|

市場調查報告書

商品編碼

1692442

紙和紙板包裝:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Paper and Paperboard Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

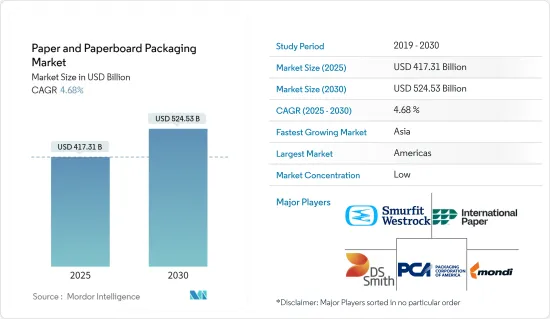

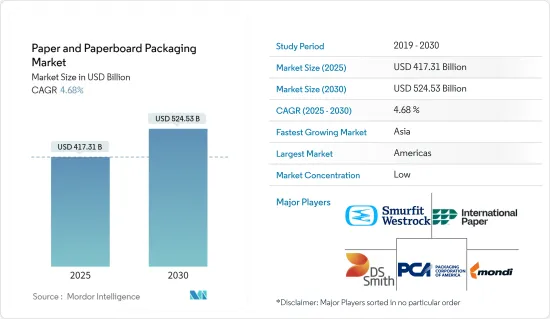

預計 2025 年紙和紙板包裝市場規模將達到 4,173.1 億美元,到 2030 年將達到 5,245.3 億美元,預測期內(2025-2030 年)的複合年成長率為 4.68%。

主要亮點

- 紙板包裝是包裝食品市場的熱門選擇。它用於各種產品,包括湯、調味品和乳製品。它們通常塗有聚合物或塑膠以確保清潔並保持食品品質。此塗層可起到阻擋濕氣和外部污染物的作用,延長包裝食品的保存期限。紙板的優點是比玻璃或金屬包裝更輕,同時仍能保持產品的新鮮度。這種輕質有助於降低運輸成本並減少對環境的影響。它的氣味和味道是中性的,不會干擾內容物的味道或香氣,使其成為理想的食品包裝材料。紙板可回收和生物分解,滿足消費者對永續包裝解決方案日益成長的需求。紙板的多功能性意味著它可以適應各種形狀和尺寸,以滿足一系列食品需求並增強零售環境中的貨架吸引力。

- 電子商務銷售額的成長和折疊紙盒包裝需求的不斷成長正在推動紙板包裝市場的發展。然而,高性能替代品的出現可能會阻礙市場的成長。紙板包裝由於其多功能性,仍然是受歡迎的環保選擇。它們可以製造成各種尺寸且佔地面積小,適合用於多個最終用戶行業。這種適應性加上其環境效益,使得紙板包裝成為許多行業的首選。

- 世界各地的消費者現在都意識到塑膠包裝對環境的影響,並將他們的購買偏好轉向更環保的選擇。這種意識涵蓋多個產品類型,從食品和飲料到個人保養用品到電子產品。製造商面臨來自消費者、政府和媒體的壓力,要求他們採用環保產品、包裝和工藝。這種壓力導致了紙板包裝設計的創新,包括可回收和可堆肥材料的開發。

- 消費者願意為環保包裝支付額外費用,進一步推動了環保包裝的趨勢。這種價格接受度反映出人們對永續包裝的長期環境成本的認知日益加深。如今,許多消費者認為環保包裝對於產品的價值提案至關重要。

- 預計這些因素將推動紙板包裝行業的顯著成長。該公司正在投資研發,以創造更永續的紙板解決方案,例如由再生材料製成並來自負責任管理的森林的紙板解決方案。紙板技術的進步改善了其性能特徵,使其成為許多應用中塑膠的可行替代品。因此,紙板包裝產業有望向各行各業擴張,滿足功能性和環境責任的雙重需求。

- 美國超過 60% 的紙板包裝被收集和回收。這種廣泛的回收利用顯示全國越來越重視包裝的永續性。該公司也推出可回收紙板產品,以滿足消費者對環保選擇的需求。例如,Cascades 最近推出了由可回收纖維製成的紙板托盤,展示了永續包裝解決方案的創新。同樣,SIG 還開發了由消費後廢棄物回收聚合物製成的紙盒,進一步表明了該行業致力於減少包裝材料對環境的影響和促進循環經濟原則。

