|

市場調查報告書

商品編碼

1773390

低程式碼開發平台市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Low Code Development Platform Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

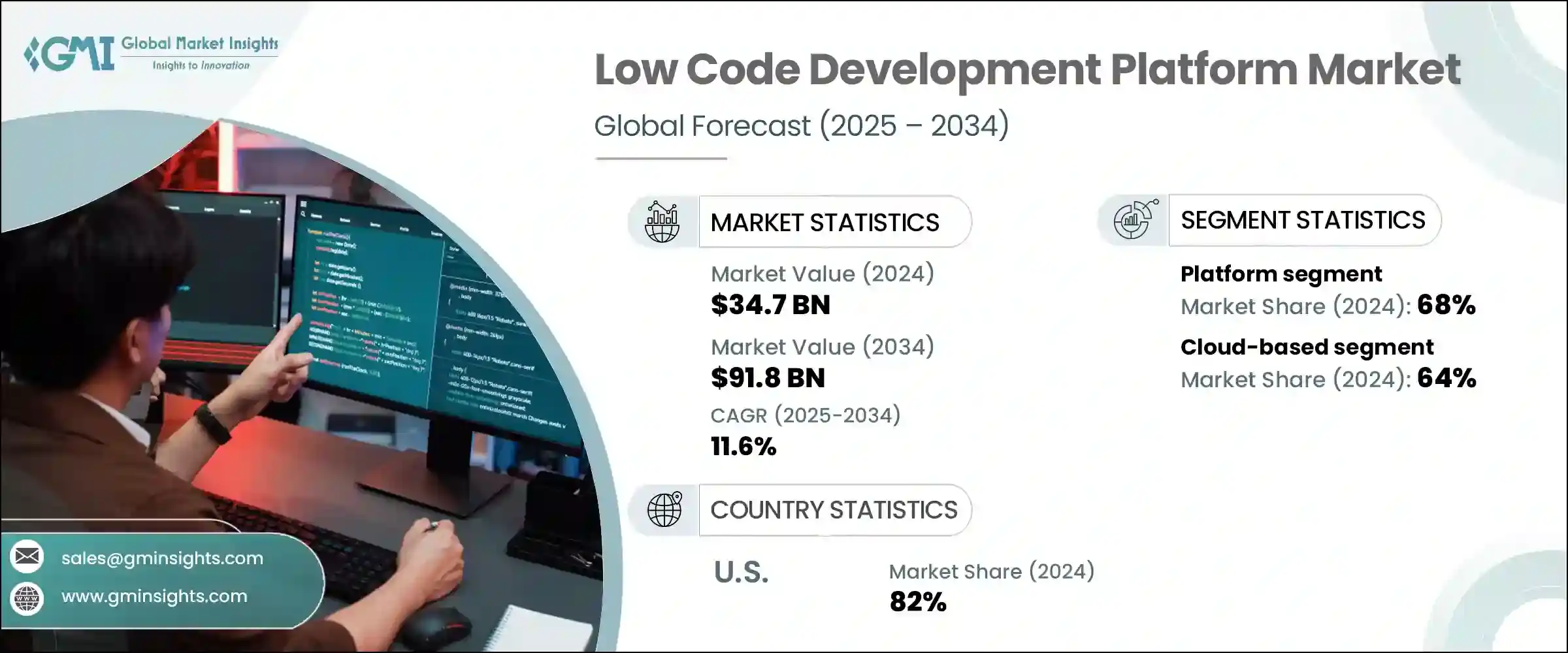

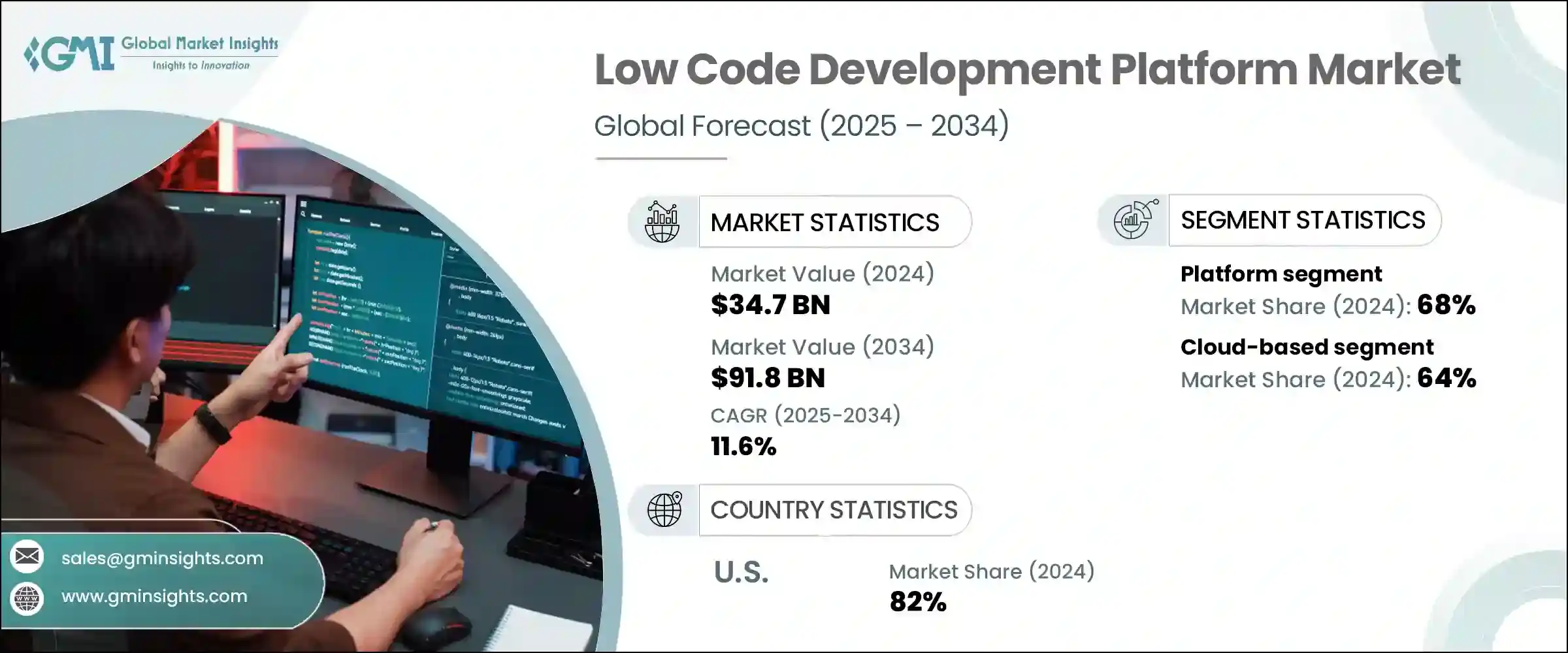

2024 年全球低程式碼開發平台市場規模達 347 億美元,預計到 2034 年將以 11.6% 的複合年成長率成長,達到 918 億美元。這一成長反映了在快速發展的數位世界中,對快速軟體部署日益成長的需求。隨著企業加大對數位轉型的關注,對能夠以最少編碼實現更快開發的工具的需求也日益成長。低程式碼平台透過減少對手動程式設計的依賴、使用視覺化介面和拖放功能,提供了一種簡化的開發路徑。這簡化了開發流程,加快了產品上市時間,降低了成本,並使新功能更快地惠及使用者。這些平台對於人力資源、供應鏈和客戶服務等部門尤其重要,因為這些部門的適應性和速度至關重要。

低程式碼工具賦能非技術使用者的能力也帶來了顛覆性的改變。這些平台讓IT部門以外的員工能夠建立功能性應用程式,從而減輕軟體團隊的壓力並提高組織的回應能力。在開發人員短缺、營運複雜性不斷上升的時代,企業可以從允許公民開發者建立客製化工具中獲益,這些工具可以提高效率並激發創新。在適當的培訓和治理支援下,這些解決方案有助於將開發能力擴展到傳統IT界限之外。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 347億美元 |

| 預測值 | 918億美元 |

| 複合年成長率 | 11.6% |

2024年,平台解決方案細分市場佔據68%的市場佔有率,預計到2034年將以12%的複合年成長率成長。這些平台正在從基礎開發環境發展成為整合介面設計、業務邏輯和部署功能的全端系統。這種整合使得從創意到功能性軟體的快速發展成為可能,即使是低程式碼使用者也能在極少的技術監督下建立可擴展的應用程式。提供全面、端到端解決方案的公司將繼續引領市場。

