|

市場調查報告書

商品編碼

1690765

南美航空燃料:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)South America Aviation Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

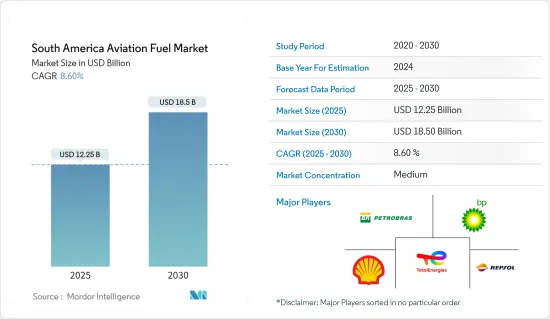

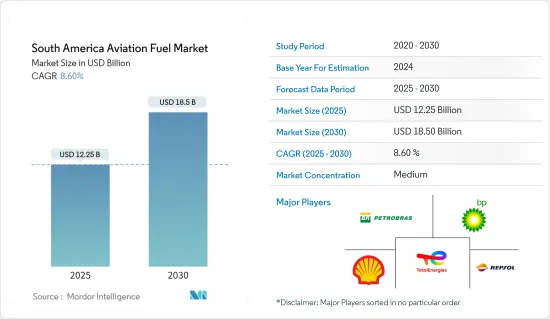

南美航空燃料市場規模預計在 2025 年為 122.5 億美元,預計到 2030 年將達到 185 億美元,預測期內(2025-2030 年)的複合年成長率為 8.6%。

關鍵亮點

- 從中期來看,近期機票價格低廉導致的空中交通復甦、經濟狀況增強以及可支配收入增加是推動市場成長的一些主要因素。

- 另一方面,由於南美國家擁有大量基於石化燃料的航空燃料,導致環境惡化,未來幾年市場可能面臨障礙。

- 南美洲是生質燃料的主要地區之一。隨著航空業繼續向生質燃料轉變,在不久的將來很可能會出現巨大的機會。

- 巴西是南美洲最大的航空燃料消費國,在該地區具有優勢。由於市場的成長,預計巴西將在預測期內保持其主導地位。

南美洲航空燃料市場趨勢

商業領域將經歷顯著成長

- 民航經營定期和非定期航空服務,並為客運和貨運提供商業航空運輸。在這一領域,私營部門是航空燃料的主要消費者之一,約佔航空公司總營運支出的四分之一。

- 2022 年 12 月拉丁美洲和加勒比海地區 (LAC) 的總客運量為 3,230 萬人次。同時,LATAM地區航空集團共運送乘客53,861人次。

- 巴西、巴拉圭和秘魯等國家正在進行的機場私有化預計將有助於發展機場基礎設施並增加容量,從而支持該地區的市場。

- 相反,該地區短程航班的比例明顯增加,短程航班在空中交通中所佔的比重也越來越大。廉價航空公司(LCC)和超低成本航空公司(ULCC)在拉丁美洲發展勢頭強勁。目前,該地區的廉價航空公司發展速度比以往任何時候都快,並顯示出超越傳統航空公司的跡象。

- 此外,2023 年 8 月,BP 航空在 LABACE 2023 上宣布,計劃在巴西聖保羅州保利尼亞建立一個飛機燃料供應中心。該設施預計將於 2023 年開始營運,是該公司超過 1,000 萬美元戰略投資的一部分。該計劃旨在提高物流靈活性並改善飛機營運商的燃料供應選擇。

- 此外,Air bp 正在聖保羅孔戈尼亞斯機場開發一個新的燃料箱,目標是在 2024 年運作。這兩個即將建成的設施代表著一項重大投資,並體現了 Air bp 致力於加強航空領域基礎設施和服務的承諾。