- 這種紙張是由新種植的森林的樹纖維和再生紙製成的。森林砍伐和森林劣化是全球性問題。然而,儘管紙質包裝的需求不斷增加,但不負責任的森林砍伐卻造成原料的損失,嚴重影響紙板包裝產業。據憂思科學家聯盟稱,紙張等「木製品」約佔森林砍伐總量的 10%,可能會限制市場。

- 紙包裝主要由新種植的森林中的木纖維和再生紙製成。該行業嚴重依賴這些原料來滿足全球對紙質包裝解決方案日益成長的需求。然而,這種不斷成長的需求正在世界各地造成嚴重的環境問題,特別是森林砍伐和森林劣化。

- 不負責任的森林砍伐威脅著紙板包裝產業的長期永續性,因此該產業面臨重大挑戰。如果目前的趨勢持續下去,該行業可能很快就會面臨嚴重的原料短缺。這種潛在的短缺可能導致生產成本上升和供應有限,最終影響該行業滿足市場需求的能力。

- 據憂思科學家聯盟稱,包括紙張在內的木製品造成了全球約 10% 的森林砍伐。這項統計數據凸顯了造紙業對世界森林資源的影響。隨著人們對環境問題的認知不斷增強,消費者和監管機構越來越嚴格地審查紙質包裝製造商的採購慣例。

- 為了應對這些挑戰,造紙業正在探索永續的林業實踐,投資重新造林工作並增加再生材料的使用。然而,在滿足市場需求和確保環境永續性之間取得平衡仍然是一個複雜的問題,可能會限制未來幾年的市場成長。該行業採用和創新更永續實踐的能力將決定其未來發展軌跡和市場潛力。

紙和紙板包裝市場的趨勢

食品和飲料行業需求增加

- 電子商務銷售額的成長以及食品和飲料行業對紙質包裝的需求的增加正在推動市場的發展。根據國際貨幣基金組織的數據,預計 2022 年食品和飲料的消費者支出將達到 950 萬美元,到 2026 年將成長到 1,221 萬美元。食品和飲料行業的這些成長趨勢預計將推動全球對紙和紙板包裝的需求。

- 電子商務的快速擴張大大增加了對運輸包裝和產品保護包裝的需求。同時,食品和飲料行業越來越青睞永續和可回收的包裝解決方案,導致折疊式紙盒包裝的採用率增加。製造商和零售商正在尋找高效、環保的包裝選擇,以滿足消費者的期望並遵守監管要求;這些因素共同推動了市場成長。

- 食品和飲料製造商正在加強滿足消費者對永續性、性能、可及性和更健康食品選擇的需求。這種變化是由環保意識的增強和消費者偏好的變化所推動的。生物分解性塑膠和再生紙產品等永續包裝材料在該行業越來越普遍。紙袋在飯店、餐廳、咖啡館和其他餐飲場所越來越受歡迎。紙袋具有生物分解性、可回收、二氧化碳排放塑膠袋少等優點。

- *許多企業採用紙袋作為其企業社會責任的一部分,並遵守有關一次性塑膠的當地法規。外帶和網路訂餐的日益普及進一步推動了餐飲業對紙袋的需求。隨著越來越多的消費者選擇外帶和外送服務,對耐用、環保的包裝解決方案的需求顯著增加。紙袋為運輸食品提供了實用、環保的選擇,符合消費者的期望和產業永續性目標。

- 消費者偏好正在推動飲料及其包裝的流行趨勢。消費者對永續性、客製化和電子商務的期望不斷變化,刺激著包裝設計和功能的創新。對永續性的關注導致了環保材料和可回收包裝選擇的發展。客製化的需求催生了允許個性化和獨特產品體驗的包裝。電子商務的興起要求包裝解決方案能夠確保產品在運送過程中的完整性並增強網路購物購物者的拆包體驗。這些不斷變化的偏好繼續影響飲料包裝產業,迫使製造商適應和創新以滿足消費者的需求。

- 為了滿足消費者的偏好,世界各地的主要食品和飲料公司都設定了使其包裝完全可回收或生物分解的目標。例如,百加得宣布計劃透過開發一種新型紙質飲料瓶,在 2030 年消除塑膠,以響應全球減少一次性塑膠的努力。對循環經濟原則的承諾可能會促進造紙業的進一步創新。

