|

市場調查報告書

商品編碼

1690838

拉丁美洲報關:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Latin America Customs Brokerage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

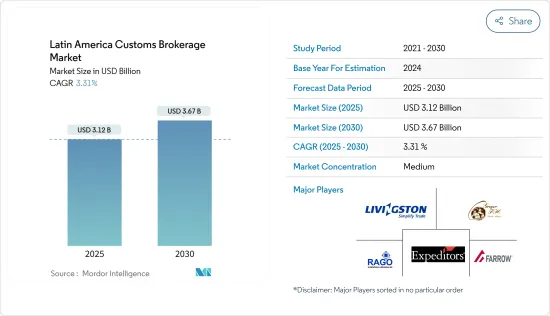

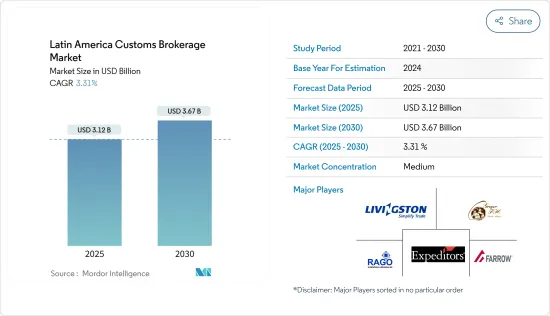

拉丁美洲報關市場規模預計在 2025 年將達到 31.2 億美元,預計到 2030 年將達到 36.7 億美元,預測期內(2025-2030 年)的複合年成長率為 3.31%。

各國必須加快藥品、診斷試劑、套件和設備的清關和放行,以對抗這場流行病。在秘魯、巴拿馬、哥倫比亞和智利等國家,海關當局正在迅速縮短期限和程序,以避免貨物積壓導致法律破產。

邊境摩擦對於航運公司進入拉丁美洲市場有重大影響。由於官僚主義和過時的海關程序,海關清關常常長時間延誤。結果導致貪腐現象猖獗,許多海關官員要求賄賂以加快貨物處理速度。

為了簡化文件和清關等程序,物流公司經常採用新技術和各種最終用戶軟體平台。

物流仲介市場最後一公里配送和端到端配送的順暢快速成長,是提供專業清關服務的公司數量激增的關鍵原因。拉丁美洲報關市場的成長受到物聯網連網型設備的日益普及以及技術主導物流服務日益成長的趨勢的推動。此外,電子商務領域的發展和逆向物流業務的增加也支持了市場的成長。然而,阻礙這一市場成長的是製造商對物流服務的控制需求。

拉丁美洲海關市場趨勢

海運費費用增加

業內專家表示,海上物流承載全球約84%的貿易量和70%的貿易額,被視為貿易的支柱。因此,港口對於確保貨物(包括食品和醫療用品等必需品)能夠順利通過供應鏈至關重要。

整理貨物對於國內報關行和仲介來說需要花費大量的時間。結果是庫存積壓、海關成本高昂以及材料往往需要很長時間才能到達,導致客戶不滿。

貨運代理和運輸業者正在大力投資南美港口和物流業務。我們正在增加對該地區的服務,以適應由於供應鏈多樣化而增加的貿易量和採購變化。 2023年9月,馬士基宣布推出Grape Express。該航班預計耗時 11 天,從秘魯的 Paita 42 飛往費城。

零售業需求不斷成長

國際網上銷售正在支撐零售業的成長。到2024年,跨境電商將佔全球零售額的20.3%。新興的拉丁美洲使零售商能夠進入新的市場並接觸新的客戶。

隨著行動電話的普及,拉丁美洲地區越來越多的人開始使用網路。這就是該地區電子商務蓬勃發展的原因。儘管與北美和歐洲相比,拉丁美洲市場規模較小,但預計未來五年該地區的線上銷售額將成長 19% 以上。

