|

市場調查報告書

商品編碼

1690128

低程式碼開發平台:市場佔有率分析、產業趨勢與成長預測(2025-2030)Low-code Development Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

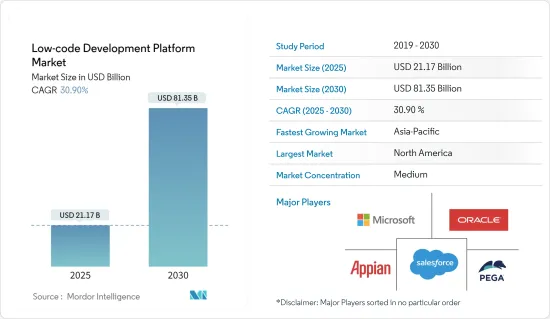

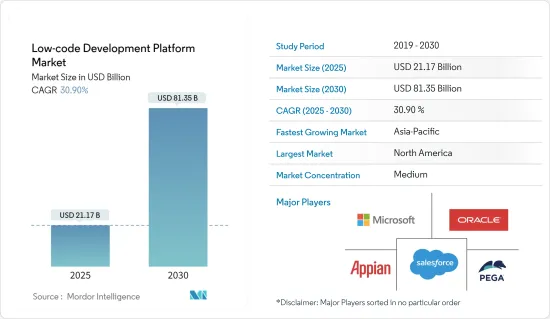

低程式碼開發平台市場規模預計在 2025 年為 211.7 億美元,預計到 2030 年將達到 813.5 億美元,預測期內(2025-2030 年)的複合年成長率為 30.9%。

專注於數位現代化的企業擴大採用低程式碼解決方案。這項轉變旨在改善使用者體驗、簡化流程和增強基本系統。低程式碼平台的吸引力在於其成本效益。低程式碼的優點在於其節省時間的拖放介面。在低程式碼中,所有流程都藉助圖形介面以視覺化的方式呈現,使一切都更容易理解。它使開發人員可以更輕鬆地創建應用程式。

低程式碼解決方案超越了傳統內部部署開發的速度和靈活性,使組織能夠快速創建功能解決方案和整合。以前,整合需要雙方進行大量的 IT 工作和自訂開發。隨著越來越多的組織採用「購買或製造」的軟體開發方式,他們開始轉向自助服務和其他具有獨特功能的解決方案來提高速度和效率。此外,供應商開發的低程式碼工具組件也提供了更好的使用者體驗。

人工智慧(AI)正在全球各行各業中廣泛應用。然而,人才短缺和實施成本高等障礙阻礙了其全面整合。為了解決這個問題,低程式碼人工智慧已成為一個關鍵概念,尤其是在應用程式和軟體開發中。它的多功能性和優勢吸引了許多企業投資該平台。

透過利用低程式碼人工智慧,企業可以獲得許多好處,包括增強資料分析、簡化使用者體驗、降低成本和縮短開發週期。這種不斷發展的效用有望推動低程式碼人工智慧的採用激增並加速市場成長。例如,2023 年 10 月,Rasa 推出了一個深植於生成式人工智慧的對話平台。此舉簡化了創建人工智慧助理的過程,並透過直覺的使用者介面優先考慮使用者的易用性。

各行各業的公司擴大採用低程式碼開發平台來縮短軟體開發時間。例如,西門子使用關鍵的低程式碼平台 Mendix 來開發工業IoT應用程式。此外,2024年1月, Oracle宣布其低程式碼平台持續增強功能。最近的 Oracle APEX 版本 23.1 和 22.1 引進了許多強大且實用的功能。

此外,越來越多的企業開始採用低程式碼解決方案,以較低的成本加速計劃開發。此外,資源和資金受限的中小型企業擴大轉向即時應用開發平台。

例如,2023 年 8 月,Workato 與 IMDA 和技術合作夥伴 SGTech、HReasily 和 Stone Forest 聯手,為新加坡 1,500 家中小企業提供支援。他們的目標是簡化和自動化工作流程。透過利用 Workato 的無程式碼、低程式碼平台,這些小型企業現在可以更好地實現其全部數位化能力。

