|

市場調查報告書

商品編碼

1690868

北美農藥包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Agricultural Chemical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

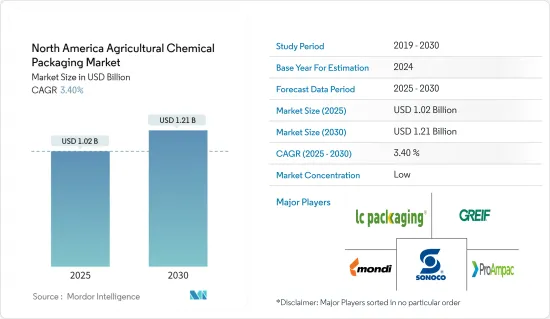

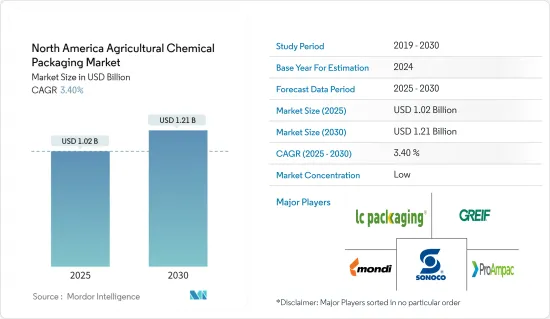

北美農業化學品包裝市場規模預計在 2025 年為 10.2 億美元,預計到 2030 年將達到 12.1 億美元,預測期內(2025-2030 年)的複合年成長率為 3.4%。

關鍵亮點

- 農藥包裝是農業的重要組成部分之一,因為肥料和殺蟲劑等農藥產品具有毒性。需要先進的包裝解決方案來減輕儲存、處理和運輸這些化學產品所帶來的風險。這裡使用的包裝解決方案旨在提供緊密的密封。

- 在材料中,塑膠是農化產品使用最廣泛的包裝材料。隨著對袋子、瓶子、小袋、容器等的需求不斷增加,市場上的供應商正在提供創新且安全的包裝解決方案。例如,Scholle IPN 為市場提供盒中袋包裝解決方案,用於包裝農業化學產品。

- 由於生物分解性包裝解決方案的先進包裝正在推動對此類包裝解決方案的需求,市場上的各種供應商都專注於將此類解決方案(主要是再生樹脂)作為其產品的一部分。例如,2021 年 1 月,Mauser Packaging Solutions 推出了 KORTRAX Barrier Tighthead 容器,用於運輸傳統上難以控制的危險溶劑型產品。 KORTRAX 容器使用後可 100% 回收,有 20 公升、5 加侖和 10 公升三種尺寸。

- 根據聯邦法律法規,產品在美國銷售前,其標籤和標誌必須符合多項規定。與法定計量相關的標籤要求必須符合公平包裝和標籤法案(FPLA)和統一包裝和標籤法規(UPLR)。此外,所有進口到美國的產品必須符合美國法典第 19 篇第 4 章第 1304 節和 19 CFR 134 的原產國標記規定。

- 包裝規定限制了供應商的利潤,並且它們被分解成更小的包裝,因為它們必須符合重量和數量規定。包裝解決方案提供者也在投資合規諮詢公司,甚至將這些合規流程外包給合約營業單位,從而影響他們的市場利益。

- COVID-19 疫情正在影響國際貿易以及必需和非必需商品和服務的全球供應鏈。 COVID-19 在全球的蔓延對企業產生了重大影響。市場最初受到了疫情的影響。該地區許多國家已推遲禁止使用一次性塑膠。由於電子商務的顯著成長,疫情導致化學品塑膠包裝的使用量增加。

北美農化包裝市場趨勢

肥料佔據主要市場佔有率

- 對於肥料、殺蟲劑和除草劑等農業化學品,北美市場已經經歷了一段相當成熟的時期,並且在過去幾年中需求保持穩定。預計未來幾年這種情況還會持續。

- 北美是化肥最成熟的市場之一,近年來成長率放緩。根據IFA統計,氨、尿素和UAN占美國氮肥應用的大部分,總合佔比超過60%。

- 依作物,玉米和小麥佔全國氮肥需求的近一半。因此,該地區提供氮肥的供應商佔據了肥料市場的很大佔有率,推動了對包裝解決方案的需求。

- 在美國,大多數氨生產都發生在路易斯安那州、奧克拉荷馬州和德克薩斯州的大型天然氣蘊藏量附近,因為天然氣既可用作氫原料,又可作為氨生產所需的高溫和高壓的燃料。大部分氨由國際公司生產並供國內消費,也有少量從特立尼達和多巴哥以及加拿大進口。該地區生產的氨僅少量出口。

