|

市場調查報告書

商品編碼

1692439

中東和非洲LED照明:市場佔有率分析、行業趨勢和成長預測(2025-2030年)Middle East and Africa LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

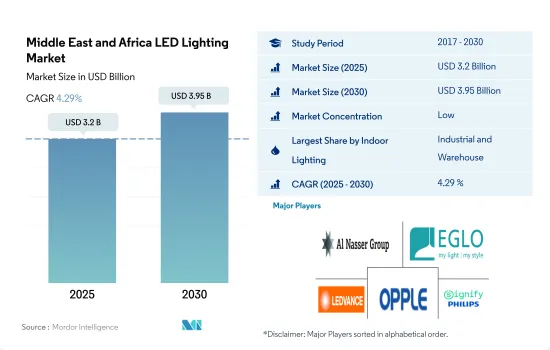

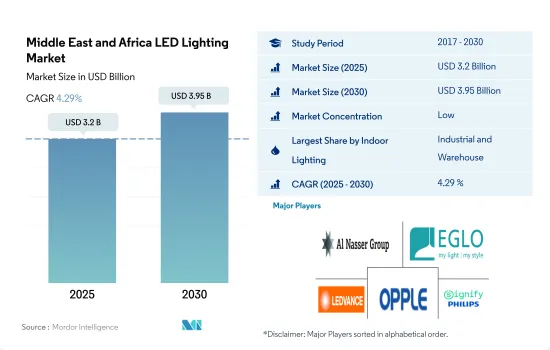

中東和非洲的 LED 照明市場規模預計在 2025 年為 32 億美元,預計到 2030 年將達到 39.5 億美元,預測期內(2025-2030 年)的複合年成長率為 4.29%。

工業和住宅領域的不斷發展正在推動市場成長

- 從價值佔有率來看,2023年工業和倉儲業將佔據大部分市場佔有率,其次是商業和住宅業。中東經濟高度依賴專用加工、生產和物流設施。此外,強勁的消費品需求和優惠的稅收政策使得當地市場對外國工業和製造公司越來越有吸引力。隨著我們從依賴石油和天然氣出口轉向更多元化的經濟,健康的工業、製造業和物流業對於我們地區經濟的未來至關重要。

- 就2023年的成交量佔有率而言,住宅領域將佔大多數,其次是商業、工業和倉儲。非洲各國政府正加強推動製造業和工業化發展,以刺激疫情後的經濟成長。因此,外國投資競爭加劇,新的產業政策不斷訂定,經濟特區在非洲大陸不斷擴張。

- 由於油價上漲和經濟成長,預計 2023 年中東房地產市場將保持活躍。目前規劃或正在建設的房地產計劃總價值估計為1.36兆美元。其中,沙烏地阿拉伯佔64.5%,約8,770億美元;阿拉伯聯合大公國佔21.6%,約2,930億美元。同樣,烏干達政府宣布計劃將坎帕拉工業和商業園區(KIBP)擴大 400 萬平方公尺,以促進工業化發展。由於上述案例,預計未來幾年室內LED的需求將會成長。

中東和非洲LED照明市場趨勢

家庭數量的增加將推動該地區 LED 的使用增加

- 截至2018年,中東和非洲人口為4.84億,預計到2030年將達到約5億。 2020年,阿布達比酋長國將建造超過92,800套住宅,其次是沙迦(41,000套)和杜拜(35,000套)。預計未來幾年阿拉伯聯合大公國將建造約 231,200 套住宅。新房間的建設可能會促進 LED 銷售的成長。

- 在中東和非洲,典型的家庭規模超過五人。在沙烏地阿拉伯,大約一半的人口擁有自己的住房,總計 546 萬戶。截至 2020 年,以色列有 681,500 個五人或五人以上的家庭。一間房子若要住五個人,至少要有兩個房間。以色列大多數人居住在單間公寓。隨著家庭人口的增加,LED的銷售量也在上升。

- 預計2022年中東和非洲地區的汽車產量將達233總合,2023年將達到245萬輛。儘管仍處於早期階段,但中東和非洲的電動車(EV)市場已顯示出令人鼓舞的成長跡象。隨著地方政府越來越意識到減少碳排放的必要性,正在通過法律來鼓勵使用電動車。例如,阿拉伯聯合大公國、沙烏地阿拉伯、巴林和阿曼已宣布淨零目標。此外,該地區的幾個國家正在提供稅收優惠和補貼以鼓勵購買電動車。由於電動車在該地區具有巨大的潛力,預計 LED 照明的需求將會上升。

