|

市場調查報告書

商品編碼

1721622

交流電電動車充電站市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測AC Electric Vehicle Charging Station Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

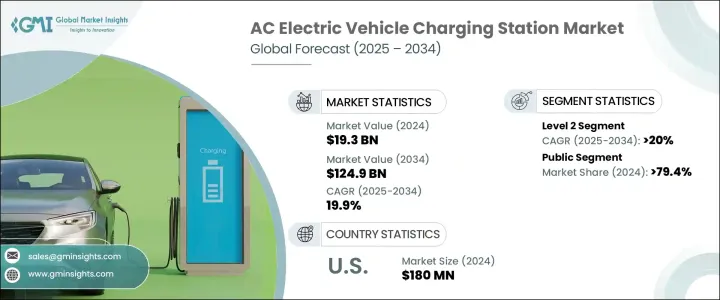

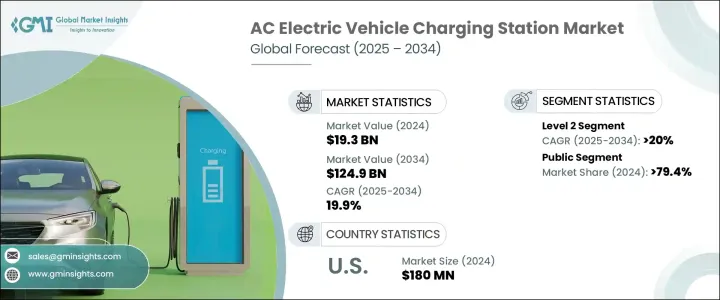

2024 年全球交流電電動車充電站市場價值為 193 億美元,預計到 2034 年將以 19.9% 的複合年成長率成長,達到 1,249 億美元。隨著電動車繼續從小眾市場轉向主流市場轉變,該市場正呈現強勁發展勢頭。隨著氣候變遷和永續性成為焦點,政府和私人企業都優先考慮採用電動車。這項轉變的關鍵要素是擁有強大且可靠的充電基礎設施。交流充電站以其相容性和易於整合而聞名,正成為這一轉變的核心。對清潔交通的日益追求、燃料價格的上漲、城市化進程的加快以及電動車的快速普及,共同推動了全球對交流電動車充電站的需求。尤其是城市地區,由於人口密度增加和車輛擁有量的增加,安裝率正在激增。此外,消費者對環保交通意識的不斷提高以及電池技術的進步也支持了長期成長。公司正積極投資融合速度、經濟性和智慧功能的交流充電解決方案,以滿足不斷變化的消費者需求。

電動車 (EV) 充電站市場根據充電站的類型及其位置進行分類。在主要類型中,1 級和 2 級充電器最為常用。 2 級充電器的效能比 1 級充電器更快,預計到 2034 年將達到 20% 的強勁複合年成長率。這種成長歸因於人們對更有效率、更省時的充電解決方案的偏好日益成長,尤其是在住宅區、商業建築和工作場所環境中。雖然 1 級充電器由於安裝成本較低,仍然受到單戶住宅的需求,但其較慢的充電速度限制了其在高流量或商業場所的廣泛使用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 193億美元 |

| 預測值 | 1249億美元 |

| 複合年成長率 | 19.9% |

從安裝地點來看,公共充電站佔了2024年79.4%的市場佔有率,佔據主導地位。公共交流充電樁主要部署在城市中心、商業停車場、高速公路沿線等地,提供電動車使用者全天候便利的充電服務。政府推出的支持性法規、激勵計畫以及旨在全國範圍內建設電動車基礎設施的公私合作夥伴關係進一步加速了公共充電網路的成長。

2024 年,美國交流電動車充電站市場創收 1.8 億美元,並顯示出顯著的成長動能。聯邦和州政府正在推出資助計劃和稅收抵免,以加快電動車充電器的部署。對州際走廊和城市內基礎設施的投資有助於縮小可及性差距並增強駕駛員信心。公共和私營部門的參與者都在採取積極措施,確保全國範圍內充電設施的便利和廣泛使用。

推動全球交流電電動車充電站市場的關鍵參與者包括 Blink Charging Co.、ABB、Bosch、Charge Zone India、Delta Electronics、ChargePoint, Inc.、Elli、Enphase Energy、Leviton Industries、NIO、Schneider Electric、EVBox、Siemens、SIGNET EV、Vinton Industries、NIO、Schneider Electric、EVBox、Siemens、SIGNET EV、Vinfast Industries、VStarge Industries Inc.、Star。這些公司優先考慮創新,並整合遠端監控、自動故障檢測和能源負載平衡等智慧功能。透過與汽車製造商和政府機構建立策略聯盟,他們正在擴大業務範圍並適應日益成長的基礎設施需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依當前,2021 - 2034 年

- 主要趨勢

- 1級

- 2級

第6章:市場規模及預測:依充電站點分類,2021 - 2034 年

- 主要趨勢

- 民眾

- 私人的

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 挪威

- 德國

- 法國

- 荷蘭

- 英國

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- ABB

- Blink Charging Co.

