|

市場調查報告書

商品編碼

1690728

北美電池能源儲存系統系統:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Battery Energy Storage System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

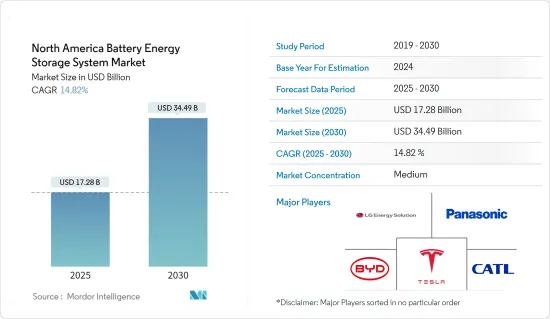

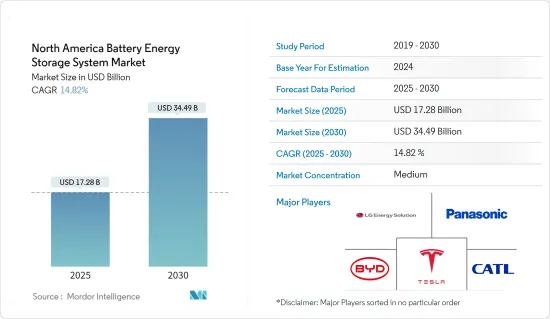

北美電池能源儲存系統市場規模預計在 2025 年為 172.8 億美元,預計到 2030 年將達到 344.9 億美元,預測期內(2025-2030 年)的複合年成長率為 14.82%。

關鍵亮點

- 從中期來看,鋰離子電池價格下降和可再生能源採用率提高等因素將在預測期內推動北美電池能源儲存系統系統市場的發展。

- 另一方面,其他能源儲存系統可能會在研究期間阻礙北美電池能源儲存系統系統市場的成長。

- 在預測期內,用於儲存能源的新電池技術的進步可能會為北美 BESS 市場創造有利的成長機會。

- 由於能源需求不斷增加,美國是預測期內成長最快的市場。這一成長歸因於該國投資的增加以及政府的支持政策。

北美電池能源儲存系統系統市場趨勢

鋰離子電池成本下降推動市場

- 北美,尤其是美國的鋰離子電池製造商的定價低於圖表中顯示的平均價格。美國價格下降的主要原因之一是原料和熟練勞動力的可用性。

- 2023年全球鋰離子電池加權價格約為每千瓦時139美元。鋰離子電池價格持續下跌,預計2023年將年與前一年同期比較13.6%,較2013年下降82.12%。隨著更多採礦和精製產能運作使用,鋰價格預計將趨於緩和,2026年將達到100美元/度。

- 電池成本的大幅下降得益於持續的研究和開發,包括改進電池材料、減少非活性材料以及提高電池設計和生產產量。此外,電池和儲存系統的競爭加劇,導致價格下降,但製造商的利潤也減少。

- 例如,到2024年,ENGIE將在美國實現超過180萬千瓦的電池能源儲存系統(BESS)容量,自今年1月以來已增加了10,000千瓦。 ENGIE 擁有 24 個計劃,其中 6 個是今年運作的項目,已成為領先的 BESS 營運商,尤其是在德克薩斯州的 ERCOT 系統中。

- 此外,2024 年 8 月,Aggreko 為北美市場推出了兩款新的中節點電池儲能系統 (BESS):500kW/250kWh 系統和 250kW/575kWh 系統。這些系統是 Aggreko 綠色升級系列的一部分,專為併併網和離網應用而設計,以減少排放和能源成本。新的 BESS 選項為各種商業和工業應用提供了靈活、便攜、即插即用的解決方案。

- 預計這種情況將進一步降低鋰離子電池的價格,使其比其他類型的電池更具成本競爭力,從而增加其在北美地區許多應用中的採用。

- 此外,快速且持續的成本降低和發展可能會增強鋰離子作為該全部區域所有終端用戶在能源儲存應用中所選擇的電池化學成分的地位。預計此類發展將在預測期內推動市場發展。

美國主導市場

- 美國的電池能源儲存系統(BESS)在過去幾年發生了重大變化。這得益於對可再生能源基礎設施(尤其是住宅和商業領域)投資的增加。

- 住宅、商業和工業(C&I)領域擴大採用太陽能發電系統,預計將成為所研究市場的重要推動力。聯邦和州的政策和激勵措施(例如投資稅額扣抵和可再生能源組合標準)鼓勵了對 BESS 設施的投資。

