|

市場調查報告書

商品編碼

1692162

亞太LED照明:市場佔有率分析、產業趨勢與成長預測(2025-2030年)Asia Pacific LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

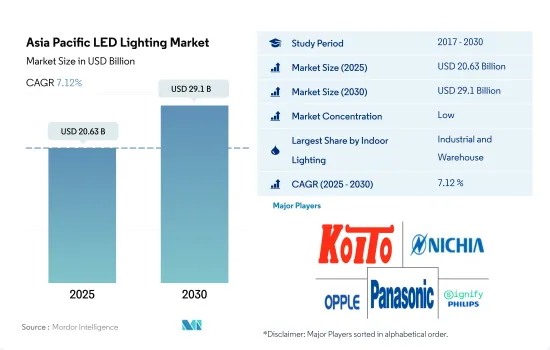

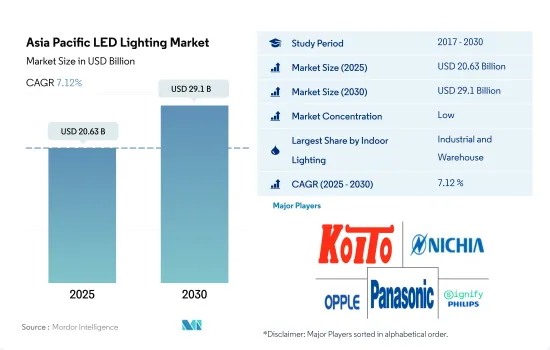

亞太地區 LED 照明市場規模預計在 2025 年為 206.3 億美元,預計到 2030 年將達到 291 億美元,預測期內(2025-2030 年)的複合年成長率為 7.12%。

工業和住宅領域的不斷發展正在推動市場成長

- 從價值佔有率來看,2023年工業和倉儲將佔據大部分佔有率。截至2022年,中國是世界第二大經濟體。新冠疫情前,中國倉庫空間成本平均為每月每平方公尺44.3 元人民幣(6.15 美元)。疫情過後,中國對倉庫的需求穩定成長,推高了倉庫租金成本。預計未來五年中國倉儲產業收益將以每年4.3%的速度成長。

- 同樣,在印度,製造業在疫情爆發前創造了印度 GDP 的 16-17%,預計將成為成長最快的產業之一。印度工業和倉儲業報告強勁吸收量,約 1,100 萬平方英尺,其中一線城市佔據 77% 的需求。由於這些因素,預計 LED 的廣泛需求將會增加。

- 從銷售佔有率來看,到2023年,住宅將佔據大部分市場佔有率。過去三十年,亞洲經歷了高速都市化。快速都市化推動了經濟成長,但也帶來了巨大的住宅需求,導致住宅飆升。在日本,由於政府為因應人口減少而推出的住宅政策,到2023年很有可能出現1,000萬套房屋的供應過剩。 2023年,家庭數量將達到高峰5,419萬戶。這些因素正在推動LED的需求。

- 政府補貼在引進新住宅發揮了重要作用。在印度,政府已經推出了多項節能計劃。例如,中央政府雄心勃勃的 PMAY(Pradhan Mantri Awas Yojana)計劃旨在到 2022 年在全國建造 2000 萬套經濟適用住宅。這些因素可能會導致大規模銷售並增加未來對 LED 的需求。

各國房地產基礎建設、汽車領域需求旺盛,推動市場需求

- 就2023年的價值和數量佔有率而言,中國將佔據最大佔有率,其次是印度。中國是一個住房大國,90%以上的家庭擁有自己的住房。同時,超過20%的中國家庭擁有一套以上的住宅,這一比例高於許多已開發國家。此類統計數據可能會刺激對 LED 照明的需求。

- 2021年,中國汽車總產值超過10兆元(1.4兆美元),對中國GDP的貢獻率接近10%。汽車市場的強勁成長得益於政策獎勵、資金支持以及消費者需求的不斷成長。 2022年5月,中國公佈了促進新能源汽車農村銷售的政策。

- 預計 2022 年印度企業將透過基礎設施和房地產投資信託籌集超過 3.5 兆印度盧比。 2020 年 7 月至 2020 年 12 月期間,前八大城市的辦公大樓市場交易量達 2,220 萬平方英尺。印度目前正在進行價值 1.3 兆美元的大規模基礎設施和工業計劃。這些發展正在推動對 LED 照明的需求。

