|

市場調查報告書

商品編碼

1692165

印度通訊平台即服務 (CPaaS) -市場佔有率分析、產業趨勢與統計、2025-2030 年成長預測India Communication Platform As A Service (CPaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

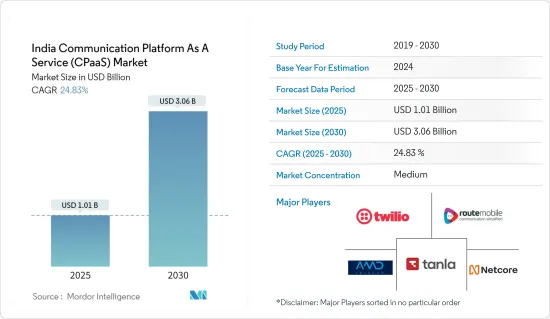

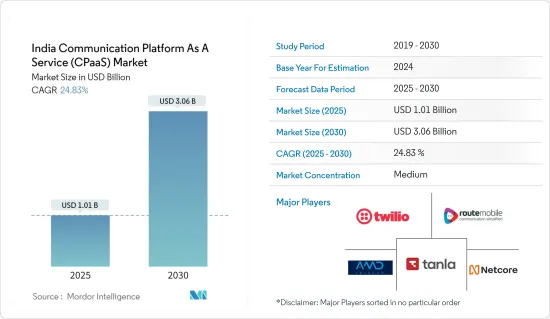

印度通訊平台即服務 (CPaaS) 市場規模預計在 2025 年為 10.1 億美元,預計到 2030 年將達到 30.6 億美元,預測期內(2025-2030 年)的複合年成長率為 24.83%。

印度 CPaaS 市場主要受到不斷成長的客戶參與、雲端加密和數位轉型的推動。 CPaaS(通訊平台即服務)是一種雲端基礎的交付架構,使企業能夠添加即時通訊功能。 CPaaS是一種雲端通訊技術,主要用於改善與客戶的溝通管道。

主要亮點

- WhatsApp Business API 和聊天機器人是兩個最熱門的 CPaaS使用案例。文字通訊、基於呼叫的幫助和基於視訊的服務都可以使用 CPaaS 整合到同一個應用程式中。由於一切都與後端相關,因此公司意識到未來的問題。此外,當客戶聯繫他們時,企業可以查看買家過去的溝通歷史,並找到問題的核心並解決問題。這當然可以提高交易效率並改善客戶體驗。

- 許多雲端基礎的API 被 CPaaS 供應商越來越頻繁地使用,因為它們具有巨大的價值。這些可作為預先打包插件或整合模組的組件提供給開發人員,使他們能夠將通訊、音訊、視訊、電子郵件和其他 OTT 整合到他們的應用程式中。該平台採用付費使用制,企業只需為其使用的服務付費。由於不需要花費大量的資金進行基礎設施建設或軟體開發,因此可以減輕您的業務資產。因此,CPaaS 在企業中越來越受歡迎。

- 技術創新具有跨多個學科的價值。智慧購物助理預計將根據用戶的瀏覽歷史提出購買提案。該軟體預計將提供準確的即時翻譯,減少對昂貴的多語言客戶支援負責人的需求。

- 該 API 據稱將提供 CPaaS 視訊聊天技術和具有臉部辨識功能的 AI,可將任何手機或網路攝影機變成生物識別安全查核點。聊天機器人的範圍和功能也將繼續擴展,以至於多家企業將能夠部署完全由機器人組成的自動化服務負責人團隊。

- 在過去的一年裡,世界溝通的方式發生了改變。永遠線上消費者正在推動期望,企業正在努力以客戶為中心的方式適應這些快速變化。靈活性、無縫連接和多通路商業通訊變得越來越重要。通訊平台即服務 (CPaaS) 產品促進了向現代數位平台的過渡,使企業能夠適應不斷變化的客戶需求。生態系統中的採用挑戰預計會阻礙市場成長。