- 例如,2024 年 7 月,IEDP Renewables North America 在加州弗雷斯諾縣推出了 Scarlet I 太陽能園區。該 200MW計劃將包括一個 40MW 電池能源儲存系統(BESS),每年將為 68,000 戶家庭供電。該計劃旨在透過提供清潔、廉價的能源以及支持 230 多個建築工作和 5 個永久性工作崗位來促進當地經濟成長。

- 一些公司正在進入該地區的電池儲能系統市場。例如,2024年8月,Power Sustainable Energy Infrastructure (PSEI)完成了對加州沙漠石英岩太陽能+儲能專案的投資第一階段,獲得了50%的權益。該計劃將提供 300MW 的太陽能,並包括一個 150MW/4 小時的電池儲能系統 (BESS)。透過與 Potentia Renewable 的合作,PSEI 正在擴大其在加州公用事業規模市場的影響力。

- 在美國,大多數住宅、商業和工業(C&I)應用的能源儲存都使用電池儲存系統。其他能源儲存系統系統包括熱能能源儲存和機械能源儲存。小型電池儲能是美國能源儲存發展的關鍵部分。小型電池將安裝在發電能力為1MW或以下的設施。

- 根據美國能源資訊署(EIA)預測,2016年至2023年間,累積安裝電池容量將從0.5GW激增至15GW,成長率高達約65%。這種快速成長凸顯了 BESS 市場的蓬勃發展,其驅動力來自於再生能源來源的日益整合以及電網穩定性的需求。

- 因此,考慮到上述因素,預計電池能源儲存系統市場將在未來幾年佔據主導地位。

北美電池能源儲存系統系統產業概況

北美電池能源儲存系統系統市場規模減少了一半。該市場的主要企業(不分先後順序)包括比亞迪股份有限公司、LG能源解決方案有限公司、三星SDI、特斯拉公司和松下公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概述

- 介紹

- 至2029年的市場規模及需求預測(單位:美元)

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 增加可再生能源的採用

- 鋰離子電池成本下降

- 限制因素

- 其他能源儲存系統系統的存在

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章市場區隔

- 技術類型

- 鋰離子電池

- 鉛酸電池

- 其他技術類型

- 應用

- 住宅

- 商業/工業

- 公共產業

- 地區

- 美國

- 加拿大

- 北美其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略及SWOT分析

- 公司簡介

- BYD Company Limited

- Saft Groupe SA

- Contemporary Amperex Technology Co. Ltd

- Tesla Inc.

- LG Energy Solution Ltd.

- Samsung SDI Co Ltd.

- Panasonic Corporation

- Sunverge Energy LLC

- AES Corporation

- 其他知名公司名單

- 市場排名/佔有率(%)分析

第7章 市場機會與未來趨勢

- 開發新型先進電池化學材料

簡介目錄

Product Code: 71202

The North America Battery Energy Storage System Market size is estimated at USD 17.28 billion in 2025, and is expected to reach USD 34.49 billion by 2030, at a CAGR of 14.82% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as declining lithium-ion battery prices and increased adoption of renewable energy are likely to drive the North American battery energy storage systems market in the forecast period.

- On the other hand, other energy storage systems will likely hinder the growth of the North America battery energy storage systems market in the studied period.

- Nevertheless, technological advancements in new battery technologies to store energy will likely create lucrative growth opportunities for the North America BESS market during the forecast period.

- The United States is the fastest-growing market during the forecast period due to the rising energy demand. This growth is attributed to increasing investments, coupled with supportive government policies in the country.

North America Battery Energy Storage System Market Trends

Declining Cost of Lithium-ion Batteries is to Drive the Market

- Lithium-ion battery manufacturers in North America, particularly in the United States, include lower prices than the average mentioned in the graph. One of the major causes of lower prices in the United States is the availability of raw materials and skilled manpower.

- In 2023, the global weighted price of lithium-ion batteries was around USD 139 per kWh. Lithium-ion battery prices are falling continuously; they decreased by 13.6 percent in 2023 year-on-year and by 82.12 percent since 2013. Lithium prices are expected to ease as more extraction and refining capacity comes online and reach USD 100/kWh by 2026.