- 因此,預計上述因素將在預測期內推動商業部門的成長。

巴西佔市場主導地位

- 在南美洲,巴西是最大的航空燃料消費國。該國的航空指定產品包括航空煤油(QAV)、航空汽油和代用航空煤油(替代QAV)。

- 巴西民航市場規模龐大,根據巴西民航局報告,2022 年巴西民航航班數量達 831,000 架次,較與前一年同期比較成長 39%。根據西班牙航空運輸協會2022年數據顯示,其中國內航班73.1萬架次,大幅增加33.7%;國際航班10萬架次,大幅成長89%。

- 由於部分批次的化學檢測結果不合格,巴西石油公司暫停進口航空燃料供應,影響了巴西的航空燃料銷售。這一事態發展也導致 BR Distribuidora 和 Raizen 等主要燃料分銷商暫停該產品的銷售。不過,情況已有所好轉,航空燃油銷售已從影響中恢復。

- 此外,2023年10月,波音公司將在巴西正式開設工程技術中心,加入波音公司在全球的15個工程基地,透過尖端技術開發推動航太創新。波音公司也宣布與坎皮納斯州立大學(Unicamp)合作提供資金支持,以擴大永續性的合作。此次擴展涉及 SAFMaps資料庫第三階段的開發,旨在了解巴西特定地區永續航空燃料 (SAF) 生產最有前景的投入的可行性。

- 總體而言,由於政府措施可能進一步提振市場,巴西航空燃料市場預計在預測期內將實現良好成長。

南美洲航空燃料產業概況

南美航空燃料市場較為分散。主要企業(排名不分先後)包括 Petroleo Brasileiro SA、BP PLC、Shell PLC、TotalEnergies SE 和 Repsol SA。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概述

- 介紹

- 至2029年的市場規模及需求預測(單位:美元)

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 主角

- 近期機票價格低廉,導致航空旅客數量回升

- 人口可支配所得增加

- 限制因素

- 南美國家石化燃料航空燃料佔比高

- 主角

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 燃料類型

- 空氣渦輪燃料(ATF)

- 航空生質燃料

- 阿布古斯

- 應用

- 商用

- 防禦

- 通用航空

- 地區

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Petroleo Brasileiro SA

- Repsol SA

- BP PLC

- Shell PLC

- TotalEnergies SE

- Pan American Energy SL

- Exxon Mobil Corporation

- Allied Aviation Services Inc.

- 市場排名/佔有率(%)分析

第7章 市場機會與未來趨勢

- 航空生質燃料的日益普及

簡介目錄

Product Code: 71500

The South America Aviation Fuel Market size is estimated at USD 12.25 billion in 2025, and is expected to reach USD 18.50 billion by 2030, at a CAGR of 8.6% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the recovering number of air passengers, on account of cheaper airfare in recent times, more robust economic conditions, and increasing disposable income are among the major driving factors for the market.

- On the other hand, the market can face hurdles in the coming years due to the high share of fossil-fuel-based aviation fuels in South American countries, which are responsible for the degradation of the environment.

- Nevertheless, South America is one of the leading regions in biofuels. With an increasing shift towards aviation biofuels, significant opportunities are likely to be created in the near future.

- Brazil is the largest consumer of aviation fuels in South America, resulting in its dominance in the region. With the growing market, the nation is expected to continue its dominance during the forecast period.

South America Aviation Fuel Market Trends

The Commercial Sector to Witness a Significant Growth

- Commercial aviation involves the operation of both scheduled and non-scheduled aircraft, facilitating the commercial air transportation of passengers or cargo. Within this sector, the commercial segment stands out as one of the leading consumers of aviation fuel, constituting approximately a quarter of the total operating expenditure for airline operators.

- The total number of passengers transported in Latin America and the Caribbean (LAC) was 32.3 million in December 2022, which is the highest number of passengers. Meanwhile, the LATAM region had a total number of 53,861 passengers boarded by the airline group.

- The ongoing privatization of airports in countries like Brazil, Paraguay, and Peru is anticipated to contribute to the development of airport infrastructure and an increase in capacity, thereby providing support to the studied market in the region.

