|

市場調查報告書

商品編碼

1716458

攜帶式儲能系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Portable Energy Storage System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

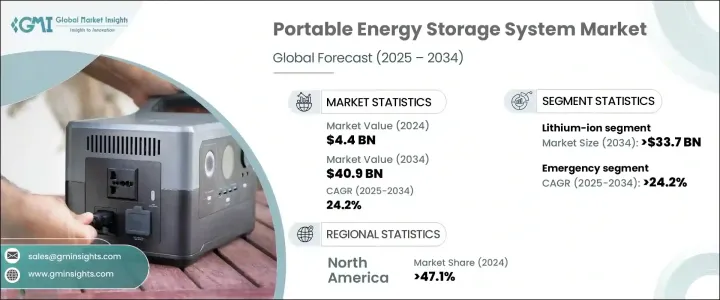

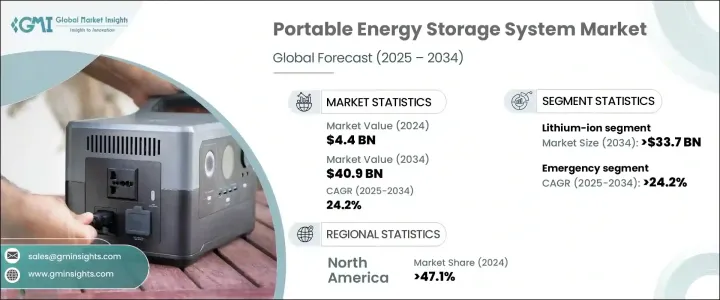

2024 年全球攜帶式儲能系統市場規模達到 44 億美元,預計 2025 年至 2034 年期間的複合年成長率為 24.2%。隨著對靈活可靠的能源解決方案的需求不斷成長,尤其是隨著全球能源消耗模式向清潔和再生替代品轉變,市場正在快速發展。隨著消費者和企業都尋求有效的方式來管理離網地區的電力需求,攜帶式儲能系統正成為住宅、商業和工業應用的熱門選擇。

露營、健行和休閒車等戶外娛樂活動的增多,對能夠隨時隨地提供可靠電力的緊湊型移動能源解決方案的需求強勁。隨著人們對電網可靠性、停電以及自然災害發生頻率不斷上升的擔憂日益加劇,攜帶式儲存系統被廣泛用於休閒和關鍵備份用途。此外,離網地區脫碳和電氣化的趨勢日益增強,也推動了對智慧、永續能源儲存裝置的需求。這些不斷變化的能源需求正在推動攜帶式能源儲存系統市場進入高成長軌道,吸引關鍵技術領域的大量投資和創新。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 44億美元 |

| 預測值 | 409億美元 |

| 複合年成長率 | 24.2% |

各公司正在積極投資先進的電池技術,包括固態電池和磷酸鐵鋰 (LFP) 電池,這些電池具有卓越的性能、更高的安全性和更長的使用壽命。隨著技術的不斷進步,製造商正專注於整合快速充電、無線充電和人工智慧能源管理系統,使攜帶式儲能解決方案更加智慧、更方便用戶使用。這些創新正在迅速改變消費者的期望,使得攜帶式能源設備不僅更加高效,而且用途更加廣泛,可用於從戶外探險到家庭和企業的緊急備用等各種應用。隨著能源獨立性和彈性成為關鍵優先事項,消費者擴大轉向攜帶式儲存系統以獲得可靠、環保和靈活的電源解決方案,直接促進市場擴張。

在關鍵技術中,鋰離子電池佔據市場主導地位,這是因為鋰離子電池使用壽命長、維護需求低,因此從長遠來看,它是一種極具成本效益的解決方案。鋰離子電池領域預計到 2034 年將創造 337 億美元的市場價值,這得益於其卓越的能量密度、緊湊的尺寸以及在不同應用中提供一致性能的能力。對長效、免維護解決方案的需求不斷成長,並持續加強鋰離子電池在全球市場的地位。

在應用方面,攜帶式儲能系統廣泛應用於戶外、緊急和其他用途,預計到 2034 年,應急部分將以 24.2% 的複合年成長率成長。自然災害、停電和電網故障發生率的上升推動了對攜帶式能源設備的需求,作為關鍵設備的重要備用電源,包括 CPAP 機器和氧氣濃縮器等醫療設備,使其成為緊急情況下不可或缺的工具。

2024 年美國攜帶式儲能系統市場價值為 19 億美元,這主要得益於住宅、商業和公用事業規模領域太陽能系統安裝的激增。隨著越來越多的家庭和企業採用太陽能電池板,對攜帶式儲存解決方案的需求正在穩步成長,以儲存多餘的太陽能以供高峰時段或停電時使用,確保持續的電力供應並推動持續的市場成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與技術格局