印度CPaaS市場趨勢

中小企業顯著成長

- 印度中小企業被視為國家經濟的支柱,佔工業產出的45%、出口的40%,每年提供6,000萬個就業崗位,每年創造130萬個新就業崗位,為國內外市場生產8,000多種優質產品。

- 根據印度品牌股權基金會的數據,截至 2023 年 2 月,印度政府的 Udyam 註冊入口網站上記錄了約 1,380 萬家微企業,佔中小微型企業的 96%。其中小型企業約佔3%,中型企業約佔0.28%。總合而言,該平台擁有超過 1,400 萬家註冊的中小微型企業。

- 對於 CPaaS 供應商來說,印度龐大且快速成長的中小企業市場為其在整個生態系統中拓展業務提供了巨大的機會。 CPaaS(通訊平台即服務)是中小企業的絕佳平台,它允許公司創建、管理和使用應用程式,而無需構建和維護通訊基礎設施的麻煩。 CPaaS 包括現代客戶管理平台、冗餘和多層資料安全,讓使用者可以完全控制他們的平台。

- 印度中小企業集中在較小的城鎮,這增加了與客戶進行多語言溝通的需求。 CPaaS 讓小型企業主能夠使用不同的語言與客戶溝通,而無需花費成本或需要專業翻譯人員或翻譯工具。

- CPaaS 不僅可以幫助中小企業維護與當地現有客戶的關係,還可以使他們與印度的潛在客戶建立聯繫。隨著數位化迅速成為印度各種規模企業業務營運的關鍵部分,在雲端和人工智慧通訊解決方案的支持下,中小企業可以利用多種管道透過個人化通訊與多個市場的潛在客戶建立聯繫。 CPaaS 讓小型企業可以根據需要擴大或縮小傳播策略,使他們能夠按照自己的步調發展和成長。它減少了原本用於成長和潛在客戶開發服務的投資資金。

- 中小企業在實施技術解決方案時,投資成本至關重要。借助 CPaaS,您可以從客製化的、支援 AI 的上下文通訊平台中受益,而無需投資新的基礎設施。一旦您擁有該應用程式,您就可以輕鬆地透過 API 將其整合到這些系統和其他系統中。 CPaaScan 可將行銷計畫的投資收益(ROI) 提高高達 25%,同時將中小企業的參與成本降低 30%。

零售和電子商務預計將佔據較大的市場佔有率

- 印度現在是一個以行動為優先的經濟體,行動和數位技術的快速應用正在改變消費者參與度和品牌互動。消費者要求更好的端到端客製化體驗和更多的選擇。 52% 的客戶希望每項優惠都是個人化的。企業正在轉向對話商務和其他技術來跟上消費者需求的變化,尤其是與尖端人工智慧 (AI) 演算法相結合時。

- 對話式商務的需求也可以透過觀察客戶在購買過程中使用聊天機器人的意願來衡量。一項調查發現,在使用零售聊天機器人進行購買的 15% 的客戶中,81% 表示他們會再次使用該服務。但創建易於與 SaaS 解決方案結合的 CPaaS 功能可能會帶來對話商務的成功。

- 預計到 2022 年,印度電子商務產業將成長 21.5%,達到 748 億美元。近年來,數位素養的提高導致對電子商務企業的投資激增,為新參與企業建立基礎創造了公平的競爭環境,並創造了挑戰現有行為的新模式。印度 CPaaS 市場因零售和電子商務投資的增加而進一步發展。

- 此外,疫情也改變了零售業,導致商店不幸關閉,並對店內體驗的未來產生不確定性。零售商最初陷入困境,但最終轉向以先進、高效的方式為客戶提供服務。數位優先和全通路體驗已成為所有企業(無論大小)的必需品。該行業轉向 CPaaS 以獲得基於電子郵件的歡迎程序、更聰明的基於語音的 IVR 和客戶服務解決方案以及傳統的 SMS舉措。