- Conversely, there has been a notable rise in the share of short-haul flights within the region, leading to an increased proportion of air traffic. In Latin America, the low-cost (LCC) and ultra-low-cost (ULCC) movements are experiencing significant momentum. Currently, more than ever, low-cost carriers in the region are witnessing accelerated growth, outpacing legacy airlines in their ascent.

- Moreover, in August 2023, Air bp has revealed plans to establish an aircraft fuel supply hub in Paulinia, located in Brazil's Sao Paulo state, as announced during LABACE 2023. The facility, anticipated to commence operations in 2023, is part of the company's strategic investment exceeding USD 10 million. This initiative aims to enhance logistical flexibility and provide improved fuel supply options for aircraft operators.

- Additionally, Air bp is in the process of developing a new fuel tank farm at Sao Paulo Congonhas Airport, set to become operational in 2024. These two upcoming facilities signify a significant investment, demonstrating Air bp's commitment to bolstering infrastructure and services in the aviation sector.

- Thus, the factors mentioned above are expected to drive growth in the commercial segment during the forecast period.

Brazil to Dominate the Market

- In South America, Brazil holds the distinction of being the largest consumer of aviation fuels. The designated products for aircraft use in the country encompass aviation kerosene (QAV), aviation gasoline, and alternative aviation kerosene (alternative QAV).

- The commercial aviation market in Brazil is substantial, with 831,000 flights recorded in 2022, marking a notable 39% increase compared to the previous year, as reported by ANAC. Within this total, 731,000 flights were domestic, reflecting a significant uptick of 33.7%, while international flights accounted for 100,000, showcasing a remarkable 89% increase, according to the Anuario do Transporte Aereo 2022.

- The sales of aviation fuel in Brazil faced an impact from Petrobras' suspension of the supply of imported aviation fuel due to chemical test results from a specific batch, which raised potential concerns. This development also prompted major fuel distributors, including BR Distribuidora and Raizen, to temporarily halt the sale of the product. However, the situation has improved and sales of aviation fuel has recovered from that impact.

- Moreover, In October 2023, Boeing officially inaugurated its Engineering and Technology Center in Brazil, joining the roster of 15 Boeing engineering sites worldwide dedicated to advancing aerospace innovation through cutting-edge technology development. In collaboration with the State University of Campinas (Unicamp), Boeing has also disclosed financial support to expand their sustainability collaboration. This extension involves the development of the third phase of the SAFMaps database, aimed at comprehending the viability of the most promising inputs for Sustainable Aviation Fuel (SAF) production in specific regions of Brazil.

- Overall, the aviation fuel market for Brazil is expected to register decent growth during the forecast period, owing to the supporting government initiatives, which are likely to aid the market's growth further.

South America Aviation Fuel Industry Overview

The South American aviation fuel market is semi-fragmented. Some of the major companies (in no particular order) are Petroleo Brasileiro SA, BP PLC, Shell PLC, TotalEnergies SE, and Repsol SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Recovering Number of Air Passengers, on Account of the Cheaper Airfare in Recent Times

- 4.5.1.2 Increasing Disposable Income of Population

- 4.5.2 Restraints

- 4.5.2.1 High Share of Fossil-Fuel-Based Aviation Fuels in South American Countries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Air Turbine Fuel (ATF)

- 5.1.2 Aviation Biofuel

- 5.1.3 AVGAS

- 5.2 Application

- 5.2.1 Commercial

- 5.2.2 Defense

- 5.2.3 General Aviation

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Colombia

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Petroleo Brasileiro SA

- 6.3.2 Repsol SA

- 6.3.3 BP PLC

- 6.3.4 Shell PLC

- 6.3.5 TotalEnergies SE

- 6.3.6 Pan American Energy SL

- 6.3.7 Exxon Mobil Corporation

- 6.3.8 Allied Aviation Services Inc.

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Shift Towards Aviation Biofuels

02-2729-4219

+886-2-2729-4219