|

市場調查報告書

商品編碼

1690697

中東和非洲木器塗料市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Middle-East And Africa Wood Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

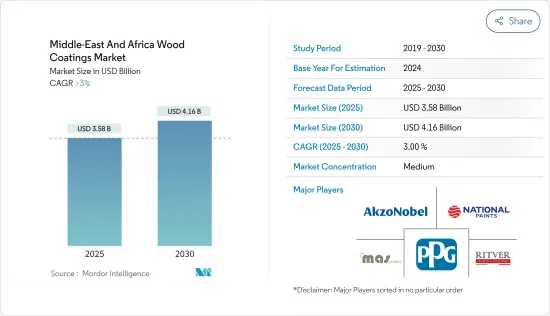

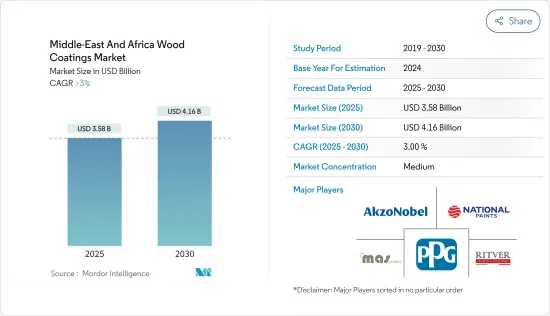

預計 2025 年中東和非洲木器塗料市場規模為 35.8 億美元,到 2030 年將達到 41.6 億美元,預測期內(2025-2030 年)的複合年成長率將超過 3%。

COVID-19 疫情對中東和非洲 (MEA) 的木器塗料市場產生了負面影響。疫情相關的限制措施導致建築業和家具業放緩,導致木材被覆劑需求下降。然而,隨著情況的好轉,這些產業預計將實現成長,達到疫情前的水平,並在未來實現激增。

主要亮點

- 從長遠來看,中東地區建築業的成長和家具產量的增加等因素預計將推動市場需求。

- 然而,對揮發性排放的擔憂日益加劇等因素可能會抑制市場成長。

- 預計對紫外線固化塗料的需求不斷增加以及向水性塗料的轉變將為市場提供成長機會。

- 在該地區,預計沙烏地阿拉伯將在預測期內佔據市場主導地位。

中東和非洲木器塗料市場趨勢

家具和固定裝置產業的需求不斷擴大

- 木材塗料因其優異的附著力、防腐蝕、增強木材耐久性和美觀的外觀等特性,已成為商業領域各種木質產品的重要組成部分。

- 木器塗料主要用於家具和設備。塗有這些油漆的木質表面可以免受白蟻和真菌感染。

- 它還可以保護木質表面免受潮濕和黴菌的滋生。這些塗料採用紫外線固化並基於粉末技術,可改善外觀並延長家具的使用壽命。

- 中等收入階層收入水準的提高,加上對家具和家居裝飾品的需求不斷增加,預計將推動對木製椅子、桌子、床、沙發、架子、櫥櫃和其他家具的需求,從而推動市場需求。

- 中東和非洲大多數國家高度依賴進口來滿足其對木製家具的需求。

- 家具業在阿拉伯聯合大公國至關重要,當地有600多家家具廠,佔全國整個產業的13%。

- 隨著跨國公司(MNC)的快速建立和就業潛力的增加,阿拉伯聯合大公國的家具產業預計將進一步成長,導致對辦公空間和家具的需求增加。

- 埃及家具業佔GDP的2.2%,擁有15,800家製造商,提供69,000個就業機會。 2023年11月,微型、小型和中型企業發展局(MSMEDA)計劃向100多個家具計劃撥款約5000萬英鎊(106萬美元),每個計劃平均資助40萬英鎊(8450美元)。

- 預計上述因素將影響家具和設備領域對木器塗料的需求。

沙烏地阿拉伯可望主導市場

- 在沙烏地阿拉伯,新興經濟體對基礎設施和商業建築的投資不斷增加,以及建築資訊模型的採用不斷增加,預計將在預測期內推動對木質家具、門窗、地板、櫥櫃和其他部件的需求。

