|

市場調查報告書

商品編碼

1773265

沉澱二氧化矽市場機會、成長動力、產業趨勢分析及2025-2034年預測Precipitated Silica Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

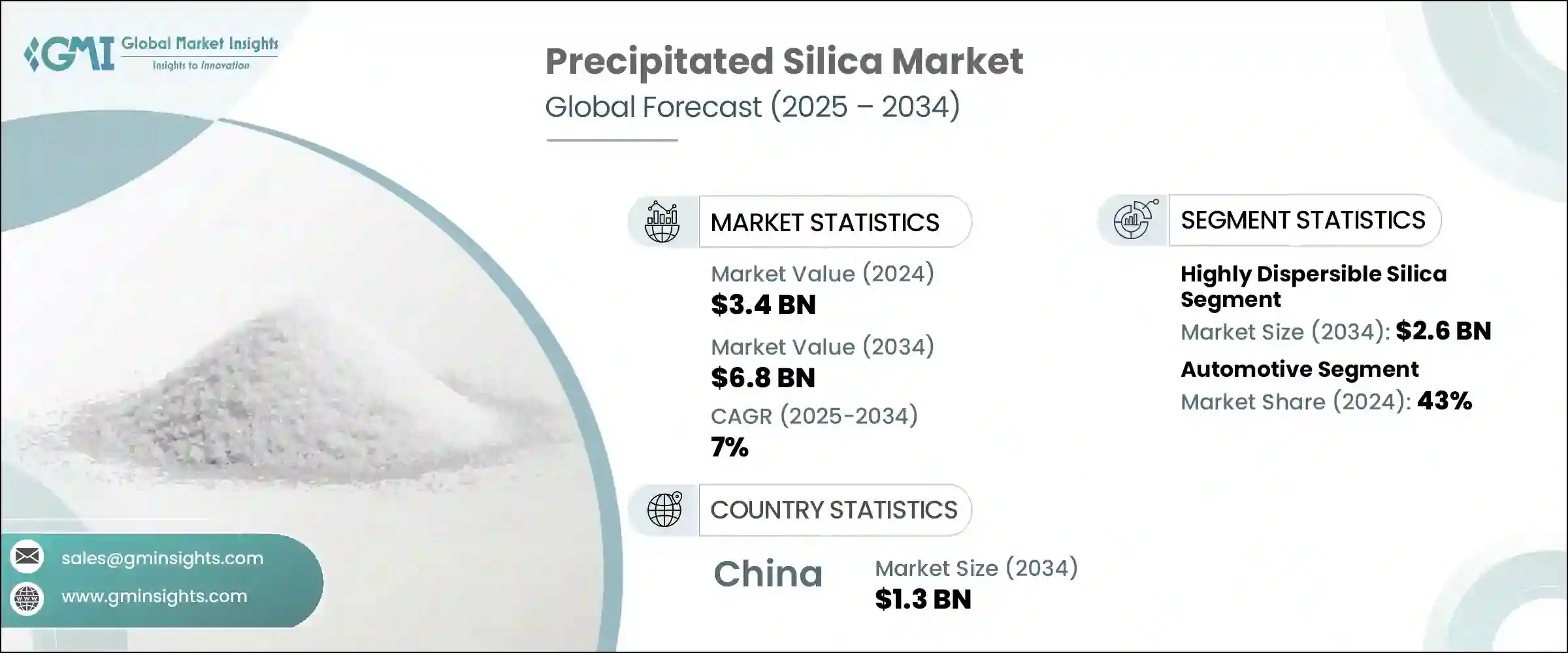

