|

市場調查報告書

商品編碼

1690719

印度宅配、快捷郵件和小包裹(CEP)-市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)India Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

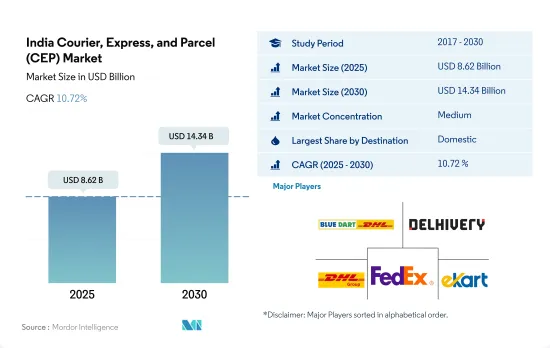

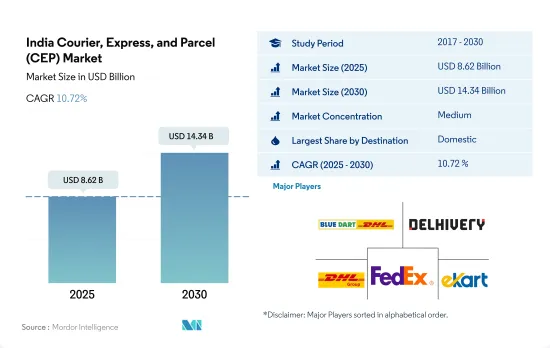

印度宅配、快捷郵件和小包裹(CEP) 市場規模預計在 2025 年為 86.2 億美元,預計到 2030 年將達到 143.4 億美元,預測期內(2025-2030 年)的複合年成長率為 10.72%。

儘管電商投資下降,電商市場規模不斷擴大,CEP市場需求旺盛,帶動CEP需求增加

- 2021年,印度電子商務資金籌措增加至110億美元,較前一年的9億美元大幅成長。印度的 B2B 電子商務和市場模式允許透過自動途徑實現 100% 的 FDI。只要產品在印度生產,食品零售商就可以根據政府核准的方式在電子商務領域進行 100% 的 FDI。然而,到 2022 年,電子商務資金籌措將降至 40 億美元,主要原因是消費者對新興企業持謹慎態度。這種下降趨勢將持續到 2023 年,2023 年第三季將年減 47% 至 2.24 億美元,並且沒有出現重大交易。

- 電子商務已成為國內和國際宅配和小包裹服務的主要驅動力。隨著網路用戶的快速成長和良好的市場環境,印度電子商務產業有望大幅成長。 2023 年印度電子商務市場價值約為 631.7 億美元,預計 2024 年將達到 754.4 億美元,2027 年將達到 1,071 億美元。

印度宅配、快捷郵件和小包裹(CEP)市場的趨勢

政府和私人投資、出口成長以及州際貨物運輸增加是運輸業的主要驅動力。

- 政府設定了2024年將物流成本降低至5-6%的目標。印度鐵路正在努力提高貨運能力、加快貨運列車速度、降低貨運票價、建立專用貨運走廊並改善火車站、公路和港口之間最後一英里的連通性。我們正在與首席部長加蒂·沙克蒂合作,賦予物流行業地位,推廣數位解決方案並發展物流基礎設施。這些努力旨在降低成本並刺激物流領域的GDP成長。

- 預計到 2027 年,這一領域將繼續成長,到 2027 年將增加 1,000 萬個就業機會。印度渴望成為全球製造和物流中心,最近的舉措吸引了約 100 億美元的倉儲物流領域投資。印度 2024 年的基礎設施計劃,如孟買跨港口連接線 (MTHL)、新孟買國際機場、諾伊達國際機場和西部專用貨運走廊,也有望加速印度成為全球物流領域重要參與企業的進程。

由於多個邦政府削減增值稅,柴油價格的漲幅沒有汽油價格的漲幅那麼大。

- 9 月份,在沙烏地阿拉伯和俄羅斯將自願減產和出口協議延長至 2023 年後,原油價格觸及每桶 90 美元的 10 個月高點。由於印度 85% 的石油依賴進口,燃料價格受到了影響。代表 1,400 萬名卡車駕駛人和車輛駕駛人的全印度汽車運輸大會表示,不斷上漲的燃油價格正在影響印度卡車司機,因為他們轉嫁價格上漲的能力有限,而價格上漲佔卡車營運成本的 70%。

- 印度政府正考慮在 2024 年將汽油和柴油價格每公升降低 4-6 印度盧比(0.04-0.07 美元),以趕上定於 2024 年上半年舉行的議會選舉。目前,政府正在與石油行銷公司進行討論,以平等分擔減價負擔,這可能會導致每公升汽油和柴油價格大幅下降,最高可達 10 盧比(0.12 美元)。此舉旨在減輕人們的經濟負擔,也可能導致零售通膨率下降,零售通膨率在2023年11月達到5.55%的高峰。

印度宅配、快捷郵件和小包裹(CEP)產業概況

印度宅配、快捷郵件和小包裹(CEP) 市場適度整合,市場前五大參與者(按字母順序)為 Blue Dart Express Limited、Delhi Ltd.、DHL Group、FedEx 和 Instakart Services Private Limited。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口統計

