|

市場調查報告書

商品編碼

1690088

汽車預測技術:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Automotive Predictive Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

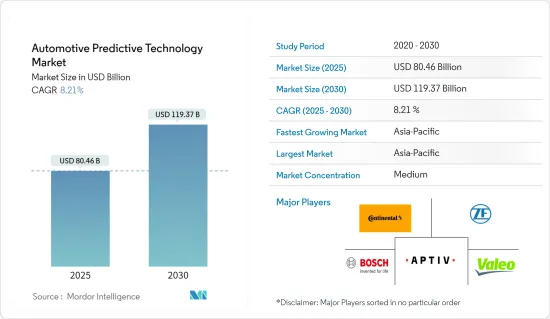

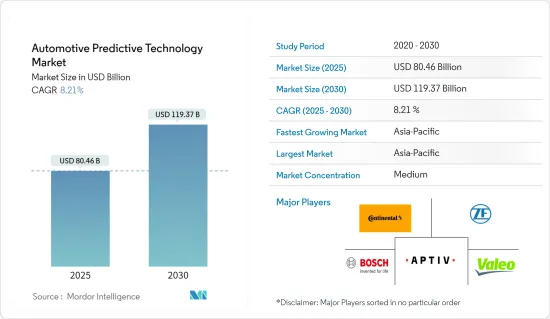

2025 年汽車預測技術市場規模預估為 804.6 億美元,預計到 2030 年將達到 1,193.7 億美元,預測期內(2025-2030 年)的複合年成長率為 8.21%。

新冠疫情為汽車預測技術市場帶來沉重打擊。全球各地汽車和零件生產工廠的暫時關閉,導致供應鏈嚴重中斷。然而,汽車行業正在顯示出復甦的跡象,預計在預測期內將繼續保持這一趨勢。

市場對汽車先進技術特性的需求不斷成長,從而推動了市場的發展。人工智慧和機器學習等技術創新正在增強安全措施,尤其是透過 ADAS(高級駕駛輔助系統)。此外,人們對預測性維護的興趣日益濃厚,希望以經濟高效的方式減少車輛停機時間並提高性能。

預測能力在自動駕駛汽車和自動駕駛技術中發揮關鍵作用,可以提醒駕駛員注意障礙物和其他駕駛提示。各大原始OEM都在大力投資自動駕駛汽車的開發,這為市場參與者帶來了光明的機會。

受印度、中國和日本豪華汽車需求激增的推動,亞太地區預計將引領汽車預測技術市場。此外,該地區對 ADAS 的日益採用預計將在未來幾年推動對預測技術的需求。

汽車預測技術市場趨勢

預計 ADAS 領域將在預測期內佔據市場主導地位

近年來,汽車產業不斷加強研發,以增強ADAS(高級駕駛輔助系統)。這種強化不僅完善了 ADAS 技術,而且還推動了對夜間行人偵測、車道偏離警告以及包括攝影機和雷達在內的各種感測器等系統的需求增加。這些技術正在迅速融入車輛中,汽車製造商正在積極推廣這些先進功能以推動市場需求。

奧迪、寶馬、戴姆勒和沃爾沃等汽車製造商已開始在其產品中加入夜間行人偵測系統。這些系統有兩個目的:如果它們偵測到行人在車輛的速度閾值內,它們可以警告駕駛或自動煞車。此類創新凸顯了當今車輛中日益普遍的不斷發展的安全標準。

為了搶佔更大的市場佔有率,許多領先的服務供應商正在大力投資尖端 ADAS 技術的研發。這一領域並非完全由產業巨頭主導。許多新興企業從這些大公司獲得資金,以帶來創新的理念和技術。成熟企業和新興新興企業之間的協同效應正在催化 ADAS 技術的快速進步。

鑑於不斷的進步和投資,ADAS 領域有望引領汽車領域的預測技術市場。由於高度重視提高安全性、改善駕駛舒適度和遵守嚴格的監管標準,ADAS 的採用正在蓬勃發展,並將在未來幾年鞏固其作為市場領導者的地位。

亞太地區預計將佔據主要市場佔有率

預計亞太地區將成為預測期內成長最快的市場。需求激增主要歸因於汽車的混合動力化和電氣化,以及電動車產量的增加。印度、中國和日本等國家正逐步將預測技術納入乘用車之中。然而,配備該技術的車輛價格高、基礎設施不足和監管障礙等挑戰限制了其應用。

在亞太地區,汽車製造商不僅採用預測技術,並將其推廣到新產品中。例如

- 2024年1月,玉柴集團宣布成立廣西低碳智慧動力傳動系統研究院。該實驗室將專注於預測控制技術與巨量資料的整合,以改善動力傳動系統系統。重點關注智慧動力傳動系統、新能源系統和高效內燃機。此外,我們正在探索利用甲醇、氫和氨等低碳和零碳燃料的動力傳動系統。該實驗室的預測控制技術旨在推動永續和智慧汽車解決方案的發展,提高性能並減少排放氣體。

