|

市場調查報告書

商品編碼

1689977

廣播設備:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Broadcast Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

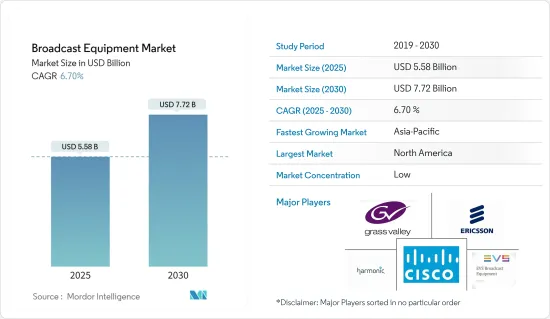

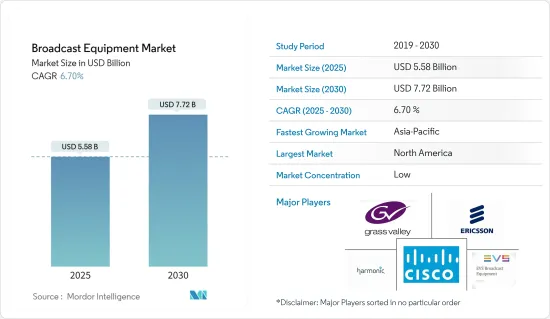

廣播設備市場規模預計在 2025 年為 55.8 億美元,預計到 2030 年將達到 77.2 億美元,預測期內(2025-2030 年)的複合年成長率為 6.7%。

透過電子大眾傳播向特定受眾傳遞音訊和影像內容稱為廣播。這是為了向盡可能多的人傳播訊息。廣播通常僅限於本地/點網路系統。廣播服務仍然很受歡迎,並為廣大觀眾提供最直接、最可靠的資訊來源。由於智慧電子設備的使用日益增多以及對 3D 和高清內容的需求不斷成長,廣播設備市場正在擴大。

關鍵亮點

- 過去幾十年來,消費者對更高品質音訊和視訊的需求推動了廣播設備產品和技術的快速升級。由於現在內容都是以 4K 和 UHD 格式製作的,以相同格式進行廣播以提高觀看品質導致了 IP 直播製作技術的出現。這對於現場製作至關重要,因為靈活且高效的系統控制是關鍵。

- 例如,2023 年 11 月,ArcGIS Motion Imagery 團隊宣布發布新的 ArcGIS Video Server。 ArcGIS Enterprise 的這個新伺服器角色旨在擴展 ArcGIS 的影片功能。最新的 ArcGIS 視訊伺服器可以將影片作為具有地理空間和時間背景的服務進行索引、發布、搜尋和串流。

- 技術進步鼓勵廣播公司提供高階用戶超高清輸出,刺激市場成長。此外,數位頻道的興起以及以 8K 品質直播體育賽事和 4K 品質直播新聞為特色的尖端廣播設備的使用日益增多,正在促進市場加速成長。據8K協會預測,未來8K電視將會越來越受歡迎。 2023 年 8K 電視的出貨量將達到約 214 萬台,高於前一年的 80 萬台。到2026年,這一數字預計將達到440萬台以上。

- 體育產業是全球最大的電視觀眾市場,並且正在尋找大規模提供視訊內容的方法。設備和格式的激增給服務供應商、內容擁有者、廣播公司和版權持有者帶來了許多挑戰。在廣播設備市場中,租賃體育廣播設備部分也是主要收益來源。國際體育賽事的增加推動了廣播設備租賃市場的發展。

- 此外,由於技術不斷發展、高速網路基礎設施投資不斷增加以及透過 OTT 服務對 D2C 產品的需求不斷成長,市場正迎來發展機會。根據電訊的數據,截至2023年,小島嶼開發中國家(SIDS)的67%人口將能夠使用網際網路,而最不開發中國家(LDC)的這一比例為35%,內陸發展中國家人口的網際網路普及率為39%。全球線上查詢率為67%。