- 印度汽車工業對印度GDP的貢獻率接近6.4%。截至 2019 年,馬哈拉斯特拉邦、古吉拉突邦、德里和卡納塔克邦等人均收入較高的邦的汽車銷量萎縮速度快於行業平均水平。計程車聚合商和乘用車車主的飽和度不斷上升,正在阻礙汽車銷售的成長。截至2019年10月,LED在尾燈的滲透率超過40%,但在前燈的滲透率不足15%。隨著汽車銷量的成長,LED尾燈和前燈的佔有率預計將大幅成長。

亞太LED照明市場趨勢

住宅建設和銷售的成長推動了LED市場的成長

- 亞太地區是全球60%人口的居住區。該地區許多國家,特別是中國,人口成長率均名列前十名。在中國社會經濟底層,截至2019年,超過60%的居民擁有自己的房屋。與大城市的居民相比,擁有率相當高。在二、三線城市和城鎮,41%的屋主沒有房屋抵押貸款。 LED 使用量的增加可能是由於中國住宅購買量的增加。此外,印度已經證明,透過公司推動的宣傳活動, LED 技術可以快速且廣泛地應用。

- 隨著本土和移民人口的快速成長,其他國家的建設產業也蓬勃發展。例如,印尼的住宅在 2017 年成長了 5%,2019 年成長了 1%,由於該國人口不斷成長,預計這一趨勢將在整個預測期內持續下去。因此,亞太地區建築業的快速擴張將增加該地區市場對LED的需求。

- 截至2021年,中國是亞太地區家庭數量最多的國家,家庭總數超過4.497億戶。此外,印度、印尼和日本分別擁有2.951億戶、6,890萬戶和4,850萬戶家庭。這些國家的家庭數量正在穩步增加,這表明亞太地區正在建造更多的住宅,從而增加了對 LED 的需求。 2022年亞太地區售出的3,750萬輛乘用車中,超過2,360萬輛來自中國。相比之下,2021 年亞太地區的乘用車銷量約為 3,457 萬輛。該地區對 LED 的需求將受到亞太地區汽車銷售成長的推動。

人口成長、人均所得提高和政府補貼推動LED市場

- 亞太地區人口約 47 億,佔全球總人口的 59.7%,其中包括中國、印度等世界人口最多的國家,其中 46.3% 的人口居住在城市(2019 年為 21.4 億)。該全部區域生育率接近每名婦女2.1個孩子。東亞的家庭規模已降至每名婦女1.7人,但南亞仍維持在每名婦女2.5人的高位。此外,該地區五分之二的人口目前居住在都市區。隨著數以百萬計的人口從農村遷移到城鎮尋找就業和更好的機會,這一比例在未來幾年將大幅增加。因此,預計都市區家庭數量的增加將推動該地區採用 LED 來滿足照明需求。

- 該地區包括幾個新興國家,儘管受到疫情影響,但發展中國家的可支配收入仍在成長。 2022 年 12 月,中國的人均收入達到 12,732.5 美元,而 2021 年 12 月為 12,615.7 美元。 2022 年 3 月,印度的人均收入為 2,301.4 美元,而 2021 年 3 月為 1,971.6 美元。 2022 年 12 月,日本的人均收入達到 33,911.2 美元,而 2021 年 12 月為 39,916.1 美元。這將提高個人的消費能力,從而將更多資金投入新的居住空間。在住宅照明領域,中國政府於2012年提供了22億元人民幣(3.1億美元)的LED照明補貼。 2010年4月,日本政府推出了名為「生態積分」的消費者回饋計畫。用戶可以使用其生態積分以二比一的比例購買LED燈,預計將進一步刺激對LED照明的需求。

亞太LED照明產業概況

亞太地區LED照明市場較為分散,五大主要企業佔26.83%的市佔率。市場的主要企業有:小糸製作所、日亞化學株式會社、歐普照明、松下控股株式會社和 Signify Holding(飛利浦)(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 汽車產量

- 人口

- 人均收入

- 汽車貸款利率

- 充電站數量

- 道路上的汽車數量

- LED進口總量

- 照明功耗

- #家庭數量

- 道路網路

- LED滲透率

- #體育場數量

- 園藝區

- 法律規範

- 室內照明

- 中國

- 印度

- 日本

- 戶外照明

- 中國

- 印度

- 日本

- 汽車照明

- 中國

- 印度

- 日本

- 韓國

- 室內照明

- 價值鍊和通路分析

第5章市場區隔

- 室內照明

- 農業照明

- 商業照明

- 辦公室

- 零售

- 其他

- 工業/倉庫

- 住宅照明

- 戶外照明

- 公共設施

- 路

- 其他

- 汽車實用照明

- 日間行車燈 (DRL)

- 方向指示器

- 頭燈

- 倒車燈

- 紅綠燈

- 尾燈

- 其他

- 汽車照明

- 二輪車

- 商用車

- 搭乘用車

- 國家

- 中國

- 印度

- 日本

- 其他亞太地區

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- EGLO Leuchten GmbH

- GRUPO ANTOLIN IRAUSA, SA

- KOITO MANUFACTURING CO., LTD.