拉丁美洲的電子商務趨勢日益成長。到2022年,近65%的拉丁美洲消費者將從國際零售商購買商品。截至 2023 年,光是阿根廷巨頭 Mercado Libre 就佔據了拉丁美洲電子商務約 28% 的佔有率。

拉丁美洲報關概述

市場較為分散,國內參與者多。有些國家對貿易持開放態度,制定了簡單、易於理解和執行的關稅法。其他國家則利用海關作為壁壘來控制貿易和收入來源。海關不斷徵收新的費用和罰款。由於化學品、製藥、快速消費品和包裝等產業的快速成長,拉丁美洲清關產業的供應商需求旺盛。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概況(拉丁美洲通關市場現況)

- 政府法規和措施(與物流基礎設施發展相關並對其產生影響)

- 技術趨勢(全球趨勢和區域層面的見解) COVID-19 對市場的影響(對市場的短期和長期影響)

- 審查通關成本佔物流總支出的百分比

- 清關價格概覽

- 海關軟體概況(全球主要軟體供應商及區域市場趨勢)

- COVID-19對市場的影響

- 產業吸引力-波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 運輸方式

- 海上

- 空運

- 跨境陸路運輸

- 最終用戶

- 車

- 化學品

- FMCG(快速消費品 - 美容及個人護理、軟性飲料、居家醫療等)

- 零售(大賣場、超級市場、便利商店、電商等)

- 時尚/生活風格(服裝、鞋履)

- 冷藏貨物(水果、蔬菜、藥品、肉類、魚類、水產品)

- 科技(家用電子電器、家用電子電器)

- 其他

- 國家

- 墨西哥

- 巴西

- 智利

- 哥倫比亞

- 巴拿馬

- 其他拉丁美洲

第6章競爭格局

- 概述(市場概況、主要企業)

- 公司簡介

- Grupo Ei

- Livingston International

- Farrow

- Rota Brasil

- Ibercondor Forwarding SA de CV

- Elemar

- Grupo Coex

- Servicios de Aduanas Jimenez

- Aduana Cordero

- Deutsche Post DHL Group

- DSV Panalpina AS

- Expeditors International*

- 其他公司

第7章:市場的未來

第 8 章 附錄

- 區域內主要邊境口岸(國家級)

The Latin America Customs Brokerage Market size is estimated at USD 3.12 billion in 2025, and is expected to reach USD 3.67 billion by 2030, at a CAGR of 3.31% during the forecast period (2025-2030).

Countries had to speed up the clearance and release of medicines, diagnostics, kits, and equipment to combat this pandemic. To avoid the accumulation of goods in legal bankruptcy, customs administrations have quickly shortened their deadlines and procedures in countries such as Peru, Panama, Colombia, and Chile.

The friction at the border can be significant for shipping companies entering Latin America's market. There are often long delays in customs clearance due to bureaucracy and outdated clearance procedures. It has resulted in widespread corruption, and many customs officials are known to ask for bribes to process goods more quickly.

To perform efficient customs processes such as documentation and clearance, logistics companies are regularly adopting new technologies and software platforms for different end users.

Some of the main reasons for an extraordinary increase in companies offering specialized customs services as part of their portfolios are rapidly rising last-mile deliveries and smooth, fast, and end-to-end delivery on the logistics broker market. The growth of the Latin American customs brokerage market is propelled by the augmented adoption of Internet of Things-enabled connected devices and an increasing trend toward technology-driven logistics services. Moreover, the market's growth is supported by the development of the e-commerce sector and by an increase in reverse logistics operations. However, the growth of this market is hampered by a need for manufacturers' control over logistics services.

Latin America Customs Brokerage Market Trends

Increase In Ocean Freight

According to industry experts, maritime logistics is considered the backbone of trade, as it transports around 84% of the volumes traded worldwide and almost 70% of the global trade value. Thus, the port is important in ensuring that goods are distributed through supply chains, including those deemede essentia,l, like food or medical supplies.

