|

市場調查報告書

商品編碼

1690784

北美印刷標籤:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Print Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

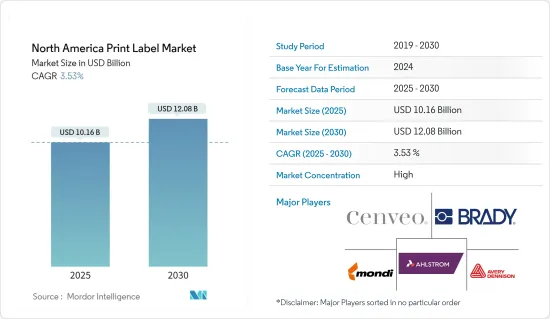

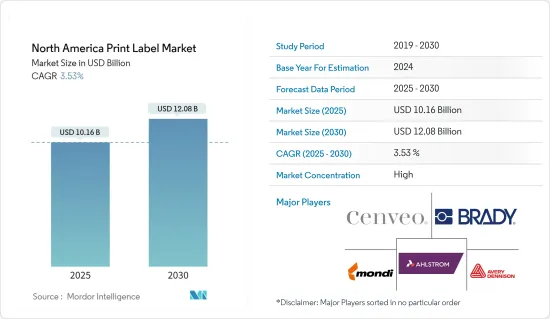

北美印刷標籤市場規模預計在 2025 年為 101.6 億美元,預計到 2030 年將達到 120.8 億美元,預測期內(2025-2030 年)的複合年成長率為 3.53%。

關鍵亮點

- 數位革命再形成北美印刷標籤格局:受技術進步和消費者偏好變化的推動,北美印刷標籤市場正在經歷數位變革時期時期。預計 2021 年市場規模為 88.1341 億美元,到 2027 年將成長至 109.0535 億美元,複合年成長率為 3.59%。數位印刷技術的日益普及是這項成長的主要驅動力,它簡化了生產流程並提供了更個人化和高效的解決方案。

- 數位印刷技術的成本效益:數位印刷技術由於能夠以低成本生產工業規模的數位標籤且不犧牲品質而迅速普及。

- 噴墨技術的進步:UV 和水性噴墨技術正在增強標籤製造中數位印刷的能力,提供更大的靈活性和精確度。

- 更有效率的短期生產:數位印刷對於短期生產特別有利,可減少庫存並縮短前置作業時間。

- 醫療和化妝品領域的廣泛採用推動了市場成長:由於監管要求和消費者對詳細和複雜標籤的需求,醫療和化妝品行業對印刷標籤市場的成長做出了重大貢獻。

- 嚴格的監管要求:美國FDA 規定醫療和藥品標籤在整個供應鏈中必須保持清晰和完整,因此需要耐用的標籤解決方案。

- 多層標籤的成長:由於需要大量的產品訊息,多層標籤在製藥領域變得越來越普遍。

- 疫情驅動的創新:COVID-19 疫情加速了智慧標籤的發展,例如用於疫苗儲存的時間-溫度指示器。

- 化妝品產業需求:在化妝品中,標籤是一種重要的行銷工具,FDA 法規要求突顯重要的產品細節。

- 電子商務繁榮推動標籤需求:電子商務的快速崛起正在重塑印刷標籤的需求,並為標籤製造商創造新的機會。

- 美國電子商務的成長:根據美國商務部的數據,2021年第二季美國電子商務銷售額年增9.3%,推動了對創新標籤的需求。

- 食品和飲料電子商務:預計到 2025 年,食品和飲料電子商務市場規模將達到 256.6 億美元,這將推動對強大標籤解決方案的需求

- 智慧標籤的使用增加:艾利丹尼森預測智慧標籤的使用將會日益普及,這將為整個電子商務供應鏈提供更高的可視性。

- 塑造未來的創新:標籤印刷技術的不斷創新正在徹底改變產業,豐富產品供應並提高業務效率。

- 新產品發布 2020 年 1 月,愛普生美國公司推出了 TM-L90II LFC熱感標籤印表機,將列印選項擴展到多種介質尺寸。

- 無線標籤列印解決方案:2021 年 5 月,Zebra Technologies 推出了一系列新型無線標籤印表機,旨在為小型企業提供經濟高效的解決方案。

- 先進的印刷技術:eAgile Inc. 等公司正在投資 Nilpeter FA-17 等技術,以滿足藥品和膳食補充劑標籤的嚴格要求。

- 市場整合和策略夥伴關係:由於公司合併、收購和尋求策略夥伴關係關係,印刷標籤市場正在進行整合。

- 擴大產品系列的收購:2021 年 4 月,Fortis Solutions Group 收購了 Total Label USA LLC,擴大了其產品供應和地理覆蓋範圍。

