|

市場調查報告書

商品編碼

1692136

日本電動車充電站:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Japan EV Charging Station - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

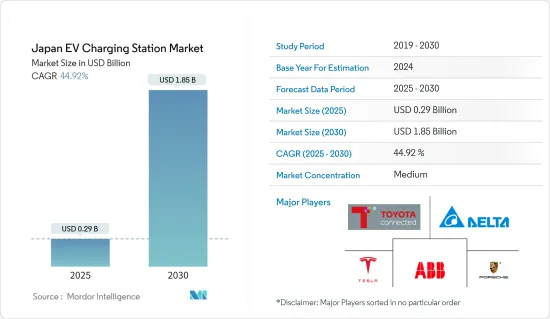

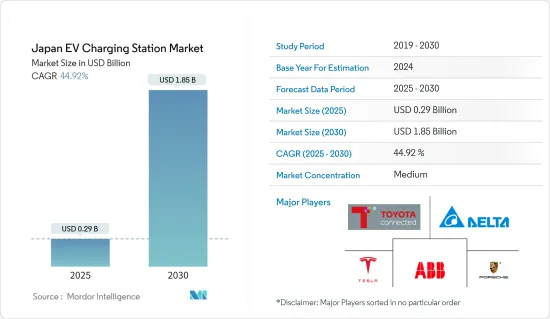

日本電動車充電站市場規模預計在 2025 年為 2.9 億美元,預計到 2030 年將達到 18.5 億美元,預測期內(2025-2030 年)的複合年成長率為 44.92%。

日本的電動車充電站市場呈現快速成長和不斷發展的態勢。隨著電動車(EV)在日本越來越受歡迎,對充電基礎設施的需求也迅速增加。

這種需求受到多種因素的推動,包括政府推廣清潔能源和減少碳排放的努力。日本承諾在2050年實現碳中和,進一步凸顯了強大的電動車充電基礎設施的重要性。

該市場的特點是參與者種類繁多,包括老牌能源公司、汽車製造商和專門從事充電解決方案的新興企業。這些公司正在積極投資擴大全國各地的充電站,以滿足日益成長的電動車用戶數量。

此外,各相關人員之間的夥伴關係和協作日益普遍,以加速充電網路的擴張。為了解決消費者對充電時間和便利性的擔憂,人們越來越重視開發快速充電技術。快速充電站可以快速為電動車電池充滿電,在市中心和主要高速公路沿線越來越普遍。

此外,物聯網和人工智慧等先進技術支援的智慧充電解決方案的出現正在改變電動車的充電方式。這些解決方案具有充電計劃最佳化、遠端監控和收費整合、增強用戶體驗和電網管理等優勢。

但挑戰依然存在,包括標準化充電通訊協定、不同充電網路之間的互通性以及解決電網容量和穩定性問題。克服這些挑戰對於日本電動車充電站市場的永續成長至關重要。

儘管存在這些障礙,但政府的支持性政策、技術進步以及人們對電動車環境效益的認知不斷提高使得市場前景光明。

日本電動車充電站市場趨勢

直流充電站佔據市場主導地位

日本雄心勃勃的電氣化目標,加上電動車的快速普及,正在推動對高效、快速充電解決方案的需求。直流充電站已成為首選,因為與交流充電站相比,直流充電站的充電時間明顯更快。

直流充電站的興起源自於多種因素。首先,它對CHAdeMO和CCS(聯合充電系統)等快速充電通訊協定的支持滿足了電動車製造商和消費者的偏好。這些通訊協定有助於電動車電池的快速充電,為駕駛員提供便利並最大限度地減少停機時間。

此外,日本的地理位置,包括人口稠密的都市區和廣泛的高速公路網路,需要部署能夠適應遠距旅行的充電基礎設施。直流充電站通常策略性地設置在高速公路沿線和城市中心,為電動車車主提供快速、可靠的充電選擇,從而滿足這一需求。