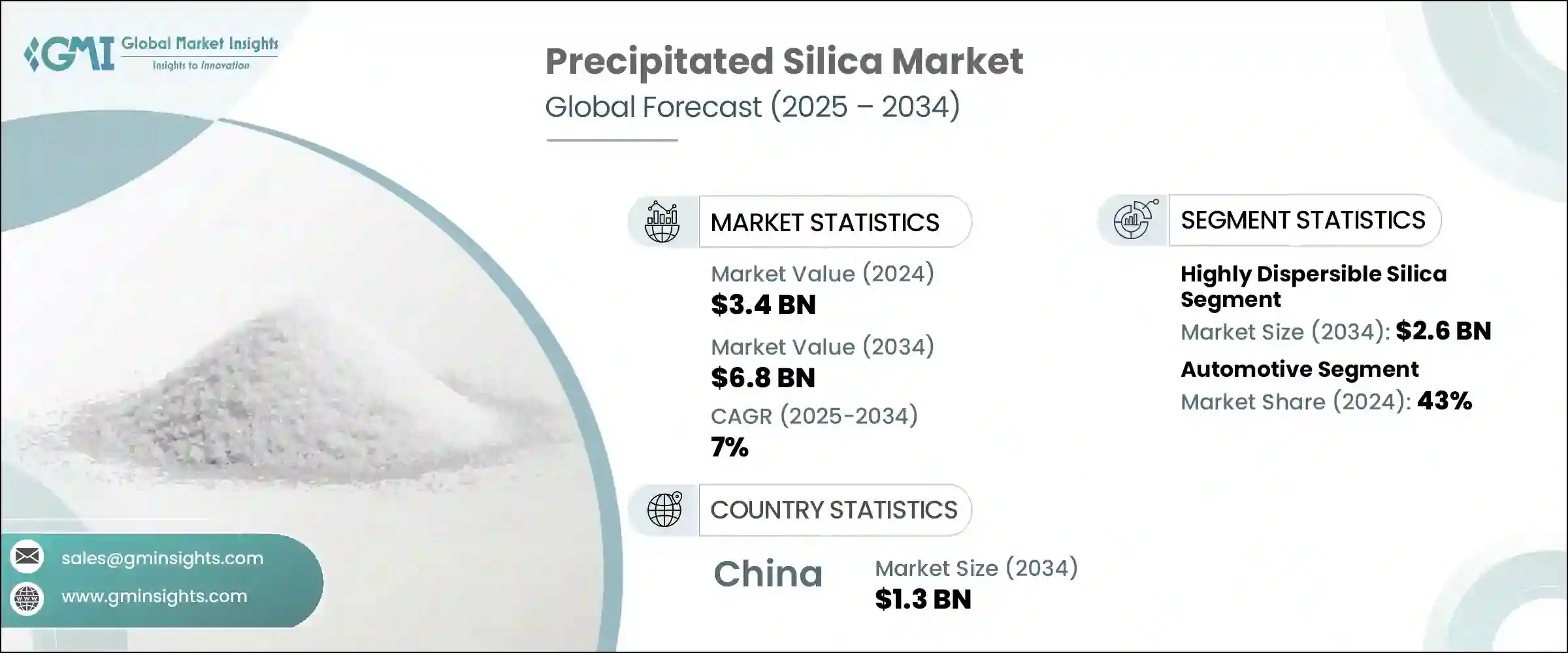

2024年,全球沉澱二氧化矽市場規模達34億美元,預計2034年將以7%的複合年成長率成長,達到68億美元。市場成長的動力源自於沉澱二氧化矽獨特的物理和化學特性,使其成為各行各業用途廣泛的成分。過去十年,其需求穩定成長,尤其作為橡膠、口腔護理產品和塗料的增效添加劑。快速城鎮化、汽車產量成長以及對環保技術的日益重視等持續趨勢,持續推動市場的發展。