- 包裝提供安全密封和可追溯性功能,以提高產品可靠性。設計師使用手工元素和當地圖像來傳達其產品的起源。品牌經常與當地藝術家合作講述引人入勝的故事。區域標識凸顯了產品的產地。環保紙和紙板廣泛用於包裝各種食品,包括乳製品、食品和飲料、乾貨和快餐。

預計亞洲將佔很大佔有率

- 中國是亞洲最大的折疊紙盒包裝市場之一,由於食品和飲料行業的巨大成長潛力,預計其需求將會增加。這種成長受到多種因素的推動,包括都市化加快、消費者偏好變化以及零售連鎖店的擴張。中國是加工紙和瓦楞紙板的主要生產國,對該行業具有重大影響力。

- 該國的生產能力對於滿足國內和國際折疊紙盒包裝材料的需求至關重要。 2023年9月,中國紙包裝產量為1,287萬噸,2024年1-2月產量上升至2,242萬噸。產量的大幅成長反映了各行各業對紙包裝的需求不斷成長,尤其是食品和飲料行業。產量的激增也凸顯了中國擴大生產以滿足市場需求的能力,進一步鞏固了其作為全球折疊紙盒包裝行業關鍵參與者的地位。

- 印度、中國、日本和韓國是亞洲地區工業化快速發展的主要國家,為瓦楞紙製造商創造了巨大的機會。這些國家的各個產業都在經歷成長,包括汽車、電子和消費品,對包裝解決方案的需求也隨之增加。瓦楞紙箱廣泛應用於食品飲料、電子、電子商務等各行業。

- 瓦楞包裝的多功能性和適應性使其適合保護和運輸各種各樣的產品。隨著消費者環保意識的增強和對經濟高效的包裝選擇的追求,該地區對此類包裝解決方案的需求正在成長。紙板可回收和生物分解,符合該地區對永續性日益成長的關注。

- 印度紙張和紙板產業將當前的轉型期視為機會和挑戰。該行業旨在開發具有成本效益且價格合理的替代品來滿足市場需求。全國各地的造紙廠正在進行試驗,生產用於各種用途的紙張和紙板,包括搬運、保護、包裹、包裝和容器。印度最近對各種上游紙產品的需求增加。

- 印度食品和飲料用紙和紙板包裝需求大幅增加。這一成長是由於消費者需求的增加和新公司進入市場。擴張的主要驅動力是消費者生活方式的改變、都市化的加速以及國內有組織的零售業的成長。食品和飲料行業正在經歷包裝產品的激增,從已調理食品到食品和飲料,都需要高效且有吸引力的包裝解決方案。 Zomato、Swiggy等外宅配服務的快速成長,大大促進了食品飲料包裝材料消費的擴大。這些平台徹底改變了人們訂購和消費食品的方式,創造了新的包裝需求領域。外帶容器、食品飲料杯、紙質食品袋的需求急劇增加,推動了紙和紙板包裝市場的成長。

- 線上食品配送平台 Zomato 宣布“100% 塑膠中性配送”,並設定了未來三年內使用永續包裝配送超過 1 億份訂單的目標。該公司計劃與包括政府主導的舉措、社會企業和新興企業在內的各相關人員合作,為食品服務業開發創新的包裝解決方案。

- 新興國家對紙張和紙漿的需求不斷成長,尤其是中國,其人均紙張消費量成長最快。受零售業和電子商務行業擴張以及環保包裝產品需求不斷成長的推動,中國紙漿和紙包裝行業正在經歷成長。網路購物平台和線上消費者的增加、消費者對永續包裝的偏好的改變以及政府的支持性政策總體上推動了該地區對紙和紙板包裝產品的需求。

- 日本是各行各業紙製品的重要消費國,包括報紙、包裝、印刷和通訊、衛生產品和其他用途。在包裝方面,由於消費者對永續包裝的意識不斷增強、對森林砍伐的擔憂以及原料的可用性等因素,我們看到了向使用紙張的轉變。

- 日本的紙和紙板包裝市場也在穩定成長。對食品、飲料和包裝食品的需求不斷成長,推動了日本對瓦楞包裝的需求。日本加工食品產業的擴張預計將成為紙板包裝市場的主要動力。除了調查對象國家的亞太國家外,台灣、馬來西亞、新加坡和越南等其他國家也顯示出在該領域佔據重要市場佔有率的潛力。