- 透過策略聯盟推動創新:2020 年 9 月,Cyngient、MPS 和 Imageworx夥伴關係為標籤製造流程提供全面的解決方案。

- 專注於永續解決方案:艾利丹尼森收購 Catchpoint Ltd 的無底紙標籤技術體現了產業對永續性和減少生產廢棄物的承諾。

北美印刷標籤市場趨勢

感壓標籤佔據市場主導地位

感壓標籤繼續引領北美印刷標籤市場,2021 年的佔有率為 35.95%。該領域的複合年成長率將達到 4.24%,到 2027 年市場規模將達到 40.7277 億美元。

- 多功能性推動需求感壓標籤的主要市場優勢在於其可靈活應用於食品和飲料等產業。 2021年,食品飲料板塊佔了53.53%的市場佔有率。

- 飲料產業的成長:2022 年至 2027 年期間,飲料產業的複合年成長率將達到 4.25%,這將進一步推動對感壓標籤的需求。

- 電子商務的影響:電子商務的成長顯著增加了對感壓標籤的需求,2021 年第二季數位銷售額成長了 9.3%。

- 永續性創新:艾利丹尼森無底紙標籤技術等技術進步可減少廢棄物並提高生產效率。

噴墨列印推動市場成長

噴墨列印預計將成為成長最快的領域,複合年成長率為 5.57%,預計到 2027 年市場規模將達到 6.9817 億美元。

- 成本效益推動採用 UV 噴墨和水性噴墨技術因其成本效益和生產高品質印刷品的能力而越來越受歡迎。

- 終端用戶產業的需求:由於庫存要求低、交貨時間快,噴墨列印在食品飲料和藥品等領域的應用越來越廣泛。

- 技術進步:Beau Label 等公司正在增強其噴墨印刷能力,例如其 PicoJet UV 數位噴墨印刷機。

- 夥伴關係主導的創新:Cyngient、MPS 和 Imageworx 等之間的策略聯盟正在幫助創新和擴展噴墨列印技術。

北美印刷標籤行業概況

北美印刷標籤市場的競爭格局是全球企業集團和專業公司的混合。主要參與企業包括 Fort Dearborn、Multi Color Corporation、Mondi Group、Avery Dennison Corporation 和 WestRock Company。

市場結構鞏固:市場集中在大型企業,但區域性和專業企業也保持激烈的競爭。

創新作為差異化因素:像艾利丹尼森這樣的領先公司正專注於永續性和無底紙標籤等技術進步,以保持競爭力。

透過收購擴張:Multi Color Corporation 等公司利用收購來擴大其產品供應和地理覆蓋範圍。

注重永續性:隨著越來越重視減少對環境的影響,公司正在開發環保材料並投資於永續生產流程。

未來市場的成功策略

未來成功的關鍵驅動力包括擁抱數位轉型、優先考慮永續性和專注於電子商務解決方案。

投資數位技術:我們預計,投資更輕的標籤格式、自動化和可變資訊印刷(VIP) 標籤的公司將會成長。

防偽和供應鏈透明度:制定防偽措施和提高供應鏈可見度對於成功至關重要。

策略夥伴關係關係:效法 Cyngient、MPS 和 Imageworx 的例子,工業公司應該考慮建立合作夥伴關係和收購,以擴大其產品供應和市場影響力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 生態系分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 使用數位印刷技術生產的標籤的需求不斷增加

- 醫療和化妝品領域的採用率很高

- 市場限制

- 缺乏能夠承受惡劣天氣條件的產品

第6章市場區隔

- 透過印刷技術

- 膠印

- 凹版印刷

- 柔版印刷

- 螢幕

- 凸版印刷

- 電子照相技術

- 噴墨

- 按標籤類型

- 濕膠標籤

- 感壓標籤

- 無底紙標籤

- 多部分追蹤標籤

- 套模標籤

- 收縮和拉伸套

- 按最終用戶產業

- 食物

- 飲料

- 醫療保健

- 化妝品

- 家用

- 工業(汽車、工業化學品、耐用性和非耐用消費品)

- 後勤

- 其他

第7章競爭格局

- 公司簡介

- Mondi Group

- Ahlstrom-munksjo Oyj

- Cenveo Corporation

- Avery Dennison Corporation

- Brady Corporation

- Westrock Company

- Brandmark Inc.

