|

市場調查報告書

商品編碼

1692470

沉澱二氧化矽:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Precipitated Silica - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

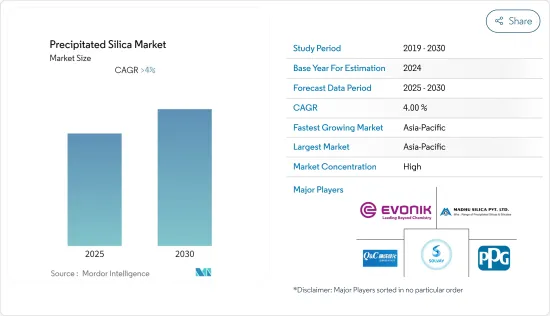

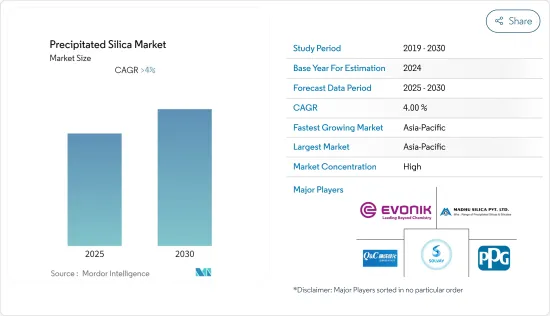

預計預測期內沉澱二氧化矽市場將以超過 4% 的複合年成長率成長。

全球汽車輪胎產業的成長導致對沉澱二氧化矽的需求激增。預計在預測期內,高品質沉澱二氧化矽的使用量增加將推動市場發展。

另一方面,嚴格的環境法規預計將阻礙市場成長。

橡膠、農業化學品和口腔清潔用品行業對沉澱二氧化矽的需求不斷成長,預計將為未來市場提供有利機會。

預計亞太地區將主導市場,並可能在預測期內呈現最高的複合年成長率。

沉澱二氧化矽的市場趨勢

汽車產業預計將主導市場

增加輪胎中沉澱二氧化矽的使用以提高輪胎胎面的耐磨性和附著力是推動市場成長的主要因素。

輪胎製造商主要使用沉澱二氧化矽來應對潮濕的天氣條件。它用於儲存低熱量並提供靈活性。在輪胎中,沉澱二氧化矽可改善拉伸強度、耐磨性、抗撕裂性和濕抓地力等物理和動態性能。

全球範圍內的汽車產量正在增加。根據OICA的預測,2021年全球汽車產量將達到8,000萬輛,比2020年成長3%。因此,汽車產量的增加增加了對輪胎的需求,從而增加了沉澱二氧化矽的消耗量。

中國佔世界輪胎產量的40%以上。 2021年輪胎產量達到近9億條,較2020年的8.0747億條大幅成長。

美國是世界上最大、最先進的輪胎市場之一。根據美國輪胎工業協會 (USTMA) 的數據,2021 年美國輪胎總出貨量將達到 3.36 億條以上,高於 2020 年的 3.032 億則。

日本、歐洲、美國、韓國、巴西等國家均已頒布或正在頒布要求輪胎標籤檢視的新法規。要符合這些新規定,就需要進行技術變革,以高分散沉澱二氧化矽取代炭黑。

預計所有上述因素都將在預測期內推動全球市場的發展。

亞太地區佔市場主導地位

預計亞太地區將主導市場。中國和印度是該地區沉澱二氧化矽市場的主要和成長最快的市場之一。

根據中國橡膠工業協會(CRIA)預測,2025年,中國輪胎年產量預計將達到7.04億條,其中包括乘用車子午線輪胎5.27億條、卡客車子午線輪胎1.48億條、斜交卡車輪胎2900兆條、超大型工業輪胎2萬條、農業輪胎1200萬條、航空輪胎。此外,到2025年,中國每年將生產1.207億輛摩托車輪胎和4.2億條自行車輪胎。

目前,印度擁有全球第五大乘用車市場、全球最大摩托車市場和全球第三大商用車市場。印度高速公路上行駛著超過 2.5 億輛Scooter/摩托車、4000 萬輛乘用車和 1000 萬輛商用車。如此巨大的車輛保有量意味著輪胎應用對沉澱二氧化矽的需求龐大。

此外,在農業領域,沉澱二氧化矽因其粒度細而可用於殺蟲劑、農藥和除草劑,並因其高吸附力而用作粉末中的抗結塊劑。

農業是印度約58%人口的主要生計來源。世界貿易中心表示,透過將重點轉向種植業並為農民提供有效支持,印度可以成為五大農產品出口國之一。 21會計年度農產品及相關產品出口總額達412.5億美元。

中國是農業大國,農業資源豐富,農業歷史悠久,有精耕細作的傳統,農村人口眾多。

由於上述因素,預計亞太地區在預測期內的需求將會增加。

沉澱二氧化矽產業概況

沉澱二氧化矽市場本質上是整合的。市場的主要企業包括 Evonik Industries AG、Solvay、PPG Industries Inc. 和 Madhu Silica Pvt。 Ltd.、QUECHEN(排名不分先後)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 汽車產業需求增加

- 其他

- 限制因素

- 嚴格的環境法規

- 其他限制因素

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 最終用戶產業

- 農業

- 化妝品

- 車

- 電子產品

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AMS Applied Material Solutions

- Anten Chemical Co.,Ltd.