- 根據全球農業資訊網路的數據,2022 年印度擁有約 1,300 萬家雜貨零售店。此類別包括傳統零售商和新興零售商。自2013年以來,數量不斷成長,但主要由傳統商店組成。零售店的增加增加了研究市場的需求,零售商可以發送有關產品折扣率和季節性銷售的訊息。

印度 CPaaS(通訊平台即服務)產業概況

印度通訊平台即服務 (CPaaS) 市場較分散,主要參與者包括 Twilio Inc.、Tanla、Route Mobile、AMD Telecom (Routee) 和 Netcore Cloud。該市場中的公司正在採用夥伴關係、合併、創新、投資和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2023 年 1 月,Telnyx LLC 推出了其新的通訊傳遞儀表板。該服務允許客戶透過儀表板即時追蹤交付能力。如果客戶想要的產品已經送達、未送達或正在運送中,系統會提醒客戶。此功能更新的目的是鼓勵更多新企業使用該公司的服務。

- 2022 年 12 月:行動應用程式對話平台供應商 Sendbird Inc. 開始提供定時訊息和投票工具,以使應用程式內聊天用戶和企業之間的互動更加成功。預定訊息允許使用者選擇傳遞訊息的最佳時間。您可以發送提醒、行動訊息和觸發完美定時通訊的活動。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 評估新冠疫情對市場的影響

第5章市場動態

- 市場促進因素

- 為最大限度地減少資本支出,對計量收費模式的需求不斷增加

- 與 UCaaS 等其他鄰近模型相比,基於 CPaaS 的解決方案的採用率呈指數級成長

- 對低程式碼支援的需求不斷成長,以使 CPaaS 能夠高度用於客戶營運、服務和行銷

- 市場限制

- 實施挑戰

- 產業生態系統分析

- 純粹的CPaaS

- 企業級 CPaaS

- 通訊業者主導的CPaaS

- 基於服務供應商的CPaaS

- 主要趨勢

- 透過自動呼叫和簡訊簡化您的收款流程

- 無伺服器部署

- 機器學習和人工智慧的興起

- 與機器人進行全通路溝通

- 安全和隱私範例

- 定價和經營模式分析

第6章市場區隔

- 按組織規模

- 中小企業

- 大型企業

- 按最終用戶產業

- 資訊科技/通訊

- BFSI

- 零售與電子商務

- 衛生保健

- 其他最終用戶產業

第7章競爭格局

- 公司簡介

- Twilio Inc.

- Tanla

- Route Mobile

- AMD Telecom(Routee)

- Netcore Cloud

- Telnyx LLC

- ACL Mobile Limited(Sinch)

- Sendbird Inc.

- Gupshup Inc.

- MessageBird Inc.

- Infobip Ltd

- Plvio Inc.

第8章:未來展望

The India Communication Platform As A Service Market size is estimated at USD 1.01 billion in 2025, and is expected to reach USD 3.06 billion by 2030, at a CAGR of 24.83% during the forecast period (2025-2030).

The Indian CPaaS market is driven primarily by increased digital customer engagement, cloud encryption, and digital transformation. A communication platform as a service (CPaaS) is a cloud-based delivery architecture that enables businesses to add real-time communication capabilities. CPaaS, a cloud communication technology, is primarily used to improve customer communication channels.

Key Highlights

- The WhatsApp Business API and chatbots are the most visible CPaaS use cases. Text messaging, call-based help, and video-based services can all be integrated into the same application with CPaaS. The company is aware of future issues as everything is linked in the back end. The company is also aware of the buyer's previous communication history when a client contacts the firm and can even get to the heart of a problem and solve it. This, of course, increases the efficiency of transactions and can improve the customer experience.

- Numerous cloud-based APIs are used more frequently by CPaaS providers since they offer tremendous value. These are made available to developers as pre-packaged plugins or as a component of integration modules so they can integrate messaging, audio, video, email, and other OTT into their applications. This platform uses a pay-as-you-go system for ads, allowing companies to only pay for the services they utilize. As there is no significant expenditure needed to create an infrastructure or develop software, it makes the business asset lighter. As a result, CPaaS is becoming more and more popular among enterprises.

