|

市場調查報告書

商品編碼

1690738

客戶資訊系統:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Customer Information System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

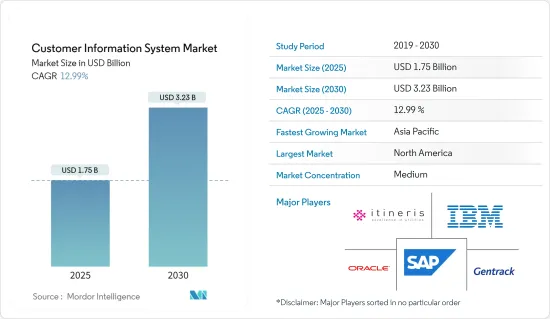

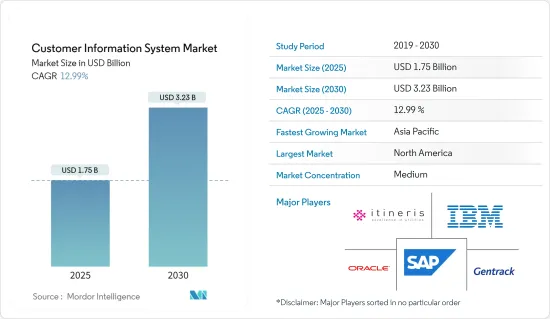

預計 2025 年客戶資訊系統市場規模為 17.5 億美元,到 2030 年將達到 32.3 億美元,預測期內(2025-2030 年)的複合年成長率為 12.99%。

人們越來越關注客戶滿意度,因此客戶資訊系統 (CIS) 的採用也越來越廣泛。公司正在轉向能夠有效整合 CRM 解決方案與具有使用者定義欄位的動態資料庫的解決方案。

關鍵亮點

- 公司優先提供完整的客戶資料歷史記錄和隨附文檔,以減少回應時間並幫助銷售負責人更好地了解問題。客戶資訊系統是客戶滿意度的核心,它為銷售負責人提供即時客戶資料庫資料,從而提高服務品質。整合 CIS 解決方案可直接存取有用的客戶資訊,消除重複資料輸入,並允許更快地跟進問題和查詢。

- 目前,CIS 解決方案供應商的市場趨勢是,從添加到 CRM 軟體的文件中提取的資訊(公司名稱、地址、訂單號碼、支援問題及其解決方案等)的整合度不斷提高。 CIS 系統將這些文件與提供資料背景的相關資訊(例如提案、合約、通訊和電子郵件)相整合,幫助提供分析支援。

- 數位技術改變了公共產業客戶與產品和服務互動的方式。需要一個高效的解決方案和軟體包公共產業解決從公共產業計量表到現金的整個流程,並支援多種客戶溝通管道,如客服中心、互動式語音應答 (IVR) 等。 CIS 解決方案允許公司將其獨特的客戶管理需求與其軟體無縫整合,而不是強迫他們圍繞軟體需求進行合理化。

- CIS 儲存非公開的公司資訊,例如銷售、客戶和企業資料資料。系統中的資料外洩可能會對您的業務造成不利影響,可能導致訴訟並對您的品牌聲譽和消費者信任造成無法彌補的損害。因此,許多公司對於實施該系統猶豫不決。資料隱私外洩的風險正在限制市場成長並對 CIS 供應商構成重大挑戰。

- COVID-19 疫情的爆發促使全部區域的各組織採取一切必要措施,確保其員工和社區的安全。然而,儘管疫情肆虐,跨產業的企業仍必須繼續尋求市場機會、實現銷售並解決客戶問題。此外,隨著在家工作規定的實施,企業擴大被要求在這種遠距工作環境中與客戶合作,這對受訪市場產生了積極影響。

客戶資訊系統(CIS)市場趨勢

零售業顯著成長

- 零售業的資訊系統解決方案發揮至關重要的作用,執行各種任務,如規劃、庫存控制、預算控制、客戶資訊管理、銷售目標管理、POS 交易、物流等。

- 許多公司在開發 CIS 解決方案時都考慮到了經濟實惠性,以使其適合各種規模的組織。例如,2023 年 1 月,Info Noble 的解決方案創建了一個 CRM 系統,無論組織規模如何,該系統都成本低、易於設定且具有使用者友好的 UI。

- 消費者資訊管理軟體分析現有和潛在客戶的資料,幫助企業更了解他們,以維持和發展關係。為了幫助企業推動銷售並更了解客戶,客戶關係管理系統收集零售領域的關鍵聯絡資訊、個人資訊、銷售歷史、客戶溝通和客戶回饋相關資訊。