- Covia Holdings LLC.

- Denka Company Limited

- Evonik Industries AG

- Madhu Silica Pvt. Ltd.

- PPG Industries Inc.

- QUECHEN

- Solvay

- Tosoh Silica Corporation

- WR Grace & Co.-Conn.

第7章 市場機會與未來趨勢

- 橡膠、農業化學品和口腔清潔用品行業的需求不斷成長

- 其他機會

The Precipitated Silica Market is expected to register a CAGR of greater than 4% during the forecast period.

The demand for precipitated silica surged due to the growth of the automobile tire industry across the world. The increasing usage of high-quality precipitated silica is expected to drive the market during the forecast period.

On the flip side, stringent environmental regulations are expected to hinder the growth of the market.

The rising demand for precipitated silica from rubber, agrochemicals, and oral care industries is projected to act as an opportunity for the market in the future.

The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Precipitated Silica Market Trends

Automobile Industry is Anticipated to Dominate the Market

Increasing utilization of precipitated silica in tires to enhance tire tread wear resistance and adhesion is the major factor driving the market growth.

Tire manufacturers largely use precipitated silica to provide performance in wet weather conditions. It is utilized to give flexibility by accumulating low heat. In tires, precipitated silica improves physical & dynamic properties such as tensile strength, abrasion resistance, tear resistance, wet grip, etc.

The production of automobiles is increasing all around the globe. According to OICA, ~ 80 million motor vehicles were produced all around the globe in 2021, which is ~3% more than in 2020. Thus, rising automobile production increases the demand for tires, which in turn increases the consumption of precipitated silica.

China contributes to more than 40% of global tire production. In 2021, the tire production volume reached almost 900 million units, a significant growth from 807.47 million units in 2020.

The United States represents one of the largest and most advanced tire markets in the world. According to the United States Tire Manufacturers Association (USTMA), total tire shipments in the United States reached more than 336 million units in 2021, up from 303.2 million units in 2020.

Countries such as Japan, Europe, the United States, South Korea, and Brazil have enacted, or are in the process of developing, new regulations requiring labels for tires. In order to comply with these new regulations, a technological change is required in place of carbon black, which can be possible by highly dispersible precipitated silica.

All the aforementioned factors are expected to drive the global market during the forecast period.

Asia-Pacific Region to Dominate the Market

The Asia-Pacific region is expected to dominate the market. China and India are among the major and fastest growing markets for precipitated silica market in the region.

According to the China Rubber Industry Association (CRIA), China is projected to produce 704 million tires per year by 2025, including 527 million passenger radial tires, 148 million truck/bus radial tires, 29 million bias truck tires, 20,000 extra-large industrial tires, 12 million agricultural tires, and 54,000 aircraft tires. In addition, China will produce 120.7 million motorcycle tires and 420 million bicycle tires annually by 2025.

At present, India has the world's fifth-largest passenger car market, the world's largest motorcycle market, and the world's third-largest commercial vehicle market. On Indian highways, there are more than 250 million scooters/motorcycles, 40 million cars, and 10 million commercial vehicles. This huge fleet can be translated into an immense demand for precipitated silica in tire applications.

Furthermore, in the agriculture sector, precipitated silica is used in pesticides, insecticides, and herbicides as the particle size is too fine, and as an anti-caking agent for powders due to its high adsorptive power.

Agriculture is the primary source of livelihood for about ~58% of India's population. According to the World Trade Centre, India can be among the top five exporters of agro commodities by shifting its focus on cultivation and effectively handholding farmers. The total agricultural and allied products exports stood at USD 41.25 billion in FY21.

China, a big agricultural country endowed with rich agricultural resources, has a long history of farming and the tradition of intensive cultivation, as well as a huge rural population.

Due to all the above-mentioned factors, the Asia-Pacific region is expected to see an increase in demand during the forecast period.

Precipitated Silica Industry Overview

The precipitated silica market is consolidated in nature. Some of the major players in the market include (not in any particular order) Evonik Industries AG, Solvay, PPG Industries Inc., Madhu Silica Pvt. Ltd., and QUECHEN, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Automotive Industry

- 4.1.2 Others

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 End-user Industry

- 5.1.1 Agriculture

- 5.1.2 Cosmetics

- 5.1.3 Automotive

- 5.1.4 Electronics

- 5.1.5 Other End-user Industries

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMS Applied Material Solutions

- 6.4.2 Anten Chemical Co.,Ltd.

- 6.4.3 Covia Holdings LLC.

- 6.4.4 Denka Company Limited

- 6.4.5 Evonik Industries AG

- 6.4.6 Madhu Silica Pvt. Ltd.

- 6.4.7 PPG Industries Inc.

- 6.4.8 QUECHEN

- 6.4.9 Solvay

- 6.4.10 Tosoh Silica Corporation

- 6.4.11 W. R. Grace & Co.-Conn.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand from Rubber, Agrochemicals, and Oral Care Industries

- 7.2 Other Opportunities