- OMNI Systems Inc.

- Blue Label Packaging Company

- Flexo Partners

- IMS Inc.

- Resource Label Group

- CP Flexible Packaging

- Traco Packaging

- Inovar

- Derksen Co.

- Multi-Color Corporation

第8章:市場的未來

The North America Print Label Market size is estimated at USD 10.16 billion in 2025, and is expected to reach USD 12.08 billion by 2030, at a CAGR of 3.53% during the forecast period (2025-2030).

Key Highlights

- Digital Revolution Reshaping North America's Print Label Landscape: The North American print label market is undergoing a digital transformation, fueled by advances in technology and shifting consumer preferences. Valued at USD 8,813.41 million in 2021 and projected to grow to USD 10,905.35 million by 2027, the market is expected to expand at a CAGR of 3.59%. The increasing adoption of digital print technologies is a primary driver of this growth, streamlining production processes and enabling more personalized, efficient solutions.

- Cost-effectiveness of digital print technologies: Digital print technologies are rapidly gaining ground due to their ability to produce industrial-size digital labels at lower costs, without sacrificing quality.

- Advances in inkjet technology: UV and water-based inkjet technologies are enhancing the capabilities of digital printing in label production, offering more flexibility and precision.

- Efficiency in small-batch production: Digital printing is particularly advantageous for smaller production runs, leading to reduced inventory and shorter lead times.

- High Adoption in Healthcare and Cosmetics Driving Market Growth: Healthcare and cosmetics industries are key contributors to the growth of the print label market, driven by regulatory requirements and consumer demand for detailed, sophisticated labeling.

- Stringent regulatory requirements: The US FDA mandates that healthcare and pharmaceutical labels remain legible and intact throughout the supply chain, necessitating durable labeling solutions.

- Growth of multi-layer labels: In the pharmaceutical sector, multi-layer labels are gaining traction due to the need for extensive product information.

- Pandemic-driven innovation: The COVID-19 pandemic has accelerated the development of smart labels, including time-temperature indicators for vaccine storage.

- Cosmetic industry demand: In cosmetics, labels are critical marketing tools, with FDA regulations ensuring that essential product details are prominently displayed.

- E-commerce Boom Catalyzing Label Demand: The rapid rise of e-commerce is reshaping the demand for print labels, presenting new opportunities for label manufacturers.

- E-commerce growth in the U.S.: U.S. e-commerce sales grew by 9.3% year-on-year in Q2 2021, according to the US Department of Commerce, boosting demand for innovative labeling.

- Food and beverage e-commerce: The food and beverage e-commerce market is forecast to reach USD 25.66 billion by 2025, increasing the need for robust labeling solutions.

- Increased use of intelligent labels: Avery Dennison predicts the growing adoption of intelligent labels, which provide enhanced visibility across the e-commerce supply chain.

- Technological Innovations Shaping the Future: Ongoing innovations in label printing technology are revolutionizing the industry, enhancing product offerings and improving operational efficiency.

- New product launches: In January 2020, Epson America introduced the TM-L90II LFC thermal label printer, expanding printing options for various media sizes.

- Wireless label printing solutions: Zebra Technologies launched a new range of wireless label printers in May 2021, targeting small businesses with affordable, efficient solutions.

- Advanced printing technologies: Companies like eAgile Inc. are investing in technologies such as the Nilpeter FA-17 to meet the stringent requirements of pharmaceutical and nutraceutical labeling.

- Market Consolidation and Strategic Partnerships: The print label market is experiencing consolidation as companies pursue mergers, acquisitions, and strategic partnerships.

- Acquisitions expanding product portfolios: In April 2021, Fortis Solutions Group acquired Total Label USA LLC, extending its product offerings and geographical reach.

- Strategic collaborations driving innovation: A partnership between Cyngient, MPS, and Imageworx in September 2020 is delivering comprehensive solutions across the label production process.

- Focus on sustainable solutions: Avery Dennison's acquisition of Catchpoint Ltd's linerless label technology reflects the industry's commitment to sustainability and reducing production waste.

North America Print Label Market Trends

Pressure-Sensitive Labels Segment Dominating the Market

Pressure-sensitive labels continue to lead the North American print label market, with a 35.95% share in 2021. This segment is set to grow at a CAGR of 4.24%, reaching a market value of USD 4,072.77 million by 2027.

- Versatility driving demand: The flexibility of pressure-sensitive labels across industries like food and beverages is a major factor in their market dominance. The food and beverage sector accounted for 53.53% of the market share in 2021.

