|

市場調查報告書

商品編碼

1687763

LED照明:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

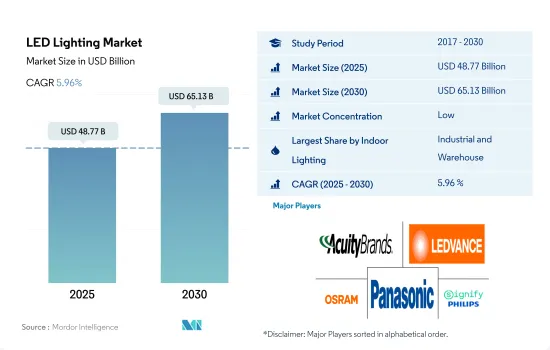

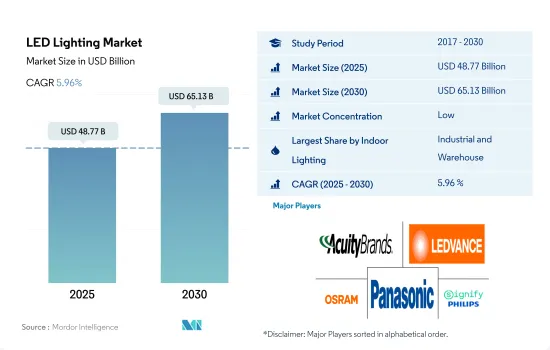

預計 2025 年 LED 照明市場規模為 487.7 億美元,到 2030 年將達到 651.3 億美元,預測期內(2025-2030 年)的複合年成長率為 5.96%。

工業生產需求的不斷成長、儲存空間需求的不斷成長以及辦公空間可用性的不斷增加正在推動室內 LED 照明市場的需求

- 就價值佔有率而言,到 2023 年,工業和倉儲 (I&W) 將佔據大部分佔有率 (49.2%),其次是商業 (31.1%)、住宅(17.5%) 和農業。未來幾年,我們預計工業和水務(I&W)和農業照明的佔有率將會增加,而其餘部分的佔有率將略有下降。在新冠疫情期間,全球各行各業都面臨許多內部和外部阻力。 2021年,許多國家的工業生產保持穩定。 2021年,美國的工業生產總額為2,4,971億美元,較2020年成長11.55%。同期,英國的工業生產總額為2,748.7億美元,較2020年成長16.57%。因此,工業生產的成長導致對倉庫的需求增加,從而導致未來幾年對室內照明的需求增加。

- 政府補貼和住宅計畫在許多國家引進新住宅方面發揮著重要作用。在印度,政府已經推出了多項節能計劃。例如,中央政府雄心勃勃的 Pradhan Mantri Awas Yojana (PMAY) 計劃旨在到 2022 年在全國建造 2000 萬套經濟適用住宅。加拿大卡加利在 2022 年開工建設了 17,306 個多單元住宅計劃。

- 物流建設是一個日益重要的領域,電子商務和出口繁榮推動了對新倉庫和其他物流基礎設施的需求。 2022年7月,百勝中國控股有限公司在上海市嘉定區開工興建佔地6.1萬平方公尺的百勝中國供應鏈管理中心。預計此類案例將推動全球室內 LED 市場的成長。

政府稅收政策、增加可再生計劃和對街道照明的投資

- 就價值佔有率和數量佔有率而言,亞太地區將在 2023 年佔據大部分市場佔有率,北美則位居第二。節能和稅收優惠是亞太地區國家工業和商業 LED 照明市場日益流行的主要趨勢。印尼政府推出2015年第18號政府法規與政策,推出一系列稅收優惠政策,吸引國內外對LED的投資,進而降低消費者購買價格。日本計畫落實國家自主貢獻(INDC)草案,2050年實現全球溫室氣體排放至少減少50%。政府鼓勵國民積極開展非營利和社區支持計劃,提高節能意識。亞太地區對可再生能源計劃和照明基礎設施的投資正在增加。 2023 年 2 月,中國黃岡市啟動了一項重大智慧基礎設施計劃,以節省能源成本。

- 在北美,美國在2021年從世界各地進口了價值約125億美元的照明設備。 2022年12月,62%的建商向買家提供了獎勵,例如降低住宅銷售的房屋抵押貸款利率。採取這項措施是由於2022年銷售活動下降。預計2023年銷售額將回升,導致LED照明需求大幅增加。對聯網街道照明的投資是推動該地區 LED 照明市場的主要因素之一。許多社區已經從街道和道路照明計劃中受益。例如,大急流城議會於 2021 年 2 月核准了一項價值 946 萬美元的契約,將該市所有路燈升級為 LED。