紙和紙板包裝市場概覽

全球紙和紙板包裝市場較為分散,國際紙業公司、DS Smith PLC 和美國包裝公司等多家全球和區域性企業在競爭激烈的市場空間中爭奪關注。該市場的特點是產品差異化程度低、產品滲透率高、競爭激烈。

- 2024 年 5 月—全球永續包裝和造紙公司 Mondi 在義大利杜伊諾舉行奠基儀式,啟動對該工廠的 2 億歐元(2.164 億美元)投資。該計劃將把工廠現有的造紙機改造成生產高品質再生箱板紙的機器。該投資旨在加強與當地相關人員的夥伴關係,並為該地區的經濟發展做出貢獻。

- 2024 年 4 月—國際紙業和 DS Smith 宣布,雙方已就推薦的全股票組合達成一致,以打造永續包裝解決方案的全球領導者。

- 2024 年 1 月—WestRock Corporation 宣布計劃在威斯康辛州普萊森特草原建造一家新的瓦楞包裝廠,以滿足五大湖地區日益成長的客戶需求。新工廠建成後,該公司計劃關閉位於芝加哥北部的工廠。此次投資旨在增強 WestRock 的生產能力並改善其在五大湖地區的成本結構。預計建設成本約1.4億美元。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業生態系統分析

第5章市場動態

- 市場促進因素

- 食品和飲料行業需求增加

- 對塑膠包裝產品的限制將導致需求增加

- 電子商務的興起推動了對紙和紙板包裝的需求

- 市場挑戰

- 原料成本上漲和外包

- 森林砍伐對紙和紙板包裝的影響

第6章市場區隔

- 北美洲

- 依產品類型

- 折疊式紙盒

- 瓦楞紙箱

- 其他產品類型

- 按最終用戶產業

- 食物

- 飲料

- 衛生保健

- 個人護理

- 電器

- 其他行業

- 按國家

- 美國

- 加拿大

- 依產品類型

- 歐洲

- 依產品類型

- 折疊式紙盒

- 瓦楞紙箱

- 其他產品類型

- 按最終用戶產業

- 食物

- 飲料

- 衛生保健

- 個人護理

- 電器

- 其他行業

- 按國家

- 英國

- 德國

- 法國

- 義大利

- 波蘭

- 依產品類型

- 亞太地區

- 依產品類型

- 折疊式紙盒

- 瓦楞紙箱

- 其他產品類型

- 按最終用戶產業

- 食物

- 飲料

- 衛生保健

- 個人護理

- 電器

- 其他行業

- 按國家

- 中國

- 印度

- 韓國

- 日本

- 印尼

- 泰國

- 澳洲和紐西蘭

- 依產品類型

- 中東和非洲

- 依產品類型

- 折疊式紙盒

- 瓦楞紙箱

- 其他產品類型

- 按最終用戶產業

- 食物

- 飲料

- 衛生保健

- 個人護理

- 電器

- 其他行業

- 按國家

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 以色列

- 卡達

- 依產品類型

- 拉丁美洲

- 依產品類型

- 折疊式紙盒

- 瓦楞紙箱

- 其他產品類型

- 按最終用戶產業

- 食物

- 飲料

- 衛生保健

- 個人護理

- 電器

- 其他行業

- 按國家

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 依產品類型

第7章 交易情景

- 歷史進出口分析

- 主要進口國名單

- 主要出口國家一覽

- 主要收穫

第8章競爭格局

- 公司簡介

- International Paper Company

- Eastern Pak Limited

- Mondi Group

- Smurfit Westrock

- DS Smith PLC

- Packaging Corporation of America

- Cascades Inc.

- Nippon Paper Industries Ltd

- Oji Holdings Corporation

- Stora Enso Oyj

- Billerud AB

- Sonoco Products Company

第9章投資分析

第10章:投資分析市場未來展望

The Paper and Paperboard Packaging Market size is estimated at USD 417.31 billion in 2025, and is expected to reach USD 524.53 billion by 2030, at a CAGR of 4.68% during the forecast period (2025-2030).