- 此外,收入的增加、耐用消費品購買量的增加以及快速廉價網際網路的普及預計將對市場成長產生積極影響。根據印度IBEF預測,到2024年,電視預計將佔據印度媒體市場的40%,其次是數位廣告(12%)、印刷媒體(13%)、電影(9%)以及OTT和遊戲(8%)。到2025年,智慧電視保有量預計將達到4,000萬至5,000萬台。

- 數位音訊和影像格式的快速發展以及對創建和儲存數位影像和視訊的開放、國家或國際認可標準的需求正在推動市場成長。隨著數位技術的每一次進步,數位音訊和視訊格式以及壓縮方法的規範也在不斷發展。

- 新冠疫情迫使廣播公司重新思考其內容製作和分發的方式,導致人員配置、技術堆疊和設施發生變化。例如,新聞廣播適應了一些國家的封鎖要求,世界各地的多個節目透過消費者視訊技術引入專家意見。廣播技術也使得疫情期間的演出和音樂會成為可能。例如,Lady Gaga 組織了一場長達八小時的活動,100 名音樂家在她的客廳、臥室和花園裡表演。

廣播設備市場趨勢

編碼器預計將經歷大幅成長

- 編碼器透過將音訊和視訊訊號轉換為數位格式以便透過網路傳輸,在廣播中發揮至關重要的作用。隨著對高清和串流內容的需求不斷增加,廣播公司需要先進的編碼器來有效地提供高品質的影像。隨著廣播公司升級其基礎設施以跟上不斷變化的觀眾偏好和技術標準,這導致對包括編碼器在內的廣播設備的需求增加。

- 2024 年 4 月,Net Insights 宣布將透過升級版 Nimbra 414 增強其榮獲艾美獎的網路媒體傳輸產品 Nimbra 400 編碼器的功能,以應對更豐富、更具互動性的活動製作的成長。隨著最新版本的 Nimbra 414 增加通道密度並支援 UHD 內容,Nimbra 414 編碼器/解碼器系列完全有能力幫助廣播公司提供更具沉浸感的製作,從而提高觀眾的參與度。

- 對視訊進行編碼的目的是創建可以透過網路傳輸的數位副本。廣播公司可以根據串流媒體的目的和預算選擇硬體或軟體編碼器。大多數專業廣播公司使用硬體編碼器,但由於價格分佈較高,大多數初級到中級廣播公司使用直播編碼器軟體。

- 例如,2024 年 4 月,美國字幕公司 Verbit 旗下的 VITAC 與廣播解決方案供應商 ENCO 宣佈建立策略合作夥伴關係,旨在讓廣播公司在硬體編碼器和雲端字幕之間有更多選擇。此次合作將為廣播公司提供根據其需求客製化的綜合字幕工具和服務。

- 此外,隨著串流媒體平台的普及,需要高效的編碼技術來透過網路傳輸高品質的影像內容。例如,2023 年 9 月,北歐付費電視和串流平台 Allente 推出了其新的 Allente Stream 多螢幕 OTT 服務。因此,該營運商正在基於 3SS 3Ready 產品平台運作於 Android TV、行動電話、LG 和三星智慧型電視、Apple TV、網路和 iOS 的最新應用程式。

- 此外,由於內容分佈在各種平台和裝置上,廣播公司需要支援適合傳輸速率串流並與各種轉碼器和通訊協定相容的編碼器。此外,實況活動、體育賽事和新聞報導的流行也使得人們需要能夠有效編碼和即時傳輸即時視訊串流的編碼器。

- 據Meltwater稱,近年來,直播視訊內容已成為線上娛樂和業務中最常見的視訊內容類型之一。 2023 年第三季度,直播覆蓋了全球約 28% 的網路用戶。此外,2023 年,Netflix 透露其在美國和加拿大擁有 8,013 萬付費串流媒體用戶。

- 編碼器的效率已顯著提高,並在 HDTV 等現代格式和 H.264 等壓縮標準的成功中發揮關鍵作用。如今,廣播環境中對編碼器的需求可分為三個主要領域:貢獻、主要分發和家庭分發。

預計亞太地區將出現顯著成長

- 亞太地區有中國、印度等人口大國。亞太國家都市化數位化的提高意味著更多的人可以接觸到電視和數位媒體內容,這推動了對廣播設備的需求。根據 Meltwater 預測,到 2023 年第三季度,菲律賓約有 96% 的 16-64 歲網路用戶將每月訂閱 Netflix 等訂閱視訊點播 (SVOD) 服務。

- 此外,該地區 OTT(Over-The-Top)串流平台的日益普及也推動了對先進廣播設備的需求,以支援高品質的串流媒體服務。例如,2024 年 5 月,Prasar Bharati 宣布計劃於 8 月推出自己的家庭友善 OTT 平台。政府的公共廣播公司將播放關注印度社會和文化的內容。最初,該平台將免費提供。這些市場的發展可能會進一步推動該地區的市場成長。

- 亞太地區是奧運、世界盃和地區性比賽等重大體育賽事的舉辦地點。為了確保無縫覆蓋和傳輸,此類活動對廣播設備的需求激增。同時,4K/UHD 廣播、虛擬實境 (VR)、擴增實境(AR) 和身臨其境型音訊等廣播技術的進步正在推動該地區採用先進的廣播設備。

- 根據 GSMA 的報告,不丹、伊朗、孟加拉和越南等國家行動普及率成長最為顯著。該地區智慧型設備的普及也推動了對高清音訊和視訊的需求。根據GSMA統計,64%的亞太居民已經擁有智慧型手機,預計到2025年普及率將超過80%。

- 此外,Netflix 於 2023 年 3 月宣布計劃在亞太地區投資約 19 億美元用於本地內容。該公司預計 2023與前一年同期比較收益將年增 12%,超過 40 億美元,而 2022 年的成長率為 9%。此外,根據國際電信聯盟 (ITU) 的數據,到 2023 年,亞太地區 66% 的人口將上網,這將進一步推動市場成長。

- 當地供應商投入大量資金,以利用新冠疫情帶來的機會。例如,去年3月,Signiant Inc.宣布收購嵌入式媒體處理軟體供應商Kyno。此次收購將有助於擴展其 SaaS 平台軟體定義內容交換 (SDCX) 的功能,包括與媒體資產互動的工具。該平台在全球擁有約一百萬用戶,連接了超過五萬家各種規模的媒體和娛樂公司。

廣播設備產業概況

廣播設備市場中各企業之間的競爭,取決於價格、產品、市場佔有率和競爭強度。主要市場參與企業包括思科系統公司、愛立信公司、Harmonic 公司、EVS 廣播設備公司和 Grass Valley。

- 2024 年 4 月:全球關鍵任務即時視訊網路和視覺協作解決方案供應商 Haivision Systems 宣布,Haivision 和索尼公司(「Sony」)已成功使用索尼的雲端製作平台 Creators' Cloud for Enterprise 測試了 Haivision 業界領先的視訊編碼器、解碼器和行動視訊發射器。

- 2024年2月:索尼宣布推出自己的專用可攜式資料發射器PDT-FP1,該發射器可透過5G網路實現高速、低延遲的影片和靜態影像資料傳輸。此無線通訊設備可以安裝在相機上,用於新聞和事件拍攝以及廣播影像製作等需要速度的場合,從拍攝影像到分發、廣播、發布。在沒有Wi-Fi的室外和室內環境中,5G網路提供高速、低延遲、穩定的行動資料通訊,實現高效、易於理解的工作流程。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

- 研究框架

- 二次研究

- 初步研究

- 資料三角測量與洞察生成

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 價值鏈分析

- 主要宏觀經濟趨勢的市場影響

第5章市場動態

- 市場促進因素

- 由於支援多種格式,對編碼器的需求不斷增加

- 透過OTT服務擴展D2C服務

- SAAS 解決方案的採用率不斷提高

- 市場限制

- 廣播媒體格式和轉碼器缺乏標準化

第6章市場區隔

- 依技術

- 類比廣播

- 數位廣播

- 按產品

- 天線

- 轉變

- 影像伺服器

- 編碼器

- 發射器和中繼器

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Cisco Systems Inc.

- Telefonaktiebolaget LM Ericsson

- Evs Broadcast Equipment SA

- Grass Valley

- Harmonic Inc.

- Clyde Broadcast

- Sencore Inc.

- Eletec Broadcast Telecom Sarl

- AVL Technologies Inc.

- ETL Systems Ltd

第8章投資分析

第9章:市場的未來

The Broadcast Equipment Market size is estimated at USD 5.58 billion in 2025, and is expected to reach USD 7.72 billion by 2030, at a CAGR of 6.7% during the forecast period (2025-2030).

The distribution of audio and video content to a precise audience via electronic mass communication is known as broadcasting. It is a spread of information to a large group of people. Typically, broadcasting is limited to a local spot network system. Broadcasting services, which remain popular, deliver a large audience with the most direct and reliable information mediums. The broadcast equipment market is expanding because of the increased use of smart electronic devices and improved demand for 3D and HD content.

Key Highlights

- Over the last few decades, consumers' demand for better-quality audio and video has rapidly upgraded broadcast equipment products and technology. With content being produced in 4K and UHD formats, broadcasting in the identical format for enhanced viewing quality has resulted in IP live-production technology. This is essential for live production, where a premium is placed on flexible and efficient system control.

- For instance, in November 2023, the ArcGIS Motion Imagery Team announced the release of the new ArcGIS Video Server. This new server role for ArcGIS Enterprise is designed to expand video capabilities across ArcGIS. The latest ArcGIS Video Server allows indexing, publishing, searching, and streaming video as a service with geospatial and temporal context.

- Technological advancements are driving broadcasters to provide UHD output to their premium users, fueling market growth. Moreover, the rise in digital channels and the increasing utilization of cutting-edge broadcasting devices, featuring 8K video quality for sports coverage and 4K quality for news coverage, contribute to the acceleration of market growth. According to the 8K Association, 8K TVs will become increasingly popular in the coming years. Around 2.14 million 8K TV sets were shipped in 2023, up from 800 thousand in the previous year. By 2026, this number is predicted to reach over 4.4 million units.

- The sports section is the biggest market for TV viewers worldwide, and it is finding ways to deliver video content at scale. The increasing number of devices and formats offer several challenges for service providers, content owners, broadcasters, and rights holders. The rental sports broadcast equipment sector is also a significant revenue generator in the broadcast equipment market. The increasing number of international sports tournaments is driving the rental market for broadcast equipment.

- Furthermore, the market is witnessing opportunities for evolution due to evolving technology, increased investments in high-speed internet infrastructure, and growing demand for D2C offerings via OTT services. According to the International Telecommunication Union, as of 2023, 67% of the population in small island developing states (SIDS) used the internet, compared to 35% of the population in least developed countries (LDCs), while the internet penetration rate for those living in landlocked growing counties was at 39%. The global online access rate was 67%.

- Moreover, the rising income, increasing purchases of consumer durables, and the increasing availability of fast and cheap internet are expected to impact the market's growth positively. As per IBEF, India, television is projected to constitute 40% of the Indian media market in 2024, trailed by digital advertising (12%), print media (13%), cinema (9%), and the OTT and gaming industries (8%). By 2025, it is anticipated that the number of linked intelligent televisions will reach around 40 to 50 million.

- The rapidly developing nature of digital audio and video formats and the need for open, domestic, or international agreement norms for generating and preserving digital video and audio are challenging the market's growth. Norms for digital audio and video formats and compression methods are evolving with every new advancement in digital technology.