此外,直流充電技術的進步和創新對於增強市場主導地位發揮著至關重要的作用。能夠提供超過 350kW 功率的超快速充電器等下一代充電解決方案的開發表明了該行業致力於提高充電效率和用戶體驗。

此外,政府機構、能源公司、汽車製造商和充電基礎設施供應商之間的合作與夥伴關係促進了日本各地直流充電站的廣泛部署。這些合作努力有助於擴大充電網路,使全國各地的電動車車主能夠更方便地使用充電網路。

儘管直流充電站越來越受歡迎,但仍存在一些挑戰,例如充電通訊協定的標準化、不同網路之間的互通性以及電網的容量限制。解決這些挑戰對於將直流充電基礎設施無縫整合到日本不斷發展的行動生態系統至關重要。

憑藉提供快速、高效充電解決方案的能力,直流充電站將繼續處於日本電氣化進程的前沿,並推動電動車充電基礎設施產業的持續成長和創新。

家庭充電推動主要市場成長

公共充電站比家庭充電設施有幾個優點。首先,它滿足了無法使用專用停車場或家庭充電設施的電動車車主的需求,這種情況在人口稠密、住宅空間有限的都市區很常見。

2022年,日本城鎮人口預計將略有減少,為115,058,684人,與前一年同期比較下降0.35%。

此外,公共充電站為電動車車主提供了更大的靈活性和便利性,尤其是在遠距旅行或長期外出時。它提供了一種可靠的選擇,可以在您跑腿、外出用餐或享受休閒時為您的電動車電池充電,而無需回家充電。

公共充電基礎設施之所以受到關注,部分原因是充電站策略性地分佈在主要高速公路和交通網路沿線。這些策略性佈局的充電站將為遠距旅行提供便利,解決駕駛者對里程焦慮的擔憂,並鼓勵更多人使用電動車進行城際旅行。

此外,日本公共充電網路的擴張得到了政府機構、能源公司、汽車製造商和充電基礎設施供應商之間合作的支持。這些夥伴關係已導致在全國範圍內部署充電基礎設施和提高可及性和覆蓋率方面的大量投資。

然而,儘管公共充電站佔據主導地位,但家庭充電仍然是整個充電生態系統的關鍵組成部分。家庭充電提供了夜間充電的便利,讓電動車車主每天都可以在充滿電的情況下開始新的一天,而無需前往公共充電站。

此外,家庭充電解決方案可能會受到電動車車主的青睞,因為它們具有成本效益,並且可以利用非尖峰電費。家用充電器也讓電動車車主感到掌控自如、安心無憂,因為他們可以直接存取充電基礎設施,並且可以在自己舒適的家中監控充電進展。

因此,雖然日本的電動車充電站市場以公共充電基礎設施為主,但家庭充電解決方案在支援電動車車主的充電需求方面仍發揮著重要作用。公共和家庭充電選項的共存反映了日本不斷發展的電動車生態系統的多樣化偏好和要求。

日本電動車充電站產業概況

日本的電動車充電站市場相當集中,大部分市場佔有率僅由少數幾家公司佔據。市場的主要企業包括 ABB、Delta電子和豐田。主要企業正與其他企業推出合資企業,開發尖端技術。例如

- 日本將於 2023 年 10 月在東京附近的柏葉啟動電動車 (EV)先導計畫,重點評估無線充電技術。這是東京大學、千葉大學以及Bridgestone、三井不動產、羅姆、NSK等9家知名公司共同參與的計劃。

- 該舉措旨在推動創新「運動動力系統」的發展。該系統旨在為通過路口的電動車提供無線充電。值得注意的是,預計僅需 10 秒的充電就能為典型的電動車提供 0.6 英里的行駛里程。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 日本政府的支持政策和獎勵推動市場成長

- 市場限制

- 預計部署和維護充電站的高額前期成本將抑制市場成長

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 充電類型

- 交流充電

- 直流充電

- 最終用途

- 家庭充電

- 公共充電

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- Charge Point Operators

- Toyota Connected Corporation(Toyota Motor Corporation)

- Tesla Motors Inc.