Key Highlights

- Paperboard packaging is a popular choice in the packaged food market. It is used for various products, including soups, seasonings, and dairy items. It is often coated with polymers or plastics to maintain cleanliness and preserve food quality. This coating acts as a barrier against moisture and external contaminants, extending the shelf life of packaged foods. Paperboard offers weight reduction advantages over glass and metal packaging while ensuring product freshness. This lightweight nature contributes to reduced transportation costs and environmental impact. Its neutral odor and taste properties make it an ideal packaging material for food products, as it does not interfere with the flavor or aroma of the contents. Paperboard is recyclable and biodegradable, aligning with the growing consumer demand for sustainable packaging solutions. The versatility of paperboard allows for various shapes and sizes, accommodating different food product requirements and enhancing shelf appeal in retail environments.

- The growth of e-commerce sales and increasing demand for folded carton packaging are driving the paperboard packaging market. However, the availability of high-performance alternatives may hinder market growth. Paperboard packaging remains a popular eco-friendly option due to its versatility. It can be produced in various sizes with a compact footprint, making it suitable for use across multiple end-user industries. This adaptability, combined with its environmental benefits, positions paperboard packaging as a preferred choice in many sectors.

- Consumers across the world are now aware of the environmental impact of plastic packaging, shifting their purchasing preferences toward eco-friendly options. This awareness extends across various product categories, from food and beverages to personal care items and electronics. Manufacturers face pressure from consumers, governments, and media to adopt environmentally responsible products, packaging, and processes. This pressure has led to innovations in paperboard packaging design, including the development of recyclable and compostable materials.

- * The trend toward eco-friendly packaging is further bolstered by consumers' willingness to pay premium prices for such options. This price tolerance reflects a growing understanding of the long-term environmental costs of non-sustainable packaging. Many consumers now view environmentally friendly packaging as integral to a product's value proposition.

- These factors are expected to drive substantial growth in the paperboard packaging industry. Companies are investing in research and development to create more sustainable paperboard solutions, including those made from recycled materials or sourced from responsibly managed forests. Advancements in paperboard technology are improving its performance characteristics, making it a viable alternative to plastic in many applications. As a result, the paperboard packaging sector is poised for expansion across various industries, meeting the dual demands of functionality and environmental responsibility.

- Over 60% of communities in the United States collect and recycle paperboard packaging. This widespread adoption of recycling practices demonstrates a growing commitment to sustainability in packaging nationwide. Companies are also introducing recyclable paperboard products to meet consumer demand for eco-friendly options. For example, Cascades recently launched a cardboard tray made from recyclable fibers, showcasing innovation in sustainable packaging solutions. Similarly, SIG has developed cartons using recycled polymers from post-consumer waste, further illustrating the industry's efforts to reduce environmental impact and promote circular economy principles in packaging materials.

- * Paper is made from tree fibers from newly planted forests or recycled paper. Deforestation and forest degradation are global issues. However, even though there is an increase in demand for paper packaging, irresponsible deforestation will severely impact the paperboard packaging industry by causing a loss of raw materials. According to the Union of Concerned Scientists, "wood products," such as paper, account for around 10% of total deforestation, which might limit the market.

- Paper packaging is primarily produced from tree fibers sourced from newly planted forests or recycled paper. The industry relies heavily on these raw materials to meet the growing global demand for paper-based packaging solutions. However, this increasing demand has raised significant environmental concerns worldwide, particularly regarding deforestation and forest degradation.

- The paperboard packaging industry faces a critical challenge as irresponsible deforestation threatens its long-term sustainability. If current trends continue, the sector may experience a severe shortage of raw materials shortly. This potential scarcity could lead to increased production costs and limited supply, ultimately affecting the industry's ability to meet market demands.

- According to the Union of Concerned Scientists, wood products, including paper, contribute to approximately 10% of worldwide deforestation. This statistic highlights the paper industry's s on global forest resources. As awareness of environmental issues grows, consumers and regulatory bodies are increasingly scrutinizing the sourcing practices of paper packaging manufacturers.

- To address these challenges, the industry is exploring sustainable forestry practices, investing in reforestation efforts, and increasing the use of recycled materials. However, the balance between meeting market demand and ensuring environmental sustainability remains a complex issue that may constrain market growth in the coming years. The industry's ability to innovate and adopt more sustainable practices will determine its future trajectory and market potential.