- The COVID-19 pandemic forced broadcasters to rethink their approach to producing and delivering content - resulting in changes to staffing, technology stacks, and facilities. News broadcasting, for instance, adapted to the lockdown requirements of several nations, with several programs worldwide gathering experts' input through consumer video technology. Broadcasting technologies also enabled programs and concerts during the pandemic. For instance, Lady Gaga organized an eight-hour event involving 100 musicians playing from their living rooms, bedrooms, and gardens.

Broadcast Equipment Market Trends

Encoders are Expected to Witness Significant Growth

- Encoders play a crucial role in broadcasting by converting audio and video signals into digital format for transmission over networks. As demand for high-definition and streaming content grows, broadcasters need advanced encoders to deliver high-quality video efficiently. This drives the demand for broadcast equipment, including encoders, as broadcasters upgrade their infrastructure to meet evolving viewer preferences and technological standards.

- In April 2024, Net Insight announced a boost to the capability of its Emmy Award-winning internet media transport offering, the Nimbra 400 encoders, to meet the growth in more prosperous and more interactive events production with the upgraded Nimbra 414. The latest version of the Nimbra 414 increases channel density and support for UHD content, making the Nimbra 414 encoder/decoder family now ideally placed to help broadcasters deliver more immersive productions that enhance viewer engagement.

- The purpose of encoding a video is to create a digital copy transmitted over the internet. Broadcasters can choose between a hardware or software encoder, depending on the purpose of the stream and the budget. Most professional broadcasters use hardware encoders, but due to the high price point, most beginner-level to mid-experienced broadcasters go with live streaming encoder software.

- For instance, in April 2024, VITAC, a Verbit Company, a US-based captioning company, and ENCO, a provider of broadcasting solutions, announced a strategic partnership aimed at providing broadcasters with expanded choice for hardware encoders and cloud captioning. Through this alliance, broadcasters will access a comprehensive suite of captioning tools and services tailored to meet their specific requirements.

- Furthermore, the increasing popularity of streaming platforms necessitates efficient encoding technologies to deliver high-quality video content over the internet. For instance, in September 2023, Nordic PayTV and streaming platform Allente launched its new Allente Stream multiscreen OTT offering. As a result, the operator has gone live with the latest apps for Android TV and mobiles, LG and Samsung Smart TVs, Apple TV, web, and iOS, based on the 3SS 3Ready product platform.

- Moreover, with content being distributed across different platforms and devices, broadcasters need encoders that support adaptive bitrate streaming and compatibility with different codecs and protocols. Further, the popularity of live events, sports, and news coverage needs encoders that can efficiently encode and transmit live video streams in real time.

- According to Meltwater, in recent years, live-streaming video content has become one of the most popular types of video content consumed online for entertainment and operational purposes. During the third quarter of 2023, live streaming registered an audience reach of almost 28% among internet users worldwide. In addition, in 2023, Netflix revealed that it had 80.13 million paying streaming subscribers in the United States and Canada.

- The effectiveness of encoders has significantly improved, and they play a significant role in the success of modern formats, like HDTV, and compression standards, like H.264. Currently, the demand for encoders in broadcast settings can be categorized into three key domains: contribution, primary distribution, and home distribution.

Asia-Pacific is Expected to Witness Significant Growth Rate

- Asia-Pacific is home to some densely populated countries such as China and India. Increasing urbanization and digitization across Asia-Pacific countries fuel the demand for broadcast equipment as more people access television and digital media content. According to Meltwater, in the third quarter of 2023, about 96% of internet users aged between 16 and 64 years in the Philippines used a subscription video-on-demand (SVOD) service, such as Netflix, each month.

- Further, over-the-top (OTT) streaming platforms are gaining popularity in the region, creating a need for advanced broadcast equipment to support high-quality streaming services. For instance, in May 2024, Prasar Bharati has announced its plans to start its own OTT platform for families in August. The government's public service broadcaster will stream content that will be focused on Indian society and culture. Initially, the platform will be available for free to the public. Such developments may further propel the market's growth in the region.

- Asia-Pacific is home to major sporting events like the Olympics, FIFA World Cup, and regional tournaments. The demand for broadcast equipment surges during such events to ensure seamless coverage and transmission. At the same time, advancements in broadcasting technologies, such as 4K/UHD broadcasting, virtual reality (VR), augmented reality (AR), and immersive audio, are driving the adoption of advanced broadcast equipment in the region.

- Countries such as Bhutan, Iran, Bangladesh, and Vietnam are demonstrating the most significant mobile penetration advances, according to a GSMA report. The implementation of smart devices in the region is another factor fueling the demand for high-definition audio and videos. As per GSMA, 64% of the residents in APAC already possess smartphones, and the adoption is expected to cross 80% in 2025.

- Furthermore, in March 2023, Netflix announced plans to spend approximately USD 1.9 billion on local content in Asia-Pacific. The company was expected to register revenue growth of 12% Y-o-Y in 2023 and exceed USD 4 billion compared to 9% growth in 2022. In addition, according to ITU, 66% of the population in Asia-Pacific reported using the Internet as of 2023, further propelling the market's growth.

- Local vendors invested heavily to capitalize on the opportunities brought by the COVID-19 pandemic. For instance, in March last year, Signiant Inc. announced the acquisition of Kyno, which provides embedded media processing software. The acquisition helps Signiant Inc. extend the functionality of the Software-Defined Content Exchange (SDCX) SaaS platform, incorporating tools for engagement with media assets. With almost 1 million users globally, the platform connects more than 50,000 media and entertainment companies of all sizes.

Broadcast Equipment Industry Overview

The competitive rivalry between various firms in the broadcast equipment market depends on price, product, or market share, along with the intensity with which they compete. Some major market players include Cisco Systems Inc., Telefonaktiebolaget LM Ericsson, Harmonic Inc., EVS Broadcast Equipment SA, and Grass Valley.

- April 2024: Haivision Systems, a global provider of mission-critical, real-time video networking and visual collaboration solutions, announced that Haivision and Sony Corporation (Sony) had successfully tested Haivision's industry-leading video encoders, decoders, and mobile video transmitters with Sony's cloud production platform, Creators' Cloud for Enterprise.

- February 2024: Sony announced the launch of a unique dedicated portable data transmitter, the PDT-FP1, that allows high-speed, low-latency video and still image data transport over 5G networks. When attached to a camera, this wireless communication device will be used when speed is required, from image capture to delivery, broadcasting, and distribution, such as news or events photography and broadcast video production. It provides high-speed, low-latency, and stable mobile data communication over 5G networks in outdoor or indoor environments where a Wi-Fi connection is unavailable, enabling efficient and straightforward workflows.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Impact of Key Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Encoders due to Support for Multiple Formats

- 5.1.2 Growing D2C Offerings through OTT Services

- 5.1.3 Increased Adoption of SAAS Solutions

- 5.2 Market Restraint

- 5.2.1 Lack of Standardization of Media Formats and Codecs Used for Broadcasting

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Analog Broadcasting

- 6.1.2 Digital Broadcasting

- 6.2 By Product

- 6.2.1 Dish Antennas

- 6.2.2 Switches

- 6.2.3 Video Servers

- 6.2.4 Encoders

- 6.2.5 Transmitters and Repeaters

- 6.2.6 Other Products

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Telefonaktiebolaget LM Ericsson

- 7.1.3 Evs Broadcast Equipment SA

- 7.1.4 Grass Valley

- 7.1.5 Harmonic Inc.

- 7.1.6 Clyde Broadcast

- 7.1.7 Sencore Inc.

- 7.1.8 Eletec Broadcast Telecom Sarl

- 7.1.9 AVL Technologies Inc.

- 7.1.10 ETL Systems Ltd