|

市場調查報告書

商品編碼

1690755

英國宅配、快捷郵件和小包裹(CEP)-市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)United Kingdom Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

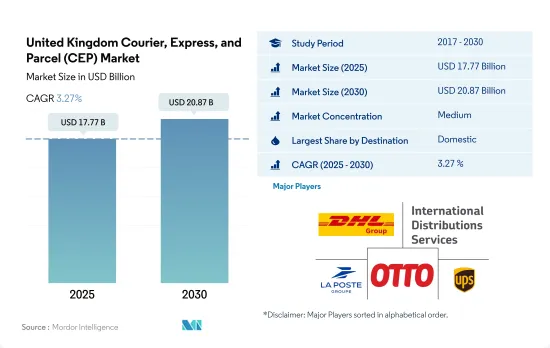

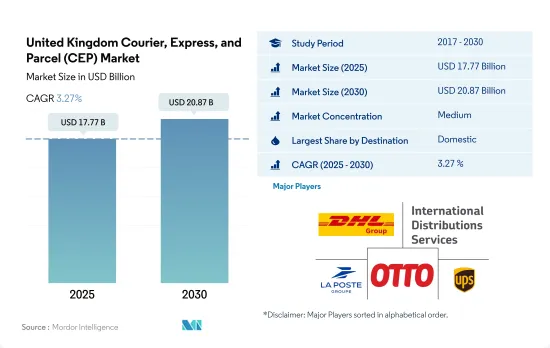

英國宅配、快捷郵件和小包裹(CEP) 市場規模預計在 2025 年達到 177.7 億美元,預計到 2030 年將達到 208.7 億美元,預測期內(2025-2030 年)的複合年成長率為 3.27%。

由於電子商務 CEP訂單的增加,減少碳足跡的舉措不斷增多,預計將對 CEP 行業產生積極影響。

- 電子商務產業正在推動國內和國際 CEP 領域的成長。時尚產品是2022年英國消費者在網路上購買最常見的商品,其中服飾佔63%,鞋子佔47%。其次是家用電子電器產品(35%)以及書籍、電影和遊戲(33%)。所有這些因素都推動了英國對 CEP 的需求。

- 擁有最大市場佔有率的CEP 公司正在採取重大措施減少運送大量小包裹所產生的碳排放。例如,皇家郵政允許 90,000 名郵遞員步行遞送包裹。三分之二的送貨都是純步行或採用「停車繞行」方式,絕大多數的送貨都是步行完成。該公司還計劃在 2023 年之前在其車隊中擁有 5,500 輛電動貨車,以進一步減少其碳排放。亞馬遜也於 2022 年開始在倫敦透過步行和電動貨運自行車進行送貨。兩家公司的努力都是到 2040 年實現所有貨物淨零碳排放承諾的一部分。

英國宅配、快捷郵件和小包裹(CEP)市場趨勢

預計到 2027 年,隨著消費者履約中心需求的不斷成長,英國的倉庫數量將達到 214,000 個。

- 2024 年 5 月,杜拜環球港務集團在考文垂開設了迄今為止最大的倉庫,佔地 598,000 平方英尺(約 8,000平方公尺),這是 5000 萬英鎊(6092 萬美元)投資的一部分,旨在增強客戶競爭力。此前,英國政府於 2023 年 9 月在比斯特開設了一座佔地 27 萬平方英尺的音樂和視訊分銷倉庫,該倉庫將處理英國70% 的實體音樂和 35% 的家庭娛樂產品。 DP World 先前已在特倫特河畔伯頓開設了一個 75,000 平方英尺的倉庫,並在其倫敦門戶物流中心開設了一個 230,000 平方英尺的多用戶倉庫。杜拜環球港務集團在南安普敦和倫敦門戶設有樞紐,業務遍及 78 個國家,控制全球 10% 的貿易。預計這些舉措將提高該產業對 GDP 的貢獻。

- 英國大型倉庫的數量正在快速成長。到 2027 年,預計全球整體將有約 214,000 個面積超過 50,000 平方英尺的倉庫。許多倉庫將作為電子商務履約中心,到 2027 年,大約 18% 的倉庫將用於消費者履約。這一成長表明,隨著電子商務的擴張,作為貿易物流中心的倉庫比例開始轉向消費者履約中心。

英國政府對燃油價格有很大影響,燃油稅和增值稅(標準稅率為 20%)構成了汽油和柴油價格的大部分。

- 2022年8月,原油價格跌破100美元,月末收在每桶90.63美元。 2023年油價進一步下跌,5月跌至每桶72.50美元的低點。 2024年3月,英國汽油價格平均為每公升150.1披索,為2023年11月以來的最高水準。這是由於油價上漲以及中東局勢惡化導致英鎊兌美元走弱。雖然整體通膨有所緩和,但 3 月汽油和柴油價格上漲。 2024 年 4 月以色列對伊朗發動報復性攻擊後,油價飆升,隨後開始下跌。

- 2024 年 6 月,英國政府確認計畫在 2030 年強制要求噴射機燃料中至少含有 10% 的永續航空燃料 (SAF)。目前,SAF 比傳統燃料稀缺且昂貴,因此很難在航空領域增加其使用。 SAF 佔世界噴射機燃料的佔有率不到 0.1%。政府對 SAF 的授權將於 2025 年 1 月開始,但需獲得立法核准。這是 2022 年「Jet Zero」策略的延續,該策略旨在 2050 年實現航空淨零排放。

英國宅配、快捷郵件和小包裹(CEP)產業概況

英國宅配、快捷郵件和小包裹(CEP) 市場適度整合,主要有五家參與者(按字母順序排列):DHL 集團、主要企業配送服務公司(包括皇家郵政)、法國郵政集團、奧托集團(包括愛馬仕集團)和美國聯合包裹服務公司 (UPS)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口統計