此外,通貨膨脹導致的成本上升將導致低程式碼平台訂閱和相關服務的價格上漲,從而降低其對注重成本的組織的吸引力。此外,影響全球供應鏈的宏觀經濟因素可能會減緩硬體採購和部署,從而減緩低程式碼平台的採用。

低程式碼開發平台市場趨勢

資訊科技產業將經歷巨大成長

- 為了滿足業務需求,需要縮短軟體開發週期,這促使 IT 部門採用低程式碼平台來大幅加快應用開發和配置。據 Mendix 稱,過去幾年低程式碼的使用一直在穩步成長。預計到2023年,全球約有50%的編碼將透過低程式碼完成,到2024年將超越傳統編碼,達到55%。

- 低程式碼平台使 IT 團隊能夠在更短的時間內開發更多應用程式,從而提高整體生產力並使他們能夠專注於需要專業知識的更複雜的任務。許多企業正在使用低程式碼平台來實現舊有系統的現代化、與新技術的整合以及擴展功能,而無需大量重新編碼。

- 2023年6月,數位業務和IT服務領域的重要公司NTT 資料在Everest Group 2023年報告《OutSystems PEAK Matrix評估》中被評為低程式碼應用開發服務的領導者。評估分析了 15 家服務供應商,重點關注他們在 OutSystems 低程式碼平台上提供服務的策略、能力、願景和市場地位。

- IT公司在主導低程式碼開發平台市場方面發揮了關鍵作用。這是因為從事該行業的公司需要為自己和客戶開發許多行動和/或線上應用程式。此外,低程式碼開發平台的優勢在於可以快速創建、共用和更新應用程式,從而提高生產力並最佳化資源利用率。

- Caspio 最近的一項調查顯示,63% 的低程式碼平台用戶持有滿足自訂應用程式需求所需的技能和資源。此外,61% 的用戶表示,他們能夠在時間和預算限制內成功交貨自訂應用程式。此外,58% 使用低程式碼平台的受訪者相信他們可以滿足其業務的自訂應用需求。

預計亞太地區將佔據最大市場佔有率

- 亞太地區許多國家正在金融、醫療保健和零售等各行業經歷重大的數位轉型。低程式碼平台透過實現更快、更有效率的應用開發來幫助加速這一進程。據IBEF稱,印度是全球成長第二快的數位經濟體。該國的數位革命預計將成為一個價值1兆美元的商機。

- 該地區對雲端運算的採用日益增加,支援了低程式碼平台的發展,其中許多都是雲端原生的。雲端基礎的低程式碼平台提供擴充性、靈活性和降低的基礎設施成本。印度公共雲端服務 (PCS) 市場預計將達到 135 億美元,2021 年至 2026 年期間的複合年成長率為 24%。此外,它可能會推動該市場的成長。

- 由於行動應用程式的普及,預計該地區在預測期內將大幅成長。亞太地區擁有許多資源有限的中小型企業,這迫使它們採用託管服務。此外,該地區的政府正在透過採用行動優先策略來更好地服務其公民,從而引領市場。

- 華為全球技術服務部推出通用數位引擎(GDE)平台,由「1+4+N」模型組成。這裡的「1」代表開放的雲端原生平台,「4」突顯了資料共用、智慧生產流程、產能共用、一體化低程式碼自開發四大功能。 GDE 將數位和智慧技術融入運輸公司的整個流程,從規劃到建造、維護和最佳化。透過這種融合,通訊業者將進化成為數位化實體和合作夥伴,推動「N」個應用場景的創新。

- 此外,2023年11月,OutSystems Japan在日本推出了雲端原生應用應用開發的低程式碼解決方案OutSystems Developer Cloud。 OutSystems 開發者雲端旨在為開發人員和企業提供高效能、安全的低程式碼應用程式平台。它的多功能性透過支援大規模應用程式的安全部署和促進從前端到後端的端到端開發而顯現出來。