LED照明市場趨勢

節能建築的興起和電動車全球銷售的成長將推動市場成長

- 2021 年世界人口達 78.9 億。預計到 2022 年,全球就業人數將從 2015 年的 31.6 億增加到 33.2 億。隨著就業人數的增加以及人們掌握的知識越來越多,預計 LED 的使用將會增加。

- 儘管受到新冠疫情的影響,全球節能建築支出仍從 2019 年的 1,650 億美元成長了 11.4%,達到 2020 年的 1,840 多億美元。能源效率投資的年成長率自 2015 年以來首次超過 3%。由於節能建築的不斷發展以及需要在住宅中建造更多房間以滿足不斷成長的人口的住宅需求,對 LED 的需求預計會增加。

- 2022年全球汽車產量為1.4396億輛。預計2023年將增加至1.5092億輛。預計2022年全球電動車銷量將突破1,000萬輛,2023年將成長35%,達到1,400萬輛。由於這種快速擴張,電動車的市場佔有率已從2020年的4%成長到2022年的14%。與傳統汽車相比,電動車每輛車所需的處理器更多,因此隨著電動車數量的成長,對車載半導體晶片的需求也會增加。汽車產業對半導體的需求不斷成長可能會推動LED照明市場的發展。

人口成長、綠色建築和政府採用 LED 的計劃正在推動市場

- 世界人口將從2020年的77.9億增加到2023年的80億。人口最多的國家包括中國(14.5億)、印度(14.2億)和美國(3.368億)。此外,全球就業人數將從 2015 年的 31.6 億增加到 2022 年的 33.2 億。隨著就業增加和人口成長導致人們知識水平提高,LED 的使用可能會增加。

- 儘管受到新冠疫情的影響,全球節能建築支出仍異常成長 11.4%,從 2019 年的 1,650 億美元增至 2020 年的 1,840 多億美元。能源效率投資年增率自 2015 年以來首次超過 3%。隨著更多節能建築的開發以及住宅需要擁有更多房間以滿足不斷成長的人口的住宅需求,對 LED 的需求將會增加。

- 在全球範圍內,住宅數量不斷增加,對照明的需求推動了 LED 的採用。例如在印度,孟買大都會區(MMR)的新房推出數量預計將從上一年的 56,883 套增加一倍以上,達到 2022 年的 124,652 套。巴西的經濟適用住宅計畫也已重啟。巴西總統宣布計劃於 2023 年 2 月重啟全國針對低收入者的聯邦住宅計劃。總統於 2009 年創建了該計劃,名為“Minha Casa, Minha Vida”(字面意思是“我的家,我的生活”)。預計此類案例將進一步增加該國對 LED 照明的需求。

LED照明產業概況

LED照明市場分散,前五大企業市佔率合計為31.38%。該市場的主要企業包括 ACUITY BRANDS, INC.、LEDVANCE GmbH (MLS)、OSRAM GmbH.、松下控股公司和 Signify (飛利浦)。 (無特定順序)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 汽車產量

- 人口

- 人均收入

- 汽車貸款利率

- 充電站數量

- 持有汽車數量

- LED進口總量

- 照明功耗

- 家庭數量

- 道路網路

- LED滲透率

- 體育場數量

- 園藝區

- 法律規範

- 室內照明

- 阿根廷

- 巴西

- 中國

- 法國

- 德國

- 波灣合作理事會

- 印度

- 日本

- 南非

- 英國

- 美國

- 戶外照明

- 阿根廷

- 巴西

- 中國

- 法國

- 德國

- 波灣合作理事會

- 印度

- 日本

- 南非

- 英國

- 美國

- 汽車照明

- 阿根廷

- 巴西

- 中國

- 法國

- 德國

- 波灣合作理事會

- 印度

- 日本

- 南非

- 韓國

- 西班牙

- 英國

- 美國

- 室內照明

- 價值鍊和通路分析

第5章市場區隔

- 透過室內照明

- 農業照明

- 商業照明

- 辦公室

- 零售

- 其他

- 工業/倉庫

- 住宅照明

- 透過戶外照明

- 公共設施

- 路

- 其他

- 汽車實用照明

- 日間行車燈 (DRL)

- 方向指示器

- 頭燈

- 倒車燈

- 紅綠燈

- 尾燈

- 其他

- 汽車照明

- 二輪車

- 商用車

- 搭乘用車

- 按地區

- 亞太地區

- 歐洲

- 中東和非洲

- 北美洲

- 南美洲

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- ACUITY BRANDS, INC.

- HELLA GmbH & Co. KGaA(FORVIA)

- KOITO MANUFACTURING CO., LTD.

- LEDVANCE GmbH(MLS Co Ltd)

- Marelli Holdings Co., Ltd.

- OPPLE Lighting Co., Ltd

- OSRAM GmbH.

