|

市場調查報告書

商品編碼

1690145

亞太低溫運輸物流:市場佔有率分析、產業趨勢與成長預測(2025-2030)Asia-Pacific Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

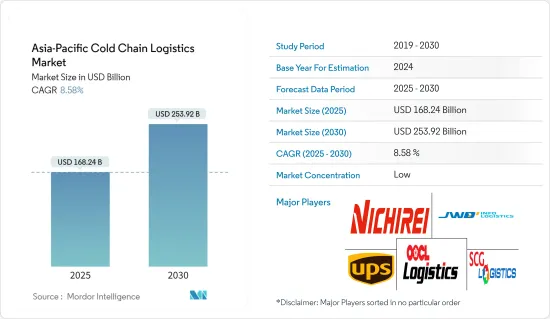

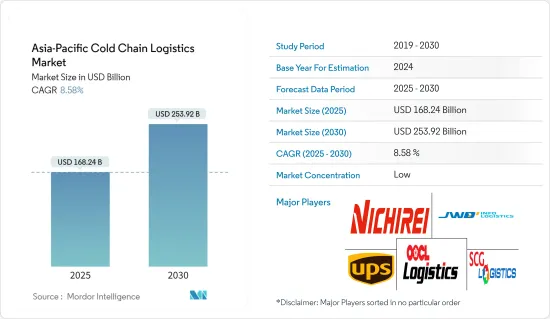

2025年亞太低溫運輸物流市場規模預估為1,682.4億美元,預估至2030年將達到2,539.2億美元,預測期間(2025-2030年)的複合年成長率為8.58%。

冷藏倉庫的增加和製藥業的市場發展等因素預計將推動亞太低溫運輸物流市場的成長。

主要亮點

- 低溫運輸物流在亞太地區頗受歡迎。該地區擁有龐大的消費群,約佔世界人口的60%。可支配收入的增加和飲食習慣的改變正在推動對奢侈品的需求。這些產品的運輸也很重要。當然,新冠疫情也影響著亞洲的低溫運輸營運,包括人們對食品安全的擔憂日益加劇。這已經改變了消費者的習慣,越來越多的人從超級市場等有組織的零售管道而不是傳統的濕貨市場購買生鮮食品和冷凍食品。電子商務和網路食品零售的興起也推動了對冷凍食品的需求。這些趨勢增加了該地區對冷藏倉儲設施的需求,並鼓勵進一步投資改善基礎設施和交通。

- 日本被認為是低溫運輸物流的成熟市場,由幾家公司主導。總部位於東京的日冷物流集團成立於 1945 年,前身為日本冷造株式會社。如今,該公司在日本和國際上提供倉儲業、冷藏倉儲業和運輸服務。來自各行各業的客戶,包括餐廳、零售商、食品製造商、公司和批發商,都使用該公司的冷藏物流服務。日本將於2024年實施業務加班上限,引發了人們對其對運輸和物流業影響的擔憂。技術創新還有望提高工作效率、減少工作失誤、預防事故。

- 無線射頻識別 (RFID) 技術在低溫運輸應用中的可用性以及低溫運輸物流自動化軟體的採用預計將為市場參與者提供豐厚的成長機會。近年來,受國內消費強勁、電子商務行業擴張以及現代物流設施發展的推動,亞太地區對優質工業和物流資產的需求旺盛。隨著可支配所得的增加和人口老化,亞太地區擁有龐大的保健產品消費群。人們對食品安全的日益擔憂導致消費者的習慣不斷改變,他們越來越傾向於透過超級市場等有組織的零售管道購買生鮮食品和冷凍食品,而不是傳統的濕貨市場。

- 飲食習慣的改變增加了對肉類、乳製品和魚貝類等奢侈品的需求,這些商品對溫度敏感,需要在受控溫度下儲存和運輸。儘管亞太地區冷藏倉庫租賃需求強勁,但與歐洲和美國等新興市場相比,冷藏倉庫容量仍然有限。冷藏倉庫的租金比乾貨倉庫高。然而,操作程序、安全、溫度和蟲害控制缺乏標準化以及營運成本增加等因素正在抑制市場成長。

亞太低溫運輸物流市場趨勢

日本國內水上貨運量減少

- 日本國內貨物吞吐量每年超過47億噸。所有運輸方式,無論是水路、鐵路、航空或公路,在經濟中都扮演著至關重要的角色。雖然貨運主要依賴製造和消費產生的需求,但運輸業對卡車和各種車輛(包括無人機)的需求。

- 日本的自動化正在經歷快速發展。日本物流業面臨勞動力短缺的問題,現有司機正在迅速老化,這可能會增加運輸成本在產品銷售中的比例。

- 從年運輸里程數來看,卡車運輸和沿海航運是日本物流業的主要運輸方式。鐵路和航空運輸也用於運輸貨物。然而,儘管鐵路網在運送人員方面效率很高,但大多數物流設施、倉庫和工廠最好透過公路連接。