- 按經濟活動分類的GDP分佈

- 按經濟活動分類的GDP成長

- 通貨膨脹率

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業GDP

- 出口趨勢

- 進口趨勢

- 燃油價格

- 物流績效

- 基礎設施

- 法律規範

- 印度

- 價值鍊和通路分析

第5章市場區隔

- 銷售目的地

- 國內的

- 國際的

- 送貨速度

- 表達

- 非快遞

- 模型

- 企業對企業(B2B)

- B2C

- 消費者對消費者(C2C)

- 運輸重量

- 重型貨物

- 輕型貨物

- 中等重量貨物

- 運輸方式

- 航空郵件

- 路

- 其他

- 最終用戶

- 電子商務

- 金融服務(BFSI)

- 醫療保健

- 製造業

- 一級產業

- 批發零售(線下)

- 其他

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Allcargo Logistics Ltd.(including Gati Express)

- Blue Dart Express Limited

- Delhivery Ltd.

- Department of Posts(India Post)

- DHL Group

- DTDC Express Limited

- Ecom Express

- FedEx

- Instakart Services Private Limited

- Safexpress Pvt. Ltd.

- United Parcel Service of America, Inc.(UPS)

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 技術進步

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 71124

The India Courier, Express, and Parcel (CEP) Market size is estimated at 8.62 billion USD in 2025, and is expected to reach 14.34 billion USD by 2030, growing at a CAGR of 10.72% during the forecast period (2025-2030).

Steady demand for CEP market owing to growing e-commerce market value despite decline in ecommerce investments leading to rising CEP demand

- In 2021, e-commerce funding in India increased to USD 11 billion, a notable jump from the previous year's USD 900 million. B2B e-commerce and the marketplace model in India allow 100% FDI under the automatic route. For e-commerce by Food Retail Companies, 100% FDI is permitted under the Government approval route, with the condition that the products are manufactured in India. However, in 2022, e-commerce funding dipped to USD 4 billion, largely due to cautious consumer sentiments towards startups. This downward trend persisted through 2023, with Q3 2023 witnessing a stark 47% Y-o-Y drop to USD 224 million and no mega deals in sight.

- E-commerce is a key catalyst for both domestic and international courier and parcel services. With a rapidly expanding internet user base and favorable market conditions, India's e-commerce industry is poised for significant growth. Valued at approximately USD 63.17 billion in 2023, the Indian e-commerce market is projected to reach USD 75.44 billion by 2024 and an estimated USD 107.10 billion by 2027.

India Courier, Express, and Parcel (CEP) Market Trends

Government and private investments, rising exports, and the increasing interstate movement of goods are the major drivers of the transportation industry

- In 2024, the government is dedicated to reducing logistics costs to 5-6%. Indian Railways is taking steps to boost freight capacity, increase the speed of freight trains, lower freight expenses, establish dedicated freight corridors, improve last-mile connectivity between railheads, roads, and ports. They're aligning with PM Gati Shakti, granting industry status to logistics, promoting digital solutions, and developing logistics infrastructure. These efforts aim to cut costs and spur GDP growth in logistics.

- The sector is expected to grow till 2027 and is expected to add 10 million jobs by 2027. India is aiming to become a global hub for manufacturing and logistics, with recent policies attracting around USD 10 billion USD in investments for the warehousing and logistics sector. Also India's infrastructure plans for 2024, such as the Mumbai Trans Harbour Link (MTHL), Navi Mumbai International Airport, Noida International Airport and Western Dedicated Freight Corridor etc, are expected to accelerate India's journey towards becoming a prominent player in the global logistics landscape.

The diesel price increase was less sharp than the increase in petrol prices due to VAT cuts offered by several state governments

- In September 2023, oil prices hit a 10-month high of USD 90 per barrel as Saudi Arabia and Russia extended their voluntary production and export cuts till 2023. As India imports 85% of its oil, the fuel prices were impacted. According to the All-India Motor Transport Congress, which represents 14 million truckers and vehicle operators, the soaring fuel prices are impacting India's truckers as they have limited ability to pass on the rising prices, which account for 70% of the cost of operating a truck.

- The Indian government is contemplating reducing petrol and diesel prices by INR 4 - INR 6 (USD 0.04 - USD 0.07) per litre in 2024, timed with the upcoming Lok Sabha elections in H1 2024. Discussion in ongoing with Oil Marketing Companies to share the burden of this reduction equally, and there's a possibility of a more substantial cut of up to Rs 10 (USD 0.12) per litre. This move aims to alleviate the financial strain on the public and could also help lower retail inflation, which peaked at 5.55% in November 2023.

India Courier, Express, and Parcel (CEP) Industry Overview

The India Courier, Express, and Parcel (CEP) Market is moderately consolidated, with the major five players in this market being Blue Dart Express Limited, Delhivery Ltd., DHL Group, FedEx and Instakart Services Private Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 India

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Allcargo Logistics Ltd. (including Gati Express)

- 6.4.2 Blue Dart Express Limited

- 6.4.3 Delhivery Ltd.

- 6.4.4 Department of Posts (India Post)

- 6.4.5 DHL Group

- 6.4.6 DTDC Express Limited

- 6.4.7 Ecom Express

- 6.4.8 FedEx

- 6.4.9 Instakart Services Private Limited

- 6.4.10 Safexpress Pvt. Ltd.

- 6.4.11 United Parcel Service of America, Inc. (UPS)

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219