- 該地區正在經歷許多數位化舉措和發展,包括低程式碼平台。例如,2023年12月,低程式碼/無程式碼企業平台Kissflow宣布與東南亞重要的雲端轉型公司PointStar Malaysia建立合作關係。此次策略聯盟旨在擴大 Kissflow 已經蓬勃發展的全球合作夥伴網路。此次合作可望提供一個現代化的低程式碼工作平台,幫助企業實現數位轉型。

低程式碼開發平台產業概覽

低程式碼開發平台市場相當分散,公司眾多,全球管治面臨重大挑戰,較小的供應商累積了相當大的市場佔有率。資金雄厚的供應商正在積極進行策略併購,而小型企業則參與產品創新策略以搶佔市場佔有率。

- 2024 年 7 月:Infragistics 是一家全球領先的設計和開發加速工具和解決方案提供商,宣布了其雲端基礎的所見即所得拖放式低程式碼工具 App Builder 的許多新功能。該工具使各種技能水平的人員(從專業和新手開發人員到業務相關人員和決策者)能夠快速創建現代業務 Web 應用程式。

- 2024 年 3 月,義大利農產品企業 Amadori 轉向 Appian 引領其數位業務轉型。透過利用 Appian 平台,Amadori 創建了更敏捷、靈活且面向未來的技術基礎架構。利用 Appian 先進的自動化和資料架構功能,Amadori 在近十年的合作中有效地改進和現代化了其多項業務營運。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 主要宏觀經濟趨勢的市場影響

第5章市場動態

- 市場促進因素

- 對快速客製化和擴充性的需求日益增加

- 提高企業移動性

- 縮小必要的 IT 技能差距

- 市場挑戰

- 依賴供應商提供的客製化

第6章 新興科技趨勢

第7章市場區隔

- 按應用程式類型

- 基於網路

- 基於行動裝置

- 基於桌面/伺服器

- 依部署類型

- 本地

- 雲

- 按組織規模

- 中小型企業

- 大型企業

- 按行業

- BFSI

- 零售與電子商務

- 政府和國防

- 資訊科技

- 能源與公共產業

- 製造業

- 衛生保健

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第8章競爭格局

- 公司簡介

- Microsoft Corporation

- Appian Corporation

- Oracle Corporation

- Pegasystems Inc.

- Magic Software Enterprises Ltd

- AgilePoint Inc.

- Outsystems Inc.

- Mendix Inc.

- ZOHO Corporation

- QuickBase Inc.

- Clear Software LLC

- Kony Inc. 8.14 ServiceNow Inc.

- Skuid Inc.

第9章供應商市場分析

第10章投資分析

第11章:投資分析市場的未來

The Low-code Development Platform Market size is estimated at USD 21.17 billion in 2025, and is expected to reach USD 81.35 billion by 2030, at a CAGR of 30.9% during the forecast period (2025-2030).

Businesses are increasingly embracing low-code solutions as they pivot toward digital modernization. This shift aims to enhance user experiences, streamline processes, and fortify essential systems. The appeal of low-code platforms lies in their cost-effectiveness. The advantage of low code is its drag-and-drop interface, which saves time. In low code, every single process is shown visually with the help of a graphical interface that makes everything easier to understand. It is easier for developers to create their applications.

Low-code solutions empower organizations to create functional solutions and integrations swiftly, outpacing the pace and flexibility of traditional on-premise developments. Previously, integration demanded laborious IT efforts, necessitating custom development on both ends. As more organizations adopt a "buy versus build" approach to software development, they turn to self-service and other solutions with unique functionality to increase speed and efficiency. In addition, the vendor-developed components of low-code tools also offer a better user experience.

Artificial intelligence (AI) is seeing broad adoption in global industries. However, hurdles like talent shortages and high implementation costs hinder its full integration. To address this, low-code AI is rising as a pivotal concept, especially in application and software development. Given its versatility and advantages, many enterprises are channeling investments into this platform.

By harnessing low-code AI, enterprises gain numerous benefits, such as bolstered data analytics, streamlined user experiences, cost savings, and faster development cycles. This heightened utility is fueling a surge in the adoption of low-code AI, poised to propel market growth. For instance, in October 2023, Rasa unveiled a conversational platform deeply rooted in generative AI. This move simplified the AI assistant creation process and prioritized user-friendliness due to its intuitive user interface.