- 許多以消費者為中心的企業主要關注遵守當地的隱私法,這可能會以加強其整體資料管理計畫為代價。客戶資料以及獲取和提煉資料的過程最終是 B2C 公司的核心。透過提高客戶資料的品質和完整性,企業可以更了解消費者行為,並針對特定細分市場提供新產品和服務,同時實現並維持合規性。

- 為了將資料轉化為有意義的知識,公司必須為每個客戶連接不同的系統,將來自忠誠度應用程式和相關社交媒體的非結構化和資料資料連結到每個人。企業可以建立全面的資料管理程序,並透過將所有可用的操作與單一消費者聯繫起來,為客戶獲取新的見解。

預計北美將佔據主要佔有率

- 北美是 CIS 軟體的主要採用地區之一,被認為是公共產業和能源分析的關鍵市場之一。該地區的需求主要受到新興經濟體對研發創新和技術進步的高度重視的推動。

- 此外,該地區擁有一批實力雄厚的供應商進入市場。其中包括 IBM 公司、Oracle 公司和 SAP SE。與加拿大相比,美國在需求成長方面發揮重要作用。需求正在成長,尤其是在石油和天然氣、精製和發電領域。

- 在過去的幾年裡,整合系統已經成熟到CIS-as-a-Service(CaaS)成為現實的程度。使用 CaaS 的好處很多,而且立竿見影。與傳統實施相比,CaaS 的總擁有成本 (TCO) 至少低 40%,運行成本為每米每月 1-2 美元,具體取決於所需的規模和服務。例如,由美國俄亥俄河谷的一個市政當局營運的 Wipro 正在採用 CaaS,並計劃將其作為服務機構提供,以便其他水務公司共用其基礎設施。

- 在美國,由於公共重新關注減少無收益水 (NRW),對智慧電錶的需求強勁。智慧收費和洩漏檢測的附加好處正在刺激智慧電錶的安裝,預計這將推動受調查市場的成長。計量和更新的需求(例如來自智慧電網和智慧系統)使得 CIS 對於計量到現金 (M2C) 流程、新產品創造和供應最佳化至關重要。 CIS 也將能夠管理 AMI(進階計量基礎設施)產生的大量資料。

- 在美國,NV Energy 是首批全面部署 AMI 的投資者擁有的公用事業公司之一,已安裝了 131 萬個智慧電錶。根據美國能源效率經濟委員會 (ACEEE) 的說法,它是少數幾個能夠充分發揮 AMI資料潛力的主要 IOU 之一。最廣泛使用的是透過企業資料分析和非行為需求面管理 (DSM) 計劃進行的 Bidgley 線上家庭能源審核。

客戶資訊系統(CIS)產業概覽

客戶資訊系統市場呈現半靜態狀態,只有少數參與企業擁有主要市場佔有率。擁有較大市場佔有率的大公司正致力於擴大跨地區的基本客群。這些公司正在利用策略創新和協作舉措來擴大市場佔有率並提高盈利。

2023 年 1 月,能源公司 AGL Energy (AGL) 與微軟合作,提供基於雲端的資料平台,使 AGL 能夠根據澳洲嚴格的消費者資料權利 (CDR) 法律為其客戶提供消費者資料權利服務。這將使 AGL 能夠為其客戶提供符合澳洲嚴格的消費者資料權利 (CDR) 法律的消費者資料權利服務。

2023 年 1 月,全球自然健康和鞋類公司 VIVOBAREFOOT 將與 Arvato CRM Solutions夥伴關係,以改善客戶服務並支持其在英國和國際上的發展。根據協議,Arvato 將與該公司合作開發多通路顧客關懷解決方案,該解決方案可隨著品牌擴張而擴展,確保消費者繼續收到對其諮詢的快速、友好的回應。

2022 年 12 月,服務於紐約和 PJM 市場的能源供應商 Ameripro Energy Corp. 與為公共產業能源企業提供雲端基礎的客戶體驗和軟體即服務 (SaaS) 解決方案的領先供應商 VertexOne 宣布兩家公司展開合作。 VertexOne 的客戶資訊系統 (CIS) 平台 VXretail 已被 Ameripro Energy Corp. 選擇用於 EDI 交易管理,而其客戶服務、發票和市場異常響應平台 VXexchange 將負責客戶服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 工業影響評估