人口成長和能源永續性宣傳活動推動LED照明的使用增加

- 在中東和非洲,阿拉伯聯合大公國 (UAE)、沙烏地阿拉伯和南非是收益和人口最多的國家。 2015年阿拉伯聯合大公國的平均家庭規模約為4.2人,到2022年將上升至4.9人。 2021年南非人口約6,050萬,人口成長率為1.2%至1.3%。同年,估計有 1800 萬個家庭,平均每個家庭有 3.34 人。人口成長和家庭規模縮小導致對住宅的需求增加,從而推動該地區對 LED 照明的需求。

- 在 MEA,典型的家庭規模超過五人。沙烏地阿拉伯近一半的人口擁有自己的住房,2020 年統計的家庭數量為 546 萬戶。截至 2020 年,以色列有 681,500 戶家庭,其中有 5 人或 5 人以上。一間房子若要住五個人,至少要有兩個房間。以色列大多數人居住在單間公寓。隨著家庭人口的增加,LED的銷售量也在上升。

- 阿拉伯聯合大公國最新的永續性宣傳活動為指定品牌的 LED 燈泡提供高達 25% 的折扣,以鼓勵當地人改用節能環保的照明。南非政府的 S&L 計劃旨在透過實施最低能源性能標準 (MEPS)、標籤計劃和獎勵計劃等措施和干涉措施,將低效電子產品從市場上淘汰,並鼓勵採用包括 LED 在內的高效技術。預計此類案例將進一步刺激該國對 LED 照明的需求。

中東和非洲LED照明產業概況

中東和非洲LED照明市場較為分散,前五大企業佔比為18.51%。市場的主要企業有:Al Nasser Group、EGLO Leuchten GmbH、LEDVANCE GmbH(MLS)、OPPLE Lighting 和 Signify(飛利浦)(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 汽車產量

- 人口

- 人均收入

- 汽車貸款利率

- 充電站數量

- 行駛車輛數

- LED進口總量

- 照明功耗

- #家庭數量

- 道路網路

- LED滲透率

- #體育場數量

- 園藝區

- 法律規範

- 室內照明

- 波灣合作理事會

- 南非

- 戶外照明

- 波灣合作理事會

- 南非

- 汽車照明

- 波灣合作理事會

- 南非

- 室內照明

- 價值鍊和通路分析

第5章市場區隔

- 室內照明

- 農業照明

- 商業照明

- 辦公室

- 零售

- 其他

- 工業/倉庫

- 住宅照明

- 戶外照明

- 公共設施

- 路

- 其他

- 汽車實用照明

- 日間行車燈 (DRL)

- 方向指示器

- 頭燈

- 倒車燈

- 紅綠燈

- 尾燈

- 其他

- 汽車照明

- 二輪車

- 商用車

- 搭乘用車

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- ACUITY BRANDS, INC.

- Al Nasser Group

- EGLO Leuchten GmbH

- GRUPO ANTOLIN IRAUSA, SA

- HELLA GmbH & Co. KGaA(FORVIA)

- LEDVANCE GmbH(MLS Co Ltd)

- Marelli Holdings Co., Ltd.

- OPPLE Lighting Co., Ltd

- Signify(Philips)

- Valeo

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 91066

The Middle East and Africa LED Lighting Market size is estimated at 3.2 billion USD in 2025, and is expected to reach 3.95 billion USD by 2030, growing at a CAGR of 4.29% during the forecast period (2025-2030).

Increasing development in the industrial sector and residential sector drives market growth

- In terms of value share, in 2023, the industrial and warehouse segment accounted for the majority of the share, followed by commercial and residential. The Middle East economy relies heavily on purpose-built processing, production, and logistics facilities. In addition, the local market is becoming a magnet for foreign industrial and manufacturing companies due to strong demand for consumer goods and tax incentives. Healthy industrial, manufacturing, and logistics industries are critical for the future of the region's economy as it continues to transition from dependence on oil and gas exports to a more diversified economy.

- In terms of volume share, in 2023, the residential segment accounted for the majority of the share, followed by commercial and industrial and warehouse. Governments across Africa have stepped up efforts to boost manufacturing and industrialization to spur economic growth after the pandemic. This intensified competition for foreign investment, introducing new industrial policies and the subsequent expansion of Special Economic Zones (SEZs) across the continent.

- The Middle East real estate market was expected to remain strong in 2023 due to high oil prices and economic growth. The total value of real estate projects currently planned or under construction is estimated at USD 1.36 trillion. Saudi Arabia accounts for 64.5% of the total, or about USD 877 billion, followed by the United Arab Emirates, with 21.6% or USD 293 billion. Similarly, the Ugandan government has stepped up its efforts to promote industrialization by announcing plans to expand the Kampala Industrial and Business Park (KIBP) by 4 million square meters. The above instances are expected to create more demand for indoor LEDs in the coming years.