- 該地區最大的氨生產商是 Nutrien、CF Industries、Moasaic 和 Yara。氮肥生產設施每天都在運轉,但儲存容量有限,因此必須將肥料運送到倉庫和碼頭進行儲存。用於運送氨的車輛包括冷凍駁船、鐵路車輛、管道和油輪。

- 美國和加拿大在全球化肥料行業佔有很大佔有率,因此該地區製造商的包裝需求很大。此外,該地區的供應商正在尋找簡單且永續的肥料包裝解決方案。例如,2021 年 4 月,Johnny Appleseed Organic 推出了 ClimateGard,這是一款採用永續棉袋包裝的無毒園藝肥料。

塑膠佔最大市場佔有率

- 美國和加拿大等北美地區的國家是世界領先的塑膠樹脂生產國之一。根據美國工業理事會塑膠工業生產商統計 (PIPS) 小組的數據,北美樹脂產量從 2020 年的 1,231 億磅成長 0.7% 至 2020 年的 1,240 億磅。根據美國工業理事會的數據,2020 年聚乙烯 (PE) 的產量佔比最大,其次是聚丙烯 (PP)、聚氯乙烯(PVC) 和聚苯乙烯 (PS)。

- 聚乙烯 (PE) 因其多功能性而成為最受歡迎的材料之一。它是一種理想的密封介質,因為它是熱塑性的,可以形成極好的防潮層。農藥製劑的保存是一項重要要求,尤其是在潮濕的氣候下。

- 高密度聚苯乙烯(HDPE)吹塑成型容器在設計和構造上具有廣泛的靈活性、優異的防潮阻隔性以及對碳氫化合物溶劑的低抵抗力。雙向拉伸聚酯也廣泛用於溶劑和水基液體產品的包裝。

- 60多個領先品牌、非營利組織和政府組織正在共同努力在美國打造塑膠循環經濟。這些努力旨在減少該地區農業化學產品中一次性塑膠的使用。

- 此外,各大城市正在採取糾正措施,減少農藥塑膠包裝的使用。例如,2021 年 8 月,蒙特婁宣布計畫在 2023 年 3 月禁止使用多種一次性塑膠。

北美農藥包裝產業概況

北美農業化學品包裝市場由大量區域和全球參與企業組成。由於競爭對手的市場滲透力和提供先進產品的能力,預計它們之間的競爭將十分激烈。此外,大規模投資的介入也提高了現有參與企業的退出門檻,推動產業競爭加劇。

- 2022 年 2 月—軟包裝和材料科學領域的領導者 ProAmpac 宣布收購屢獲殊榮的軟包裝產品製造商 Belle-Pak Packaging。收購 Belle-Pak 擴大了 ProAmpac 在加拿大的業務,並增加了其在高成長電子商務、醫療保健和物流終端市場的影響力。

- 2021 年 9 月 - Greif Inc. 加入了由 50 多家公司組成的非營利聯盟,致力於消除環境中的塑膠廢棄物並保護地球。該聯盟由代表塑膠價值鏈上各企業和組織的成員公司和支持者組成,並與世界各地的政府、環境和非政府組織合作,共同應對消除環境中塑膠廢棄物的挑戰。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

- COVID-19對農化包裝市場的影響

- 行業法規和標準

- B2B 與直銷通路銷售細分的定性分析

第5章市場動態

- 市場促進因素

- 基於材料的創新可延長產品保存期限,並延續包裝永續性的持續主題

- 市場問題

- 監管和定價挑戰

第6章市場區隔

- 依產品類型

- 袋子和小袋

- 容器和罐頭

- 中型散裝容器(IBC)

- 其他

- 按材質

- 塑膠

- 紙和紙板

- 金屬

- 其他

- 按應用

- 肥料

- 殺蟲劑

- 除草劑

- 其他

第7章競爭格局

- 公司簡介

- LC Packaging International BV

- Greif Inc.