- Technological innovations carry a value that works in multiple sectors. Smart shopping assistants are expected to be better at making purchase suggestions based on the user's browsing history. The software would provide accurate, real-time translations, reducing the need for expensive multilingual customer support representatives.

- APIs would provide CPaaS video chat technology and AI capable of facial recognition to turn any phone or webcam into a biometric security checkpoint. Chatbots would also continue to grow in scope and capacity, allowing multiple businesses to deploy teams of automated service reps made entirely of bots.

- Over the past year, global communication has changed. Always-on consumers drive expectations, and businesses work harder to adapt to these rapid changes in a customer-centric manner. Flexibility, seamless connectivity, and multichannel commercial communication are becoming increasingly important. The transition to a contemporary digital platform is fueled by communications-platform-as-a-service (CPaaS) services, allowing businesses to adapt to changing client needs. Implementation challenges in the ecosystem are expected to hinder the market growth.

CPAAS in India Market Trends

SMEs to Witness Significant Growth

- The SME sector in India is recognized as the foundation of the country's economy, accounting for 45% of industrial output, 40% of exports, 60 million jobs annually, 1.3 million new jobs annually, and the production of more than 8000 high-quality goods for domestic and international markets.

- According to India Brand Equity Foundation, By February 2023, nearly 13.8 million micro-enterprises had been recorded on the Indian government's Udyam registration portal, constituting 96 percent of the MSME sector. Around 3 percent of small enterprises and 0.28 percent of medium enterprises were occupied. More than 14 million MSMEs were registered on the platform in total.

- For CPaaS providers, the enormous and rapidly expanding market for SMEs in India offers a significant chance to expand their operations across the ecosystem. A fantastic platform for SMEs is CPaaS (Communication Platform as a Service), which enables businesses to create, manage, and use applications without dealing with the hassle of setting up and maintaining communication infrastructure. It includes a modern customer management platform, redundancy, and multi-layer data security, allowing users complete control over the platform.

- Due to the concentration of Indian MSMEs in smaller towns and cities, there is an increased requirement for multilingual communication with their clients. With the help of CPaaS, small business owners can communicate with their clients in various languages without the expense or requirement for specialized translators or translation tools.

- In addition to assisting MSMEs in maintaining relationships with their current clients in their local areas, CPaaS also enables them to connect with potential clients in India. Cloud and AI-enabled communication solutions allow MSMEs to connect with potential clients in multiple markets with personalized messaging, utilizing numerous channels since digital is rapidly becoming a significant component of business operations for enterprises of all sizes in India. MSMEs may scale their communications strategies up or down as necessary with CPaaS, allowing them to develop and expand at their rate. The investment money that would have been spent on growth and lead-generating services is reduced.

- The investment cost is crucial for SMEs when deploying any technology solution. They can profit from a customized, AI-enabled contextual communications platform with CPaaSwithout investing capital in new infrastructure. If they have any apps, they can easily incorporate them into those and other systems via APIs. CPaaScan increases marketing initiatives' return on investment (ROI) by up to 25% while lowering the cost of engagement for MSMEs by 30%.

Retail and E-commerce is Expected to Hold Significant Market Share

- India is now a mobile-first economy, and rapid mobile and digital adoption have altered consumer engagement and brand interactions. They demand better end-to-end tailored experiences along with more options to pick from. Customers expect all offers to be individualized, according to ~52% of them. Organizations have been utilizing conversational commerce and other technologies to keep up with these shifting consumer demands, particularly when integrated with cutting-edge artificial intelligence (AI) algorithms.

- The requirement for conversational commerce may also be measured by looking at how willing customers are to use chatbots in their purchasing trips. The research found that 81% of the 15% of customers who used a retail chatbot to make purchases stated they would do it again. However, creating CPaaS capabilities that are simple to combine with SaaS solutions may help conversational commerce succeed.