Companies in diverse industries increasingly embrace low-code development platforms to accelerate their software development timelines. For instance, Siemens utilizes Mendix, a significant low-code platform, for developing industrial IoT applications. Also, in January 2024, Oracle announced that the low-code platform continues to enhance its capabilities. The recent Oracle APEX versions 23.1 and 22.1 introduced many potent and practical features.

Furthermore, businesses increasingly turn to low-code solutions to accelerate project development at a reduced cost. Additionally, given their constraints in resources and funds, small and medium-sized enterprises are increasingly gravitating toward instant application development platforms.

For instance, in August 2023, Workato, in collaboration with IMDA and tech partners SGTech, HReasily, and Stone Forest, joined forces to assist 1,500 SMEs in Singapore. Their goal is to streamline and automate workflows. Leveraging Workato's no-code, low-code platform, these SMEs were poised to realize their digital capabilities fully.

Moreover, rising costs due to inflation can lead to increased prices for low-code platform subscriptions and associated services, making them less attractive to cost-conscious organizations. Also, macroeconomic factors affecting global supply chains can lead to delays in hardware procurement and deployment, which can, in turn, slow down the adoption of low-code platforms.

Low-code Development Platform Market Trends

The Information Technology Segment to Witness Significant Growth

- The need for faster software development cycles to keep up with business demands is pushing IT departments to adopt low-code platforms, significantly speeding up application development and deployment. According to Mendix, low-code usage has grown consistently over the past few years. In 2023, about 50% of global coding was done using low code, while in 2024, it is expected to overtake conventional coding to reach 55%.

- Low-code platforms enable IT teams to develop more applications in less time, improving overall productivity and allowing them to focus on more complex tasks that require their expertise. Many organizations use low-code platforms to modernize legacy systems, integrating them with new technologies and extending their functionality without extensive re-coding.

- In June 2023, NTT DATA, a significant player in digital business and IT services, was recognized as a leader by Everest Group in its 2023 report on Low-Code Application Development Services for OutSystems PEAK Matrix Assessment. The assessment analyzed 15 service providers and focused on their strategies, capabilities, vision, and market presence in delivering services on the OutSystems low-code platform.

- IT enterprises played a key role in dominating the low-code development platform market. This is because the firms operating in this vertical need to develop many applications, either for mobile or online (or both), for themselves and their clients. Further, the benefits of low-code development platforms enabled apps to be created, shared, and updated quickly, leading to improved productivity and optimized resource utilization.

- A recent study by Caspio revealed that 63% of low-code platform users possess the necessary skills and resources to meet the demand for custom apps. Additionally, 61% of these users reported successful delivery of custom apps, meeting both deadlines and budget constraints. Moreover, 58% of respondents using low-code platforms expressed confidence in meeting their business's custom app demands.

Asia-Pacific is Expected to Hold the Largest Market Share

- Many countries in Asia-Pacific are undergoing significant digital transformation across various industries, such as finance, healthcare, and retail. Low-code platforms help accelerate this process by enabling faster and more efficient application development. According to IBEF, India has become the world's second-fastest-growing digital economy. The country's digital revolution is expected to be a USD 1 trillion opportunity.

- The increasing adoption of cloud computing in the region supports the growth of low-code platforms, many of which are cloud-native. Cloud-based low-code platforms offer scalability, flexibility, and lower infrastructure costs. The Indian public cloud services (PCS) market is anticipated to reach USD 13.5 billion, registering a compound annual growth rate of 24% between 2021 and 2026. Further, it may propel the growth of the market studied.

- The region is anticipated to grow significantly over the forecast period, owing to the increasing adoption of mobile applications. Asia-Pacific includes many SMEs with limited resources, forcing them to adopt managed services. The governments in the region also adopted a mobile-first strategy to provide better services to their citizens, thereby driving the market.