第5章:市場規模及預測:依產能,2021 - 2034 年

- 主要趨勢

- 少於500瓦時

- 501-1000瓦時

- 1000Wh以上

第6章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 鋰離子

- 鉛酸電池

- 其他

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 戶外的

- 緊急狀況

- 其他

第8章:市場規模及預測:依最終用途,2021 - 2034

- 主要趨勢

- 住宅

- 商業和工業

第9章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 世界其他地區

第10章:公司簡介

- AceOn Group

- Anker Innovations

- ATGepower

- Bluetti Power

- Chint Global

- EcoFlow

- Goal Zero

- Jackery Technology

- Jntech Renewable Energy

- Jiangsu Senji New Energy Technology

- iForway

- Schneider Electric

- Zhejiang Xili New Energy

The Global Portable Energy Storage System Market reached USD 4.4 billion in 2024 and is projected to grow at a CAGR of 24.2% between 2025 and 2034. The market is rapidly evolving with the rising need for flexible and reliable energy solutions, especially as global energy consumption patterns shift toward clean and renewable alternatives. As consumers and businesses alike seek efficient ways to manage power needs in off-grid locations, portable energy storage systems are becoming a popular choice for residential, commercial, and industrial applications.

Increasing outdoor recreational activities, such as camping, hiking, and the use of recreational vehicles, are creating a strong demand for compact, mobile energy solutions that can deliver reliable power anytime, anywhere. With growing concerns over grid reliability, power outages, and the rising frequency of natural disasters, portable storage systems are being widely adopted for both leisure and critical backup purposes. Additionally, the rising inclination toward decarbonization and electrification of off-grid areas is fueling the need for smart, sustainable energy storage units. These evolving energy needs are propelling the portable energy storage system market into a high-growth trajectory, attracting strong investments and innovation across key technology segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $40.9 Billion |

| CAGR | 24.2% |

Companies are actively investing in advanced battery technologies, including solid-state and lithium-iron-phosphate (LFP) batteries, which offer superior performance, enhanced safety, and longer life cycles. As technology continues to advance, manufacturers are focusing on integrating fast charging, wireless charging, and AI-powered energy management systems, making portable energy storage solutions smarter and more user-friendly. These innovations are rapidly changing consumer expectations, making portable energy units not only more efficient but also more versatile for various applications, from outdoor adventures to emergency backups for homes and businesses. As energy independence and resilience become critical priorities, consumers are increasingly turning to portable storage systems for reliable, eco-friendly, and flexible power solutions, directly contributing to market expansion.

Among the key technologies, lithium-ion batteries dominate the market, driven by their long lifespan and minimal maintenance needs, which make them a highly cost-effective solution over time. The lithium-ion battery segment is expected to generate USD 33.7 billion by 2034, supported by their superior energy density, compact size, and ability to deliver consistent performance across diverse applications. The growing demand for long-lasting, maintenance-free solutions continues to strengthen the position of lithium-ion batteries in the global market.

In terms of application, portable energy storage systems are widely used for outdoor, emergency, and other purposes, with the emergency segment projected to grow at a CAGR of 24.2% through 2034. Rising incidences of natural disasters, blackouts, and grid failures are driving demand for portable energy units as essential backup power sources for critical devices, including medical equipment like CPAP machines and oxygen concentrators, making them indispensable during emergencies.

The U.S. Portable Energy Storage System Market was valued at USD 1.9 billion in 2024, largely driven by the surging installation of solar energy systems across residential, commercial, and utility-scale sectors. As more homes and businesses adopt solar panels, the need for portable storage solutions to store surplus solar energy for later use during peak hours or outages is growing steadily, ensuring continuous power supply and fueling the sustained market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Billion & Million Units)

- 5.1 Key trends

- 5.2 Less than 500Wh

- 5.3 501-1000Wh

- 5.4 Above 1000Wh

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Billion & Million Units)

- 6.1 Key trends

- 6.2 Lithium-Ion

- 6.3 Lead-Acid

- 6.4 Others

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion & Million Units)

- 7.1 Key trends

- 7.2 Outdoor

- 7.3 Emergency

- 7.4 Others

Chapter 8 Market Size and Forecast, By End Use, 2021 - 2034 (USD Billion & Million Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial & Industrial

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion & Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.5 Rest of World

Chapter 10 Company Profiles

- 10.1 AceOn Group

- 10.2 Anker Innovations

- 10.3 ATGepower

- 10.4 Bluetti Power

- 10.5 Chint Global

- 10.6 EcoFlow

- 10.7 Goal Zero

- 10.8 Jackery Technology

- 10.9 Jntech Renewable Energy

- 10.10 Jiangsu Senji New Energy Technology

- 10.11 iForway

- 10.12 Schneider Electric

- 10.13 Zhejiang Xili New Energy