- Marelli Holdings Co., Ltd.

- Nichia Corporation

- OPPLE Lighting Co., Ltd

- OSRAM GmbH.

- Panasonic Holdings Corporation

- Signify Holding(Philips)

- Stanley Electric Co., Ltd.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 91026

The Asia Pacific LED Lighting Market size is estimated at 20.63 billion USD in 2025, and is expected to reach 29.1 billion USD by 2030, growing at a CAGR of 7.12% during the forecast period (2025-2030).

Increasing development in the industrial sector and residential sector drives the market growth

- In terms of value share, in 2023, industrial and warehouse accounts for most of the share. China is the second-largest economy in the world as of 2022. Warehouse space in China cost an average of CNY 44.3 (USD 6.15) per square meter per month during pre-COVID-19. In China, there has been a steady rise in the demand for warehouses, raising the cost of renting them post-pandemic. Revenue for the storage industry in China is expected to increase at an annualized 4.3% over the five years.

- Similarly, in India, manufacturing generated 16-17% of India's GDP before the pandemic and is expected to be one of the fastest-growing sectors. India's industrial and warehousing sector reported a nearly 11 million square feet robust absorption, with tier-I cities driving 77% of the demand. Such factors are expected to increase the LED penetration demand.

- In terms of volume share, in 2023, residential accounts for most of the share. Over the past three decades, Asia experienced a high urbanization rate. While rapid urbanization helped to fuel economic growth, it has led to major demand for housing, resulting in high housing prices. Japan will likely see an excess supply of 10 million dwelling units in 2023, partly due to government housing policy with a shrinking population. The number of households will peak at 54.19 million in 2023. Such a factor caters to a major LED demand.

- Government subsidy plays a major role in the adoption of new housing. In India, the government has introduced several energy-saving programs. For example, the central government's ambitious Pradhan Mantri Awas Yojana (PMAY) program aims to build 20 million affordable metropolitan housing units nationwide by 2022. Such factors might lead to major sales, leading to more LED demand in the coming period.

Increase in development in real estate infrastructure and strong demand in automotive sector in various countries increase the market demand

- In terms of value and volume share, in 2023, China comprised most of the share, and India stood second. China is a country of homeowners, with more than 90% of households owning homes. At the same time, more than 20% of Chinese households own multiple homes, higher than many developed nations. Such stats may propel the demand for LED lighting.

- China's automobile gross output was more than CNY 10 trillion (USD 1.4 trillion) in 2021, contributing to almost 10% of China's GDP. The strong growth of the automotive market can be attributed to policy incentives, capital support, and increasing consumer demand. In May 2022, China released a policy to boost new energy vehicle (NEV) sales in rural parts.

- Indian firms were expected to raise more than INR 3.5 trillion through infrastructure and real estate investment trusts in 2022. The office market in the top eight cities recorded transactions of 22.2 msf from July 2020 to December 2020. In 2022, office absorption in the top seven cities stood at 38.25 million sq. ft. Currently, India is undertaking major infrastructure and industrial projects worth USD 1.3 trillion. Such development fuels the demand for LED lighting.

- The Indian automobile industry contributes almost 6.4% to India's GDP. As of 2019, vehicle sales in higher per capita income states such as Maharashtra, Gujarat, Delhi, and Karnataka were shrinking faster than the industry average. Taxi aggregators and rising saturation among passenger car owners have hit vehicle sales growth. As of October 2019, LEDs gained more than 40% penetration in tail lamps, but they accounted for less than 15% of the share in headlamps. With increasing vehicle sales, the shares of tail lamps and headlamp LEDs are expected to increase significantly.

Asia Pacific LED Lighting Market Trends

Increase in construction and sales of residential houses to drive the growth of the LED market

- Asia-Pacific is home to 60% of the world's population. Numerous nations in the region, notably China, are in the top ten in terms of population growth. In China's lower socioeconomic strata, as of 2019, more than 60% of residents were homeowners. In comparison to citizens of big cities, the ownership rate was substantially greater. In lower-tier cities and towns, 41% of homeowners did not have a mortgage on their home. The increased use of LEDs may be influenced by the rise in home purchases in China. Moreover, India has shown that it is possible to install LED technology quickly and extensively via campaigns promoted by the companies.

- The other nations' construction industries are prospering as their native and immigrant populations both grow quickly. For instance, the volume of residential buildings climbed by 5% in Indonesia in 2017 and by 1% in 2019, and this trend will continue throughout the forecast period due to the countries' growing populations. As a result, the rapidly expanding building sector in Asia-Pacific will increase the demand for LEDs in the regional market.