- Huawei Global Technical Service unveiled its General Digital Engine (GDE) platform, structured around the "1+4+N" model. Here, "1" signifies an open cloud-native platform, while "4" highlights its four key capabilities, i.e., data sharing, intelligent production flow, capability sharing, and integrated low-code self-development. The GDE integrates digital and smart technologies across carriers' processes, from planning and construction to maintenance and optimization. This integration empowers carriers to evolve into digital entities and collaborative partners, fostering innovation across "N" application scenarios.

- Furthermore, in November 2023, OutSystems Japan Co. Ltd rolled out its OutSystems Developer Cloud, a low-code solution tailored for cloud-native application development in Japan. OutSystems Developer Cloud is designed to offer a high-performance, secure, and low-code application platform catering to both developers and enterprises. Its versatility shines as it supports secure deployment in large-scale applications and facilitates end-to-end development from front to back.

- Many digital initiatives and developments, including low-code platforms, are occurring in the region. For instance, in December 2023, the low-code/no-code enterprise platform Kissflow announced a partnership with PointStar Malaysia, a significant cloud transformation firm in Southeast Asia. This strategic collaboration intends to broaden Kissflow's already thriving global partner network. It is expected to offer a modern low-code work platform to aid businesses in digitally transforming their operations.

Low-code Development Platform Industry Overview

The low-code development platform market is moderately fragmented, with the presence of many players, significant governance challenges globally, and smaller vendors cumulatively holding a substantial market share. The market vendors with deep pockets are actively involved in strategic M&A activities, while small companies are involved in product innovation strategies to gain market share.

- July 2024: Infragistics, a significant global provider of tools and solutions to accelerate design and development, announced an array of new features in "App Builder," the essential cloud-based WYSIWYG drag-and-drop low-code tool that enables all skill levels, from professional and novice developers to business stakeholders and decision-makers, to create modern business web applications quickly.

- March 2024: Amadori, an Italian agribusiness company, turned to Appian to spearhead its digital business transformation. By harnessing the Appian Platform, Amadori has constructed a technology infrastructure that is faster, more flexible, and future-ready. Over nearly a decade of collaboration, Amadori has effectively revamped and modernized several business operations, capitalizing on Appian's advanced automation and data fabric features.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Key Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Rapid Customization and Scalability

- 5.1.2 Increasing Enterprise Mobility

- 5.1.3 Elimination of Gaps in Required IT Skills

- 5.2 Market Challenges

- 5.2.1 Dependency on Vendor-supplied Customization

6 EMERGING TECHNOLOGY TRENDS

7 MARKET SEGMENTATION

- 7.1 By Application Type

- 7.1.1 Web-based

- 7.1.2 Mobile-based

- 7.1.3 Desktop- and Server-based

- 7.2 By Deployment Type

- 7.2.1 On-premise

- 7.2.2 Cloud

- 7.3 By Organization Size

- 7.3.1 Small and Medium Enterprises

- 7.3.2 Large Enterprises

- 7.4 By End-user Vertical

- 7.4.1 BFSI

- 7.4.2 Retail and E-commerce

- 7.4.3 Government and Defense

- 7.4.4 Information Technology

- 7.4.5 Energy and Utilities

- 7.4.6 Manufacturing

- 7.4.7 Healthcare

- 7.4.8 Other End-user Verticals

- 7.5 By Geography

- 7.5.1 North America

- 7.5.2 Europe

- 7.5.3 Asia-Pacific

- 7.5.4 Latin America

- 7.5.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Microsoft Corporation

- 8.1.2 Appian Corporation

- 8.1.3 Oracle Corporation

- 8.1.4 Pegasystems Inc.

- 8.1.5 Magic Software Enterprises Ltd

- 8.1.6 AgilePoint Inc.

- 8.1.7 Outsystems Inc.

- 8.1.8 Mendix Inc.

- 8.1.9 ZOHO Corporation

- 8.1.10 QuickBase Inc.

- 8.1.11 Clear Software LLC

- 8.1.12 Kony Inc. 8.14 ServiceNow Inc.

- 8.1.13 Skuid Inc.