- 2023年5月,位於班加羅爾的大陸印度技術中心在開發適合印度道路的ADAS解決方案方面取得了顯著進展。其創新的模組化ADAS可輕鬆適應不同的汽車平臺,確保廣泛的兼容性。

這些發展標誌著亞太地區預測技術的快速成長,預計未來幾年需求將會成長。

汽車預測技術產業概況

汽車預測技術市場由成熟企業和新興企業主導,它們爭奪市場佔有率。該領域的主要波動包括大陸集團、採埃孚股份公司、羅伯特·博世、安波福集團和法雷奧集團。

最近的趨勢證實了將先進的預測和人工智慧技術融入汽車的顯著轉變。此舉不僅旨在提高安全性和效率,也凸顯了該產業對創新和豐富用戶體驗的堅定承諾。透過夥伴關係並利用彼此的技術力,這些公司在汽車創新領域中佔據重要地位。例如

- 2024 年 1 月,在 CES 2024 上,HERE Technologies 與博世和戴姆勒卡車股份公司合作發布了用於商用車的 ADAS(高級駕駛輔助系統)。該系統將 HERE 的 ADAS 地圖與博世的 Electronic Horizon 軟體結合,與戴姆勒卡車的預測動力傳動系統控制 (PPC) 無縫整合。即時考慮道路複雜性、交通標誌和速度規定可提高駕駛員的舒適度並最佳化燃料和電池效率。

- 2024年1月,同樣在CES 2024上,英飛凌和Aurora Labs推出了一款尖端的人工智慧驅動的汽車維護解決方案。該解決方案基於英飛凌的 TriCore AURIX TC4x 微控制器和 Aurora Labs 的代碼行智慧 (LOCI) AI,旨在提高轉向和煞車等關鍵汽車零件的可靠性和安全性,從而提高車輛的整體性能和安全性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 聯網汽車需求不斷成長

- 資料分析和機器學習的進步

- 市場限制

- 安裝和維護成本高

- 波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 車型

- 搭乘用車

- 商用車

- 最終用戶

- 車隊車主

- 保險公司

- 其他最終用戶

- 按組件

- 軟體

- 硬體

- ADAS

- 機載診斷

- 其他硬體

- 按應用

- 安全與保障

- 車輛維護

- 預測性智慧停車

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 巴西

- 墨西哥

- 阿拉伯聯合大公國

- 其他國家

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Continental AG

- Aptiv PLC

- Garrett Motion Inc.

- Harman International Industries Incorporated

- Visteon Corporation

- ZF Friedrichshafen AG

- Valeo SA

- Robert Bosch GmbH

- Verizon

- Infineon Technologies AG

第7章 市場機會與未來趨勢

- 與 ADAS(高級駕駛輔助系統)整合

The Automotive Predictive Technology Market size is estimated at USD 80.46 billion in 2025, and is expected to reach USD 119.37 billion by 2030, at a CAGR of 8.21% during the forecast period (2025-2030).

COVID-19's outbreak dealt a blow to the automotive predictive technology market. Temporary shutdowns of vehicle and component manufacturing facilities worldwide led to significant supply chain disruptions. Yet, the automotive industry has shown signs of recovery and is poised to continue this trend during the forecast period.

The market is being propelled by a rising demand for advanced technological features in vehicles. Innovations like artificial intelligence and machine learning are enhancing safety measures, notably through advanced driver-assistance systems (ADAS). Additionally, there's a focus on predictive maintenance, aiming to reduce vehicle downtime and boost performance in a cost-effective manner.

Predictive features play a crucial role in autonomous vehicles and self-driving technologies, alerting drivers to obstacles and other driving cues. Major OEMs are pouring investments into the development of autonomous vehicles, signaling promising opportunities for market players.

Asia-Pacific is set to lead the automotive predictive technology market, driven by a surging demand for luxury vehicles in India, China, and Japan. Furthermore, the rising adoption of ADAS in the region is anticipated to amplify the demand for predictive technologies in the coming years.

Automotive Predictive Technology Market Trends

ADAS Segment Likley to Dominate the Market During the Forecast Period

In recent years, the automobile industry has ramped up its R&D efforts to bolster Advanced Driver-Assistance Systems (ADAS). This intensified focus has not only refined ADAS technologies but also ignited a heightened demand for systems like night-time pedestrian detection, lane departure warnings, and an array of sensors including cameras and RADAR. These technologies are swiftly being embedded into vehicles, with automotive players actively pushing these advanced features to stimulate market demand.

Leading the charge, OEMs like Audi, BMW, Daimler, and Volvo have begun integrating night-time pedestrian detection systems into their offerings. These systems serve a dual purpose: they either alert the driver or autonomously engage the brakes when a pedestrian is detected within the vehicle's speed threshold. Such innovations underscore the evolving safety standards becoming commonplace in today's vehicles.