冷藏倉庫增加

- 新冠疫情為供應鏈前景帶來了重大變化,加之人們對健康的擔憂,使得企業更多地使用數位和高階技術來提高業務效率。物流行業前景的變化、對顯著成本最佳化的需求以及最佳庫存管理預計將支持亞太低溫運輸物流市場的成長。

- 組成低溫運輸系統的多個倉庫旨在確保對溫度敏感的產品擁有理想的儲存和運輸條件。目前,許多出口產業都依賴低溫運輸解決方案提供的關鍵環節。

- 由於端對端低溫運輸安全是系統中的薄弱環節,公司正在低溫運輸業務中投資數百萬美元,以創建有效、高效和可靠的流程。此外,亞太地區食品和藥品需求的激增也推動了冷藏倉庫數量的增加。因此,冷藏倉庫的興起預計將推動亞太地區低溫運輸物流市場的成長。

亞太低溫運輸物流行業概況

亞太低溫運輸市場高度分散,許多全球和本地參與者都在滿足日益成長的需求。 UPS、OOCL Logistics 和 JWD 是該市場的一些主要企業。低溫運輸產業面臨的主要挑戰是巨大的能源和空間消耗,以及龐大的設置和改造成本。缺乏儲存溫度和工作程序的標準化是該行業面臨的另一個主要挑戰。可用冷藏空間的品質和靈活性是一個值得關注的問題。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場動態

- 當前市場狀況

- 市場概覽

- 市場動態

- 驅動程式

- 限制因素

- 機會

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 技術趨勢和自動化

- 政府法規和舉措

- 專注於環境和溫度控制存儲

- 排放標準和法規對低溫運輸產業的影響

- COVID-19 市場影響

第5章市場區隔

- 按服務

- 貯存

- 運輸

- 附加價值服務(速凍、貼標、庫存管理等)

- 按溫度類型

- 冷藏

- 《冷凍》

- 按應用

- 園藝(新鮮水果和蔬菜)

- 乳製品(牛奶、冰淇淋、奶油等)

- 肉類、魚類、家禽

- 加工食品

- 製藥、生命科學、化學

- 其他用途

- 按國家

- 中國

- 日本

- 印度

- 韓國

- 印尼

- 泰國

- 澳洲

- 菲律賓

- 其他亞太地區

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- United Parcel Service of America

- OOCL Logistics Ltd

- JWD Infologistics Public Company Ltd

- Nichirei Logistics Group Inc.

- SCG Logistics Management Company Limited

- X2 Logistics Network(X2 GROUP)

- AIT Worldwide Logistics Inc.

- CWT PTE. LIMITED(CWT International Ltd)

- SF Express

- CJ Rokin Logistics*

7. 亞太低溫運輸物流市場未來前景

第 8 章 附錄

The Asia-Pacific Cold Chain Logistics Market size is estimated at USD 168.24 billion in 2025, and is expected to reach USD 253.92 billion by 2030, at a CAGR of 8.58% during the forecast period (2025-2030).

Factors such as the increasing number of refrigerated warehouses and the development of the pharmaceutical sector are expected to drive the growth of the Asia-Pacific cold chain logistics market.

Key Highlights

- Cold chain logistics are popular in the Asia Pacific. The region has a large consumer base, accounting for roughly 60% of the global population. Demand for premium products is increasing, driven by rising disposable incomes and a shift in dietary habits. Transportation for these products is also important. Of course, COVID-19 has had an impact on Asian cold chain operations, including increased concerns about food safety. This is already changing consumer habits, with more people buying fresh and frozen food from organized retail channels like supermarkets rather than traditional wet markets. The rise of e-commerce and online food retailing has also fueled demand for frozen foods. These trends have increased the demand for cold storage facilities in the region and bolstered further investments in infrastructure and transportation improvements.

- Japan is regarded as a mature market for cold chain logistics, with several players dominating. Nichirei Logistics Group Inc., based in Tokyo, was founded in 1945 as Nippon Reizo Inc. Today, the company provides warehousing, cold storage, and transportation services in Japan and around the world. Customers in a variety of industries use its low-temperature logistics services, including restaurants, retail stores, food manufacturers, trading companies, and wholesalers. The 'upper limit on overtime hours in automobile driving operations' will be implemented in Japan in 2024, raising concerns about the impact on the transportation and logistics industries. Technological innovation is also expected to improve work efficiency, reduce workplace errors, and prevent accidents.

- The availability of Radio-frequency identification (RFID) technologies for cold chain applications and the adoption of automated software for cold chain logistics is projected to offer lucrative growth opportunities for the market players. Recent years have seen robust demand for high-quality industrial and logistics assets in Asia-Pacific due to strong domestic consumption, the e-commerce industry's expansion, and the development of modern logistics facilities. Due to the rising disposable income and ageing population, Asia-Pacific has a vast consumer base for healthcare supplies. There are increasing concerns over food safety and a continuous shift in consumer habits to buy fresh and frozen food products from organized retail channels, such as supermarkets, compared to traditional wet markets.

- The shift in dietary patterns is increasing the demand for premium products, including meat, dairy, and seafood, which are temperature-sensitive and need to be stored and transported at controlled temperatures. Despite robust leasing demand for cold storage facilities in Asia-Pacific, cold storage capacity in the region is limited compared to that in developed western markets. Cold storage facilities command higher rental premiums than dry warehouses. However, factors such as lack of standardization about operating procedures, security, temperature, pest control, and increased operational costs restrain the market's growth.

Asia Pacific Cold Chain Logistics Market Trends

Decreasing Volume of Domestic Water Freight Transport in Japan

- Japan handles more than 4.7 billion tons of domestic freight every year. Every mode of transport, including water, rail, air, and road, fulfills a crucial role in the economy. While cargo transport relies primarily on demand created by manufacturing industries and consumption, transportation creates demand for trucks and vehicles of any kind, including drones.

- Rapid developments in automation are taking place in Japan. The Japanese logistics industry suffers labor shortages, and the existing drivers are rapidly aging, thereby threatening to increase the fraction of transport costs in the sale of goods.

- Trucking and coastal shipping are the Japanese logistics industry's dominant modes of transport in terms of yearly payload distance. Railway and air transport are also used for transporting goods. However, despite the railway network being highly efficient for the transport of people, most logistics facilities, warehouses, and factories are better connected to roads.

Increased Number of Refrigerated Warehouses

- The COVID-19 pandemic has resulted in a significant change in the supply chain outlook, enabling the growing usage of digital high-end technologies to attain operational efficiency along with health concerns. The changing logistics industry outlook, requirement for substantial cost optimization, and optimum inventory management are anticipated to support the growth of the Asia-Pacific cold chain logistics market.

- Several warehouses comprising cold chain systems are designed to ensure the ideal storage and transportation conditions for temperature-sensitive products. Multiple export industries are now dependent on the vital links provided by cold chain solutions.

- Businesses are investing millions of dollars in their cold chain operations to create effective, efficient, and reliable processes, as end-to-end cold chain security is the weak link in the system. Moreover, the number of refrigerated warehouses is increasing due to a surge in demand for food and pharmaceutical products in the Asia-Pacific region. Therefore, an increase in refrigerated warehouses is anticipated to boost the growth of the Asia-Pacific cold chain logistics market.

Asia Pacific Cold Chain Logistics Industry Overview

The Asia-Pacific cold chain market is highly fragmented, with many global and local players catering to the growing demand. UPS, OOCL Logistics, and JWD are some of the major players in the market. Critical challenges faced by the cold chain industry are enormous energy and space consumption and huge setup and modification costs. Lack of standardization related to storage temperature and operating procedures are a few more significant challenges the industry faces. The quality and flexibility of available cold warehousing space are a considerable concern.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Method

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Overview

- 4.3 Market Dynamics

- 4.3.1 Drivers

- 4.3.2 Restraints

- 4.3.3 Opportunities

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Trends and Automation

- 4.7 Government Regulations and Initiatives

- 4.8 Spotlight on Ambient/Temperature-controlled Storage

- 4.9 Impact of Emission Standards and Regulations on Cold Chain Industry

- 4.10 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Services

- 5.1.1 Storage

- 5.1.2 Transportation

- 5.1.3 Value-added Services (Blast Freezing, Labeling, Inventory Management, Etc.)

- 5.2 By Temperature Type

- 5.2.1 Chilled

- 5.2.2 Frozen

- 5.3 By Application

- 5.3.1 Horticulture (Fresh Fruits and Vegetables)

- 5.3.2 Dairy Products (Milk, Ice-cream, Butter, Etc.)

- 5.3.3 Meats, Fish, Poultry

- 5.3.4 Processed Food Products

- 5.3.5 Pharma, Life Sciences, and Chemicals

- 5.3.6 Other Applications

- 5.4 By Country

- 5.4.1 China

- 5.4.2 Japan

- 5.4.3 India

- 5.4.4 South Korea

- 5.4.5 Indonesia

- 5.4.6 Thailand

- 5.4.7 Australia

- 5.4.8 Philippines

- 5.4.9 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 United Parcel Service of America

- 6.2.2 OOCL Logistics Ltd

- 6.2.3 JWD Infologistics Public Company Ltd

- 6.2.4 Nichirei Logistics Group Inc.

- 6.2.5 SCG Logistics Management Company Limited

- 6.2.6 X2 Logistics Network (X2 GROUP)

- 6.2.7 AIT Worldwide Logistics Inc.

- 6.2.8 CWT PTE. LIMITED (CWT International Ltd)

- 6.2.9 SF Express

- 6.2.10 CJ Rokin Logistics*