- Mondi Group

- Sonoco Products Company

- ProAmpac LLC

- Mauser Packaging Solutions

- Greif, Inc

- Tri Rinse

- Silgan Holdings

- Hoover CS

第8章投資分析

第9章:市場的未來

The North America Agricultural Chemical Packaging Market size is estimated at USD 1.02 billion in 2025, and is expected to reach USD 1.21 billion by 2030, at a CAGR of 3.4% during the forecast period (2025-2030).

Key Highlights

- Agrochemical packaging is one of the crucial parts of the agriculture industry as agrochemical products, such as fertilizers and pesticides, are toxic. They require advanced packaging solutions, helping reduce the risk of storing, handling, and transporting such chemical products. Packaging solutions used here are designed for better sealing.

- Among the materials, plastic is the most widely used packaging material for agrochemical products. The demand for bags, bottles, pouches, and containers is increasing, and vendors in the market are offering innovative and high-safety packaging solutions. For example, Scholle IPN offers a bag-in-a-box pouch packaging solution for packaging agricultural chemical products in the market.

- With the advancements in biodegradable packaging solutions fueling the demand for such packaging solutions, various vendors in the market are focusing on adopting such solutions as part of their offering, focusing on recycled resins. For example, in January 2021, Mauser Packaging Solutions introduced the KORTRAX Barrier Tight-Head container for transporting hazardous solvent-based products that are traditionally difficult to contain. KORTRAX containers are 100% recyclable post-use and are available in 20-liter, 5-gallon, and 10-liter sizes.

- According to Federal laws and regulations, there are many regulations with which a product's label or markings must comply before being sold in the United States. Labeling requirements related to legal metrology must abide by The Fair Packaging and Labeling Act (FPLA) and Uniform Packaging and Labeling Regulation (UPLR). In addition, all products imported into the US must conform to Title 19, United States Code, Chapter 4, Section 1304 and 19 CFR 134, Country of Origin Marking regulations.

- The packaging regulations limit vendor profits and divide them into smaller packages as weight and quantity regulations are to be followed. Packaging solution providers also invest in compliance consultants and even outsource these compliance handling processes to entities that take care of these processes, thus impacting their profits in the market.

- The COVID-19 outbreak has affected international trade and global supply chains of essential and non-essential goods and services. With the spread of COVID-19 across the world, businesses have suffered significantly. The market was initially impacted due to the pandemic. Many countries in the region postponed the ban on single-use plastic. The pandemic led to the increase in the usage of plastic packaging for chemicals due to significant growth in e-commerce.

North America Agricultural Chemical Packaging Market Trends

Fertilizers to Hold Major Market Share

- In terms of agrochemicals, such as fertilizers, pesticides, herbicides, and other chemicals, the North American market has reached significant maturity, with the demand maintaining a steady point over the last few years. It is expected to remain the same over the coming years as well.

- North America is one of the most mature markets for fertilizer; it witnessed a slower growth rate in the last few years. According to the IFA, a prominent share of Nitrogen fertilizer application in the United States was held by Ammonia, Urea, and UAN, with a combined percentage share of over 60%.

- Among the crops, Maize and Wheat crops held nearly half of the country's Nitrogen fertilizer demand. Hence, vendors offering Nitrogen fertilizers in the region command a major share of the fertilizer market and drive the demand for packaging solutions.

- In the United States, most ammonia production occurs near large natural gas reserves in Louisiana, Oklahoma, and Texas due to the use of natural gas as a hydrogen feedstock and to fuel the high temperature and pressure needed to produce ammonia. A major share of the ammonia is produced by international companies and used for domestic consumption, with some imports from Trinidad and Tobago and Canada. A very small amount of ammonia produced in the region is exported.

- The region's largest ammonia producers are Nutrien, CF Industries, Moasaic, and Yara. Nitrogen fertilizer production facilities operate daily but have limited storage capacity, so fertilizers must be transported to warehouses and terminals for storage. Modes of transportation used to transport ammonia include refrigerated barge, rail car, pipeline, and tank truck.