Middle East and Africa LED Lighting Market Trends

Increase in household size to bolster the growth of LED usage in the region

- The Middle East & Africa had a population of 484 million people as of 2018, with that number predicted to climb to around 500 million by 2030. In 2020, over 92.8 thousand homes were built in the emirate of Abu Dhabi, followed by 41 thousand in the emirate of Sharjah and 35 thousand in the emirate of Dubai. There are expected to be 231.2 thousand residences in the entire United Arab Emirates over the coming years. The building of new rooms will consequently boost sales of LEDs.

- In the Middle East and Africa, the typical household size exceeds five people. In Saudi Arabia, about half of the population owns a home, with 5.46 million households counted in the country. In Israel, there were 681.5 thousand homes with five or more people as of 2020. There must be more than two rooms in a house to accommodate five people. The majority of people in Israel live in studio apartments. Sales of LEDs have increased as a result of the growth in household sizes.

- In the Middle East and Africa, 2.33 million automobiles were produced in total in 2022, and 2.45 million were anticipated to be produced in 2023. Although it is still in its early stages, the electric vehicle (EV) market across the Middle East and African countries is already showing hopeful signs of growth. As local governments become more aware of the need to reduce their carbon footprint, they are passing legislation to promote the use of EVs. The United Arab Emirates, Saudi Arabia, Bahrain, and Oman, for instance, have announced their net-zero targets. Several countries in the region are also offering tax incentives and subsidies to promote the purchase of electric vehicles. Due to the enormous potential that EVs present in this region, it is projected that demand for LED lighting will rise.

Increasing population and energy sustainability campaign to promote higher use of LED lights

- In the MEA region, UAE, Saudi Arabia, and South Africa are the largest countries in terms of revenue and population. The United Arab Emirates' average size of households was around 4.2 persons in 2015, and by 2022, it had increased to 4.9 people per household. In 2021, South Africa had a population of approximately 60.5 million people, and the population has been growing at a rate between 1.2% and 1.3%. In the same year, the country had an estimated 18 million households, with an average household size of 3.34 persons. The growing population and reducing household size are generating the need for more houses, which is boosting the demand for LED illumination in the region.

- In MEA, the typical household size exceeds five people. In Saudi Arabia, about half of the population owns a home, and 5.46 million households were counted in 2020. In Israel, there were 681.5 thousand homes with five or more people as of 2020. There must be more than two rooms in a house to accommodate five people. The majority of people in Israel live in studio apartments. Sales of LEDs have increased as a result of the growth in household sizes.

- To encourage local people to switch to more energy-efficient and environmentally friendly lights, the UAE's latest sustainability campaign involves giving discounts of up to 25% on selected brand LED bulbs. The South African government's S&L program aims to remove inefficient electronic appliances from the market and encourage the adoption of efficient technologies, which include LEDs, by implementing measures/interventions such as minimum energy performance standards (MEPS), labeling programs, and incentive programs. Such instances are further expected to boost the demand for LED lighting in the country.

Middle East and Africa LED Lighting Industry Overview

The Middle East and Africa LED Lighting Market is fragmented, with the top five companies occupying 18.51%. The major players in this market are Al Nasser Group, EGLO Leuchten GmbH, LEDVANCE GmbH (MLS Co Ltd), OPPLE Lighting Co., Ltd and Signify (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 Lighting Electricity Consumption

- 4.9 # Of Households

- 4.10 Road Networks

- 4.11 Led Penetration

- 4.12 # Of Stadiums

- 4.13 Horticulture Area

- 4.14 Regulatory Framework

- 4.14.1 Indoor Lighting

- 4.14.1.1 Gulf Cooperation Council

- 4.14.1.2 South Africa

- 4.14.2 Outdoor Lighting

- 4.14.2.1 Gulf Cooperation Council

- 4.14.2.2 South Africa

- 4.14.3 Automotive Lighting

- 4.14.3.1 Gulf Cooperation Council

- 4.14.3.2 South Africa

- 4.14.1 Indoor Lighting

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

- 5.2 Outdoor Lighting

- 5.2.1 Public Places

- 5.2.2 Streets and Roadways

- 5.2.3 Others

- 5.3 Automotive Utility Lighting

- 5.3.1 Daytime Running Lights (DRL)

- 5.3.2 Directional Signal Lights

- 5.3.3 Headlights

- 5.3.4 Reverse Light

- 5.3.5 Stop Light

- 5.3.6 Tail Light

- 5.3.7 Others

- 5.4 Automotive Vehicle Lighting

- 5.4.1 2 Wheelers

- 5.4.2 Commercial Vehicles

- 5.4.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 Al Nasser Group

- 6.4.3 EGLO Leuchten GmbH

- 6.4.4 GRUPO ANTOLIN IRAUSA, S.A.

- 6.4.5 HELLA GmbH & Co. KGaA (FORVIA)

- 6.4.6 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.7 Marelli Holdings Co., Ltd.

- 6.4.8 OPPLE Lighting Co., Ltd

- 6.4.9 Signify (Philips)

- 6.4.10 Valeo

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219