- Panasonic Holdings Corporation

- Signify(Philips)

- Stanley Electric Co., Ltd.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 65296

The LED Lighting Market size is estimated at 48.77 billion USD in 2025, and is expected to reach 65.13 billion USD by 2030, growing at a CAGR of 5.96% during the forecast period (2025-2030).

The increasing demand for industrial production, rising need for storage space, and increasing availability of office space drive the demand for indoor LED lighting market in the region

- In terms of value share, in 2023, industrial and warehouse (I&W) accounted for the majority of the share (49.2%), followed by commercial (31.1%), residential (17.5%), and agricultural. The market share is expected to gain in (I&W) and agricultural lighting in coming years and a small reduction in the remaining divisions. Across the globe, industries faced several internal and external headwinds during COVID-19. A large number of countries sustained their industrial production in 2021. In 2021, the United States produced a total of USD 2,497.1 billion, an increase of 11.55% compared to 2020. During the same period, the UK produced a total of USD 274.87 billion, an increase of 16.57% compared to 2020. Thus, the growing industrial production resulted in creating more need for warehouses and increasing the demand for indoor lighting in coming years.

- Government subsidies and housing schemes play a key role in the adoption of new houses in many nations. In India, the government has introduced several energy-saving programs. For example, the central government's ambitious Pradhan Mantri Awas Yojana (PMAY) program aimed to build 20 million affordable metropolitan housing units nationwide by 2022. In Calgary, Canada, under multi-units, home projects fueled 17,306 starts in 2022.

- E-commerce and the export boom have led to demand for new warehouses and other logistics infrastructure, and logistics-related building is becoming an increasingly important sector. In July 2022, Yum China Holdings Inc. commenced the construction of the Yum China Supply Chain Management Center in Shanghai's Jiading district, with an area of 61,000 square meters. Such instances are expected to drive the growth of the global indoor LED market.

Government tax policies, increase in renewable projects and investment in streetlights lead to market demand

- In terms of value and volume share, Asia-Pacific accounts for the majority of the share in 2023, and North America stands at the second spot. In APAC countries, energy saving and tax benefits are a key trend gaining popularity in the industrial and commercial LED lighting market. The Indonesian government issued a 2015 Government Regulation No. 18, a series of preferential tax policies to attract domestic and foreign investment for LED, thereby providing low-cost consumer purchases. Japan planned to implement Japan's Intended Nationally Determined Contributions (INDCs) draft to achieve at least a 50% reduction of global GHG emissions by 2050. The government encouraged citizens to proactively run NPOs and local outreach projects to raise energy-saving awareness. APAC region is increasingly investing in renewable energy projects and lighting infrastructure. In February 2023, a large-scale smart infrastructure project was initiated in Huanggang City, China, to save energy costs.

- In North America, in 2021, the United States imported approximately USD 12.5 billion worth of lighting fixtures and fittings from the rest of the world. In December 2022, 62% of builders incentivized buyers, including providing mortgage rate buy-downs for residential sales. Such a step was taken due to dropping sales activity in 2022. The sale is expected to regain its position in 2023, providing LED lighting demand significantly. Investments in connected streetlights are one of the major factors driving the market for LED lighting in the region. Numerous communities have already benefited from street and roadway lighting projects. For instance, Grand Rapids city council members approved a USD 9.46 million contract in February 2021 to upgrade all of the city's street lights to LEDs.

Global LED Lighting Market Trends

Increasing energy-efficient construction and the rise in global sales of EVs are expected to drive the growth of the market

- The world's population reached 7.89 billion people in 2021. Global employment figures reached 3.32 billion in 2022 from 3.16 billion in 2015, an increase of almost 0.13 billion. The use of LEDs is expected to increase as more knowledge is spread throughout the population as a result of the rise in the number of employed individuals.

- Despite the COVID-19 pandemic, worldwide spending on energy-efficient construction increased by an exceptional 11.4% in 2020 to over USD 184 billion, up from USD 165 billion in 2019. The yearly growth rate for investments in energy efficiency surpassed 3% for the first time since 2015. The requirement for additional rooms in a house is anticipated to result in increased demand for LEDs due to the rise in the development of energy-efficient buildings and to meet the residential needs of the expanding population.

- In 2022, there were 143.96 million automobiles produced worldwide. In 2023, that number was projected to rise to 150.92 million. Global sales of electric vehicles exceeded 10 million in 2022, and it was predicted that sales in 2023 would rise by another 35% to a total of 14 million. The market share of electric cars rose from 4% in 2020 to 14% in 2022 as a result of this quick expansion. Due to the fact that electric cars need more processors per vehicle than conventional automobiles, there has also been an increase in the need for automotive semiconductor chips as more of them are used. The rise in semiconductor demand in the automotive industry is likely to help the market for LED lighting.