Paper and Paperboard Packaging Market Trends

Increase in Demand from the Food and Beverage Sector

- The growth of e-commerce sales and increasing demand for folded carton packaging in the food and beverage industry are driving the market. According to the International Monetary Fund, consumer spending on food and beverages reached USD 9.5 million in 2022 and is projected to grow to USD 12.21 million by 2026. This upward food and beverage sector trend will boost global demand for paper and paperboard packaging.

- The rapid expansion of e-commerce has significantly increased the demand for shipping and product protection packaging. Concurrently, the food and beverage industry has shown a growing preference for sustainable and recyclable packaging solutions, leading to increased adoption of folded-carton packaging. These factors collectively drive market growth as manufacturers and retailers seek efficient, environmentally friendly packaging options to meet consumer expectations and comply with regulatory requirements.

- Food and beverage manufacturers are intensifying efforts to meet consumer demands for sustainability, performance, accessibility, and healthier food options. This shift is driven by increasing environmental awareness and changing consumer preferences. Sustainable packaging materials, such as biodegradable plastics and recycled paper products, are becoming more prevalent in the industry. Paper bags are gaining popularity in hotels, restaurants, cafes, and other food establishments. These bags offer several advantages, including biodegradability, recyclability, and a lower carbon footprint than plastic alternatives.

- * Many businesses are adopting paper bags as part of their corporate social responsibility initiatives and to comply with local regulations on single-use plastics. The increasing trend of on-the-go meal delivery and online food ordering further drives the demand for paper bags in food services. As more consumers opt for takeout and delivery options, the need for sturdy, eco-friendly packaging solutions has grown significantly. Paper bags provide a practical and environmentally responsible choice for transporting food items, aligning with consumer expectations and industry sustainability goals.

- Consumer preferences drive trends in both beverages and their packaging. Changes in consumer expectations regarding sustainability, customization, and e-commerce have spurred innovation in packaging design and functionality. Sustainability concerns have led to the development of eco-friendly materials and recyclable packaging options. Customization demands have resulted in packaging that allows for personalization or unique product experiences. The rise of e-commerce has necessitated packaging solutions that ensure product integrity during shipping and enhance the unboxing experience for online shoppers. These evolving preferences continue to shape the beverage packaging industry, prompting manufacturers to adapt and innovate to meet consumer needs.

- Primary global food and beverage companies have established goals to make their packaging fully recyclable or biodegradable, responding to consumer preferences. For example, Bacardi announced plans to eliminate plastic by 2030 by developing new paper-based beverage bottles, aligning with the worldwide effort to reduce single-use plastics. This commitment to circular economy principles may lead to further innovations in the paper industry.

- Packaging enhances product authenticity through safety seals and traceability features. Designers use artisanal elements and local imagery to convey product origins. Brands often collaborate with local artists for compelling storytelling. Regional identifiers highlight product provenance. Paper and paperboard, being eco-friendly, are widely used for packaging various food products, including dairy, beverages, dry goods, and fast-food items.

Asia is Expected to Hold Significant Share

- China, one of Asia's largest folding carton packaging markets, is expected to see increased demand due to substantial growth potential in its food and beverage sector. This growth is driven by several factors, including rising urbanization, changing consumer preferences, and expanding retail chains. As a leading manufacturer of processed paper and cardboard, China significantly influences the industry.

- The country's production capacity is crucial in meeting domestic and international demand for folding carton packaging materials. In September 2023, China produced 12.87 million metric tons of these materials, which rose to 22.42 million in January-February 2024. This notable increase in production reflects the growing demand for folding carton packaging across various industries, particularly in the food and beverage sector. The surge in output also highlights China's ability to scale up manufacturing to meet market needs, further solidifying its position as a critical player in the global folding carton packaging industry.

- India, China, Japan, and South Korea are leading countries in the Asia region experiencing rapid industrialization, creating significant opportunities for corrugated packaging manufacturers. The growth of various industries in these countries, such as automotive, electronics, and consumer goods, has increased demand for packaging solutions. Corrugated boxes are widely used across multiple industries, including food and beverage, electronics, and e-commerce.

- Corrugated packaging's versatility and adaptability make it suitable for protecting and transporting a wide range of products. Demand for these packaging solutions is growing in the region as consumers become more environmentally conscious and seek cost-effective packaging options. Corrugated boxes are recyclable and biodegradable, aligning with the region's increasing focus on sustainability.