- 根據沙烏地阿拉伯統計總局統計,該國2023年第三季建築業GDP為328.72億沙烏地裡亞爾(87.6368億美元),較2022年同期成長約4.22%。

- 沙烏地阿拉伯的家具業受到住宅需求不斷成長、房地產開發和政府改善經濟基礎設施的舉措的推動。

- 沙烏地阿拉伯擺脫對石油依賴的經濟戰略承諾到2030年讓70%以上的家庭擁有住房。此外,預計國際投資者將為沙烏地阿拉伯2030願景投資1兆美元。

- 隨著眾多家具行業零售商進入網上零售市場,由於網際網路的廣泛使用、都市化的加快、青年人口的成長以及政府舉措的不斷擴大,透過在線門戶網站購買家居和辦公家具的需求也在增加。

- 此外,包括IKEA和 Midas 在內的許多公司都已進軍網路購物領域,以吸引更多客戶。

- 因此,預計上述因素將影響沙烏地阿拉伯木器塗料市場的成長。

中東和非洲木器塗料產業概況

中東和非洲木器塗料市場已部分整合。市場的主要企業包括 NATIONAL PAINTS FACTORIES、Ritver、Akzo Nobel NV、MAS Paints 和 PPG Industries Inc.

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 中東和非洲建設活動成長

- 家具產量成長

- 其他促進因素

- 限制因素

- 對揮發性排放的擔憂日益加劇

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 樹脂類型

- 丙烯酸纖維

- 硝化纖維素

- 聚氨酯

- 聚酯纖維

- 其他樹脂種類(醇酸樹脂、乙烯基樹脂、環氧樹脂等)

- 科技

- 水

- 溶劑型

- UV固化型

- 粉末

- 應用

- 家具和配件

- 門窗

- 甲板和櫥櫃

- 其他用途(包括地板和裝飾線條)

- 原產地

- 沙烏地阿拉伯

- 埃及

- 摩洛哥

- 奈及利亞

- 阿爾及利亞

- 肯亞

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 伊朗

- 其他中東和非洲地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- Akzo Nobel NV

- Crown Paints Kenya PLC

- IVM Chemicals srl

- Jotun

- Kansai Paint Co. Ltd

- KAPCI Coating

- Nippon Paint Holdings Co. Ltd

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- NATIONAL PAINTS FACTORIES CO. LTD

- Ritver

- MAS Paints

- Sipes Egypt

第7章 市場機會與未來趨勢

- 轉向水性塗料

- 政府支持政策

The Middle-East And Africa Wood Coatings Market size is estimated at USD 3.58 billion in 2025, and is expected to reach USD 4.16 billion by 2030, at a CAGR of greater than 3% during the forecast period (2025-2030).

The COVID-19 pandemic negatively affected the wood coatings market in the Middle East and Africa (MEA). Due to restrictions associated with the pandemic, there was a slowdown in the construction and furniture industries, leading to a decrease in demand for wood coatings. However, as situations improve, the industries are expected to grow and reach pre-pandemic levels, witnessing a sharp increase in the future.

Key Highlights

- Over the long term, factors such as the growing construction industry in the Middle Eastern region and growing furniture production are expected to drive market demand.

- However, factors such as rising concerns regarding volatile material emissions are expected to restrain the growth of the market.

- Increasing demand for UV-cured coatings and a shift toward water-borne coatings are expected to offer growth opportunities for the market.

- In the region, Saudi Arabia is expected to dominate the market during the forecast period.

Middle-East And Africa Wood Coatings Market Trends

The Demand from the Furniture and Fixtures Segment is Growing

- Wood coatings, owing to their properties such as excellent adhesion, anti-corrosiveness, increased durability on woods, and esthetic appearance, are becoming an integral part of various wood-based products in commercial sectors.

- Wood coatings mainly find applications in furniture and fixtures. Wood surfaces coated with these coatings remained protected from termites and fungal infections.

- In addition, the wood surfaces are also protected from moisture and mold formation by these coatings. These coatings are UV-curable and powder technology-based, enhancing the furniture's appearance and prolonging its life.

- The increasing level of income for the middle-income group and the growing demand for furniture and home decor are expected to boost the demand for furniture such as wooden chairs, tables, beds, sofas, shelves, cupboards, and others, driving market demand.

- Most countries in the Middle East and Africa are majorly dependent on imports for their wooden furniture demand.