The market is driven by increasing population, green buildings, and government programs to promote LED adoption

- The world's population reached 8 billion people in 2023, up from 7.79 billion in 2020. The largest countries by population included China (1.45 billion), India (1.42 billion), and the US (336.8 million). Furthermore, global employment increased to 3.32 billion people in 2022 from 3.16 billion in 2015, an increase of almost 0.13 billion people. The use of LEDs will increase as more knowledge is spread throughout the population as a result of the rise in the number of employed individuals and population growth.

- Despite the COVID-19 pandemic, worldwide spending on energy-efficient construction increased by an exceptional 11.4% in 2020 to over USD 184 billion, up from USD 165 billion in 2019. The yearly growth rate for investments in energy efficiency surpassed 3% for the first time since 2015. The requirement for additional rooms in a house will result in increased demand for LEDs due to the rise in the development of energy-efficient buildings and to meet the residential needs of the expanding population.

- Globally, launches of new houses have been rising, creating more LED penetration due to the need for illumination. For instance, in India, new launches in the Mumbai Metropolitan Region (MMR) increased over two-fold to 1,24,652 units in 2022 from 56,883 units in the previous year. Brazil's affordable housing program also restarted. The Brazilian President announced plans to restart the nationwide federal housing program for low-income individuals in February 2023. The President created the program, named "Minha Casa, Minha Vida," which translates to "My Home, My Life," in 2009. Such instances are further expected to raise the demand for LED lighting in the country.

LED Lighting Industry Overview

The LED Lighting Market is fragmented, with the top five companies occupying 31.38%. The major players in this market are ACUITY BRANDS, INC., LEDVANCE GmbH (MLS Co Ltd), OSRAM GmbH., Panasonic Holdings Corporation and Signify (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 Lighting Electricity Consumption

- 4.9 # Of Households

- 4.10 Road Networks

- 4.11 Led Penetration

- 4.12 # Of Stadiums

- 4.13 Horticulture Area

- 4.14 Regulatory Framework

- 4.14.1 Indoor Lighting

- 4.14.1.1 Argentina

- 4.14.1.2 Brazil

- 4.14.1.3 China

- 4.14.1.4 France

- 4.14.1.5 Germany

- 4.14.1.6 Gulf Cooperation Council

- 4.14.1.7 India

- 4.14.1.8 Japan

- 4.14.1.9 South Africa

- 4.14.1.10 United Kingdom

- 4.14.1.11 United States

- 4.14.2 Outdoor Lighting

- 4.14.2.1 Argentina

- 4.14.2.2 Brazil

- 4.14.2.3 China

- 4.14.2.4 France

- 4.14.2.5 Germany

- 4.14.2.6 Gulf Cooperation Council

- 4.14.2.7 India

- 4.14.2.8 Japan

- 4.14.2.9 South Africa

- 4.14.2.10 United Kingdom

- 4.14.2.11 United States

- 4.14.3 Automotive Lighting

- 4.14.3.1 Argentina

- 4.14.3.2 Brazil

- 4.14.3.3 China

- 4.14.3.4 France

- 4.14.3.5 Germany

- 4.14.3.6 Gulf Cooperation Council

- 4.14.3.7 India

- 4.14.3.8 Japan

- 4.14.3.9 South Africa

- 4.14.3.10 South Korea

- 4.14.3.11 Spain

- 4.14.3.12 United Kingdom

- 4.14.3.13 United States

- 4.14.1 Indoor Lighting

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

- 5.2 Outdoor Lighting

- 5.2.1 Public Places

- 5.2.2 Streets and Roadways

- 5.2.3 Others

- 5.3 Automotive Utility Lighting

- 5.3.1 Daytime Running Lights (DRL)

- 5.3.2 Directional Signal Lights

- 5.3.3 Headlights

- 5.3.4 Reverse Light

- 5.3.5 Stop Light

- 5.3.6 Tail Light

- 5.3.7 Others

- 5.4 Automotive Vehicle Lighting

- 5.4.1 2 Wheelers

- 5.4.2 Commercial Vehicles

- 5.4.3 Passenger Cars

- 5.5 Region

- 5.5.1 Asia-Pacific

- 5.5.2 Europe

- 5.5.3 Middle East and Africa

- 5.5.4 North America

- 5.5.5 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 HELLA GmbH & Co. KGaA (FORVIA)

- 6.4.3 KOITO MANUFACTURING CO., LTD.

- 6.4.4 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.5 Marelli Holdings Co., Ltd.

- 6.4.6 OPPLE Lighting Co., Ltd

- 6.4.7 OSRAM GmbH.

- 6.4.8 Panasonic Holdings Corporation

- 6.4.9 Signify (Philips)

- 6.4.10 Stanley Electric Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219