沉澱二氧化矽能夠提升產品性能,同時契合永續發展目標,使其具備持續應用的潛力。由於產業加速發展、汽車產業蓬勃發展以及消費品市場蓬勃發展,亞太地區新興經濟體正在大力推動這一成長。中國和印度等國家不僅是二氧化矽消費大國,而且正在發展成為重要的生產中心,進一步鞏固了該地區在該領域的主導地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 34億美元 |

| 預測值 | 68億美元 |

| 複合年成長率 | 7% |

輪胎和橡膠產業仍然是沉澱二氧化矽應用的基石。它在增強牽引力、降低滾動阻力和提高燃油效率方面發揮著至關重要的作用,使其成為現代輪胎配方中不可或缺的一部分,尤其是在電動車和高性能汽車領域。除了輪胎之外,沉澱二氧化矽的用途正在擴展到製藥、食品加工和個人護理產品領域,在這些領域中,它可用作抗結塊劑、增稠劑和清潔劑。

高分散性二氧化矽 (HDS) 的市場規模在 2024 年達到 13 億美元,預計到 2034 年將達到 26 億美元,複合年成長率為 7.1%。該品種因其卓越的補強性能以及與輪胎橡膠配方的相容性而備受青睞。 HDS 顯著提升了滾動阻力、濕地牽引力和燃油經濟性,使其成為綠色高性能輪胎製造的關鍵材料,特別適用於混合動力和電動車。這與日益嚴格的全球環境法規以及原始設備製造商 (OEM) 對節油產品的需求相契合。低排放汽車和環保輪胎解決方案的轉變正在推動 HDS 的普及,以鞏固其作為未來輪胎技術關鍵材料的地位。

2024年,汽車領域佔了43%的市場。這一領先地位歸功於其在輪胎生產中的廣泛應用,二氧化矽透過降低滾動阻力來提高輪胎的抓地力、耐磨性和燃油效率。隨著全球節能低排放汽車的興起,製造商擴大採用二氧化矽增強輪胎,以滿足監管標準和客戶偏好。電動車和混合動力車產量的激增推動了對高性能輪胎的需求,這些輪胎嚴重依賴沉澱二氧化矽來提供增強的牽引力和更長的續航里程。隨著汽車製造商優先考慮永續和高品質的輪胎材料,預計這一趨勢將持續下去。

至2034年,美國沉澱二氧化矽市場將以6.7%的複合年成長率成長。這一成長主要得益於輪胎和橡膠應用,尤其是電動車專用輪胎銷量的成長。此外,應用領域多元化,涵蓋個人護理、醫藥、塗料和黏合劑等領域,也有助於拓寬市場基礎。日益成長的環境問題以及推廣環保材料的法規,正鼓勵製造商採用永續的二氧化矽生產技術。領先的公司正在大力投資產能擴張和研發,以創新更環保的材料和工藝,這凸顯了美國市場對永續性和長期創新的行業關注。

沉澱二氧化矽產業的主要參與者包括PPG工業公司、贏創工業公司、東方二氧化矽公司、WR Grace & Co.和索爾維公司。為了鞏固其在沉澱二氧化矽市場的立足點,領先的公司正致力於透過開發針對不同行業需求的專業化、永續的二氧化矽等級來擴展其產品組合。對研發的大量投資推動了圍繞環保生產方法和增強材料性能的創新,從而滿足了對綠色高效解決方案日益成長的需求。各公司正在建立策略合作夥伴關係和合作關係,以進入新的地理市場並拓寬分銷網路。公司還透過技術支援服務和客製化解決方案來增強客戶參與度,從而建立更牢固的客戶關係。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計數據