- 按經濟活動分類的GDP分佈

- 經濟活動GDP成長

- 通貨膨脹率

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業GDP

- 出口趨勢

- 進口趨勢

- 燃油價格

- 物流績效

- 基礎設施

- 法律規範

- 英國

- 價值鍊和通路分析

第5章市場區隔

- 銷售目的地

- 國內的

- 國際的

- 送貨速度

- 快捷郵件

- 非快捷郵件

- 模型

- 企業對企業(B2B)

- B2C

- 消費者對消費者(C2C)

- 運輸重量

- 重型貨物

- 輕型貨物

- 中等重量貨物

- 運輸方式

- 航空郵件

- 路

- 其他

- 最終用戶

- 電子商務

- 金融服務(BFSI)

- 醫療保健

- 製造業

- 一級產業

- 批發零售(線下)

- 其他

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- APC Overnight

- DHL Group

- FedEx

- GEODIS

- 國際配送服務(包括皇家郵政)

- La Poste Group

- Otto Group(including The Hermes Group)

- Rapid Parcel

- United Parcel Service of America, Inc.(UPS)

- Yodel

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 技術進步

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

The United Kingdom Courier, Express, and Parcel (CEP) Market size is estimated at 17.77 billion USD in 2025, and is expected to reach 20.87 billion USD by 2030, growing at a CAGR of 3.27% during the forecast period (2025-2030).

Growing carbon footprint reduction initiatives owing to increasing e-commerce CEP orders are expected to positively impact CEP industry

- The e-commerce industry is a leading driver of growth in the domestic and international CEP segments. The most common goods purchased online by UK consumers in 2022 were fashion goods , with clothing accounting for a 63% share and shoes for a 47% share. These were followed by consumer electronics, with a 35% share, and books, movies, and games, with a 33% share in 2022. All these item deliveries collectively drove CEP demand in the United Kingdom.

- CEP companies with some of the biggest market shares are taking significant steps to reduce the carbon footprint generated by delivering huge volumes of parcels. For instance, Royal Mail has allowed 90,000 posties to make on-feet deliveries. Two-thirds of the deliveries are made purely by foot or through a 'park and loop' method, which is mostly on foot. The company is also aiming to have 5,500 electric vans by 2023 in a further effort to reduce carbon emissions. Amazon also started on-foot and electric cargo bike delivery in London in 2022. Initiatives by both companies are a part of their commitment toward all shipments having net-zero carbon emissions by 2040.

United Kingdom Courier, Express, and Parcel (CEP) Market Trends

The UK's warehouse count is expected to reach 214,000 by 2027 due to a rise in demand for consumer fulfillment centers

- In May 2024, DP World opened its largest warehouse yet, a 598,000 sq ft facility in Coventry, as part of a GBP 50 million (USD 60.92 million) investment to boost customer competitiveness. This follows the September 2023 opening of a 270,000 sq ft music and video distribution warehouse in Bicester, handling 70% of the UK's physical music and 35% of home entertainment products. Previously, DP World opened a 75,000 sq ft site in Burton upon Trent and a 230,000 sq ft multi-user warehouse at London Gateway's logistics hub. Alongside its hubs at Southampton and London Gateway, operating in 78 countries, DP World manages 10% of global trade. Such initiaves are expected to boost the GDP contribution from the sector.

- The number of large warehouses in the United Kingdom is rapidly increasing. By 2027, there are expected to be around 214,000 warehouses larger than 50,000 square feet globally. Many of these warehouses are to serve as e-commerce fulfillment centers, and approximately 18% of all warehouses will be for consumer fulfillment by 2027. This increase suggests the global expansion of e-commerce as the proportion of warehouses operating as trade distribution hubs begins to shift in favor of consumer fulfillment centers.

UK government has a major influence on fuel prices, and both fuel duty and VAT (standard 20% rate) make up majority of the petrol and diesel prices

- In August 2022, the oil price dropped under USD 100 and finished the month at USD 90.63 a barrel. Prices dropped further in 2023, and by May, a barrel of oil was down to USD 72.50. In March 2024, petrol prices in the UK averaged 150.1p per litre, the highest since November 2023. This is due to rising oil prices due to Middle East tensions and a weaker pound against the dollar. Although overall inflation has eased, petrol and diesel prices increased in March. Oil prices have since dropped after spiking following Israel's retaliatory attack on Iran in April 2024.

- In June 2024, the UK government confirmed it plans to require at least 10% sustainable aviation fuel (SAF) in jet fuel by 2030. Currently, SAF is scarce and more expensive than traditional fuels, making it challenging to increase its use in aviation. SAF represents less than 0.1% of jet fuel globally. The government's SAF mandate, pending legislative approval, is set to start in January 2025. This follows the 2022 "Jet Zero" strategy aiming for net-zero emissions in aviation by 2050.

United Kingdom Courier, Express, and Parcel (CEP) Industry Overview

The United Kingdom Courier, Express, and Parcel (CEP) Market is moderately consolidated, with the major five players in this market being DHL Group, International Distributions Services (including Royal Mail), La Poste Group, Otto Group (including The Hermes Group) and United Parcel Service of America, Inc. (UPS) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 United Kingdom

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 APC Overnight

- 6.4.2 DHL Group

- 6.4.3 FedEx

- 6.4.4 GEODIS

- 6.4.5 International Distributions Services (including Royal Mail)

- 6.4.6 La Poste Group

- 6.4.7 Otto Group (including The Hermes Group)

- 6.4.8 Rapid Parcel

- 6.4.9 United Parcel Service of America, Inc. (UPS)

- 6.4.10 Yodel

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms