|

市場調查報告書

商品編碼

1851445

木器塗料:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Wood Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

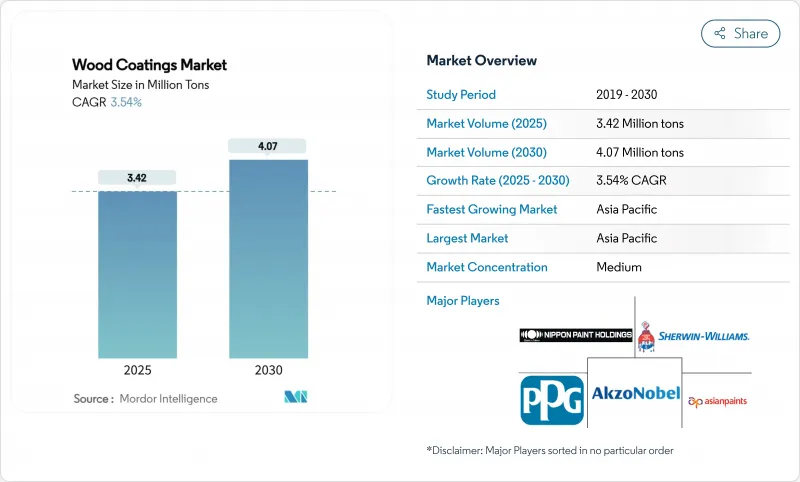

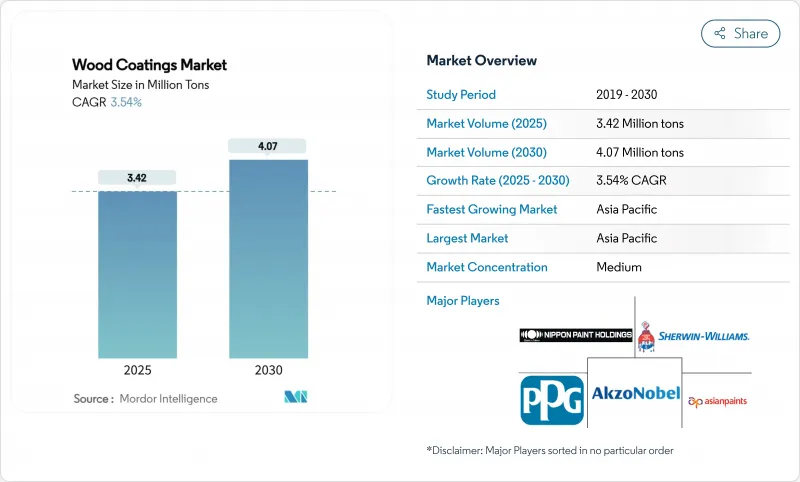

預計到 2025 年,木材塗料市場規模將達到 342 萬噸,到 2030 年將達到 407 萬噸,預測期(2025-2030 年)複合年成長率為 3.54%。

這一穩步擴張得益於亞太地區的製造業基礎、水性化學品加速普及以及全球家具產業的持續需求。儘管聚氨酯因其耐久性仍是領先的樹脂平台,但環保法規正推動低揮發性有機化合物(VOC)替代品的快速普及。製造商也透過投資配方靈活性和在地採購來應對原料價格(尤其是二氧化鈦)的波動。頂級供應商之間的整合,加上中端企業在生物基添加劑領域不斷創新,加劇了市場競爭,同時也提高了小型企業必須達到的基準值。

全球木器塗料市場趨勢與洞察

亞太地區模組化與RTA家具的蓬勃發展

快速的都市化和日益縮小的公寓面積正在推動中國、印度和印尼等國模組化和組裝家具的普及。這些大量生產的家具需要耐刮擦、快乾的塗料,這迫使配方師最佳化塗料在人造基材(如中密度纖維板)上的滲透性。光是印尼的工廠到2024年10月就將生產100.4萬噸塗料,其中木器塗料佔7%。快乾型聚氨酯-丙烯酸混合塗料的供應商正在贏得新契約,亞太地區在木器塗料市場中扮演核心角色。

歐盟主導轉向低VOC水性配方轉變

歐盟日益嚴格的VOC法規正加速從溶劑型系統朝向水性系統的轉型。現代水性聚氨酯分散體的耐久性如今已與溶劑型系統相媲美,消除了以往的性能差距。歐洲配方商將這些符合法規的產品出口到北美和亞洲,透過使用單一配方運作全球生產線,實現了成本協同效應,並在其他地區推行類似法規之際,享受先發優勢。這種合作是木器塗料市場的關鍵結構性驅動力,促進了以生物基共黏合劑為重點的研發,從而進一步減少排放。

樹脂和溶劑價格波動

自2025年1月起,歐盟對中國產二氧化鈦徵收11.4%至32.3%的反傾銷稅,導致原物料成本飆升。木器塗料市場的小型生產商面臨利潤空間壓縮,部分企業不得不採用減少顏料用量或使用替代填料的方式進行再生產,而跨國公司則透過簽訂長期供應協議來規避風險。

細分市場分析

預計到2024年,聚氨酯將佔據木器塗料市場60%的佔有率,並在2030年之前以3.79%的複合年成長率成長。聚氨酯的交聯密度使其具備家具出口商所需的耐化學性,能夠通過嚴格的耐久性測試。到2024年,聚氨酯將成為樹脂木器塗料市場最大的組成部分,隨著生物多元醇等級的推出,其領先優勢將繼續擴大。生物多元醇等級在降低化石成分的同時,也能保持硬度。丙烯酸樹脂因其紫外線穩定性,仍是戶外樹脂的主流;而硝化纖維素在安全法規較寬鬆的地區仍用於傳統家具。與Solus相容的生物基體係正引導買家選擇更安全的即用型塗料。聚酯在鋼琴和精品櫥櫃的高光澤飾面領域佔據著獨特的地位,展現了其獨特的市場定位。新興的木質素基黏合劑有望在永續性主導的試點計劃中佔有一席之地,但目前僅佔總需求的不到1%。因此,聚氨酯的強勢地位為木器塗料市場所有主要製造商的競爭性配方藍圖提供了支持。

濕固化脂肪族聚氨酯技術的進步使得VOC含量低於50克/公升,在不犧牲開放時間的前提下,超越了以往的規範。越南和波蘭的領先家具OEM廠商正在使用平板噴塗機和真空塗裝機檢驗這些系統,這表明聚氨酯將繼續代表高階性能。 </p><h3><u>地理分析</u></h3><p>到2024年,亞太地區將以57%的市佔率主導木器塗料市場,並實現3.9%的最快區域複合年成長率。中國仍然是關鍵,這得益於國內消費和出口導向家具產業叢集的推動;而印度新興的中產階級正在推動當地高階市場的發展。隨著各國政府收緊排放法規並加速水性產品的採用,亞太地區已成為規模主導創新的關鍵區域。 </p>

北美在木器塗料市場佔據重要佔有率,並在技術升級方面處於領先地位。 DIY 的普及和高階裝飾風格的興起正在改變消費者的購買習慣,大型零售商的自有品牌項目也要求產品獲得第三方永續性認證。 HIRI 預測,到 2025 年,住宅投資將復甦 3.9%,從而增強短期需求的韌性。此外,氣候變遷正在推動對具有軟性膜的外牆塗料的需求,這種塗料能夠適應牆板基材上的濕度變化,進一步豐富了該地區木器塗料市場的 SKU 種類。

在歐洲,嚴格的法規與建築中木材的廣泛應用相輔相成。歐盟的「綠色新政」激勵措施鼓勵使用低碳建築材料,並推動了對高性能塗料的需求,這些塗料能夠保護多用戶住宅中的CLT構件。隨著甲醛和VOC閾值的實施,從2022年起,該地區近一半的家具塗裝生產線將轉向水性或UV固化塗料,溶劑型塗料的淘汰速度超過其他任何地區。這些動態使得歐洲既成為監管標桿,也成為發展中國家配方技術的出口中心。

其他好處

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞太地區模組化與RTA家具的蓬勃發展

- 歐盟主導轉向低VOC水性配方轉變

- 北美高階室內裝潢趨勢

- DIY家居裝修中心的擴張

- 歐洲的木造多戶住宅

- 市場限制

- 樹脂和溶劑價格波動

- 加強甲醛/揮發性有機化合物法規

- 家具中層壓板和塑膠的替代

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依樹脂類型

- 聚氨酯

- 丙烯酸纖維

- 硝化纖維素

- 聚酯纖維

- 其他

- 透過技術

- 水系統

- 溶劑型

- 紫外線固化型

- 粉末塗裝

- 透過使用

- 家具及設備

- 門窗

- 內閣

- 其他用途(包括地板、露台和裝飾線條)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 南非

- 奈及利亞

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Akzo Nobel NV

- Asian Paints

- Axalta Coating Systems

- Benjamin Moore & Co.

- Ceramic Industrial Coatings

- Hempel A/S

- Jotun

- Kansai Nerolac Paints Limited

- KAPCI Coating

- MAS Paints

- National Paints Factories Co. Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- Ritver

- RPM International Inc.

- Teknos Group

- The Sherwin-Williams Company

第7章 市場機會與未來展望

The Wood Coatings Market size is estimated at 3.42 Million tons in 2025, and is expected to reach 4.07 Million tons by 2030, at a CAGR of 3.54% during the forecast period (2025-2030).

This steady expansion is supported by the Asia-Pacific manufacturing base, accelerating shifts toward water-borne chemistries, and sustained demand from the global furniture sector. Polyurethane's durability keeps it the leading resin platform, while environmental regulations are fast-tracking adoption of low-VOC alternatives. Manufacturers are also navigating raw-material price swings-especially titanium dioxide-by investing in formulation flexibility and localized sourcing. Consolidation among top suppliers, paired with growing mid-tier innovation in bio-based additives, is strengthening competition while raising the performance baseline that smaller firms must match.

Global Wood Coatings Market Trends and Insights

Modular & RTA Furniture Boom in Asia-Pacific

Rapid urbanization and shrinking apartment sizes have spurred a surge in modular and ready-to-assemble furniture across China, India, and Indonesia. These high-volume furniture lines require scratch-resistant finishes that cure quickly, pushing formulators to optimize penetration on engineered substrates such as MDF. Indonesian factories alone produced 1.004 million tons of coatings by October 2024, with wood coatings representing 7%, highlighting the scale of regional demand. Suppliers responding with fast-drying polyurethane-acrylic hybrids are capturing new contracts, reinforcing Asia-Pacific's central role in the wood coatings market.

EU-Led Shift to Low-VOC Waterborne Formulations

The European Union's tightening VOC caps have accelerated migration away from solvent-borne systems. Recent aqueous polyurethane dispersions now match solvent-borne durability, closing the historical performance gap. European formulators exporting these compliant chemistries to North America and Asia achieve cost synergies by running global production lines on a single recipe, gaining first-mover advantages as other regions move toward similar rules. This alignment is a leading structural driver for the wood coatings market, stimulating R&D focused on bio-based co-binders that further cut emissions.

Resin & Solvent Price Volatility

Anti-dumping duties of 11.4%-32.3% on Chinese titanium dioxide entering the EU, effective January 2025, have pushed raw-material costs sharply higher. Smaller manufacturers in the wood coatings market face margin compression, leading some to reformulate with lower pigment volumes or alternative extenders, while multinationals hedge exposure through long-term supply contracts.

Other drivers and restraints analyzed in the detailed report include:

- Premium Interior Decor Trend in North America

- Timber-Rich Multi-Family Housing in Europe

- Stricter Formaldehyde / VOC Caps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyurethane dominated the wood coatings market with a 60% share in 2024 and is set to grow at 3.79% CAGR through 2030. Its cross-linking density delivers chemical resistance that furniture exporters demand to meet stringent durability tests. In 2024 polyurethane already represented the largest slice of wood coatings market size for resins and continues widening its lead with introductions of bio-polyol grades that cut fossil content without sacrificing hardness. Acrylic resins remain the exterior workhorse thanks to UV stability, while nitrocellulose still services classic furniture in regions with lenient safety codes. Solus-enabled biobased systems are nudging buyers toward safer drop-in options. Polyester's niche in high-build gloss finishes for pianos and boutique cabinetry signals its specialty positioning. Emerging lignin-based binders are poised to capture sustainability-driven pilot projects but remain under 1% of total demand today. Polyurethane's entrenched position therefore anchors competitive formulation roadmaps across every major producer participating in the wood coatings market.

Advancements in moisture-curing aliphatic polyurethanes now offer <50 g/L VOC content, surpassing legacy specifications without sacrificing open time. Major OEM furniture lines in Vietnam and Poland have validated these systems for flat-line spray and vacuum coaters, demonstrating that polyurethane will continue shaping premium performance tiers. As environmental scrutiny tightens, suppliers integrating recycled PET polyols further extend the resin's lifecycle credentials, keeping this chemistry at the center of investment decisions across the global wood coatings industry.

The Wood Coatings Market Report Segments the Industry by Resin Type (Polyurethane, Acrylic, Nitrocellulose, and More), Technology (Water-Borne, Solvent-Borne, UV-Cured, and More), Application (Furniture and Fixtures, Doors and Windows, Cabinets, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific dominated the wood coatings market with 57% share in 2024 and posted the quickest regional CAGR at 3.9%. China remains the cornerstone, supported by domestic consumption and export-oriented furniture clusters, while India's rising middle class powers local premium segments. Water-borne adoption is accelerating as regional governments tighten emission ceilings, making Asia-Pacific the pivotal arena for scale-driven innovation.

North America holds significant share in the wood coatings market and leads in technology upgrades. DIY participation and premium decor formats shape buying patterns, and big-box retailers' private-label programs now demand third-party sustainability certifications. HIRI forecasts a 3.9% rebound in 2025 home-improvement expenditures, reinforcing short-cycle demand resilience. Climatic events have also heightened demand for exterior stains with flexible membranes that tolerate moisture swings across siding substrates, further diversifying SKU count in the region's wood coatings market.

Europe combines stringent regulations with architectural timber adoption. The EU's Green Deal incentives favor low-carbon building materials, propelling demand for high-performance coatings that shield CLT elements in multi-family structures. Enforcement of formaldehyde and VOC thresholds has shifted nearly half of regional furniture finishing lines to water-borne or UV-cure chemistries since 2022, compressing the solvent-borne base faster than in any other geography. These dynamics position Europe as both a regulatory benchmark and an export hub for formulation technology destined for developing markets.

- Akzo Nobel N.V.

- Asian Paints

- Axalta Coating Systems

- Benjamin Moore & Co.

- Ceramic Industrial Coatings

- Hempel A/S

- Jotun

- Kansai Nerolac Paints Limited

- KAPCI Coating

- MAS Paints

- National Paints Factories Co. Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- Ritver

- RPM International Inc.

- Teknos Group

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Modular and RTA Furniture Boom in Asia-Pacific

- 4.2.2 EU-Led Shift to Low-VOC Waterborne Formulations

- 4.2.3 Premium Interior Decor Trend in North America

- 4.2.4 Expansion of DIY Home-Improvement Retail

- 4.2.5 Timber-Rich Multi-Family Housing in Europe

- 4.3 Market Restraints

- 4.3.1 Resin and Solvent Price Volatility

- 4.3.2 Stricter Formaldehyde / VOC Caps

- 4.3.3 Substitution by Laminates and Plastics in Furniture

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Resin Type

- 5.1.1 Polyurethane

- 5.1.2 Acrylic

- 5.1.3 Nitrocellulose

- 5.1.4 Polyester

- 5.1.5 Others

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 UV-Cured

- 5.2.4 Powder Coatings

- 5.3 By Application

- 5.3.1 Furniture and Fixtures

- 5.3.2 Doors and Windows

- 5.3.3 Cabinets

- 5.3.4 Other Applications (including Floors, Decks, and Molding Products)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordics

- 5.4.3.7 Russia

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 South Africa

- 5.4.5.5 Nigeria

- 5.4.5.6 Egypt

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Asian Paints

- 6.4.3 Axalta Coating Systems

- 6.4.4 Benjamin Moore & Co.

- 6.4.5 Ceramic Industrial Coatings

- 6.4.6 Hempel A/S

- 6.4.7 Jotun

- 6.4.8 Kansai Nerolac Paints Limited

- 6.4.9 KAPCI Coating

- 6.4.10 MAS Paints

- 6.4.11 National Paints Factories Co. Ltd.

- 6.4.12 Nippon Paint Holdings Co., Ltd.

- 6.4.13 PPG Industries Inc.

- 6.4.14 Ritver

- 6.4.15 RPM International Inc.

- 6.4.16 Teknos Group

- 6.4.17 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Increasing Demand for UV-cured Coatings