- The Indian paper and paperboard industry perceives the current transition phase as both an opportunity and a challenge. The sector aims to develop cost-effective and affordable alternatives to meet market demands. Paper mills nationwide are conducting trials to produce paper and paperboard for various applications, including carrying, protecting, wrapping, packaging, and container use. India has recently seen a growing demand for various upstream paper products.

- India has witnessed a substantial rise in paper and paperboard packaging for food and beverages. This increase is driven by growing consumer demand and the entry of new companies into the market. The expansion is primarily attributed to evolving consumer lifestyles, increasing urbanization, and the growth of organized retail in the country. The food and beverage industry has seen a surge in packaged products, ranging from ready-to-eat meals to beverages, all requiring efficient and attractive packaging solutions. The rapid growth of food delivery services, notably Zomato and Swiggy, has substantially contributed to the increased consumption of food and beverage packaging materials. These platforms have revolutionized the way people order and consume food, creating a new segment of packaging demand. The need for takeaway containers, beverage cups, and food-grade paper bags has risen dramatically, driving the growth of the paper and paperboard packaging market.

- Online food delivery platform Zomato announced '100% plastic-neutral deliveries' and set a target to deliver over 100 million orders in sustainable packaging within the next three years. The company plans to collaborate with various stakeholders, including government-led initiatives, social enterprises, and startups, to develop innovative packaging solutions for the restaurant industry.

- The demand for paper pulp is increasing in developing countries, particularly in China, which is the fastest-growing paper per capita consumer. China's paper packaging sector is experiencing growth, driven by the expanding retail and e-commerce industries and increased demand for environmentally friendly packaging products. The rise in online shopping platforms and online shoppers, shifting consumer preferences toward sustainable packaging, and supportive government policies have collectively boosted the demand for paper and paperboard packaging products in the region.

- Japan is a significant consumer of paper-based products across various industries, including newspapers, packaging, printing and communication, sanitary products, and other miscellaneous applications. The packaging sector has seen a shift toward paper usage due to increased consumer awareness about sustainable packaging, concerns over deforestation, and raw material availability, among other factors.

- The paper and paperboard packaging market in Japan is also experiencing steady growth. The increasing demand for beverages and packaged food has driven the need for corrugated packaging in the country. Japan's expanding processed food industry is expected to be a key driver for the paperboard packaging market. Beyond the countries included in the Asia-Pacific region study, other nations such as Taiwan, Malaysia, Singapore, and Vietnam also show significant potential for gaining substantial market share in this sector.

Paper and Paperboard Packaging Market Overview

The global paper and paperboard packaging market is fragmented, with several global and regional players, such as International Paper Company, DS Smith PLC, Packaging Corporation of America, and others, vying for attention in a contested market space. This market is characterized by low product differentiation, growing levels of product penetration, and high levels of competition.

- May 2024 - Mondi, a global player in sustainable packaging and paper, held a groundbreaking ceremony in Duino, Italy, marking the start of its EUR 200 million (USD 216.4 million) investment in the mill. The project involves converting the facility's existing paper machine into a high-quality recycled containerboard machine. This investment aims to strengthen partnerships with local stakeholders and contribute to the region's economic development.

- April 2024 - International Paper and DS Smith Plc announced an agreement on the terms of a recommended all-share combination, aiming to create a global leader in sustainable packaging solutions.

- January 2024 - WestRock Company unveiled plans to construct a new corrugated box facility in Pleasant Prairie, Wisconsin, to address increasing customer demand in the Great Lakes region. Upon completion of the new facility, the company intends to close its North Chicago plant. This investment aims to enhance WestRock's production capabilities and improve its cost structure in the Great Lakes area. The estimated construction cost is approximately USD 140 million.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from the Food and Beverage Sector

- 5.1.2 Regulations on Plastic-based Packaging Products Contribute to Higher Demand

- 5.1.3 Increasing Growth of E-commerce Creates Demand for Various Paper and Paperboard Packaging Types