- Porsche AG(Volkswagen AG)

- EDION Corporation

- Hitachi Ltd

- Delta Electronics Inc.

- Enechange Ltd

- Tritium DCFC Limited

- Kaluza

- WeCharge(Ubiden Co. Ltd)

- ABB Ltd

- TE Connectivity Ltd

- Charge Point Operators

第7章 市場機會與未來趨勢

The Japan EV Charging Station Market size is estimated at USD 0.29 billion in 2025, and is expected to reach USD 1.85 billion by 2030, at a CAGR of 44.92% during the forecast period (2025-2030).

The Japanese EV charging stations market reveals a landscape marked by rapid growth and evolving dynamics. With the increasing adoption of electric vehicles (EVs) in Japan, the demand for charging infrastructure has surged.

This demand is fueled by various factors, including government initiatives to promote clean energy and reduce carbon emissions. Japan's commitment to achieving carbon neutrality by 2050 further underscores the importance of robust EV charging infrastructure.

The market is characterized by a diverse range of players, including established energy companies, automotive manufacturers, and startups specializing in charging solutions. These entities are actively investing in the deployment of charging stations across the country to cater to the growing EV user base.

Moreover, partnerships and collaborations between different stakeholders are becoming increasingly common to accelerate the expansion of the charging network. The emphasis is on developing fast-charging technology to address consumer concerns regarding charging time and convenience. Fast-charging stations, capable of replenishing EV batteries quickly, are gaining traction in urban centers and along major highways.

Furthermore, the emergence of smart charging solutions, enabled by advanced technologies such as IoT and AI, is transforming the way EVs are charged. These solutions offer benefits such as optimized charging schedules, remote monitoring, and billing integration, enhancing user experience and grid management.

However, challenges persist, including the need for standardization of charging protocols, interoperability between different charging networks, and addressing concerns related to grid capacity and stability. Overcoming these challenges will be crucial for the sustained growth of the Japanese EV charging stations market.

Despite these obstacles, the outlook for the market remains promising, driven by supportive government policies, technological advancements, and the growing awareness of the environmental benefits of EVs.

Japan EV Charging Station Market Trends

DC Charging Stations are Dominating the Market

Japan's ambitious electrification targets, coupled with the rapid adoption of electric vehicles, have intensified the demand for efficient and high-speed charging solutions. DC charging stations have emerged as a preferred choice due to their ability to deliver significantly faster charging times compared to AC alternatives.

The prominence of DC charging stations can be attributed to several factors. Firstly, their compatibility with fast-charging protocols such as CHAdeMO and CCS (Combined Charging System) aligns with the preferences of EV manufacturers and consumers alike. These protocols facilitate rapid replenishment of EV batteries, offering convenience and minimizing downtime for drivers.

Moreover, Japan's geographical characteristics, including its densely populated urban areas and extensive highway networks, necessitate the deployment of charging infrastructure capable of supporting long-distance travel. DC charging stations, often strategically positioned along highways and in urban centers, address this need by providing fast and reliable charging options for EV owners on the go.

Furthermore, technological advancements and innovation in DC charging technology have played a pivotal role in driving its dominance in the market. The development of next-generation charging solutions, such as ultra-fast chargers capable of delivering power levels exceeding 350 kW, demonstrates the industry's commitment to enhancing charging efficiency and user experience.

Additionally, collaborations and partnerships between government entities, energy companies, automotive manufacturers, and charging infrastructure providers have facilitated the widespread deployment of DC charging stations across Japan. These collaborative efforts have expedited the expansion of the charging network, making it more accessible and convenient for EV owners throughout the country.

Despite the growing prevalence of DC charging stations, challenges such as standardization of charging protocols, interoperability between different networks, and grid capacity, constraints persist. Addressing these challenges will be essential to ensure the seamless integration of DC charging infrastructure into Japan's evolving mobility ecosystem.

With their ability to deliver fast and efficient charging solutions, DC stations are poised to remain at the forefront of Japan's electrification efforts, driving continued growth and innovation in the EV charging infrastructure industry.