基於雲端的部署領域佔據了 64% 的佔有率,預計到 2034 年將以 13% 的複合年成長率成長。雲端原生低程式碼平台透過根據需求自動調整運算資源來提供彈性,從而最大限度地降低延遲和成本,同時提升用戶體驗。這些系統減輕了基礎設施管理的負擔,並支援數位解決方案的無縫擴展。無伺服器執行和容器化等技術增加了另一層靈活性,使基於雲端的低程式碼系統成為動態全球化應用程式的理想選擇。

美國低程式碼開發平台市場佔82%的市場佔有率,2024年市場規模達98億美元。國內企業正優先考慮數位化創新,以提高營運效率、提升服務品質並保持競爭敏捷性。低程式碼工具能夠提供比傳統開發更快、更具成本效益的替代方案,與這些策略完美契合。美國在將人工智慧和超自動化等新興技術融入低程式碼環境方面繼續保持領先地位,進一步加速了企業採用低程式碼技術的速度。

該行業的主要市場參與者包括 Zoho Corporation、微軟、Appian Corporation、SAP SE、ServiceNow、甲骨文和 Salesforce。為了鞏固其市場地位,領先的公司正專注於透過嵌入人工智慧和機器學習功能來持續增強平台,以提高自動化程度和使用者個人化。他們正在透過第三方整合和應用市場擴展其生態系統,以增強平台功能。雲端原生產品仍然是重中之重,各公司正在最佳化基礎架構以提高效能和可擴展性。此外,供應商正在投資教育和支援計劃,以賦能公民開發者並擴大採用範圍。策略性收購也被用於拓寬產品組合併加速上市策略,尤其是在特定垂直用例中。企業級安全和合規性支援日益整合,以吸引受監管行業。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 加速數位轉型

- 對業務敏捷性的需求增加

- 雲端運算需求不斷成長

- 遠距工作和協作日益增多

- 產業陷阱與挑戰

- 安全和治理問題

- 客製化程度有限且應用複雜

- 市場機會

- 與人工智慧和自動化的整合

- 在特定行業應用中的使用日益增多

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 成本細分分析

- 軟體開發和授權成本

- 部署和整合成本

- 維護和支援成本

- 網路安全與合規成本

- 培訓和變更管理成本

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 用例

- 最佳情況

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 平台

- 服務

- 諮詢

- 整合與實施

- 支援與維護

第6章:市場估計與預測:依部署模式,2021 - 2034 年

- 主要趨勢

- 本地

- 基於雲端

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 基於網路

- 基於行動裝置

- 桌面

- 資料庫

第8章:市場估計與預測:依組織規模,2021 - 2034 年

- 主要趨勢

- 中小企業

- 大型企業

第9章:市場估計與預測:依產業垂直,2021-2034

- 主要趨勢

- 金融服務業

- 資訊科技和電信

- 政府與國防

- 衛生保健

- 零售與電子商務

- 製造業

- 能源與公用事業

- 教育

- 其他

第 10 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 商業用戶

- 開發者

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- AgilePoint

- Appian Corporation

- Betty Blocks

- Creatio

- DWKit

- Google Cloud

- Joget

- Kissflow

- LANSA

- Mendix

- Microsoft

- Nintex

- Oracle

- OutSystems

- Quick Base

- Salesforce

- SAP SE

- ServiceNow

- Zoho Corporation

The Global Low Code Development Platform Market was valued at USD 34.7 billion in 2024 and is estimated to grow at a CAGR of 11.6% to reach USD 91.8 billion by 2034. This growth reflects the rising need for rapid software deployment in a fast-evolving digital world. As businesses intensify their focus on digital transformation, there's increasing demand for tools that allow for quicker development with minimal coding. Low-code platforms offer a streamlined path by reducing reliance on manual programming, using visual interfaces and drag-and-drop capabilities. This simplifies the development process, speeds up time to market, reduces costs, and allows new functionality to reach users more quickly. These platforms are especially vital in departments like HR, supply chain, and customer service, where adaptability and speed are critical.