- Beverage industry growth: The beverage sector is poised for a CAGR of 4.25% from 2022 to 2027, further driving demand for pressure-sensitive labels.

- Impact of e-commerce: E-commerce growth has significantly increased the demand for pressure-sensitive labels, with digital sales rising by 9.3% in Q2 2021.

- Sustainability innovations: Technological advancements, like Avery Dennison's linerless label technology, are reducing waste and enhancing production efficiency.

Inkjet Printing Spearheading Market Growth

Inkjet printing is emerging as the fastest-growing segment, with a CAGR of 5.57%, and is expected to reach a market value of USD 698.17 million by 2027.

- Cost-effectiveness driving adoption: UV inkjet and water-based inkjet technologies are becoming more prevalent due to their cost efficiency and ability to produce high-quality prints.

- End-user industry demand: Inkjet printing is seeing increased adoption across sectors like food, beverages, and pharmaceuticals due to its lower inventory requirements and faster turnaround times.

- Technological advancements: Companies like Beau Label are enhancing inkjet printing capabilities, as seen with the PicoJet UV digital inkjet press, capable of producing superior quality prints with a 1200 x 1200 dpi resolution.

- Partnership-driven innovation: Strategic collaborations, such as between Cyngient, MPS, and Imageworx, are helping to innovate and expand inkjet printing technologies.

North America Print Label Industry Overview

The competitive landscape of the North American print label market is dominated by a mix of global conglomerates and specialized firms. Key players include Fort Dearborn, Multi Color Corporation, Mondi Group, Avery Dennison Corporation, and WestRock Company.

Consolidated market structure: While the market is concentrated among major players, regional and specialized companies maintain a strong competitive presence.

Innovation as a differentiator: Leading firms like Avery Dennison are focusing on sustainability and technological advancements, such as linerless labels, to maintain their competitive edge.

Expanding through acquisitions: Companies like Multi Color Corporation are leveraging acquisitions to expand their product offerings and geographic footprint.

Sustainability focus: With a growing emphasis on reducing environmental impact, firms are developing eco-friendly materials and investing in sustainable production processes.

Strategies for Future Success in the Market

Key factors for future success include embracing digital transformation, prioritizing sustainability, and focusing on e-commerce solutions.

Investment in digital technologies: Companies that invest in lightweight label formats, automation, and variable information print (VIP) labels are expected to thrive.

Anti-counterfeiting and supply chain transparency: Developing anti-counterfeiting measures and enhancing visibility in supply chains will be crucial for success.

Strategic partnerships: Following the example of Cyngient, MPS, and Imageworx, industry players should consider partnerships and acquisitions to expand their product offerings and market presence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Labels Manufactured with Digital Print Technologies

- 5.1.2 High Adoption from the Healthcare and Cosmetics Segment

- 5.2 Market Restraints

- 5.2.1 Lack of Products with Ability to Withstand Harsh Climatic Conditions

6 MARKET SEGMENTATION

- 6.1 By Printing Technology

- 6.1.1 Offset Lithography

- 6.1.2 Gravure

- 6.1.3 Flexography

- 6.1.4 Screen

- 6.1.5 Letterpress

- 6.1.6 Electrophotography

- 6.1.7 Inkjet

- 6.2 By Label Type

- 6.2.1 Wet-glue Labels

- 6.2.2 Pressure-sensitive Labels

- 6.2.3 Linerless Labels

- 6.2.4 Multi-part Tracking Labels

- 6.2.5 In-mold Labels

- 6.2.6 Shrink and Stretch Sleeves

- 6.3 By End-user Industry

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Healthcare

- 6.3.4 Cosmetics

- 6.3.5 Household

- 6.3.6 Industrial (Automotive, Industrial Chemicals, and Consumer and Non- consumer Durables)

- 6.3.7 Logistics

- 6.3.8 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mondi Group

- 7.1.2 Ahlstrom-munksjo Oyj

- 7.1.3 Cenveo Corporation

- 7.1.4 Avery Dennison Corporation

- 7.1.5 Brady Corporation

- 7.1.6 Westrock Company

- 7.1.7 Brandmark Inc.

- 7.1.8 OMNI Systems Inc.

- 7.1.9 Blue Label Packaging Company

- 7.1.10 Flexo Partners

- 7.1.11 IMS Inc.

- 7.1.12 Resource Label Group

- 7.1.13 C-P Flexible Packaging

- 7.1.14 Traco Packaging

- 7.1.15 Inovar

- 7.1.16 Derksen Co.

- 7.1.17 Multi-Color Corporation