|

市場調查報告書

商品編碼

1692097

北美絕緣運輸貨櫃:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Insulated Shipping Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

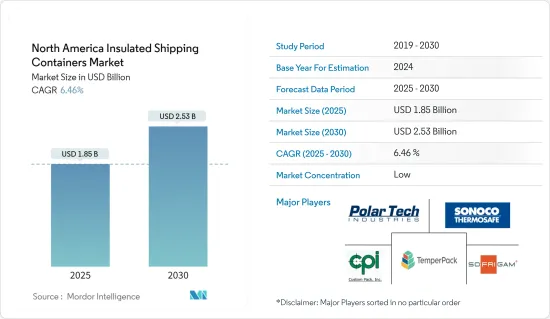

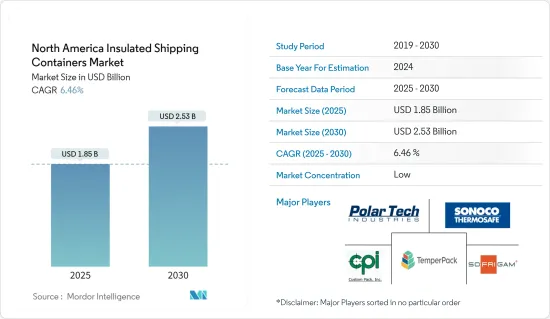

北美絕緣運輸貨櫃市場規模預計在 2025 年為 18.5 億美元,預計到 2030 年將達到 25.3 億美元,預測期內(2025-2030 年)的複合年成長率為 6.46%。

主要亮點

- 儲存箱通常用於隔離運輸貨櫃,以保護其免受極端溫度變化的影響。世界各地有許多種水果和蔬菜都是有機種植的。因此這些包裝材料被廣泛採用以保持水果在運輸過程中的新鮮度。

- 化學品、藥品、新鮮蔬菜、飲料和冷凍食品等產品需要精確的溫度控制以防止感染疾病。進出貨櫃的空氣必須經過過濾,因此隔熱材料起著關鍵作用。透過將運輸貨櫃與外部完全隔離,可以保持運輸產品的完整性。

- 熱感包裝絕緣運輸容器內襯套件旨在顯著降低受潮風險,使其成為儲存期間保護產品的最經濟的方式。必須在穩定溫度下運輸的易腐貨物(例如食品、飲料和藥品)也可以使用內襯保存。

- 發泡聚苯乙烯 (EPS) 容器是食品和製藥業最常用的絕緣運輸容器之一。 EPS 冷卻器具有多種優點,包括隔熱、重量輕和價格實惠。由於發泡聚苯乙烯產品對環境有負面影響且不具備生物分解性,因此已被紐約、洛杉磯、華盛頓特區和波特蘭等美國 100 多個縣禁止使用。

- 藥品的儲存環境對藥品溫度變化的速度有很大影響。如果在沒有防護的情況下暴露在高溫或低溫下,疫苗很快就會超出其所需的溫度範圍,從而降低其有效性。這些因素正在推動隔熱運輸貨櫃市場的擴張。

- 整個市場的倉庫都開始儲存大量冷藏食品。尤其是美國農業部近日透露,美國倉庫正在囤積大量冷凍蔬菜。庫存激增將在預測期內刺激對絕緣運輸貨櫃的需求。

- 由於新冠疫情,優質冷藏運輸貨櫃已成為醫藥產品運輸的重要組成部分,確保製藥公司能夠克服許多運輸障礙,因為貨櫃製造商遵守嚴格的公眾監管標準。美國食品藥物管理局(FDA) 和其他監管機構對藥物物質和產品以及用於運輸它們的容器有嚴格的規定。

北美絕緣運輸貨櫃市場趨勢

生命科學和製藥領域佔據了很大的市場佔有率

- 在美國,許多對溫度敏感的藥物,包括昂貴且高度專業的癌症治療藥物和預防感染疾病的疫苗,都生產和運輸。因此,隔熱運輸容器對於防止昂貴藥品因溫度變化而損失至關重要。

- 處理對溫度敏感的藥品的需求不斷成長,刺激了隔熱運輸容器的銷售成長。越來越多的法規強調遵守儲存溫度標準將推動製藥和醫療應用的需求。

- 憑藉對生物醫學研究的投入,美國已成為藥物研發領域的全球領導者,並擁有大量製造商。此類容器的需求量很大,而且由於美國和加拿大生命科學和製藥行業蓬勃發展,產量增加,預計需求量將繼續成長。

- 2024 年 2 月,合約物流公司 DHL Supply Chain 宣布了一項 2 億美元的投資計劃,致力於加強其在生命科學和醫療保健領域的能力。這項策略性舉措包括開發倉儲設施,這將使 DHL 的營運空間增加到驚人的 1,300 萬平方英尺。此外,DHL 計劃投資先進技術,旨在簡化營運並增強其醫療保健和生命科學供應鏈的彈性。此項重大投資彰顯了 DHL 堅定不移地致力於為業界提供可靠、高效和溫控的物流解決方案。