In a bid to capture a larger slice of the market, numerous major service providers are pouring substantial investments into R&D for cutting-edge ADAS technologies. This landscape isn't solely dominated by industry giants; a plethora of startups, often buoyed by funding from these major entities, are injecting fresh ideas and technologies. This synergy between established players and emerging startups is catalyzing swift progress in ADAS technology.

Given the relentless advancements and investments, the ADAS segment is poised to spearhead the predictive technology market within the automotive realm. With a concerted emphasis on bolstering safety, amplifying driving comfort, and adhering to rigorous regulatory standards, the adoption of ADAS is surging, solidifying its position as a market leader in the coming years.

Asia-Pacific Expected to Hold Significant Market Share

During the forecast period, the Asia-Pacific region is poised to emerge as the fastest-growing market. The surge in demand can be attributed primarily to the hybridization and electrification of vehicles, coupled with a rising production of electric vehicles. Nations such as India, China, and Japan are gradually embracing predictive technology in passenger cars. However, the adoption has been tempered by the higher price segment of these tech-equipped vehicles and challenges like inadequate infrastructure and regulatory hurdles.

In the Asia-Pacific, automobile manufacturers are not just adopting predictive technology but are also rolling out new products featuring it. For instance,

- In January 2024, Yuchai Group unveiled the Guangxi Low-carbon and Intelligent Powertrain Laboratory. The lab, spotlighting predictive control technology and the integration of big data, aims to refine powertrain systems. Its focus spans intelligent powertrains, new energy systems, and high-efficiency internal combustion engines. Moreover, it explores powertrains harnessing low- and zero-carbon fuels like methanol, hydrogen, and ammonia. The lab's predictive control technology is designed to enhance performance and curtail emissions, championing the cause of sustainable and intelligent automotive solutions.

- In May 2023, Bengaluru's Continental Technology Centre India made notable advancements in crafting ADAS solutions tailored for Indian roads. Their innovative modular ADAS can be effortlessly adapted across diverse vehicle platforms, ensuring broad compatibility.

These developments signal a burgeoning opportunity for predictive technology in the Asia-Pacific, with demand set to escalate in the coming years.

Automotive Predictive Technology Industry Overview

The automotive predictive technology market is witnessing a blend of established giants and emerging players, all competing for a slice of the market share. Key players making waves in this arena include Continental AG, ZF Friedrichshafen AG, Robert Bosch, Aptiv PLC, and Valeo SA.

Recent trends underscore a pronounced shift towards embedding advanced predictive and AI technologies in vehicles. This move not only aims to bolster safety and efficiency but also underscores the industry's unwavering commitment to innovation and an enriched user experience. By forging partnerships and tapping into each other's technological prowess, these companies are carving out a leading position in the automotive innovation landscape. For Instance,

- In January 2024, at CES 2024, HERE Technologies, in collaboration with Bosch and Daimler Truck AG, unveiled an advanced driver-assistance system (ADAS) tailored for commercial vehicles. This system marries HERE's ADAS Map with Bosch's Electronic Horizon software, seamlessly integrating into Daimler Truck's Predictive Powertrain Control (PPC). The results in enhanced driver comfort and optimized fuel and battery efficiency, all thanks to real-time considerations of road intricacies, traffic signs, and speed regulations.

- In January 2024, also at CES 2024, Infineon and Aurora Labs rolled out cutting-edge AI-driven automotive maintenance solutions. Harnessing Aurora Labs' Line-of-Code Intelligence (LOCI) AI on Infineon's TriCore AURIX TC4x microcontrollers, these solutions aim to bolster the reliability and safety of pivotal automotive components like steering and braking, thereby elevating overall vehicle performance and safety.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand For Connected Cars

- 4.1.2 Advancements In Data Analytics And Machine Learning

- 4.2 Market Restraints

- 4.2.1 High Implementation And Maintenance Costs

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.2 End-User

- 5.2.1 Fleet Owners

- 5.2.2 Insurers

- 5.2.3 Other End-Users

- 5.3 By Component

- 5.3.1 Software

- 5.3.2 Hardware

- 5.3.2.1 ADAS

- 5.3.2.2 On-board Diagnosis

- 5.3.2.3 Other Hardware Types

- 5.4 By Application

- 5.4.1 Safety & Security

- 5.4.2 Vehicle Maintenance

- 5.4.3 Predictive Smart Parking

- 5.4.4 Others

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 Mexico

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Continental AG

- 6.2.2 Aptiv PLC

- 6.2.3 Garrett Motion Inc.

- 6.2.4 Harman International Industries Incorporated

- 6.2.5 Visteon Corporation

- 6.2.6 ZF Friedrichshafen AG

- 6.2.7 Valeo SA

- 6.2.8 Robert Bosch GmbH

- 6.2.9 Verizon

- 6.2.10 Infineon Technologies AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration With Advanced Driver Assistance Systems (ADAS)