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 高分散性二氧化矽

- 常規沉澱二氧化矽

- 表面處理二氧化矽

- 特種沉澱二氧化矽

第6章:市場估計與預測:依等級,2021 - 2034 年

- 主要趨勢

- 工業級

- 食品級

- 醫藥級

- 化妝品級

- 其他

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 橡皮

- 輪胎應用

- 乘用車輪胎

- 商用車輪胎

- 越野輪胎

- 其他

- 非輪胎橡膠應用

- 鞋類

- 工業橡膠製品

- 其他

- 輪胎應用

- 口腔護理

- 牙膏

- 其他口腔護理產品

- 食品和飼料添加劑

- 抗結塊劑

- 承運商

- 其他

- 工業應用

- 油漆和塗料

- 塑膠

- 黏合劑和密封劑

- 其他

- 個人護理和化妝品

- 保養產品

- 護髮產品

- 其他

- 製藥

- 片劑輔料

- 其他

- 農業

- 其他

第8章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 汽車

- 消費品

- 食品和飲料

- 醫療保健和製藥

- 工業的

- 建造

- 農業

- 其他

第9章:市場估計與預測:按製造程序,2021 - 2034 年

- 主要趨勢

- 濕式工藝

- 乾法工藝

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第 11 章:公司簡介

- Anten Chemical Co., Ltd.

- Evonik Industries AG

- Gujarat Multi Gas Base Chemicals Pvt. Ltd.

- Huber Engineered Materials

- Madhu Silica Pvt. Ltd.

- Oriental Silicas Corporation

- PPG Industries, Inc.

- PQ Corporation

- Quechen Silicon Chemical Co., Ltd.

- Shandong Link Silica Co., Ltd.

- Solvay SA

- Tata Chemicals Ltd.

- Tosoh Silica Corporation

- WR Grace & Co.

- Wacker Chemie AG

The Global Precipitated Silica Market was valued at USD 3.4 billion in 2024 and is estimated to grow at a CAGR of 7% to reach USD 6.8 billion by 2034. This market growth is driven by precipitated silica's unique physical and chemical properties, which make it a versatile ingredient across various industries. Over the past decade, its demand has steadily increased, particularly as a performance-enhancing additive in rubber, oral care products, and coatings. The ongoing trends of rapid urbanization, growing automotive production, and the increasing emphasis on environmentally friendly technologies continue to propel the market forward.

Precipitated silica's ability to improve product performance while aligning with sustainability goals positions it well for continued adoption. Emerging economies in the Asia Pacific region are fueling much of this growth, thanks to accelerated industrial development, expanding automotive sectors, and booming consumer goods markets. Countries such as China and India are not only large consumers but are also evolving as major production hubs, further solidifying the region's dominance in this sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $6.8 Billion |

| CAGR | 7% |

The tire and rubber industry remains the cornerstone of precipitated silica applications. Its vital role in enhancing traction, lowering rolling resistance, and boosting fuel efficiency has made it indispensable in modern tire formulations, especially for electric and high-performance vehicles. Beyond tires, precipitated silica's uses are broadening into pharmaceuticals, food processing, and personal care products, where it acts as an anti-caking agent, thickener, and detergent.

Highly dispersible silica (HDS) accounted for USD 1.3 billion in 2024 and is expected to reach USD 2.6 billion by 2034, growing at a CAGR of 7.1%. This variant is favored for its superior reinforcement capabilities and compatibility with tire rubber compounds. HDS significantly enhances rolling resistance, wet traction, and fuel economy, making it essential in the manufacture of green and high-performance tires, particularly for hybrid and electric vehicles. This aligns well with increasing global environmental regulations and original equipment manufacturers' (OEMs) demand for fuel-efficient products. The shift toward low-emission vehicles and eco-friendly tire solutions is boosting HDS adoption, reinforcing its position as a key material in future tire technologies.

In 2024, the automotive segment held a 43% share. This leadership is attributed to its widespread use in tire production, where silica improves tire grip, wear resistance, and fuel efficiency through reduced rolling resistance. With the global rise of energy-efficient, low-emission vehicles, manufacturers are increasingly incorporating silica-reinforced tires to meet regulatory standards and customer preferences. The surge in electric and hybrid vehicle production is driving demand for high-performance tires that depend heavily on precipitated silica to deliver enhanced traction and extended driving range. This trend is expected to continue as automotive manufacturers prioritize sustainable and high-quality tire materials.