第5章市場動態

- 市場促進因素

- 全球公共產業消費不斷成長

- 雲端運算和物聯網技術的興起

- 市場問題

- 嚴格的政府資料法規

第6章市場區隔

- 按部署

- 雲

- 本地

- 按組件

- 按解決方案

- 按服務

- 按最終用戶

- CRM 的最終用戶

- BFSI

- 零售

- 通訊

- CIS 最終用戶

- 用水和污水管理

- 能源公共產業

- 其他

- CRM 的最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Oracle Corporation

- Fluentgrid Limited

- IBM Corporation

- Wipro Limited

- Cayenta CIS

- Gentrack Group Limited

- SAP SE

- Itineris NV

- Hydro Comp Enterprises Ltd

- Open International LLC

第8章投資分析

第9章:未來展望

The Customer Information System Market size is estimated at USD 1.75 billion in 2025, and is expected to reach USD 3.23 billion by 2030, at a CAGR of 12.99% during the forecast period (2025-2030).

The growing adoption of a Customer Information System (CIS) is driven by the increasing focus on customer satisfaction. Companies are moving toward a suite of solutions that can effectively integrate CRM solutions into a dynamic database with user-defined fields.

Key Highlights

- Companies have prioritized decreasing customer response times and providing sales personnel with a full history of the customer data and accompanying documents to help them better understand the problem. Central to the customer satisfaction theme, Customer Information Systems equip sales personnel with real-time customer database data, which leads to an enhanced quality of service. The follow-up of issues and queries becomes faster with the integration of CIS solutions as the scope of duplicate data entries is eliminated with direct access to useful customer information.

- The current market trends of vendors offering CIS solutions can be characterized by the increasing integration of information extracted from documents added to the CRM software, including company names and addresses, order numbers, and support issues and their resolution. The CIS systems help with providing analytical support by integrating these documents with related information like proposals, contracts, correspondence, and emails that provide the context for that data.

- Digital technology has changed the way utility customers interact with products and services. There is a need for highly efficient solutions and software packages to resolve this utility meter-to-cash utility meter-to-cash process and enable several client communications channels, including call centers, interactive voice responses (IVRs), and others. CIS solutions allow companies to seamlessly integrate their unique customer management needs with the software rather than compelling companies to streamline according to the software needs.

- CIS stores the companies' private information, including sales, customer, and corporate intelligence data. A system data breach could be detrimental to the company, resulting in lawsuits or irrevocable harm to its brand's reputation and consumer trust. Many companies are hesitant to adopt the system as a result. The risk of data privacy violations is restricting market growth and providing a significant challenge for CIS vendors.

- The outbreak of COVID-19 prompted organizations across the region to undertake all the necessary steps to ensure the safety of their employees and the community. However, organizations operating in multiple verticals must pursue market opportunities, close sales, and resolve customer issues despite the pandemic. Also, following the mandate of working from home, companies have increasingly been required to collaborate with their clients in this remote working environment, which has created a positive impact on the studied market.

Customer Information System (CIS) Market Trends

Retail to Witness Significant Growth

- Information system solutions in the retail sector play a vital role and perform a variety of tasks, including planning, inventory control, budgeting, maintaining customer information and sales targets management, as well as point-of-sale transactions and logistics.

- Many companies are developing their CIS solutions suitable for organizations of any size with a consideration of affordable pricing. For instance, in January 2023, Info Noble's solution made a CRM system at a low cost, with ease of setup, and with a user-friendly UI for organizations irrespective of their sizes.

- Consumer information management software analyses data about existing and potential customers to help a firm better understand the client to keep and grow customer relationships. To assist businesses in driving sales and obtaining a better understanding of their customers, customer relationship management systems collect information related to contact details, personal information, sales history, customer communication, and customer feedback, which are important in the retail sector.

- Many consumer-oriented businesses are primarily concerned with adhering to local privacy laws, which may come at the expense of enhancing their entire data management program. Customer data and the process of acquiring and improving that data are ultimately at the heart of B2C firms. Organizations may better understand consumers' behaviors and target new products and services to specific segments by enhancing the quality and completeness of their customer data, all while achieving and maintaining compliance.

- To turn the data into meaningful knowledge, the company must link the various systems together by the customer and associate both unstructured and structured data from the loyalty app and any related social media with each individual. A business can establish a comprehensive data management program to incorporate fresh insights for its customers by tying all available actions to a single consumer, which would be beneficial for retail businesses and driving the adoption of CIS in the retail sector.