- 5.2 Market Challenges

- 5.2.1 Increasing Raw Material Costs and Outsourcing

- 5.2.2 Effects of Deforestation on Paper and Paperboard Packaging

6 MARKET SEGMENTATION

- 6.1 North America

- 6.1.1 By Product Type

- 6.1.1.1 Folding Cartons

- 6.1.1.2 Corrugated Boxes

- 6.1.1.3 Other Product Types

- 6.1.2 By End-user Vertical

- 6.1.2.1 Food

- 6.1.2.2 Beverage

- 6.1.2.3 Healthcare

- 6.1.2.4 Personal Care

- 6.1.2.5 Electrical

- 6.1.2.6 Other End-user Verticals

- 6.1.3 By Country

- 6.1.3.1 United States

- 6.1.3.2 Canada

- 6.1.1 By Product Type

- 6.2 Europe

- 6.2.1 By Product Type

- 6.2.1.1 Folding Cartons

- 6.2.1.2 Corrugated Boxes

- 6.2.1.3 Other Product Types

- 6.2.2 By End-user Vertical

- 6.2.2.1 Food

- 6.2.2.2 Beverage

- 6.2.2.3 Healthcare

- 6.2.2.4 Personal Care

- 6.2.2.5 Electrical

- 6.2.2.6 Other End-user Verticals

- 6.2.3 By Country***

- 6.2.3.1 United Kingdom

- 6.2.3.2 Germany

- 6.2.3.3 France

- 6.2.3.4 Italy

- 6.2.3.5 Poland

- 6.2.1 By Product Type

- 6.3 Asia-Pacific

- 6.3.1 By Product Type

- 6.3.1.1 Folding Cartons

- 6.3.1.2 Corrugated Boxes

- 6.3.1.3 Other Product Types

- 6.3.2 By End-user Vertical

- 6.3.2.1 Food

- 6.3.2.2 Beverage

- 6.3.2.3 Healthcare

- 6.3.2.4 Personal Care

- 6.3.2.5 Electrical

- 6.3.2.6 Other End-user Verticals

- 6.3.3 By Country***

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 South Korea

- 6.3.3.4 Japan

- 6.3.3.5 Indonesia

- 6.3.3.6 Thailand

- 6.3.3.7 Australia and New Zealand

- 6.3.1 By Product Type

- 6.4 Middle East and Africa

- 6.4.1 By Product Type

- 6.4.1.1 Folding Cartons

- 6.4.1.2 Corrugated Boxes

- 6.4.1.3 Other Product Types

- 6.4.2 By End-user Vertical

- 6.4.2.1 Food

- 6.4.2.2 Beverage

- 6.4.2.3 Healthcare

- 6.4.2.4 Personal Care

- 6.4.2.5 Electrical

- 6.4.2.6 Other End-user Verticals

- 6.4.3 By Country***

- 6.4.3.1 Saudi Arabia

- 6.4.3.2 United Arab Emirates

- 6.4.3.3 Egypt

- 6.4.3.4 Israel

- 6.4.3.5 Qatar

- 6.4.1 By Product Type

- 6.5 Latin America

- 6.5.1 By Product Type

- 6.5.1.1 Folding Cartons

- 6.5.1.2 Corrugated Boxes

- 6.5.1.3 Other Product Types

- 6.5.2 By End-user Vertical

- 6.5.2.1 Food

- 6.5.2.2 Beverage

- 6.5.2.3 Healthcare

- 6.5.2.4 Personal Care

- 6.5.2.5 Electrical

- 6.5.2.6 Other End-user Verticals

- 6.5.3 By Country***

- 6.5.3.1 Brazil

- 6.5.3.2 Mexico

- 6.5.3.3 Argentina

- 6.5.3.4 Colombia

- 6.5.1 By Product Type

7 TRADE SCENARIO

- 7.1 Historical Import-Export Analysis

- 7.2 List of Major Importing Countries

- 7.3 List of Major Exporting Countries

- 7.4 Key Takeaways

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 International Paper Company

- 8.1.2 Eastern Pak Limited

- 8.1.3 Mondi Group

- 8.1.4 Smurfit Westrock

- 8.1.5 DS Smith PLC

- 8.1.6 Packaging Corporation of America

- 8.1.7 Cascades Inc.

- 8.1.8 Nippon Paper Industries Ltd

- 8.1.9 Oji Holdings Corporation

- 8.1.10 Stora Enso Oyj

- 8.1.11 Billerud AB

- 8.1.12 Sonoco Products Company