Home Charging Driving Major Growth for the Market

Public charging stations offer several advantages over home charging setups. Firstly, they cater to the needs of EV owners who may not have access to private parking or home charging facilities, which is common in densely populated urban areas where residential space is limited.

In 2022, Japan's urban population experienced a slight decline, totaling 115,058,684 individuals, marking a decrease of 0.35% compared to the previous year.

Furthermore, public charging stations provide greater flexibility and convenience for EV owners, especially during long-distance travel or when away from home for extended periods. They offer a reliable option for topping up EV batteries while running errands, dining out, or engaging in leisure activities without the need to return home for charging.

The prominence of public charging infrastructure is also driven by the strategic placement of charging stations along major highways and transportation corridors. These strategically located stations facilitate long-distance travel and promote the adoption of electric vehicles for intercity journeys, addressing range anxiety concerns among drivers.

Moreover, the expansion of Japan's public charging network is supported by collaborations between government agencies, energy companies, automotive manufacturers, and charging infrastructure providers. These partnerships have led to significant investments in charging infrastructure deployment and enhancing accessibility and coverage across the country.

However, despite the dominance of public charging stations, home charging remains an essential component of the overall charging ecosystem. Home charging setups offer the convenience of overnight charging, allowing EV owners to start each day with a full battery without needing to visit a public charging station.

Additionally, home charging solutions may be preferred by EV owners for their cost-effectiveness and the ability to take advantage of off-peak electricity rates. Home chargers also provide a sense of control and security, as EV owners have direct access to their charging infrastructure and can monitor charging progress from the comfort of their homes.

Therefore, while public charging infrastructure dominates the Japanese EV charging station market, home charging solutions continue to play a vital role in supporting the charging needs of EV owners. The coexistence of both public and home charging options reflects the diverse preferences and requirements of Japan's growing electric vehicle ecosystem.

Japan EV Charging Station Industry Overview

The Japanese EV charging station market is fairly consolidated, with a major share being held by a few companies. Some of the major players in the market are ABB, Delta Electronics Inc., and Toyota. The major players in the country are entering joint ventures with other players to develop the latest technologies. For instance,

- In October 2023, in Japan, an electric vehicle (EV) pilot project was set to commence in Kashiwa-no-ha, near Tokyo, focusing on the evaluation of wireless charging technology. It was spearheaded by a collaborative effort involving the University of Tokyo, Chiba University, and nine prominent companies including Bridgestone, Mitsui Fudosan, ROHM, and NSK.

- This initiative aims to advance the development of an innovative "in-motion power supply system." This system is designed to wirelessly charge EVs as they navigate traffic intersections. Notably, a mere 10-second charge is projected to provide sufficient power for a typical electric car to cover a distance of 0.6 miles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Supportive Policies and Incentives from the Japanese Government Driving Market Growth

- 4.2 Market Restraints

- 4.2.1 High Upfront Costs Associated with Deploying and Maintaining Charging Stations Anticipated to Restrain Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces' Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Charging Type

- 5.1.1 AC Charging

- 5.1.2 DC Charging

- 5.2 End Use

- 5.2.1 Home Charging

- 5.2.2 Public Charging

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Charge Point Operators

- 6.2.1.1 Toyota Connected Corporation (Toyota Motor Corporation)

- 6.2.1.2 Tesla Motors Inc.

- 6.2.1.3 Porsche AG (Volkswagen AG)

- 6.2.1.4 EDION Corporation

- 6.2.1.5 Hitachi Ltd

- 6.2.1.6 Delta Electronics Inc.

- 6.2.1.7 Enechange Ltd

- 6.2.1.8 Tritium DCFC Limited

- 6.2.1.9 Kaluza

- 6.2.1.10 WeCharge (Ubiden Co. Ltd)

- 6.2.1.11 ABB Ltd

- 6.2.1.12 TE Connectivity Ltd

- 6.2.1 Charge Point Operators