- The furniture industry is essential in the United Arab Emirates; more than 600 furniture factories are in operation, accounting for 13% of the total number of industries in the UAE.

- The furniture industry in the UAE is expected to grow further due to the rapidly increasing establishment of multinational corporations (MNCs) and increasing employment possibilities, which are driving up demand for office spaces and furniture.

- The Egyptian furniture industry accounts for 2.2% of the GDP, and it consists of 15,800 manufacturers who provide 69,000 jobs. In November 2023, The Micro, Small, and Medium Enterprise Development Agency (MSMEDA) planned to allocate approximately EGP 50 million (USD 1.06 million) to fund over 100 furniture projects, with an average of EGP 400 thousand (USD 8.45 thousand) per project.

- The above-mentioned factors are expected to affect the demand for wood coatings in the furniture and fixtures segment.

Saudi Arabia is Expected to Dominate the Market

- In Saudi Arabia, the demand for wood-based furniture, doors, windows, decks, cabinets, or other components is likely to increase over the forecast period as a result of increasing investment in infrastructure and commercial constructions in developing economies, along with the implementation of Building Information Models.

- According to the General Authority for Statistics, Saudi Arabia, in Q3 2023, the GDP from construction in the country was SAR 32,872 million (USD 8,763.68 million), about 4.22% more than the same period in 2022.

- The Saudi Arabian furniture industry is driven by increasing residential property demand, real estate development, and government measures to improve economic infrastructure.

- The Saudi economic strategy, which attempts to wean the country's economy off of oil dependency, promises to deliver home ownership to more than 70% of families by 2030. Further, international investors are expected to invest USD 1 trillion in Saudi Vision 2030.

- As many furniture industry retailers entered online retailing, the demand for home and office furniture through online portals increased, owing to increasing internet penetration and urbanization, a growing younger population, and expanding government initiatives.

- Also, many companies, including IKEA and Midas, have moved into online furniture shopping in order to attract more customers.

- Hence, the above-mentioned factors are expected to affect the growth of the wood coatings market in Saudi Arabia.

Middle-East And Africa Wood Coatings Industry Overview

The Middle East and African wood coatings market is partially consolidated in nature. The key players in the market include NATIONAL PAINTS FACTORIES CO. LTD, Ritver, Akzo Nobel NV, MAS Paints, and PPG Industries Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Construction Activities in the Middle East and Africa

- 4.1.2 Growing Furniture Production

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Rising Concern Toward Volatile Material Emission

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 Resin Type

- 5.1.1 Acrylic

- 5.1.2 Nitrocellulose

- 5.1.3 Polyurethane

- 5.1.4 Polyester

- 5.1.5 Other Resin Types (Alkyd, Vinyl Resins, Epoxy, etc.)

- 5.2 Technology

- 5.2.1 Waterborne

- 5.2.2 Solvent-borne

- 5.2.3 UV-cured

- 5.2.4 Powder

- 5.3 Application

- 5.3.1 Furniture and Fixtures

- 5.3.2 Doors and Windows

- 5.3.3 Decks and Cabinets

- 5.3.4 Other Applications (including Floors and Molding Products)

- 5.4 Country

- 5.4.1 Saudi Arabia

- 5.4.2 Egypt

- 5.4.3 Morocco

- 5.4.4 Nigeria

- 5.4.5 Algeria

- 5.4.6 Kenya

- 5.4.7 Saudi Arabia

- 5.4.8 United Arab Emirates

- 5.4.9 Iran

- 5.4.10 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Crown Paints Kenya PLC

- 6.4.3 IVM Chemicals srl

- 6.4.4 Jotun

- 6.4.5 Kansai Paint Co. Ltd

- 6.4.6 KAPCI Coating

- 6.4.7 Nippon Paint Holdings Co. Ltd

- 6.4.8 PPG Industries Inc.

- 6.4.9 RPM International Inc.

- 6.4.10 The Sherwin-Williams Company

- 6.4.11 NATIONAL PAINTS FACTORIES CO. LTD

- 6.4.12 Ritver

- 6.4.13 MAS Paints

- 6.4.14 Sipes Egypt

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shift toward Water-borne Coatings

- 7.2 Supportive Government Policies