116,382輛,成長率約98%。預計這些因素將增加對黏合劑的需求,有助於預測期內的市場成長。

亞太地區汽車膠合劑和密封劑產業概況

亞太汽車黏合劑和密封劑市場分散,前五大公司佔據13.25%的市場佔有率。該市場的主要企業是:3M、漢高股份公司、湖北迴天新材料、亨斯邁國際有限責任公司和西卡股份公司(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 車

- 法律規範

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 新加坡

- 韓國

- 泰國

- 價值鍊和通路分析

第5章市場區隔

- 樹脂

- 丙烯酸纖維

- 氰基丙烯酸酯

- 環氧樹脂

- 聚氨酯

- 矽膠

- VAE,EVA

- 其他樹脂

- 科技

- 熱熔膠

- 反應性

- 密封劑

- 溶劑型

- 紫外線固化膠合劑

- 水性

- 國家

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 新加坡

- 韓國

- 泰國

- 其他亞太地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- Arkema Group

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- Hubei Huitian New Materials Co. Ltd

- Huntsman International LLC

- SHINSUNG PETROCHEMICAL

- Sika AG

- ThreeBond Holdings Co., Ltd.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、限制因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 92419

The Asia-Pacific Automotive Adhesives & Sealants Market size is estimated at 4.41 billion USD in 2024, and is expected to reach 5.78 billion USD by 2028, growing at a CAGR of 6.99% during the forecast period (2024-2028).

The adoption of sustainability in the automotive industry coupled with growing EV production to aid market demand

- Across the Asia-Pacific automotive adhesives and sealants market, polyurethane resins account for the largest share. The scope of polyurethane adhesive in North America is higher than other resins since the region includes many production facilities. From 2017 to 2019, the consumption growth rate declined by about -5% due to a reduction in automotive production. After the COVID-19 pandemic, the consumption growth rate rose by 10% Y-o-Y. Polyurethane adhesives are expected to record a CAGR of 4.5% during the forecast period 2022 to 2028.

- Epoxy and acrylic adhesives also have a significant presence in the Asia-Pacific automotive adhesives market. However, for epoxy, the upcoming year could be a great challenge as the raw materials used to produce epoxy adhesives are hazardous in nature and, thus, are getting regulated by government bodies in the region, such as AICS, PICCS, IECSC, and NZIoC. Epoxy adhesive is the second-largest consumed material and is expected to record a CAGR of about 4.2% during the forecast period 2022-2028. The epoxy adhesives segment is followed by the acrylic adhesives segment, which is expected to record a CAGR of about 4.5% during the forecast period 2022-2028.

- Adhesives such as cyanoacrylate and silicone sealants are on a growing trend. The adoption of sustainability in the automotive industry is increasing significantly, and EV production is increasing to a large extent. As a result, the usage of these adhesives for electronic component assembly in automobiles is increasing, which, as a result, may lead to increased demand over the coming years. Cyanoacrylate and silicone adhesives are expected to record CAGRs of above 3.41% and 4.05%, respectively, in terms of volume during the forecast period 2022-2028.

China to hold the pole position in the market owing to being major automobile manufacturer

- The Asia-Pacific is the largest producer of vehicles in the world, as countries like China, India, and Japan are among the major vehicle producers across the globe. Vehicle production in the region was expected to grow by 5.9% in 2022 from 47.9 million units in 2021.

- In 2020, many countries, including China, India, Malaysia, Japan, and Indonesia, were impacted by the COVID-19 pandemic. The consumption of automotive adhesives and sealants declined by nearly 13.3% compared to 2019 due to the shutdown of production facilities, the closing of international borders, and raw material shortages in several countries.

- Asia-Pacific is a growing region in the production of adhesives and sealants, of which China is the largest producer of automotive adhesives and sealants owing to the high-quality production facilities in the country. China has over 100 adhesives and sealants manufacturers supplying products worldwide. India is also a leading producer of vehicles, and it was expected to produce 6.1 million units of vehicles in 2022, which is 6.5% more than in 2021.

- The production of electric vehicles is increasing in the region due to the policies implemented by many countries to promote electric vehicles. China and India are the growing markets for electric vehicles. These factors are expected to drive the demand for automotive adhesives and sealants in the forecast period. For instance, electric vehicle production in China amounted to 1.11 million units in 2021, an increase of 1.05% more than in 2020.

Asia-Pacific Automotive Adhesives & Sealants Market Trends

Increasing adoption of electric vehicles to drive the industry

- The Asia-Pacific automotive industry is one of the leading industries in the market, as the sales of automotive vehicles are largely increasing. Among all the countries, China is the largest automotive producer, accounting for about 57% of the regional production, followed by Japan with 17%, India with 10%, and South Korea with 8%.

- Vehicle sales in the region have majorly declined along with production, owing to which the utilization of adhesives has been impacted. While the Y-o-Y variation in 2017-18 was -1.8%, it fell further by -6.4% in 2018-19. In 2019-20, regional production was again impacted negatively and recorded a -10.2% decline from the previous year due to the COVID-19 pandemic. The shutdown of manufacturing facilities and the shortage of vehicle components due to disruptions in the supply chain constrained the production level. However, in 2021, the demand for automobiles rose again and is expected to continue, thereby increasing the utilization of adhesives across the region over the forecast period.

- The EV market in Asia-Pacific offers another opportunity for the adhesives market to grow. The rising production and adoption of EVs and hybrid vehicles are boosting the usage of adhesives for electronic component assembly in vehicles. China is the largest producer of EVs globally as well as across the region. From 2016 to 2021, the volume of commercial electric vehicles increased from 562,603 to 1,116,382 units, recording a growth rate of about 98%. These factors are expected to increase the demand for adhesives and result in the higher market growth over the forecast period.

Asia-Pacific Automotive Adhesives & Sealants Industry Overview

The Asia-Pacific Automotive Adhesives & Sealants Market is fragmented, with the top five companies occupying 13.25%. The major players in this market are 3M, Henkel AG & Co. KGaA, Hubei Huitian New Materials Co. Ltd, Huntsman International LLC and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Automotive

- 4.2 Regulatory Framework

- 4.2.1 Australia

- 4.2.2 China

- 4.2.3 India

- 4.2.4 Indonesia

- 4.2.5 Japan

- 4.2.6 Malaysia

- 4.2.7 Singapore

- 4.2.8 South Korea

- 4.2.9 Thailand

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 Resin

- 5.1.1 Acrylic

- 5.1.2 Cyanoacrylate

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Silicone

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Sealants

- 5.2.4 Solvent-borne

- 5.2.5 UV Cured Adhesives

- 5.2.6 Water-borne

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Malaysia

- 5.3.7 Singapore

- 5.3.8 South Korea

- 5.3.9 Thailand

- 5.3.10 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Dow

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Hubei Huitian New Materials Co. Ltd

- 6.4.7 Huntsman International LLC

- 6.4.8 SHINSUNG PETROCHEMICAL

- 6.4.9 Sika AG

- 6.4.10 ThreeBond Holdings Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219