- China had the most households in Asia-Pacific as of 2021, with a total of over 449.7 million. In addition, there are 295.1 million, 68.9 million, and 48.5 million households in India, Indonesia, and Japan, respectively. There is a steady rise in the number of households in these nations, which suggests that more homes are being built and that the demand for LEDs in the Asia-Pacific is rising. Over 23.6 million of the 37.5 million passenger cars sold in 2022 in Asia-Pacific were in China. Comparatively, Asia-Pacific sold about 34.57 million passenger cars in 2021. The demand for LEDs in the region will be aided by the rise in automotive vehicle sales in Asia-Pacific.

The LED market is driven by increasing population, rising per capita income, and government subsidies

- Asia-Pacific is home to 59.7% of the world's population, which is around 4.7 billion people, and includes the world's most populous countries, such as China and India, and 46.3 % of the population is urban (2.14 billion people in 2019). The region's overall fertility rate is close to 2.1 births per woman. Family size has decreased to 1.7 children per woman in East Asia while maintaining a high of 2.5 children per woman in South Asia. Further, two out of every five people in the region currently live in urban areas. This ratio will increase significantly in the coming years as millions move from the countryside to towns and cities in search of employment and better opportunities. Thus, the increase in the number of households in urban areas is expected to create more LED penetration for need for illumination in region.

- This region includes several developing nations, and despite pandemic, disposable income is growing in developing countries. China's per capita income reached USD 12,732.5 in December 2022, compared to USD 12,615.7 in December 2021. India's per capita income reached USD 2301.4 in March 2022, compared to USD 1971.6 in March 2021. Japan's per capita income reached USD 33,911.2 in December 2022, compared to USD 39,916.1 in December 2021. Such instances result in the rising spending power of individuals and affording more money for new residential spaces. For households, in 2012, the Chinese government offered a subsidy of CNY 2.2 billion (USD 0.31 billion) for the use LEDs. The Japanese government introduced a consumer rebate program known as the "Eco-Point" program in April 2010. Users may use their Eco-Points to purchase LED lamps at a 2 to 1 Eco-point ratio, which is further expected to surge the demand for LED lighting.

Asia Pacific LED Lighting Industry Overview

The Asia Pacific LED Lighting Market is fragmented, with the top five companies occupying 26.83%. The major players in this market are KOITO MANUFACTURING CO., LTD., Nichia Corporation, OPPLE Lighting Co., Ltd, Panasonic Holdings Corporation and Signify Holding (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 Lighting Electricity Consumption

- 4.9 # Of Households

- 4.10 Road Networks

- 4.11 Led Penetration

- 4.12 # Of Stadiums

- 4.13 Horticulture Area

- 4.14 Regulatory Framework

- 4.14.1 Indoor Lighting

- 4.14.1.1 China

- 4.14.1.2 India

- 4.14.1.3 Japan

- 4.14.2 Outdoor Lighting

- 4.14.2.1 China

- 4.14.2.2 India

- 4.14.2.3 Japan

- 4.14.3 Automotive Lighting

- 4.14.3.1 China

- 4.14.3.2 India

- 4.14.3.3 Japan

- 4.14.3.4 South Korea

- 4.14.1 Indoor Lighting

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

- 5.2 Outdoor Lighting

- 5.2.1 Public Places

- 5.2.2 Streets and Roadways

- 5.2.3 Others

- 5.3 Automotive Utility Lighting

- 5.3.1 Daytime Running Lights (DRL)

- 5.3.2 Directional Signal Lights

- 5.3.3 Headlights

- 5.3.4 Reverse Light

- 5.3.5 Stop Light

- 5.3.6 Tail Light

- 5.3.7 Others

- 5.4 Automotive Vehicle Lighting

- 5.4.1 2 Wheelers

- 5.4.2 Commercial Vehicles

- 5.4.3 Passenger Cars

- 5.5 Country

- 5.5.1 China

- 5.5.2 India

- 5.5.3 Japan

- 5.5.4 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 EGLO Leuchten GmbH

- 6.4.2 GRUPO ANTOLIN IRAUSA, S.A.

- 6.4.3 KOITO MANUFACTURING CO., LTD.

- 6.4.4 Marelli Holdings Co., Ltd.

- 6.4.5 Nichia Corporation

- 6.4.6 OPPLE Lighting Co., Ltd

- 6.4.7 OSRAM GmbH.

- 6.4.8 Panasonic Holdings Corporation

- 6.4.9 Signify Holding (Philips)

- 6.4.10 Stanley Electric Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219