U.S. Precipitated Silica Market will grow at a CAGR of 6.7% through 2034. This growth is primarily fueled by tire and rubber applications, especially with the rising sales of tires tailored for electric vehicles. Additionally, the diversification of applications into personal care, pharmaceuticals, coatings, and adhesives is helping broaden the market base. Increasing environmental concerns and regulations promoting eco-friendly materials are encouraging manufacturers to adopt sustainable silica production techniques. Leading companies are investing heavily in capacity expansion and research & development to innovate greener materials and processes, highlighting a clear industry focus on sustainability and long-term innovation in the U.S. market.

Key players in the Precipitated Silica Industry include PPG Industries, Evonik Industries, Oriental Silicas Corporation, W.R. Grace & Co., and Solvay S.A. To strengthen their foothold in the precipitated silica market, leading companies are focusing on expanding their product portfolios by developing specialized and sustainable silica grades tailored to diverse industry needs. Heavy investment in R&D is enabling innovation around eco-friendly production methods and enhanced material performance, which meets the growing demand for green and efficient solutions. Strategic partnerships and collaborations are being formed to access new geographic markets and broaden distribution networks. Companies are also enhancing customer engagement through technical support services and customized solutions, fostering stronger client relationships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 End use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1.1 Mergers & acquisitions

- 4.6.1.2 Partnerships & collaborations

- 4.6.1.3 New Product Launches

- 4.7 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Highly dispersible silica

- 5.3 Conventional precipitated silica

- 5.4 Surface-treated silica

- 5.5 Specialty precipitated silica

Chapter 6 Market Estimates and Forecast, By Grade, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Industrial grade

- 6.3 Food Grade

- 6.4 Pharmaceutical grade

- 6.5 Cosmetic grade

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Rubber

- 7.2.1 Tire applications

- 7.2.1.1 Passenger car tires

- 7.2.1.2 Commercial vehicle tires

- 7.2.1.3 Off-road tires

- 7.2.1.4 Others

- 7.2.2 Non-tire rubber applications

- 7.2.2.1 Footwear

- 7.2.2.2 Industrial rubber products

- 7.2.2.3 Others

- 7.2.1 Tire applications

- 7.3 Oral care

- 7.3.1 Toothpaste

- 7.3.2 Other oral care products

- 7.4 Food and feed additives

- 7.4.1 Anti-caking agents

- 7.4.2 Carriers

- 7.4.3 Others

- 7.5 Industrial applications

- 7.5.1 Paints and coatings

- 7.5.2 Plastics

- 7.5.3 Adhesives and sealants

- 7.5.4 Others

- 7.6 Personal care and cosmetics

- 7.6.1 Skin care products

- 7.6.2 Hair care products

- 7.6.3 Others

- 7.7 Pharmaceuticals

- 7.7.1 Tablet excipients

- 7.7.2 Others

- 7.8 Agriculture

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Consumer goods

- 8.4 Food and beverage

- 8.5 Healthcare and pharmaceuticals

- 8.6 Industrial

- 8.7 Construction

- 8.8 Agriculture

- 8.9 Others

Chapter 9 Market Estimates and Forecast, By Manufacturing Process, 2021 - 2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 Wet process

- 9.3 Dry process

- 9.4 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Anten Chemical Co., Ltd.

- 11.2 Evonik Industries AG

- 11.3 Gujarat Multi Gas Base Chemicals Pvt. Ltd.

- 11.4 Huber Engineered Materials

- 11.5 Madhu Silica Pvt. Ltd.

- 11.6 Oriental Silicas Corporation

- 11.7 PPG Industries, Inc.

- 11.8 PQ Corporation

- 11.9 Quechen Silicon Chemical Co., Ltd.

- 11.10 Shandong Link Silica Co., Ltd.

- 11.11 Solvay S.A.

- 11.12 Tata Chemicals Ltd.

- 11.13 Tosoh Silica Corporation

- 11.14 W. R. Grace & Co.

- 11.15 Wacker Chemie AG