The ability of low-code tools to empower non-technical users is also a game changer. These platforms let employees outside of IT build functional applications, relieving pressure on software teams and improving organizational responsiveness. In times of developer shortages and rising operational complexity, businesses benefit from allowing citizen developers to craft tailored tools that improve efficiency and spark innovation. When supported with appropriate training and governance, these solutions help scale development capacity beyond traditional IT boundaries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $34.7 Billion |

| Forecast Value | $91.8 Billion |

| CAGR | 11.6% |

In 2024, the platform solutions segment held 68% share and is expected to grow at a CAGR of 12% through 2034. These platforms are evolving beyond basic development environments into full-stack systems that integrate interface design, business logic, and deployment functions. This integration allows rapid progression from idea to functional software, helping even low-code users build scalable applications with minimal technical oversight. Companies that offer comprehensive, end-to-end solutions continue to lead the market.

Cloud-based deployment segment held a 64% share and is forecasted to grow at a CAGR of 13% through 2034. Cloud-native low-code platforms offer elasticity by automatically adjusting compute resources based on demand, which minimizes latency and costs while improving user experience. These systems remove the burden of infrastructure management and support seamless scaling for digital solutions. Technologies like serverless execution and containerization add another layer of flexibility, making cloud-based low-code systems ideal for dynamic, global applications.

U.S. Low Code Development Platform Market held an 82% share and generated USD 9.8 billion in 2024. Domestic firms are prioritizing digital innovation to boost operational efficiency, elevate service quality, and maintain competitive agility. Low-code tools fit well into these strategies by offering faster, more cost-effective alternatives to traditional development. The country continues to lead in the integration of emerging technologies like artificial intelligence and hyper-automation into low-code environments, further accelerating enterprise adoption.

Key market players in this industry include Zoho Corporation, Microsoft, Appian Corporation, SAP SE, ServiceNow, Oracle, and Salesforce. To strengthen their presence in the market, leading companies are focusing on continuous platform enhancements by embedding AI and machine learning capabilities to improve automation and user personalization. They're expanding their ecosystem through third-party integrations and app marketplaces to increase platform functionality. Cloud-native offerings remain a central priority, with firms optimizing infrastructure for performance and scalability. Additionally, vendors are investing in education and support programs to empower citizen developers and expand adoption. Strategic acquisitions are also being used to broaden product portfolios and accelerate go-to-market strategies, particularly across vertical-specific use cases. Enterprise-grade security and compliance support are increasingly integrated to attract regulated industries.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment Mode

- 2.2.4 Application

- 2.2.5 Enterprise Size

- 2.2.6 Industry Vertical

- 2.2.7 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Accelerated digital transformation

- 3.2.1.2 Increased demand for business agility

- 3.2.1.3 Rising demand for cloud computing

- 3.2.1.4 Rising remote work and collaboration

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Security and governance concern

- 3.2.2.2 Limited customization and complex applications

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with AI and automation

- 3.2.3.2 Growing use in industry specific application

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Software development & licensing cost

- 3.8.2 Deployment & integration cost

- 3.8.3 Maintenance & support cost

- 3.8.4 Cybersecurity & compliance cost

- 3.8.5 Training & change management cost

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Platform

- 5.3 Services

- 5.3.1 Consulting

- 5.3.2 Integration & implementation

- 5.3.3 Support & maintenance

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Web-based

- 7.3 Mobile-based

- 7.4 Desktop

- 7.5 Database

Chapter 8 Market Estimates & Forecast, By Organization Size, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large Enterprises

Chapter 9 Market Estimates & Forecast, By Industry Vertical, 2021- 2034 (USD Million)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 IT & Telecom

- 9.4 Government & Defense

- 9.5 Healthcare

- 9.6 Retail & E-commerce

- 9.7 Manufacturing

- 9.8 Energy & utilities

- 9.9 Education

- 9.10 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2021- 2034 (USD Million)

- 10.1 Key trends

- 10.2 Business user

- 10.3 Developers

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Nordics

- 11.3.7 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AgilePoint

- 12.2 Appian Corporation

- 12.3 Betty Blocks

- 12.4 Creatio

- 12.5 DWKit

- 12.6 Google Cloud

- 12.7 Joget

- 12.8 Kissflow

- 12.9 LANSA

- 12.10 Mendix

- 12.11 Microsoft

- 12.12 Nintex

- 12.13 Oracle

- 12.14 OutSystems

- 12.15 Quick Base

- 12.16 Salesforce

- 12.17 SAP SE

- 12.18 ServiceNow

- 12.19 Zoho Corporation