- With the region's major share of the global fertilizer sector, the manufacturers' demand for packaging in the United States and Canada is significant. In addition, the region's vendors are witnessing easy and sustainable packaging solutions for fertilizers. For instance, in April 2021, Johnny Appleseed Organic came out with ClimateGard, a no-kill fertilizer for gardens that comes in sustainable cotton bags.

Plastic to Hold the Largest Market Share

- The countries in the North American region, such as the United States and Canada, are prominent manufacturers of plastic resins worldwide. According to the American Chemistry Council's Plastics Industry Producers Statistics (PIPS) Group, North American resin output increased by 0.7% to 124 billion pounds, up from 123.1 billion pounds in 2020. Polyethylene (PE) accounted for the largest share of production in 2020, followed by polypropylene (PP), polyvinyl chloride (PVC), and polystyrene (PS), according to the American Chemistry Council.

- Polyethylene (PE) is one of the most preferred materials because it has universal application. It is thermoplastic, and therefore an ideal sealing medium, and forms an excellent moisture barrier. The predominant requirement is the preservation of agrochemical formulations, particularly in humid climates.

- Blow-molded containers of high-density polyethylene (HDPE) offer broad flexibility in design and construction, good moisture barrier properties, and poor resistance to hydrocarbon solvents. Also, Biaxially oriented polyester is widely used for packaging solvent and aqueous-based liquid products.

- More than 60 major brands, nonprofits, and government agencies are coming together to create a circular economy for plastics in the United States. Such acts are poised to reduce the usage of single-use plastics for agrochemical products in the region.

- Further, major cities are taking corrective measures to reduce the application of plastic packaging solutions for agricultural chemicals. For instance, in August 2021, Montreal made plans to ban many single-use plastics by March 2023.

North America Agricultural Chemical Packaging Industry Overview

The North American agricultural chemical packaging market is fragmented, with a considerable number of regional and global players. Owing to their market penetration and the ability to offer advanced products, intense competitive rivalry is expected. Moreover, the involvement of large-scale investment also increases the barriers to exit for existing players, thereby pushing the industry toward improved competition.

- February 2022 - ProAmpac, one of the leaders in flexible packaging and material science, announced that it has acquired Belle-Pak Packaging, an award-winning manufacturer of flexible packaging products. With the addition of Belle-Pak, ProAmpac expands its growing presence in Canada and extends its reach in high-growth e-commerce, healthcare and logistics end markets.

- September 2021 - Greif Inc. joined an alliance with a non-profit organization consisting of over 50 companies to end plastic waste in the environment and protect the planet. The alliance consists of member companies and supporters representing companies and organizations from across the plastic value chain and they partner with government, environmental and non-governmental organizations around the world to address the challenge of ending plastic waste in the environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Agricultural Chemical Packaging Market

- 4.5 Industry Regulations and Standards

- 4.6 Qualitative Coverage on the Beakdown of B2B and Direct Channel-based Sales

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Material-based Innovations to Enhance Shelf Life of Products and Ongoing Theme of Sustainability in Packaging

- 5.2 Market Challenges

- 5.2.1 Regulatory and Price-related Challenges

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Bags and Pouches

- 6.1.2 Containers and Cans

- 6.1.3 Intermediate Bulk Containers (IBCs)

- 6.1.4 Other Product Types

- 6.2 By Material Type

- 6.2.1 Plastic

- 6.2.2 Paper and Paperboard

- 6.2.3 Metal

- 6.2.4 Other Materials

- 6.3 By Application Type

- 6.3.1 Fertilizers

- 6.3.2 Pesticides

- 6.3.3 Herbicides

- 6.3.4 Other Application Types

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 LC Packaging International BV

- 7.1.2 Greif Inc.

- 7.1.3 Mondi Group

- 7.1.4 Sonoco Products Company

- 7.1.5 ProAmpac LLC

- 7.1.6 Mauser Packaging Solutions

- 7.1.7 Greif, Inc

- 7.1.8 Tri Rinse

- 7.1.9 Silgan Holdings

- 7.1.10 Hoover CS