- Bosch

- ChargePoint, Inc.

- Charge Zone India

- Delta Electronics

- Elli

- Enphase Energy

- EVBox

- Leviton Industries

- NIO

- Schneider Electric

- Siemens

- SIGNET EV

- StarCharge

- Vinfast

- Volta Industries Inc.

- Zunder

The Global AC Electric Vehicle Charging Station Market was valued at USD 19.3 billion in 2024 and is estimated to grow at a CAGR of 19.9% to reach USD 124.9 billion by 2034. The market is witnessing strong momentum as electric vehicles continue to transition from niche to mainstream. With climate change and sustainability taking center stage, governments and private enterprises alike are prioritizing EV adoption. A critical component of this transition is the availability of robust and reliable charging infrastructure. AC charging stations, known for their compatibility and ease of integration, are becoming central to this shift. The growing push for clean mobility, rising fuel prices, increasing urbanization, and the rapid penetration of electric cars are collectively propelling demand for AC EV charging stations worldwide. Urban areas, in particular, are seeing surging installation rates due to higher population density and increasing vehicle ownership. In addition, rising consumer awareness around eco-friendly transportation and advancements in battery technologies are supporting long-term growth. Companies are aggressively investing in AC charging solutions that blend speed, affordability, and smart functionality to meet evolving consumer needs.

The electric vehicle (EV) charging station market is categorized based on the type of charging stations and their locations. Among the key types, Level 1 and Level 2 chargers are most commonly used. Level 2 chargers, offering faster performance than Level 1, are expected to register a strong CAGR of 20% through 2034. This growth is attributed to the rising preference for more efficient and time-saving charging solutions, particularly in residential complexes, commercial buildings, and workplace settings. While Level 1 chargers remain in demand for single-family homes due to their lower installation costs, their slower charging speed restricts widespread use in high-traffic or commercial locations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.3 Billion |

| Forecast Value | $124.9 Billion |

| CAGR | 19.9% |

In terms of installation site, the public charging station segment accounted for a dominant 79.4% market share in 2024. Public AC chargers are primarily deployed in places like urban centers, commercial parking spaces, and along highways, offering convenient, round-the-clock access for EV users. The growth in public charging networks is further accelerated by supportive government regulations, incentive programs, and public-private partnerships designed to build out EV infrastructure nationwide.

U.S. AC Electric Vehicle Charging Station Market generated USD 180 million in 2024 and is showing remarkable traction. Federal and state governments are rolling out funding initiatives and tax credits to speed up the deployment of EV chargers. Investment in infrastructure along interstate corridors and within cities is helping to bridge accessibility gaps and enhance driver confidence. Both public and private sector players are taking proactive steps to ensure the convenient and widespread availability of charging facilities across the country.

Key players driving the Global AC electric vehicle charging station market include Blink Charging Co., ABB, Bosch, Charge Zone India, Delta Electronics, ChargePoint, Inc., Elli, Enphase Energy, Leviton Industries, NIO, Schneider Electric, EVBox, Siemens, SIGNET EV, Vinfast, Volta Industries Inc., StarCharge, and Zunder. These companies are prioritizing innovation, and integrating smart features like remote monitoring, automated fault detection, and energy load balancing. Through strategic alliances with automakers and government agencies, they're expanding footprints and adapting to growing infrastructure demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Current, 2021 - 2034 (Units, USD Billion)

- 5.1 Key trends

- 5.2 Level 1

- 5.3 Level 2

Chapter 6 Market Size and Forecast, By Charging Site, 2021 - 2034 (Units, USD Billion)

- 6.1 Key trends

- 6.2 Public

- 6.3 Private

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (Units, USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Norway

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Netherlands

- 7.3.5 UK

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Blink Charging Co.

- 8.3 Bosch

- 8.4 ChargePoint, Inc.

- 8.5 Charge Zone India

- 8.6 Delta Electronics

- 8.7 Elli

- 8.8 Enphase Energy

- 8.9 EVBox

- 8.10 Leviton Industries

- 8.11 NIO

- 8.12 Schneider Electric

- 8.13 Siemens

- 8.14 SIGNET EV

- 8.15 StarCharge

- 8.16 Vinfast

- 8.17 Volta Industries Inc.

- 8.18 Zunder