The sorting of goods takes significant time for customs agents and brokers in the country. As a result, there is a build-up of stocks, and customs costs can be too high, leading to frustration for customers when materials often take too long to arrive.

Forwarders and carriers are investing heavily in South American ports and logistics businesses. They are adding services to the region to capitalize on growing trade volumes and sourcing shifts from diversifying supply chains. In September 2023, Maersk announced the introduction of Grape Express, which is expected to start in 42 Paita, Peru, and go to Philadelphia with a transit time of 11 days.

Growing Demand In Retail Sector

International online sales support the growth of the retail sector. By 2024, global cross-border e-commerce will account for 20.3% of retail sales. In developing regions of Latin America, retailers can penetrate new markets and attract new clients.

Due to cell phones, an increasing number of people in Latin America are accessing the Internet. It is also the reason why eCommerce has grown in this area. Although the Latin American market is small compared with North America and Europe, online sales in this region are estimated to increase by more than 19% over the coming five years.

Latin America's inclination towards e-commerce is increasing. Nearly 65% of all Latin American consumers bought from an overseas retailer in 2022. As of 2023, Mercado Libre, the Argentine giant alone, accounted for roughly 28% of ecommerce in Latin America.

Latin America Customs Brokerage Industry Overview

The market is fragmented, with the presence of many domestic companies. Some countries are open to trade with simple customs laws that are easy to understand and execute. Others use customs as a barrier to controlling trade and sources of revenue. They continually enforce new fees or penalties. The suppliers in the customs brokerage industry in Latin America are observing a high demand due to the exponential growth of industries such as chemicals, pharmaceuticals, FMCG, and packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview (Current Scenario of Customs Brokerage Market in Latin America)

- 4.2 Government Regulations and Initiatives (Related to Logistics and Logistics Infrastructure Development and Its Impact)

- 4.3 Technological Trends (Global and Regional-level Insights)Impact of COVID-19 on the Market (Short-term and Long-term Effects on the Market)

- 4.4 Review of Customs Brokerage Costs as Percentage of Total Logistics Spend

- 4.5 Overview of Customs Pricing

- 4.6 Brief on Customs Brokerage-related Software (Key Software Providers and Trends in the Global and Regional Market)

- 4.7 Impact of COVID-19 on the Market

- 4.8 Industry Attractiveness - Porter Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Mode of Transport

- 5.1.1 Ocean

- 5.1.2 Air

- 5.1.3 Cross-border Land Transport

- 5.2 End User

- 5.2.1 Automotive

- 5.2.2 Chemicals

- 5.2.3 FMCG (Fast-moving Consumer Goods - Includes Beauty and Personal Care, Soft Drinks, Home Care, etc.)

- 5.2.4 Retail (Hypermarkets, Supermarkets, Convenience Stores, and E-commerce Channels)

- 5.2.5 Fashion and Lifestyle (Apparel and Footwear)

- 5.2.6 Reefer (Fruits, Vegetables, Pharmaceuticals, Meat, Fish, and Seafood)

- 5.2.7 Technology (Consumer Electronics, Home Appliances)

- 5.2.8 Other End Users

- 5.3 Country

- 5.3.1 Mexico

- 5.3.2 Brazil

- 5.3.3 Chile

- 5.3.4 Colombia

- 5.3.5 Panama

- 5.3.6 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration Overview, Major Players)

- 6.2 Company Profiles

- 6.2.1 Grupo Ei

- 6.2.2 Livingston International

- 6.2.3 Farrow

- 6.2.4 Rota Brasil

- 6.2.5 Ibercondor Forwarding SA de CV

- 6.2.6 Elemar

- 6.2.7 Grupo Coex

- 6.2.8 Servicios de Aduanas Jimenez

- 6.2.9 Aduana Cordero

- 6.2.10 Deutsche Post DHL Group

- 6.2.11 DSV Panalpina AS

- 6.2.12 Expeditors International*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Key Border Ports in the Region (Country-level)