- The drastic cost decline in batteries is due to sustained R&D improving battery materials, reducing non-active materials, and enhancing cell design and production yield. Additionally, battery storage systems have increased competition, which has lowered prices but reduced manufacturers' profits.

- For instance, in 2024, ENGIE achieved over 1.8 GW of battery energy storage system (BESS) capacity in the United States, adding 1 GW since January. With 24 projects, including six commissioned this year, ENGIE has become a leading BESS operator, particularly in Texas' ERCOT system.

- Additionlly, in August 2024, Aggreko launched two new mid-node battery energy storage systems (BESS) for the North American market: a 500 kW/250 kWh system and a 250 kW/575 kWh system. These systems are part of Aggreko's Greener Upgrades line, designed for both on and off-grid applications, reducing emissions and energy costs. The new BESS options offer flexible, mobile, plug-and-play solutions for various commercial and industrial applications

- Such a scenario is expected to reduce lithium-ion battery prices further, making it much more cost-competitive than other battery types, resulting in the increasing adoption of lithium-ion batteries in numerous applications in the North American region.

- Moreover, the sharp and sustained cost reduction and developments are likely to strengthen lithium-ion as the battery chemistry of choice among all the end-users in energy storage applications across the region. Such developments are expected to drive the market during the forecast period.

The United States to Dominate the Market

- The battery energy storage system (BESS) in the United States experienced significant changes in the past few years. It is especially in the residential and commercial sectors, supported by rising investments in renewable energy infrastructure.

- The rise in the adoption of solar PV systems by the residential, Commercial, and industrial (C&I) sectors is expected to be a substantial driver for the market studied. Federal and state-level policies and incentives, such as investment tax credits and renewable portfolio standards, encouraged investments in BESS installations.

- For instance, in July 2024, IEDP Renewables North America unveiled the Scarlet I Solar Energy Park in Fresno County, California. This 200 MW project, including a 40 MW battery energy storage system (BESS), will power 68,000 homes annually. The project aims to provide clean, affordable energy and contribute to local economic growth by supporting over 230 construction jobs and five permanent positions.

- several companies are invetsing in the battery energy storage systems in the region. For instance, In August 2024, Power Sustainable Energy Infrastructure (PSEI) completed phase one of its investment in the Desert Quartzite Solar+Storage Project in California, securing a 50% ownership stake. The project will deliver 300 MW of solar power and includes a 150 MW/4-hour battery energy storage system (BESS). This collaboration with Potentia Renewables enhances PSEI's presence in the California utility-scale market.

- In the United States, most energy storage for residential, Commercial, and industrial (C&I) applications uses battery storage systems. Other energy storage systems include thermal and mechanical energy storage. Small-scale battery storage is a significant part of developing energy storage in the United States. Small-scale battery storage is at facilities with less than 1 MW of generating capacity.

- According to the U.S. Energy Information Administration (EIA) reveals that from 2016 to 2023, the cumulative installed battery capacity surged from 0.5 GW to 15 GW, marking a notable growth rate of around 65 percent. This swift ascent highlights the burgeoning BESS market, propelled by a rising integration of renewable energy sources and an imperative for grid stability.

- Therefore, considering the abovementioned factors, the battery energy storage systems market is expected to dominate in the upcoming years.

North America Battery Energy Storage System Industry Overview

The North America battery energy storage system market is semi-fragmented. Some key players in this market (in particular order) include BYD Company Limited, LG Energy Solution Ltd., Samsung SDI Co Ltd, Tesla Inc., and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increase in Adoption of Renewable Energy

- 4.5.1.2 Declining Cost of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 Presence of Other Energy Storage Systems

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology Type

- 5.1.1 Lithium-ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Other technology types

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial & Industrial

- 5.2.3 Utility

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Limited

- 6.3.2 Saft Groupe SA

- 6.3.3 Contemporary Amperex Technology Co. Ltd

- 6.3.4 Tesla Inc.

- 6.3.5 LG Energy Solution Ltd.

- 6.3.6 Samsung SDI Co Ltd.

- 6.3.7 Panasonic Corporation

- 6.3.8 Sunverge Energy LLC

- 6.3.9 AES Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of New Advance Battery Chemistries

02-2729-4219

+886-2-2729-4219