- The Indian e-commerce sector is expected to grow by 21.5% and reach USD 74.8 billion in 2022. The recent increase in digital literacy has resulted in a surge of investment in e-commerce businesses, leveling the playing field for new companies to establish their bases and generating novel patterns to challenge established behavior. The CPaaS market in India is further fueled by increased investment in retail and e-commerce.

- Moreover, the pandemic altered the retail sector, resulting in regrettable store closures and anxiety regarding the future of the in-store experience. Retailers struggled initially but eventually changed course to serve clients through cutting-edge methods efficiently. For all players, big or small, digital-first and omnichannel experiences have become a need. The industry turned to CPaaS for welcome email-based programs, more intelligent voice-based IVR and customer service solutions, and conventional SMS initiatives.

- According to Global Agriculture Information Network, in 2022, there were around 13 million retail grocery stores in India. Within the category, this encompassed traditional and new retailers. While there has been a constant growth in numbers since 2013, it primarily comprises traditional stores. The rise in the retail stores would increase the demand for the studied market, and the retailers may send the product discount rate and any seasonal sales through messages.

CPAAS in India Industry Overview

The India Communications Platform-as-a-Service (CPaaS) Market is moderately fragmented, with major players like Twilio Inc., Tanla, Route Mobile, AMD Telecom (Routee), and Netcore Cloud, among others. Players in the market are adopting strategies such as partnerships, mergers, innovations, investments, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- January 2023: Telnyx LLC launched a new messaging deliverability dashboard. With this service, customers can track real-time deliverability through the dashboard. The customer gets an alert about whether the desired product is delivered, not delivered, or is in flight. The updated feature launch is to attract more new businesses to opt for the company's services.

- December 2022: Sendbird Inc., a provider of mobile app conversation platforms, launched scheduled messages and poll tools to encourage more successful interactions between in-app chat users and businesses. Scheduled messages allow users to choose the best time to deliver their message. They can transmit reminders, operational messages, and activities triggered by perfectly timed communications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for the Pay-per-use Model to Minimize Capital Spending

- 5.1.2 Exponential Increase in the Uptake of CPaaS Based Solutions over other Adjacent Models, such as UCaaS

- 5.1.3 Growing Demand for Low Code Enablement to Make Enterprises CPaaS Highly Usable for Customer Operations, Service and Marketing

- 5.2 Market Restraints

- 5.2.1 Implementation Challenges

- 5.3 Industry Ecosystem Analysis

- 5.3.1 Pure-Play CPaaS

- 5.3.2 Enterprise-Grade CPaaS

- 5.3.3 Telco-Driven CPaaS

- 5.3.4 Service Provider-Based CPaaS

- 5.4 Key Trends

- 5.4.1 Streamlining of Payment Collection Process with Automated Calls and Texts

- 5.4.2 Serverless Deployments

- 5.4.3 Advent of Machine Learning and AI

- 5.4.4 Omnichannel Communication through Bots

- 5.4.5 Security and Privacy Paradigm

- 5.5 Analysis of Pricing and Business Model

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 Small and Medium Enterprises

- 6.1.2 Large Enterprises

- 6.2 By End-user Industry

- 6.2.1 IT and Telecom

- 6.2.2 BFSI

- 6.2.3 Retail and E-commerce

- 6.2.4 Healthcare

- 6.2.5 Other End-user Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Twilio Inc.

- 7.1.2 Tanla

- 7.1.3 Route Mobile

- 7.1.4 AMD Telecom (Routee)

- 7.1.5 Netcore Cloud

- 7.1.6 Telnyx LLC

- 7.1.7 ACL Mobile Limited (Sinch)

- 7.1.8 Sendbird Inc.

- 7.1.9 Gupshup Inc.

- 7.1.10 MessageBird Inc.

- 7.1.11 Infobip Ltd

- 7.1.12 Plvio Inc.