North America is Expected to Hold Major Share

- North America is one of the major adopters of CIS software and is considered to be one of the leading markets for utility and energy analytics. A higher focus on innovations mainly drives the demand in the region through R&D and technology advancement in developed economies.

- Moreover, the region has a strong foothold of vendors in the market. Some of them include IBM Corporation, Oracle Corporation, and SAP SE, among others. The United States plays a crucial role in increasing the demand when compared to Canada. The country has increased demand, especially from oil and gas, refining, and power generation segments.

- Over the last few years, integrated systems have matured to the point where CIS as a Service (CaaS) has become a reality. The advantages of using CIS as a Service are varied and immediate. The TCO (total cost of ownership) for CaaS, as compared with traditional implementations, is at least 40% lower, and the run cost can be between USD 1 and USD 2 per meter per month, depending on the size and services needed. For example, Wipro, a municipally owned and operated utility in the Ohio Valley of the USA, has adopted CaaS and planning to offer it in the form of a Service Bureau that allows other water utilities to share the infrastructure.

- In the United States, there is a huge demand for smart metering due to the renewed focus on the reduction of NRW by the utilities. The added advantages of smart billing and leak detection have spurred the installation of smart meters, which is expected to drive the growth of the studied market. With metering and newer needs (from smart grids and smart systems, etc.), CIS has become essential to the meter-to-cash (M2C) process, to the creation of new products, and to optimizing supply. Also, CIS can be able to manage the large volume of data generated by AMI (Advanced Metering Infrastructure).

- In the United States, NV Energy was one of the first investor-owned utilities (IOUs) to fully roll out AMI with its 1,310,000 smart meter deployment. It is one of the few major IOUs working with most of AMI data's potential, according to the American Council for an Energy-Efficient Economy (ACEEE). The widest use is for online home energy audits through Bidgley's enterprise data analytics and non-behavioral demand-side management (DSM) programs.

Customer Information System (CIS) Industry Overview

The market for the customer information system is semi-consolidated, as few players own a major market share. The major players with a prominent share in the market are focusing on expanding their customer base across regions. These companies are leveraging strategic innovations and collaborative initiatives to increase their market share and increase their profitability.

In January 2023, Energy company AGL Energy (AGL) partnered with Microsoft to offer a cloud-powered data platform that enables AGL to provide Consumer Data Rights services to clients in accordance with the strict Consumer Data Rights (CDR) legislation of Australia. Consumers would have more leverage as a result of this move, and fascinating additional opportunities would arise for AGL to offer distinctive customer experiences.

In January 2023, The global natural health and footwear company VIVOBAREFOOT would benefit from a partnership with Arvato CRM Solutions that would improve customer service and support its growth in the UK and internationally. In this agreement, Arvato would collaborate with the company to develop multichannel customer care solutions that scale with the brand as it expands and continue to offer prompt, helpful responses to consumer inquiries.

In December 2022, Ameripro Energy Corp., an energy supplier entering the New York and PJM markets, and VertexOne, the leading provider of cloud-based, customer experience, software-as-a-service (SaaS) solutions for the utility and energy business, announced their partnerships. The customer information system (CIS) platform VXretail from VertexOne has been selected by Ameripro Energy Corp. to conduct EDI transaction management, while VXexchange, a platform for customer service, billing, and market exceptions, would handle customer service.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Global Utility Consumption

- 5.1.2 Emerging Cloud and IoT Technologies

- 5.2 Market Challenges

- 5.2.1 Stringent Government Data Regulations

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Cloud

- 6.1.2 On-Premises

- 6.2 By Component

- 6.2.1 Solution

- 6.2.2 Services

- 6.3 By End-User

- 6.3.1 End-User by CRM

- 6.3.1.1 BFSI

- 6.3.1.2 Retail

- 6.3.1.3 Telecommunications

- 6.3.2 End-User by CIS

- 6.3.2.1 Water and Wastewater Management

- 6.3.2.2 Energy and Utility

- 6.3.2.3 Other End-Users

- 6.3.1 End-User by CRM

- 6.4 By Region

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Oracle Corporation

- 7.1.2 Fluentgrid Limited

- 7.1.3 IBM Corporation

- 7.1.4 Wipro Limited

- 7.1.5 Cayenta CIS

- 7.1.6 Gentrack Group Limited

- 7.1.7 SAP SE

- 7.1.8 Itineris NV

- 7.1.9 Hydro Comp Enterprises Ltd

- 7.1.10 Open International LLC