- 生命科學產業的成長主要受到製藥業的崛起的推動,其標誌是創新治療方法的不斷湧入,尤其是針對體重管理和糖尿病的創新療法。這一趨勢,加上當地製藥業的復甦,正在推動對額外生產能力的需求激增。隨著越來越多的品牌轉向國內生產,簡化入境物流以支持這些生產線已成為當務之急。

預計美國將實現最高成長率

- 北美是全球最重要的絕緣運輸貨櫃市場之一,其中美國佔據了相當大的市場佔有率。大量供應商的存在和進出口活動的蓬勃發展導致該國的需求量很大。出口貿易的擴大可能會為隔熱運輸的使用帶來巨大的前景。

- 此外,該國還有幾項與該行業相關的法律。例如,美國食品藥物管理局對食品接觸包裝產業進行嚴格監管。由於食品是運輸和儲存最精細的物品之一,預計這項規定將鼓勵全國使用隔熱運輸容器。

- 市場正在擴大,泰森食品、肯塔基州州長安迪貝希爾和鮑靈格林市領導宣布新建一個價值 3.55 億美元的培根生產工廠證明了這一點。該工廠佔地 40 萬平方英尺,計劃於 2023 年投入營運,將僱用 450 名員工,旨在滿足該公司 Jimmy Dean 和 Lite 品牌日益成長的需求。這些發展增加了用於運輸食品的隔熱集裝箱的需求。

- 根據美國商務部Census.gov網站的數據,美國電子商務銷售額十多年來一直穩定成長,過去兩年成長尤為顯著。根據美國人口普查局的貿易數據,2023年美國新鮮水果和蔬菜出口將達70億美元,與前一年同期比較增加2%。新鮮水果和蔬菜出口需求的激增預計將成為北美市場成長的主要驅動力。

- 最近發生的事件凸顯了美國和全球生命科學和醫療保健產業建立敏捷且有彈性的供應鏈的必要性。因此,供應商正在增加對技術和戰略位置的投資。此舉旨在透過為客戶提供主動應對中斷的工具來保障基本物資的無縫流動。

北美絕緣運輸貨櫃產業概況

北美隔熱運輸貨櫃市場較為分散,有 Polar Tech Industries、Sonoco Thermosafe、Custom Pack Inc.、TemperPack 和 Sofrigam 等多家公司,使得市場競爭更加激烈。

- 2024 年 5 月,標準和改裝倉儲及運輸貨櫃供應商 Conexwest 推出了一系列可供購買和租賃的新型隔熱冷藏集裝箱。這些貨櫃有多種尺寸,從 10 英尺到 45 英尺不等。這些儲存容器製造商和經銷商現在可以為豐塔納和洛杉磯的企業提供最廣泛、最優質的冷藏解決方案。 Conexwest 在所有貨櫃的製造過程中優先使用最高品質的材料和節能隔熱材料。這項承諾不僅保證了客戶能夠負擔得起的購買和租賃價格,而且還保證了長期的能源節約。

- 2024 年 5 月,創新供應鏈和技術公司 CJ 物流 America 透露計劃在堪薩斯州新世紀(距離堪薩斯城僅 30 英里)開設一個新的冷藏倉庫。該合資企業是國家冷藏倉庫開發商 Yukon Real Estate Partners 與冷藏倉庫房地產領域知名品牌 BGO 的合資企業,擁有配備 Alta EXPERT 冷凍系統的 291,000 平方英尺倉庫。該設施預計將於 2025 年第三季投入營運。國內外客戶都將從降低的物流成本以及提高的環境永續性和運輸效率中受益匪淺。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

- 研究框架

- 二次調查

- 主要研究方法及主要受訪者

- 數據三角測量與洞察生成

第3章執行摘要

第4章 市場動態

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 陶瓷市場

- 市場促進因素

- 製藥和醫療保健行業的成長將推動市場

- 消費者對生鮮食品的需求不斷增加

- 市場挑戰

- 原料成本上漲

- 關鍵市場創新與合作

- 分析師對 Direct2Consumer 絕緣托運產業需求的評論

- 市場區隔分析

第6章市場區隔

- 依材料類型

- 發泡聚苯乙烯(EPS)

- 聚氨酯泡棉(PU)

- 發泡聚丙烯(EPP)

- 其他材料類型

- 按最終用戶應用程式

- 已調理食品食品及冷凍食品

- 生命科學與製藥

- 生鮮肉

- 新鮮農產品

- 麵包店、植物、花卉

- 其他最終用戶應用(化妝品、葡萄酒、其他飲料)

- 按國家

- 美國

- 加拿大

第7章競爭格局

- 公司簡介

- Polar Tech Industries

- Sonoco Thermosafe(sonoco Products Company)

- Custom Pack Inc.

- Temperpack

- Sofrigam

- Intelsius(A DGP Company)

- Cascades Inc.

- Softbox Systems Ltd(CSAFE Global)

- Insulated Products Corporation

- Chill-Pak

- Airlite Plastics Co.(KODIAKOOLER)

- Therapak(AVANTOr Group)

- Thermal Shipping Solution

第8章投資分析

第9章 未來市場展望

簡介目錄

Product Code: 90471

The North America Insulated Shipping Containers Market size is estimated at USD 1.85 billion in 2025, and is expected to reach USD 2.53 billion by 2030, at a CAGR of 6.46% during the forecast period (2025-2030).

Key Highlights

- Storage containers are frequently used to protect against extreme temperature swings by insulating transport containers. Many different kinds of fruits and vegetables are grown utilizing organic methods worldwide. These packing materials are, therefore, widely employed to keep fruit fresh during transportation.

- To protect from infection, products such as chemicals, medicines, fresh vegetables, beverages, and frozen goods require precise temperature control. As the air entering and leaving the containers must be filtered, insulation plays a significant role. It maintains the condition of the conveyed products by completely closing off a shipping container from the outside.

- Thermal packing insulated shipping container liner kits are the most economical way to protect products in storage since they are made to lower the risk of moisture considerably. Perishable commodities that must be mandatorily transported at steady temperatures, such as food, beverages, and medicines, can also be preserved using liners.

- Expanded polystyrene (EPS) containers are among the most frequently used insulated transportation containers in the food and pharmaceutical industries. EPS coolers provide several benefits, including thermal insulation, being lightweight, and being affordable. Due to their negative environmental effects and lack of biodegradability, polystyrene foam products are prohibited in over 100 counties across the United States, including New York, Los Angeles, Washington, DC, and Portland.

- The environment in which medicine is kept significantly impacts how quickly it changes temperature. When left unprotected and exposed to heat or cold, a vaccination can leave the necessary temperature range within a short period, thereby disrupting its efficacy. Because of such factors, the usage of insulated shipping containers is fueling market expansion.

- Warehouses across the market are increasingly stocking a substantial volume of chilled food products. Notably, the US Department of Agriculture recently highlighted a significant inventory of frozen vegetables across US warehouses, closely trailed by dairy products and frozen potatoes. This surge in inventory is poised to drive up the demand for insulated shipping containers over the forecast period.

- Due to the COVID-19 pandemic, high-quality cold transport containers emerged as a vital component in the transportation of pharmaceuticals, guaranteeing that pharmaceutical companies could overcome the many shipping obstacles since container makers abide by stringent regulatory standards for the benefit of the general population. The US Food and Drug Administration and other regulatory authorities have strict rules governing pharmaceutical substances, goods, and the containers used to carry them.

North America Insulated Shipping Containers Market Trends

The Life Sciences and Pharmaceutical Segment Holds a Significant Market Share

- In the United States, many temperature-sensitive medications are produced and shipped, including expensive and highly specialized cancer therapies and vaccines against infectious diseases. Insulated shipping containers, therefore, prove crucial in preventing the loss of expensive drugs due to temperature variations.

- Rising demand for handling temperature-sensitive pharmaceuticals is fueling a sales increase for insulated shipping containers. A growing regulatory emphasis on compliance with storage temperature standards will promote demand in medicine and medical applications.

- Due mostly to its investments in biomedical research, the United States has emerged as a global leader in drug discovery and development, with a sizable number of manufacturers. The demand for these containers is considerable and is expected to continue to rise with the increase of production in the United States and Canada, which have notable life sciences and pharmaceutical industries.

- In February 2024, DHL Supply Chain, a contract logistics company, unveiled plans for a USD 200 million investment, specifically earmarked for bolstering its life sciences and healthcare capabilities. This strategic initiative encompasses the development of warehouse facilities, poised to expand the company's operational space to a staggering 13 million sq. ft. Moreover, DHL plans to channel funds into advanced technologies aimed at streamlining operations and fortifying the resilience of its healthcare and life sciences supply chains. This substantial investment underscores DHL's unwavering dedication to furnishing the industry with dependable, efficient, and temperature-controlled logistics solutions.

- The growth in this industry is primarily fueled by the pharmaceutical segment's rise, marked by a consistent influx of innovative treatments, notably those targeting weight management and diabetes. This trend, alongside the resurgence of local drug manufacturing, has catalyzed a surge in demand for expanded capacity. With more brands pivoting toward domestic production, the necessity for streamlined inbound logistics to support these manufacturing lines has become paramount.

The United States is Expected to Register the Highest Growth Rate

- North America is considered one of the important markets worldwide for insulated shipping containers, with the United States making up a sizeable portion of that market. The substantial presence of numerous vendors, exports, and imports can be linked to the nation's high demand. The use of insulated shipping will see substantial prospects as a result of this expansion in export trade.

- Additionally, there are several laws pertaining to the industry in the nation. For instance, the Food and Drug Administration in the United States heavily regulates the industry of food-contact packaging. The rules are anticipated to encourage the use of insulated shipping containers nationwide because food is one of the most delicate things to move and store.

- The market is expanding, as was witnessed by the announcement of a new USD 355 million bacon manufacturing facility made by Tyson Foods, Kentucky Governor Andy Beshear, and Bowling Green city leaders. The 450 workers at the 400,000 sq. ft plant, scheduled to debut in 2023, aimed to help meet growing demand for the company's Jimmy Dean and Wright brands. These developments increase the demand for insulated shipping containers for moving food.

- According to the US Department of Commerce's Census.gov website, e-commerce sales in the United States have shown a consistent upward trend for over a decade, with particularly notable increases in the last two years. Data from the US Census Bureau Trade Data reveals that in 2023, the country's fresh fruit and vegetable exports were valued at USD 7.0 billion, marking a 2% rise over the previous year. This surge in demand for fresh produce exports is expected to be a key driver of market growth in North America.

- Recent events underscore the critical need for agile and resilient supply chains in the life sciences and healthcare industries, both in the United States and worldwide. Consequently, market vendors are ramping up investments in technology and strategic locations. This move aims to equip their customers with tools to proactively tackle disruptions, thereby safeguarding the seamless flow of essential supplies.

North America Insulated Shipping Containers Industry Overview

The North American insulated shipping containers market is fragmented due to the presence of many players, such as Polar Tech Industries, Sonoco Thermosafe, Custom Pack Inc., TemperPack, and Sofrigam, which are making the market competitive.

- In May 2024, Conexwest, a supplier of standard and modified storage and shipping containers, unveiled a new range of insulated cold storage reefer containers for both purchase and rental. These containers come in sizes varying from 10 to 45 feet. The fabricators and retailers of these storage containers can now provide companies in Fontana and Los Angeles with the most extensive and top-quality line of cold storage solutions. Conexwest has been prioritizing using the highest-quality materials and energy-efficient insulation in all its container fabrications. This commitment not only ensures an affordable purchase or rental price for customers but also promises long-term energy savings.

- In May 2024, CJ Logistics America, an innovative supply chain and technology firm, revealed plans to inaugurate a new cold storage warehouse in New Century, Kansas, a mere 30 miles from Kansas City. This venture, a collaboration between national cold storage developer Yukon Real Estate Partners and BGO, a prominent player in cold storage real estate, features a 291,000 sq. ft warehouse equipped with Alta EXPERT refrigeration. The facility is set to commence operations in Q3 2025. Customers stand to gain significantly, with reduced logistics costs, alongside enhanced environmental sustainability and heightened shipping efficiency, both domestically and internationally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research Approach and Key Respondents

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in the Pharmaceutical and Healthcare Industries to Boost the Market

- 5.1.2 Increasing Consumer Demand for Perishable Food

- 5.2 Market Challenges

- 5.2.1 Rising Cost of Raw Materials

- 5.3 Key Market Innovations and Collaborations

- 5.4 Analyst Commentary on the Demand for Direct2Consumer Insulated Shipper Industry

- 5.5 Market Breakdown Analysis

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Expanded Polystyrene (EPS)

- 6.1.2 Polyurethane Foam (PU)

- 6.1.3 Expanded Polypropylene (EPP)

- 6.1.4 Other Material Types

- 6.2 By End-user Application

- 6.2.1 Pre-cooked Food and Frozen Food

- 6.2.2 Life Sciences and Pharmaceutical

- 6.2.3 Fresh Meat

- 6.2.4 Fresh Produce

- 6.2.5 Bakery, Plants, and Flowers

- 6.2.6 Other End-user Applications (Cosmetics, Wine, and Other Beverages)

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Polar Tech Industries

- 7.1.2 Sonoco Thermosafe (sonoco Products Company)

- 7.1.3 Custom Pack Inc.

- 7.1.4 Temperpack

- 7.1.5 Sofrigam

- 7.1.6 Intelsius (A DGP Company)

- 7.1.7 Cascades Inc.

- 7.1.8 Softbox Systems Ltd (CSAFE Global)

- 7.1.9 Insulated Products Corporation

- 7.1.10 Chill-Pak

- 7.1.11 Airlite Plastics Co. (KODIAKOOLER)

- 7.1.12 Therapak (AVANTOr Group)

- 7.1.13 Thermal Shipping Solution

8 INVESTMENT ANALYSIS

9 FUTURE MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219